Dear NCRC

Community,

We’re pleased to share with you these highlights from NCRC’s work and impact in 2024. This year, our coalition of 736 member organizations has continued to build on our mission to make a Just Economy a national priority and a local reality, delivering meaningful change even in the face of significant challenges.

Our persistent engagement with financial institutions, exemplified by our work with KeyBank and HSBC, has demonstrated the power of evidence-based advocacy in holding banks accountable to the communities they serve. These efforts have yielded substantial commitments for community lending, investments, and philanthropy that will strengthen neighborhoods across the nation.

Our research and investigations have once again exposed persistent inequities in the financial system. We’ve provided policymakers and the public with data-driven insights that highlight the urgent need for continued financial system reforms, maintaining pressure on institutions that fall short in serving all communities equitably.

And our organizing, policy and communications teams helped NCRC lead the fight to stop the dangerous and anticompetitive proposed merger between Capital One and Discover, ensuring that the banks’ preferred narratives did not dominate public understanding or policymaker thinking.

We will carry this momentum into 2025, fully aware of the challenges ahead as a new presidential administration takes office. The coming year will test everyone working to build the Just Economy, but NCRC is prepared to meet these challenges with the same determination, moral clarity, and hard work that have defined our organization for decades.

The achievements detailed in this Impact Report reflect the collective strength of our coalition—736 member organizations working shoulder to shoulder across the nation. While we don’t win every battle, we continue to make real progress toward our vision of solving America’s historic racial and socioeconomic wealth, income, and opportunity divides.

We are deeply grateful for your support and commitment to building a Just Economy. With your continued partnership, we will keep fighting for a better future where everyone has the opportunity to build wealth and live well, regardless of the political climate.

Together, we can and will overcome the obstacles ahead.

In solidarity,

Jesse Van Tol

Numbers

At A Glance

NCRC Members

- 167 New Members

- Members in 41 states, DC, and Puerto Rico

Grants:

in grants going towards underserved communities

Loans:

through CDF for Small Businesses

Training:

- 111 Webinars & Trainings

- 4 in person events

- Over 1,500 in classroom hours,

- NTA serves 43% of ALL US housing counselors

Campaigns

KeyBank Agreement:

- $17million loan fund to support AA homeownership

- $8.5 deployed KeyBank and $8.5 NCRC’s deployment

HSBC Agreement:

- $10 million in loan subsidy support for homebuyers in underserved areas

- $8 million in separately-administered grant funds for CDFIs and other mission-critical NGOs

Capital One Campaign:

- 30+ NCRC members recruited to testify against the merger

- 130 NCRC members signed comment letter opposing merger

In comparison to 2021

Membership

- from 625 members to 736

Grants

- from $2.8M to $6M distributed to Organizations

Loans

- from $4.64M in small business loans to $5.7M

- from 12k to 14k families served, an increase by 17%

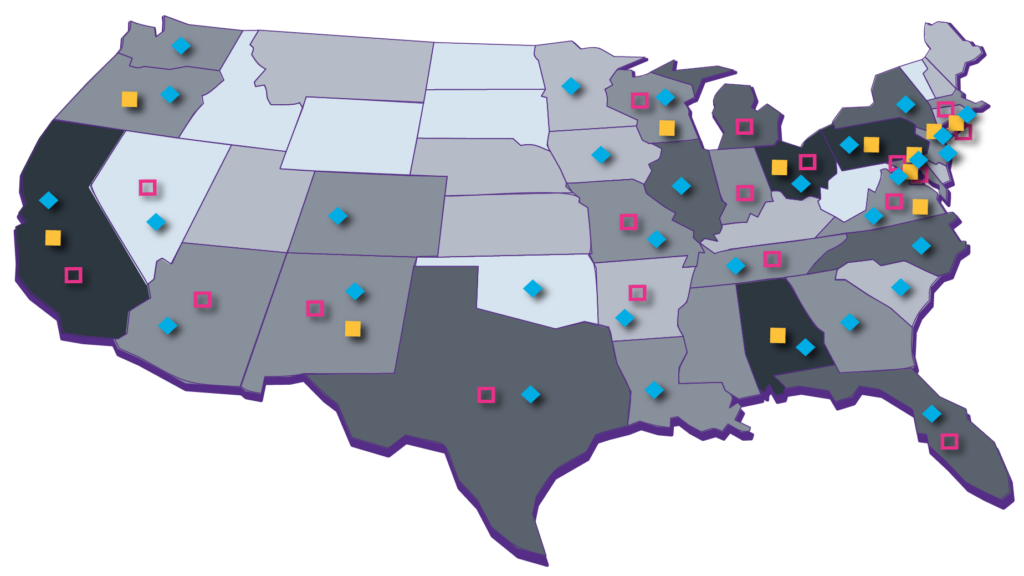

Network Map

739 Total Members

Up to 9

10-19

20-39

40-70

Housing Counseling Network

- 26 Member organizations in 18 states and the District of Columbia.

