Does Perceived Socio-Economic Status Impact Access to Credit in the Small Business Arena?

December 2021

Image: ©Andrey Popov

— Key Takeaways

- Mystery shopper tests at banks continue to reveal implicit bias in lending and potential violations of the Equal Credit Opportunity Act.

- A new set of tests by NCRC found the customer experience was worse for Black testers compared to White testers, especially for those with lower perceived socioeconomic status.

- Lenders need to do more and regulators need to step up enforcement to root out discrimination and implicit bias that exacerbates racial wealth inequality.

— Key Findings

- NCRC conducted multi-layered matched-pair tests of 22 different financial institutions. 73% of the institutions had at least one test that showed a control (either a White or the High SES Black) tester was favored relative to a perceived Low SES Black tester.

- 38% of the tests revealed a difference in treatment between the High SES White and the High SES Black testers and 44% of tests revealed a difference in treatment between the Low SES White tester and the Low SES Black tester. These differences in treatment are violations against the protected class status of race under ECOA.

- 44% of the tests revealed a difference in treatment based on perceived SES of White testers, and 41% of the tests revealed a difference in treatment based on perceived SES of Black testers.

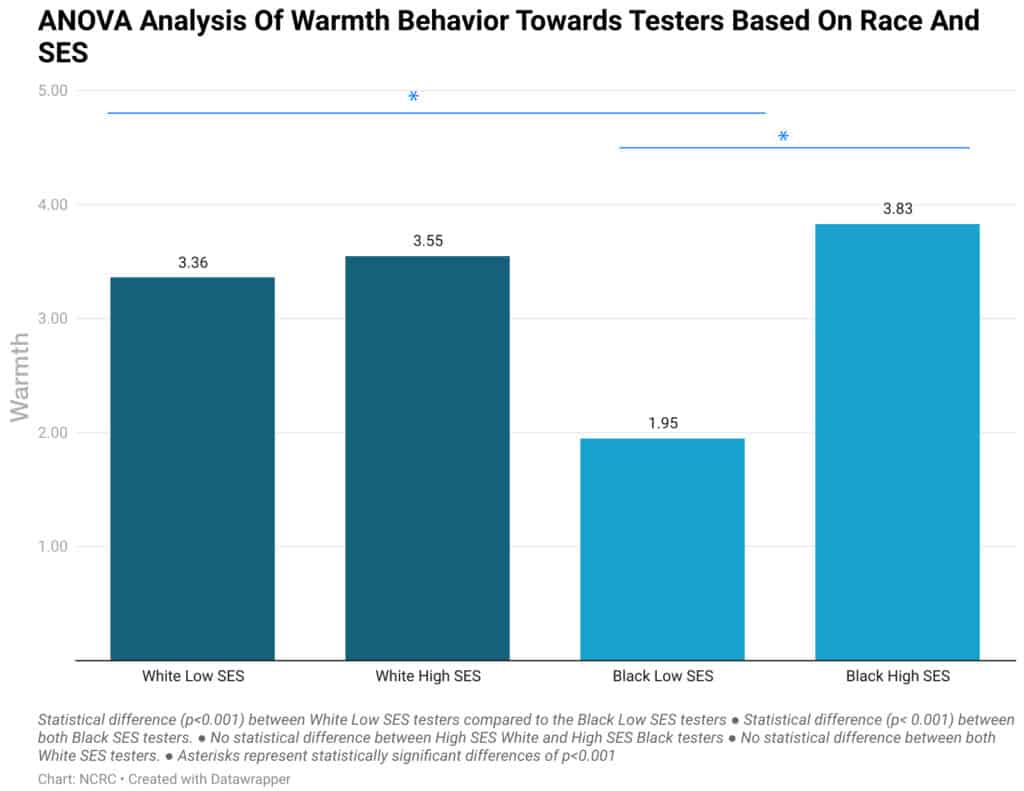

- Fewer “warmth behaviors” were exhibited toward Low SES Black testers than toward other testers (High SES Black, Low SES White, High SES White).

Anneliese Lederer, Director, Fair Lending & Consumer Protection, NCRC

Sara Oros, Program Coordinator, Fair Housing/Fair Lending, NCRC

Dr. Sterling Bone, Professor of Marketing, Huntsman ProSales Director, Utah State University

Dr. Maura Scott, Persis E. Rockwood Professor of Marketing, College of Business, Florida State University

Dr. Glenn Christensen, Garrett Research Fellow, Associate Professor of Marketing, Brigham Young University

Executive Summary

From November 1, 2020, to December 14, 2020, NCRC conducted multi-layered matched-pair tests of 22 different financial institutions. The purpose of this study was to examine the role of socio-economic status (SES), specifically perceived education, on the interactions between race and treatment in the small business pre-application arena. SES is defined by the American Psychological Association as the social standing or class of an individual or group and is often measured as a combination of education, income and occupation. In this paper, we conducted two different types of analysis: a marketplace audit that is a statistical analysis of the marketplace as a whole and a fair lending review of each matched-pair interaction. We found differences in the following areas:

- Information requested and different products offered

- Information provided

- Discouragement

The marketplace analysis revealed statistical significance and supported the analysis that disparate impact exists across the marketplace, which will require large-scale policy reform with buy-in from both industry and regulators. The analysis of the individual matched-pair tests revealed disparate treatment between classes, which can be addressed individually through cases filed under ECOA and through changes in lending practices at individual financial institutions.

