October 16, 2024

Federal Reserve Board

CCA-CRA-Staff@frb.gov

Federal Reserve Bank of Dallas

Dallas-CASup@dal.frb.org

CRA Officer

Charles Schwab Bank, SSB

Charles Schwab Premier Bank, SSB

CRAPlanComments@schwab.com

Re: Proposed 2025 Community Reinvestment Act Strategic Plan for Charles Schwab Bank, SSB (the CSB Plan) and Proposed 2025 Community Reinvestment Act Strategic Plan for Charles Schwab Premier Bank, SSB (the CSPB Plan)

The National Community Reinvestment Coalition (NCRC) appreciates the opportunity to provide comments on the proposed CRA Strategic Plans (the Plans) of Charles Schwab Bank, SSB (CSB) and Charles Schwab Premier Bank, SSB (CSPB). This letter includes NCRC’s comments on both the CSB Plan and the CSPB Plan.

NCRC is a coalition of over 700 community organizations that work with policymakers and financial institutions to champion fairness in banking, housing, and business development. NCRC members are leaders and experts in their communities, and regularly volunteer their time to partner with banks to ensure banks remain responsive to local community credit needs. As banks increasingly offer digital and online banking services on a national scale, public participation and community engagement are more important than ever to ensure that banks meet CRA obligations.

The Federal Reserve describes the strategic plan evaluation option as follows (emphasis added):

“The strategic plan evaluation option in the regulation provides a bank with the opportunity to tailor its CRA objectives to the needs of its community and to its own capacities, business strategies and expertise. Therefore, not all of the factors described in the regulation would necessarily apply to each strategic plan. A bank has a great deal of latitude in constructing a strategic plan, but it is expected that public participation in development of the plan will provide a bank access to the fullest possible information about the needs of its community and how those needs might be met.”[1]

Our comments focus on the capacity of CSB and CSPB, retail lending, and public participation. We highlight several issues and concerns that both CSB and CSPB must address to achieve a satisfactory or outstanding CRA rating.

Capacity

Banks that opt for a CRA Strategic Plan have the same capacity for CRA lending and investments that other banks have and should benchmark their goals based on performance metrics of all bank peers, not just banks that opt for the strategic plan evaluation method.

Currently, 76 banks have opted for the CRA Strategic Plan option for CRA performance evaluation: 11 are regulated by the Federal Reserve, 51 by the FDIC and 14 by the OCC. The Federal Reserve and the OCC post strategic plans on their websites – and we commend this commitment to public engagement and transparency. In analyzing the 11 strategic plans on the Federal Reserve’s site, we notice a troubling trend – banks opting for the strategic plan option benchmark CRA performance targets only against other banks that opt for the CRA strategic plan evaluation option, rather than against all banks of their asset size, and have created a race to the bottom.