- 14,279 Households Served

Fellows

- 29 Fellows, 11 States and DC

Community Development Fund

- 391 CDFI Supported Businesses from 31 states received 1180+ hours of training

Campaigns

Equipping Communities with the resources to fight for an equitable tomorrow.

Community Mobilization

- CBA’s, known as community benefits agreements, are legally binding contracts where a financial institution commits to providing specific benefits to a neighborhood (affordable housing, community services, workforce development, etc.) in exchange for community support of their development project.

- Negotiated: 4 New CBAs

- Committed: Over $100 Billion for Loans, Investments & Philanthropy -> Going towards underserved communities

Enforcement

Keybank

After we raised concerns about KeyBank’s lending in minority and underserved communities and whether or not they kept their promise to be a leader in inclusive home mortgage lending, which they disputed, we worked to resolve these concerns through a mutual agreement to renew our relationship to ensure greater levels of investment in minority and underserved communities.

KeyBank Will:

- PROVIDE $17 million loan fund to fund grants, down payment assistance, fee waivers, banking access that increases AA homeownership

- COLLABORATE with NCRC on an ongoing basis to continue to improve KeyBank’s lending to minority and underserved communities

HSBC

After NCRC raised concerns over lending practices, HSBC responded by engaging in active discussions with NCRC to ensure that its community investment strategy aligns with the needs of the community it serves. Through this, NCRC and HSBC are engaging within a four-year partnership with a distinct approach, separate to CBAs, to support underserved communities.

HSBC Will:

- COMMIT: $10 million in loan subsidies to support LMI homebuyers.

- COLLABORATE with NCRC to oversee $4 million in grants to CDFIs

- DONATE: $6 million to NCRC

- DEDICATE: $1 million toward community engagement

Capital One

When Capital One announced its intention to buy Discover and increase its predatory stranglehold on the communities NCRC members serve, we immediately led the charge to ensure policymakers and the public understood why the deal was dangerous and likely to violate banking and antitrust laws. Despite the bank’s immeasurably larger resources, NCRC and our allies garnered more than 200 news stories about our concerns, highlighted Capital One’s ugly track record of breaking commitments to communities, and effectively exposed the bank’s deceitful public claims.

- More than 30 NCRC members signed up to testify against the merger at a public hearing in July.

- 130 NCRC members signed our official comment letter opposing the merger.

- NCRC staff held dozens of meetings with lawmakers and co-wrote several other letters to regulators with peer organizations opposed to the deal on complementary grounds.

Fair Housing/Fair Lending

- Matched Pair Tests Conducted: 358

- Matched-Pair tests, also known as mystery shopping, is a means of testing real estate agents by going in as a potential buyer to see if they violate fair housing standards by denying candidates on the basis of their race, religion, or other protected classes alone.

- Match Pair Testers Trained: 100+

- Realtors given fair housing training: 300+

Capacity

Building

Financing the next generation of leaders

Grants

- $3.6 Million in NEW funding was distributed in 19 separate states for affordable housing, small business development, housing counseling, critical wealth-building, housing stability services and workforce development.

- Back to Business (B2B) Program

- $175 million in grants were provided to 4,000 small businesses in partnership with the Illinois Department of Commerce and Economic Opportunity

- $2.4 Million provided to 17 NCRC member community organizations through NCRC’s Field Empowerment Fund (FEF) from Morgan Stanley & PNC Bank to expand and scale their impact in affordable housing, small business development and workforce development.

Loans

- CDF: The NCRC Community Development Fund (NCRC CDF), a US Treasury-certified Community Development Financial Institution, is a mission-based lender, focused on ensuring Black, Latino and other underserved borrowers and LMI individuals have the tools, knowledge and expertise to move toward economic mobility.