Introduction

At the beginning of the COVID pandemic in 2020, Congress created programs to ensure that small businesses could survive. The primary conduit for government aid to small businesses was the Paycheck Protection Program (PPP). The PPP program ended as of May 31, 2021, and resulted in nearly $800 billion in loans, but the program was not available to all small businesses throughout the pandemic. Some sought financing through traditional credit products.

During the time period when PPP was available, we conducted two different rounds of matched-pair tests – one in DC and one in LA – to determine the level of access to lending products in the small business arena. This research yielded a difference in treatment based on race and national origin in both locations.

Furthermore, our prior research during the same time period revealed other factors, such as business legal structure, that also acted as a greater barrier to accessing credit than previously thought. We have now expanded this research to examine more closely the role a different factor, socio-economic status (SES), may have on access to credit. Other research has measured and defined SES with additional factors. For this study, we examined the role of SES, specifically perceived education, on the interactions between race and treatment in the small business pre-application arena.

Race and SES status are intertwined in many ways, as race and ethnicity can predict SES. A combination of race and SES can predict health outcomes. Research in the medical arena suggests that low SES status may have compounding effects on racial and ethnic minorities. SES can also be an indicator of a person’s access to public services, assets accumulated throughout time, and an individual’s ability to take advantage of community resources.

Consumer behavior not only studies the behavior of the consumer but also the behavior of the employee. Perceptions of socio-economic status also changes perceptions of Black and White consumer behavior. For example, Black restaurant patrons are perceived to be poor tippers. But in actuality, when testers were sent into restaurants, the racial disparities in tips diminished the further up the socio-economic ladder the tester was.

There is some research focused on SES in lending, but little focused explicitly on the interconnectedness of SES and race in small business lending. Some forthcoming research discusses SES in relation to online lending and applications to the online lender Prosper.com from February 2007 through October 2008. During this time period, prospective borrowers were allowed to write a paragraph describing why they needed the funding. The authors found that borrowers whose paragraphs were considered to be highly readable were more likely to receive a loan. Researchers examined readability of linguistics and word choice as being associated with education and social status.

Discrimination and implicit bias increase the likelihood a financial institution will violate fair lending laws. Our testing shed light on the role that perceived SES, through the variable of education, in conjunction with race, played in the difference in treatment in the small business lending arena, resulting in: different products offered, different information provided, different information requested and discouragement.

Testing Methodology

NCRC, in collaboration with our academic partners, conducted pre-application multi-layered matched audit testing based on race and SES in the Washington, DC, metropolitan statistcal area (MSA). Multi-layered matched testing consisted of testers contacting a bank branch to determine if there was a difference in treatment. We designed a 2 (customer race: White, Black) x 2 (customer SES: low, high) testing experiment to examine this. The multi-layered matched testing only occurred in the pre-application phase, with the tester requesting information about loan products. For this round of testing, we conducted 34 male multi-layered matched tests consisting of White and Black testers using scripts to represent either high SES or low SES small business owners. We had a total of 136 interactions with bank branches.

From November 1, 2020, to December 14, 2020, our testers contacted 34 bank branches representing 22 different financial institutions. We audited the marketplace by randomly selecting from all small business lending institutions to represent a broad cross-section of the small business lending marketplace. The banks selected ranged from lenders with assets over $10 billion to community banks. Tests were conducted by phone since many bank branches were closed to in-person services due to the pandemic. The purpose of the research was to determine the baseline customer service level that male testers of different race and SES backgrounds received when seeking information about small business loans to help stay afloat during the COVID-19 pandemic, when PPP products were unavailable. The PPP product became available again, after the testing was completed, for a few more months.

Testing, a critical tool for fair lending enforcement, is used to assess equal access to credit. Federal agencies also conduct similar testing to investigate when they have been alerted to suspicious behavior. Upon implementation of section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, matched pair testing will be the only method to measure pre-application small business discrimination and discouragement since banks will not be required to collect demographic data on loan inquires before an application is submitted. The Department of Housing and Urban Development (HUD) partners with fair housing groups to do testing under their Fair Housing Initiatives Program (FHIP). The Department of Justice (DOJ) Civil Rights Division has taken on many cases developed from its testing program. Additionally, the Consumer Financial Protection Bureau (CFPB) has taken enforcement action against Bancorpsouth after implementing testing that revealed multiple threats to consumers’ fair and equal access to mortgages. The US Supreme Court has upheld testing as a crucial private enforcement tool in fighting against civil rights violations.