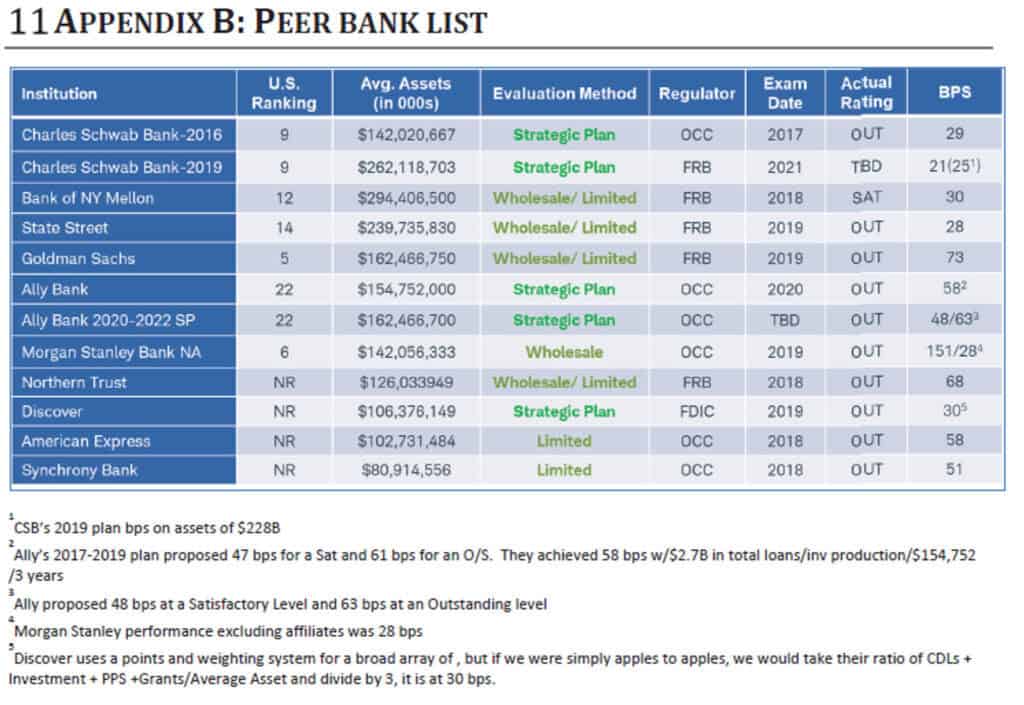

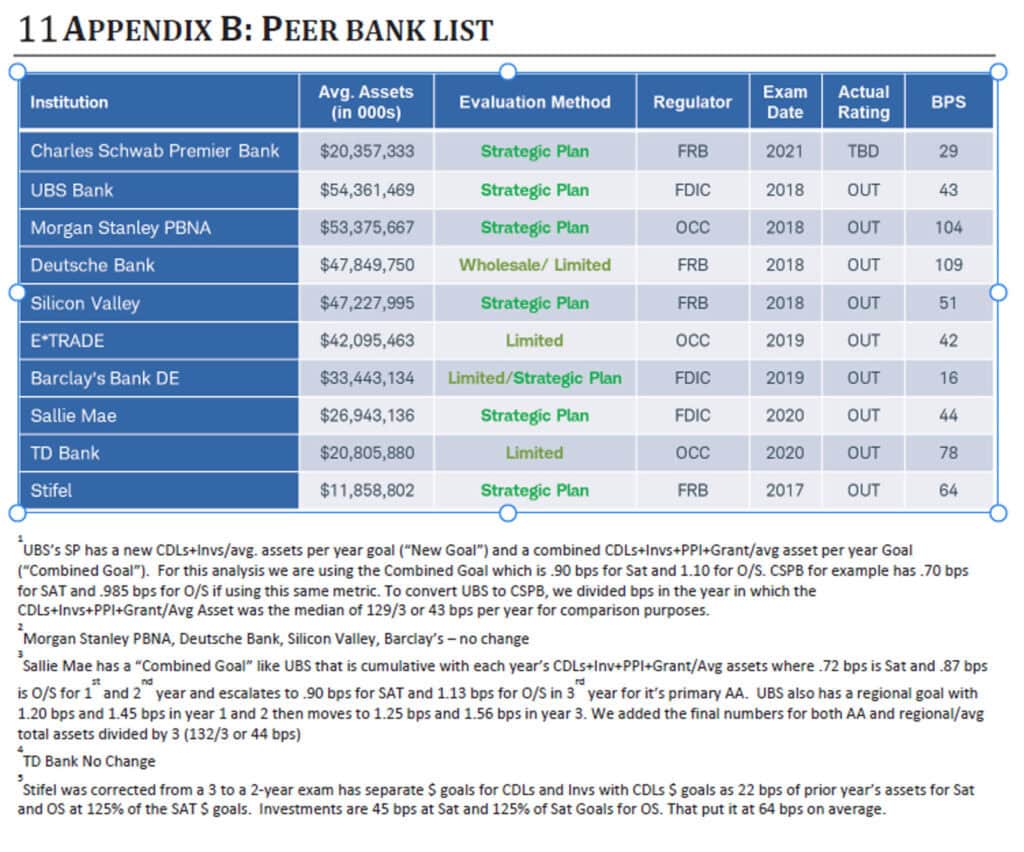

Like many CRA strategic plans, CSB and CSPB include a peer analysis as a metric for their own performance targets. The peer analysis from previous CSP and CSPB plans is attached. In the proposed 2025 plans, there is no detailed analysis but both plans include the following language:

“The Bank reviewed the recent CRA performance evaluations of 25 nontraditional regulated large banks (which included Wholesale, Limited Purpose, and Strategic Plan) with assets between $88 billion and $486 billion with CRA performance evaluations between 2018 and 2023. Six institutions had asset sizes that approximated the Bank’s assets (i.e., $100 to $300 billion). Four institutions do not yet have their ratings published, two earned a CRA rating of “Satisfactory” and four earned a CRA rating of “Outstanding.” We have sized our average annual CRA qualifying lending and investment volume to be similar to that of our closest peer banks, consistent with the Bank’s type, product set, balance sheet and other performance context, such as business model. Accordingly, the Bank has set the following cumulative five-year targets for CRA qualifying lending and investment volume and community development service hours.” (page 29)