- $5.7 Million in low-interest loans were disbursed for local capacity building, small business resilience, and construction of affordable housing across dozens of our member organizations and communities.

- 100% going to minority-owned businesses

- $5.7 Million in low-interest loans were disbursed for local capacity building, small business resilience, and construction of affordable housing across dozens of our member organizations and communities.

Trainings

Housing Counseling Trainings:

- NCRC’s National Training Academy (NTA) empowers housing professionals and organizations through comprehensive education and training on economic topics that bridge societal wealth divides. They deliver their mission through diverse formats including webinars, in-person events, eLearning courses, and regional summits.

- 38 Total Trainings

- Nearly 2,000 practitioners, managers, and executives trained

- 80% of participants reported that the knowledge shared was valuable to their work and professional development.

- 43% of ALL housing counselors in the US use our training services.

- 230 scholarships provided through the NTA for recipients to join the September Summer Intensive OR the Just Economy: Detroit summit

- $578,614 in HUD funding – the largest federal award for housing counseling training

- 38 Total Trainings

Small Business Trainings

- 500 attendees from over 390 businesses received vital technical assistance within business financing and financial management to foster their ability to secure funding, achieve sustainable growth, and navigate complex financial landscapes.

Fellowships

- 17 graduate students participated in NCRC’s Fellowship for Equitable Development program which helped our member organizations expand their capacity and pursue an innovative economic development project – while also helping build skills and knowledge among the next generation of economic justice activists.

- 13 organizations across Alabama, California, DC, Georgia, Florida, Maryland, New York and Ohio participated in this program

Advocacy

Accountability for Progress

Just Economy Conference

1,200 attendees for 39 breakout sessions.

- NCRC’s Just Economy Conference has become a must-attend annual event for community, business, foundation, policy and government leaders who want a nation that not only promises but delivers opportunities for all Americans to build wealth and live well.

2024 Featured Speakers

Charles M. Blow

Columnist, The New York Times

Leah Rothstein

Co-Author of JUST ACTION: How to Challenge Segregation Enacted Under the Color of Law

Rohit Chopra

Director of the Consumer Financial Protection Bureau

Seema Agnani

CEO, National CAPACD

Asahi Pompey

Global Head of Corporate Engagement and President of the Goldman Sachs Foundation

Michael Hsu

Acting Comptroller of the Currency

Michael Barr

Vice Chair for Supervision of the Board of Governors, Federal Reserve System

Nan Whaley

Director of Membership, United States Conference of Mayors

Martin Gruenberg

Chairman, Federal Deposit Insurance Corporation

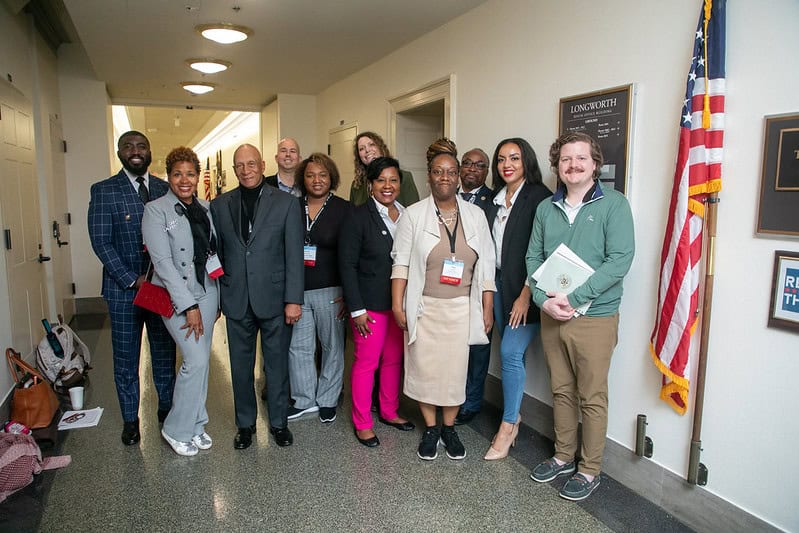

Hill Day

1,200 attendees for 39 breakout sessions.

- NCRC’s Just Economy Conference has become a must-attend annual event for community, business, foundation, policy and government leaders who want a nation that not only promises but delivers opportunities for all Americans to build wealth and live well.