Pretesting for Perceived Race

Similar to previous NCRC tests, tester profiles were controlled with racially identifiable names, and each tester was required to pass a voice panel test to determine whether or not their perceived race could be determined over the phone. Testers were only used if their voice was perceived to be racially identifiable by a blind panel. Other research has revealed that linguistic profiling occurs over the phone and that many Americans can accurately guess demographics such as race over the phone after a few sentences.

Pretesting for Perceived SES

Once testers passed the voice panels, they were required to pass an additional panel to determine their perceived socio-economic status over the phone (pace of natural speech or accent). After listening to each recording, a national panel of respondents — blind to the research questions guiding the study — were asked to assess using ten-point Likert scales the perceived SES of the individual along with two indicators of “how educated you think this person is” and “what level of income this person has.” Respondents then categorized each voice recording by race/ethnicity and sex categories. Those individuals whose voice recordings had the highest and lowest averages of perceived education and income and also had an acceptable level of agreement of the race and sex were selected. For the test phone calls, we further manipulated SES by using profile names and script linguistics/grammar. The script testers used was adapted using the Gunning Fog Index Score rating system. This index estimates the years of formal education a person needs to understand a text. Higher scored opening monologues were used by High SES testers, and low scored opening monologues were used by Low SES testers. Other research has used the Gunning Fog index to create varying scripts to study complexity and readability in relation to lending outcomes.

As with our previous work, this study was designed to answer the following research questions: Are minority and non-minority small business owners with similar economic and business profiles:

- Presented with the same information?

- Required to provide the same information?

- Given the same level of service quality and encouragement?

The matched-pair mystery shoppers had nearly identical business profiles and strong credit histories to inquire about small business products. The profiles of all testers were sufficiently strong that, on paper, they were all qualified for credit. Furthermore, the protected Black and Low SES tester profiles were intentionally designed to be slightly better than their White and High SES counterparts in income, assets and credit scores. This was done to make it a more conservative test for differential treatment. Immediately following the interaction, testers were asked to answer yes or no about whether bank employees made specific behaviors, queries and comments. They were also required to provide a narrative of the interaction.

The data was analyzed using two approaches: market analysis using chi-square and analysis of variance (ANOVA) statistical difference tests and a fair lending review. For the chi-square difference, we applied statistical analysis to evaluate whether differences in the interactions between High SES White testers, Low SES White testers, High SES Black testers and Low SES Black testers were significant across all banks visited. The chi-square test for independence is a particularly robust way for social scientists to evaluate whether or not there are substantial differences in outcomes between groups. Testers were asked “yes or no” (dichotomous) questions about their interaction with bank personnel in a survey. The number of interactions observed ensures a high level of validity. To make sure we were analyzing and comparing cases that reached a similar point-of-contact with the bank, we only included cases where the tester was able to speak to a bank representative regarding their small business loan request. The sample size is n = 137, which is broken down into the following:

- White High SES = 31 interactions

- White Low SES = 31 interactions

- Black High SES = 36 interactions

- Black Low SES = 39 interactions

ANOVA is a statistical tool used to analyze the difference in statistical means. This was used primarily in the review of warmth behaviors.

For the fair lending review, each of the narratives was qualitatively analyzed independently by two fair lending experts as matched-pair sets to determine a difference in treatment under fair lending standards.

- High SES White v High SES Black examining for differences based on race

- Low SES White v Low SES Black examining for differences based on race

- High SES White v Low SES White examining for differences based on SES

- High SES Black v Low SES Black examining for differences based on SES

We used four categories to determine a difference in treatment:

- Products offered

- Information requested

- Information provided

- Discouragement.

For our fair lending review, we looked to ECOA and Regulation B, the fair lending law that applies to small business loans. ECOA makes it illegal for a member of a protected class to be discriminated against in any aspect of a credit transaction, including the pre-application arena. Protected classes under ECOA include race, color, religion, national origin, sex, marital status or age (provided the applicant has the capacity to contract); to the fact that all or part of the applicant’s income derives from a public assistance program; or to the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act. Discrimination occurs when a protected applicant is offered different products, provided different information, or experiences discouragement to apply or pursue a loan compared to the non-protected applicant. SES is not a protected class under ECOA.