In the attached peer analysis, CSB committed 0.21% to 0.29% of assets towards CRA lending and investments; CSPB committed 0.29%. In the 2025 plan proposal, the banks propose to commit 0.43% to 0.54% of assets towards CRA lending and investments. We commend CSB and CSPB for increasing this ratio, but it is still dramatically lower than the comparable ratio for CRA eligible loans and investments by banks evaluated under the traditional performance evaluation method. NCRC analyzes CRA performance evaluations regularly, and we almost never see levels of lending and investment this low. For example, looking at just current period community development lending and investments as a ratio of total assets, most banks we analyze come in between 0.7% and 1.5% – this ratio doesn’t even include prior period investments, mortgage lending or small business lending. We are at a loss to understand why strategic plan banks aim for a lower standard when they have the same capacity as other banks of similar asset sizes. There is no reason a “nontraditional regulated large bank” has diminished capacity to deploy CRA loans and investments relative to other banks of similar asset size.

The Federal Reserve should demand more from CSB and CSPB – they have the capacity to devote much more than a meager 0.5% or less to underserved communities. And no bank that invests a fraction of 1% of its assets in CRA eligible loans and investments should receive an outstanding CRA rating. CSB and CSPB should recreate their performance targets using all banks of similar asset size as a benchmark.

Retail Lending

The CRA strategic plan evaluation method “provides a bank with the opportunity to tailor its CRA objectives to the needs of its community and to its own capacities, business strategies and expertise.”[2] For example, some investment banks or other non-traditional banks might not offer a full suite of retail products. However, CSB offers multiple retail products, including online checking and savings accounts, and credit cards.

With the new CRA rule on the horizon, regulators must not permit banks to avoid CRA obligations by proposing CRA strategic plan terms that would, in effect, delay their obligation to comply with the new rule, which may go into effect as early as 2026. The Federal Reserve must not approve the CSB Plan unless the term is changed to, at most, three years.

By using the CRA strategic plan option, CSB avoids its retail lending obligations altogether. By not including a retail lending performance target, and by choosing the strategic plan option, CSB is avoiding oversight of its lending in minority and low-income communities. This lack of oversight and attention to retail lending performance has resulted in fair lending issues, as evidenced by CSB’s mortgage lending performance.

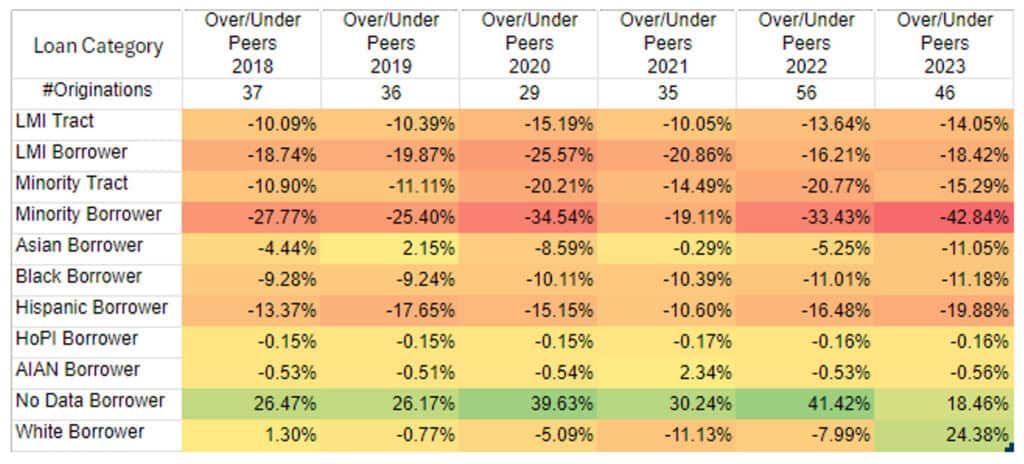

NCRC analyzed CSB’s home purchase mortgage lending performance for the years 2018 – 2023 in their assessment area, the Dallas Forth Worth Assessment Area. The CSPB assessment area consists of 11 counties in the Dallas-Fort Worth area. Although its home purchase lending volume was small, ranging from 29 to 56 HMDA-reported loans annually throughout its assessment area, there is enough volume to detect a consistent trend: CSPB is not serving minority or low- to moderate income borrowers, nor is the bank servicing minority or low- to moderate-income census tracts. The following table shows the difference in the percentage of loans made by CSB relative to all mortgage lending in the assessment area.

Charles Schwab Bank, SSB Home Purchase Loans, Dallas-Fort Worth Assessment Area, 2018 – 2023[3]

In addition, this data shows that CSB made no loans to Black borrowers in Dallas County during the 2018 – 2023 period. In other words, in a six-year period, CSB made zero mortgage purchase loans to Black borrowers in a county where, according to the latest census, the population is 24% Black.