150 offices visited

- 300 NCRC members took part

- Issues:

- Bank lobbyists filing against new CRA rule

- CapitalOne-Discover Merger

Just Economy Summit: Detroit

Nearly 50 organizations

On September 24, 2024, the Detroit Reinvestment Coalition, Community Development Advocates of Detroit (CDAD), and NCRC hosted the Just Economy: Detroit event to explore what it will take to create a “Just Economy” in Detroit. Local and national leaders discussed the lasting impacts of redlining, uneven investment in community development, the inequitable effects of climate change, and the housing shortage affecting average Detroiters.

Policy Work:

8 CRA Training Sessions

- 440 community organizations, bankers, and students participated, reviewing the final rule passed in 2023. NCRC is uniquely positioned as a trusted resource to educate local communities, given its active involvement in shaping the CRA ruling and its longstanding commitment to promoting fair access to financial resources.

Passage of Illinois SB3235- Illinois CRA

- NCRC collaborated with the Illinois CRA coalition on state regulations that encourage special purpose credit programs and limit loan purchase weighting. This effort resulted in the passage of Illinois SB3235, which mandates a disparity study and allows the state to consider how financial institutions serve underserved racial groups in CRA evaluations.

- This made Illinois the first state to adopt NCRC’s recommendation for incorporating race into CRA.

Language adoption in Open Banking rule issued by the CFPB

- In October 2024…. NCRC succeeded in advocating for consumers to have more control over how their financial data is used by lenders

Press:

Media Mentions

590 press mentions in 2024, a 59% increase year-on-year…

- including dozens of high-profile pieces in the American Banker, Bloomberg, Reuters, the Associated Press, NBC News, Fortune, HousingWire, the New York Times and the Washington Post.

- Prominent reporters came to NCRC proactively on the biggest stories of the year, from the fight to block Capital One’s acquisition of Discover, to the finalization of Section 1071 rules, to the implications of the 2024 election for financial regulators and racial wealth inequality.

- Jesse Van Tol published op-eds in the Washington Post and the American Banker.

Audience

Email subscribers

Social impressions

Unique visitors

Website sessions

Other

cool stuff

Impact Ventures & Funds

GROWTH by NCRC built or rehabbed 184 homes in 2024, representing an investment of $13.5 million, and sold 87 homes. GROWTH’s mission is to deliver entry-level and move-up homes in low- and moderate-income neighborhoods or for low- and moderate-income buyers.

Since 2015, Growth Homes has:

Touched over

Invested more than

built or rehabbed

Sold

86% of which were either to LMI buyers and/or within LMI communities

Board of

Directors

Robert Dickerson, Jr., Chair

Birmingham Business Resource Center

Bethany Sanchez, Vice Chair

Metropolitan Milwaukee Fair Housing Council

Irvin Henderson, Vice Chair

National Trust for Historic Preservation

Ernest Hogan, Treasurer

Pittsburgh Community Reinvestment Group

Elisabeth Risch, Secretary

Housing Opportunities Made Equal (HOME)

Aaron Miripol

Urban Land Conservancy

Andreanecia Morris

HousingNola

Arden Shank

South Bend Heritage Foundation

Beverly Watts

NAACP

Cornell Crews

Community Reinvestment Alliance of South Florida

Carol Johnson

City of Austin’s inaugural Civil Rights Office

Jean Ishmon

Northwest Indiana Reinvestment Alliance

Charles Harris

Housing Education & Economic Development

Kevin Stein

California Reinvestment Coalition

Matt Hull

Texas Association of Community Development Corporations

Matthew Lee

Inner City Press

Phyllis Edwards

Bridging Communities

Moises Loza

Formerly, Housing Assistance Council

Peter Hainley

CASA of Oregon

Roberto Barragan

California Community Economic Development Association

Stephen Glaude

Coalition for Non-Profit Housing and Economic Development (CNHED)

Sharon H. Lee

Low Income Housing Institute

Vernice Miller-Travis

WE ACT for Environmental Justice

Will Gonzalez

Ceiba

Support

These Major Funders Provided $400,000 Or More To NCRC In 2024:

Bank of America

First Citizens Bank and Trust Company

Goldman Sachs Urban Investment Group

JP Morgan Chase

Morgan Stanley

PNC Financial

Truist

Wells Fargo

WK Kellogg Foundation