In December 2019, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) issued a notice of proposed rulemaking (NPRM) that would considerably weaken the regulations implementing the Community Reinvestment Act (CRA), a law designed to combat redlining by requiring banks to affirmatively and continually meet community needs for credit and banking services in all communities where they have branches. CRA would be diluted in many significant ways, especially for older adults with low- to moderate-incomes (LMI).

Age-Friendly Banking

Age-Friendly Banking is a set of recommendations that NCRC has developed for federal, state and industry stakeholders that will improve the financial system’s accessibility, responsiveness and safety for older adults. Older adults hold approximately 70% of deposit balances.

NCRC’s Age-Friendly Banking initiative centers around six primary principles: protecting older people from financial abuse and fraud, customizing financial products and services to senior needs, expanding affordable financial management, guaranteeing access to critical income supports, facilitating aging in the community and improving the accessibility of banking for those with restricted mobility or who are living alone.

The Effect on Senior Banking

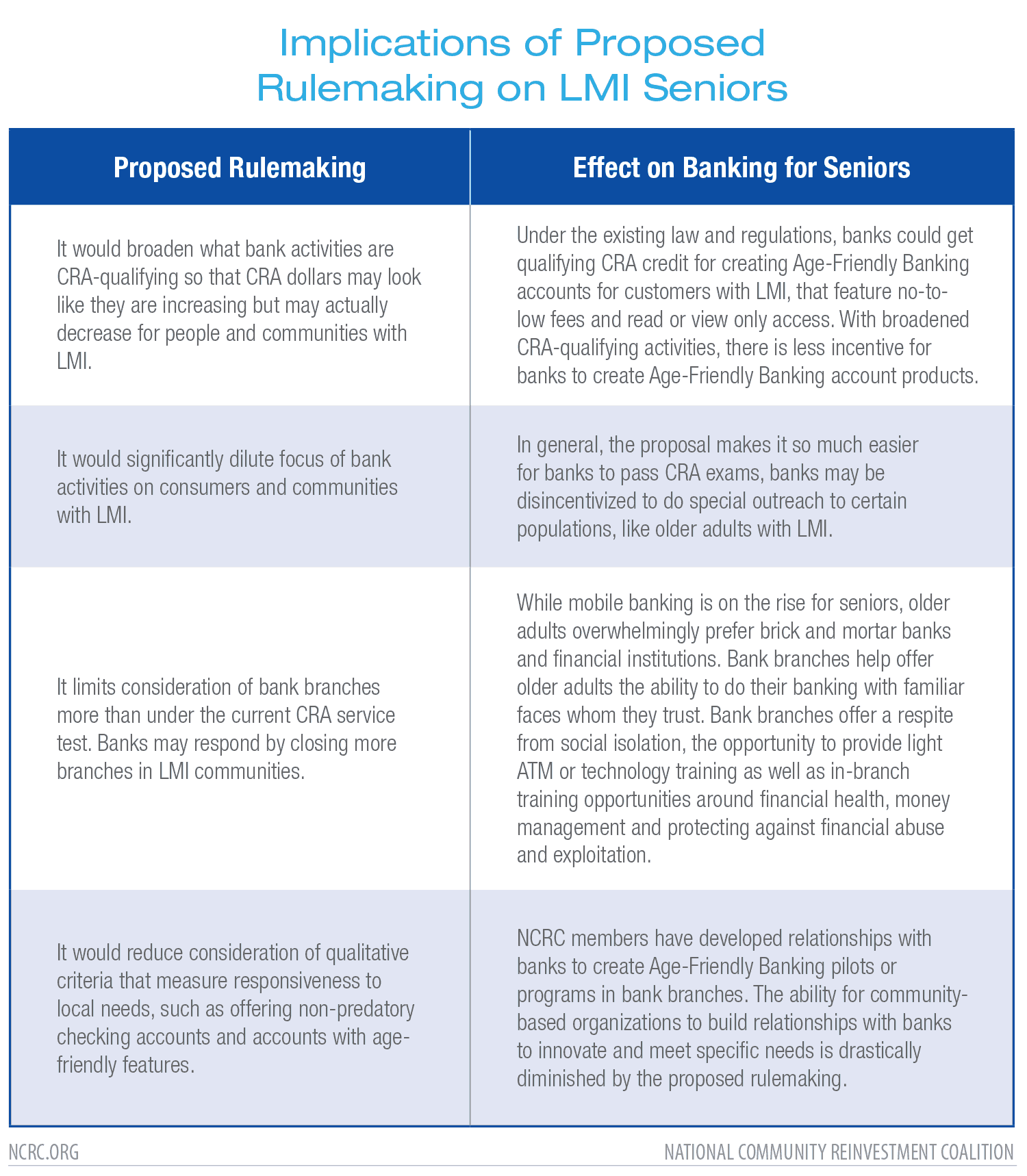

The Community Reinvestment Act would be substantially diluted by the new OCC and FDIC proposal, with distinct implications for safe and affordable banking for seniors with LMI. The following chart highlights the implications for seniors with LMI and banking given the proposed rulemaking, based on NCRC’s analysis.

CRA was created to combat redlining and systematic discrimination against communities with LMI and communities of color. CRA’s imposed affirmative obligation on banks to serve LMI communities helps customers make safe and sound banking decisions. This OCC and FDIC proposal will diminish, if not outright halt, progress by allowing banks to divert their attention and investment away from communities with LMI. Safe, secure and affordable options for seniors with LMI will likely be minimized under this proposed rulemaking.

Learn more:

https://ncrc.org/treasureCRA/

https://ncrc.org/afb-standards/