The CSB Plan must address these discrepancies and describe how the bank plans to remedy its performance. At a minimum, CSB must commit to developing a fair lending action plan that will detail how the bank plans to improve its mortgage lending performance to ensure that this product serves the entire community in which CSB operates, as required by the CRA. This plan should include a commitment to a contract with a fair lending testing agency to determine if there are barriers to lending across their markets, including potential discrimination. The data should be analyzed and used to correct business practices that create barriers, and to develop training opportunities for lending officers.

Public Participation

NCRC applauds CSB and CSPB for acknowledging its nationwide digital footprint and proposing to engage in CRA lending and investing nationwide. “Consistent with the New Rule, § 228.19, the Bank is proposing a Plan that permits lending and investing nationwide after it meets its obligations in its DFW AA.”[4]

However, the Plans must also describe how the CSB and CSPB will engage with the public to ensure that their loans and investments serve community credit needs. Therefore, we recommend that CSB and CSPB include a commitment to both (i) hosting a series of community listening sessions and (ii) forming a national community advisory board in their Plans.

Community listening sessions gather leaders from markets throughout the nationwide service area and should inform how CSB and CSPB design and implement the commitments outlined in their Plans. A national community advisory board is another important avenue for ensuring that banks stay responsive to local credit needs. A community advisory board should be comprised of leaders from regional and national organizations, and should meet, at a minimum, three times a year – twice in person and once virtually.

NCRC and its members are available to partner with CSB and CSPB to participate in community listening sessions, and to join and make recommendations for a national community advisory board.

Conclusions

NCRC applauds CSB and CSPB for increasing its levels of CRA lending and investments relative to its asset sizes. We also applaud both banks for acknowledging their nationwide footprint, and for proposing to engage in CRA lending and investing nationwide, in addition to its obligations to the Dallas-Fort Worth assessment area.

However, before the Federal Reserve approves either plan, we have the following recommendations that will ensure that CSB and CSPB truly earn a satisfactory or outstanding CRA rating:

- CSB and CSPB should increase their performance targets to at least 1% of total assets. A bank of their size has the capacity to do so, and any amount less than 1% should not result in an Outstanding CRA rating.

- CSB and CSPB should commit to hosting a series of listening sessions during their Plan terms and should create a national community advisory board that meets in person at least twice a year to discuss the credit needs of communities outside the Dallas-Fort Worth assessment area.

- CSPB must create a fair lending action plan, detailing its plans to improve mortgage lending performance in its assessment area. This plan should include a commitment to contract with a fair lending testing agency to determine if there are barriers to lending across their markets, including potential discrimination. The data should be analyzed and used to correct business practices that create barriers and to develop training opportunities for lending officers.

- While the new CRA rule effective date is pending, but could occur as early as January 2026, no CRA Strategic Plan should have a term longer than 3 years right now. A term longer than three years would allow banks to significantly delay compliance with this new rule. We urge CSB and CSPB to recognize this and adopt a three-year plan.

NCRC appreciates the opportunity to provide these comments on the CSB and CSPB proposed 2025 CRA Strategic Plans. We are ready and willing to partner with both banks in hosting listening sessions, forming a national community advisory board and in developing a fair lending plan for the Dallas-Fort Worth community, where we have many members who are active community-based organizations serving a diverse range of clients in the market. We look forward to hearing from you and thank you for your consideration.

Sincerely,

Jesse Van Tol

President and CEO

NCRC

ATTACHMENT:

Charles Schwab Bank, SSB CRA STRATEGIC PLAN, January 1, 2022 – December 31, 2024, Peer Bank List (page 34)

ATTACHMENT:

Charles Schwab Premier Bank, SSB CRA STRATEGIC PLAN, January 1, 2022 – December 31, 2024, Peer Bank List (page 34)

[1] Federal Reserve. Strategic plan guidance. Retrieved from https://www.federalreserve.gov/consumerscommunities/files/strategic-plan-guidance.pdf.

[2] Id.

[3] Using the CFPB HMDA dataset (available at https://ffiec.cfpb.gov/) NCRC analyzed CSB’s mortgage lending performance in the bank’s Dallas-Fort Worth assessment area by looking at home purchase loans, 1- to 4-unit, site built, owner occupied homes. Our methodology to determine race and ethnicity is available at https://ncrc.org/ncrcs-hmda-2018-methodology-how-to-calculate-race-and-ethnicity/.

[4] Charles Schwab Bank, SSB and Charles Schwab Premier Bank, SSB proposed 2025 CRA Strategic Plans (Draft, p. 9).