Discrimination can be found through either overt statements, disparate impact or disparate treatment. Disparate impact is a neutral policy that has a disproportionately adverse effect against a protected class. This can be shown through the use of statistical tools. Disparate treatment compares the treatment between two individuals and their experience with one of the individuals being a member of a protected class. Disparate treatment can range from subtle differences in treatment to more overt behaviors.

Testing Results - Market Analysis and Fair Lending Review

Overall, the analysis revealed statistically significant differences in how the testers were treated in different categories across the marketplace. In addition to the statistical findings, the fair lending analysis combining race and SES revealed an overall difference in treatment in 24 out of 34 (70%) of the multilayered tests with the control tester being favored.

Control in each matched pair was defined as:

- High SES White (control) v. High SES Black (protected)

- Low SES White (control) v. Low SES Black (protected)

- High SES Black (control) v. Low SES Black (protected)

- High SES White (control) v. Low SES White (protected)

Differences in treatment between the White and Black testers, regardless of SES, are ECOA violations. Differences between races based on SES highlight violations that would not be covered by ECOA.

Of the 22 different financial institutions tested in this audit, 16 (73%) had at least one test that showed a control (either White or the Black High SES) tester was favored. Combined, both Black testers and Low SES White testers experienced 56 different instances of difference in treatment in this round of testing.

We completed a fair lending analysis of each multi-layered test for both race and SES. For the analysis based on race, we examined the difference in treatment between the White and Black testers, with both testers being of the same perceived SES level. For this analysis, we found the following results:

The differences found above continue to remind us that race discrimination in the pre-application arena continues. We found that 13 out of 34 tests (38.2%) revealed a difference in treatment based on race between the High SES testers, and 15 out of 34 tests (44.1%) revealed a difference in treatment based on race between the Low SES testers. The Low Black SES tester experienced a higher rate of discrimination based on race than the High Black SES tester.

The SES analysis examined how testers of the same race but different perceived SES levels were treated. For this analysis, we found the following results:

We found that 15 out of 34 tests (44.1%) revealed a difference in treatment based on SES between the White testers, and 14 out of 34 tests (41.2%) revealed a difference in treatment based on SES between the Black testers. This difference highlighted the role that SES played in accessing information and credit – in almost half the tests, the Low SES tester did not receive the same level of treatment as the High SES tester.

Our analysis highlighted a difference in treatment across four categories in both the marketplace audit and the fair lending review. These categories were: difference in products offered, the difference in the information requested, the difference in the information provided and discouragement.

The Difference in Products Offered and Information Requested

Market Analysis:

This situation is highlighted in the following test from our fair lending review.

Fair Lending Example:

All four testers contacted the bank and were asked if they currently have an account with the institution. All four testers replied that they were not current customers of the bank. Both the High and Low SES Black testers were then told to ask the bank they currently have a relationship with for loan information. The contact between these testers and the institution ended at this point.

A different situation occurred with the White testers – both High SES and Low SES. Both White testers were able to move forward and continued to receive information on loan products. The High SES White tester was provided information about a line of credit. The Low SES White tester was told about a credit card. Further examination of the test revealed that the High SES tester was asked more questions about the tester’s business and financials than the Low SES tester.

The test revealed a difference in treatment based on race and SES. By not offering anything to the Black testers whose profiles were better situated for credit products, the institution violated ECOA and Reg B. Furthermore, the test revealed the institution’s employee’s implicit bias as both White testers spoke to the same agent. Still, the High SES tester was offered the better product and asked more questions about the business so that the employee could help steer that tester to the better credit product.

The Difference in Information Provided

Market Analysis:

We continued to observe statistical differences resulting in disparate impact based on race across the marketplace. We found a difference among the High SES testers, with the High SES Black testers being told about loan fees significantly more often than the High SES White testers. We also found that a personal guarantee was significantly told to the White High SES testers more often than the Black High SES testers. Between the two Low SES testers, the chi-square analysis revealed that the White Low SES tester was told information about interest rates, loans application fees, and length of the loan significantly more often than the Black Low SES tester even though the Black Low SES tester profile was better situated to be approved if he had applied for a loan.

Analysis of the difference in treatment by SES revealed that the High SES Black tester received statistically significantly more loan information than the Black Low SES tester except for information about personal guarantee. Only in the measure of interest rates did we see that both High SES testers received this information significantly more often than the Low SES testers regardless of race. This information revealed the financial institution’s employee’s implicit bias in informing High SES testers, especially the Black High SES tester, about loan information.

Fair Lending Example:

An application that is not correctly filled out will either be rejected or result in greater scrutiny and time to ensure that the business can pay back the loan. At one financial institution, three out of four of our testers received an email from a bank employee providing them with the information about what documents they would be required to submit with an application. The White High SES and White Low SES testers received emails from the same employee. Our testing revealed a reduction in information by both race and SES, with the White High SES tester getting the best treatment even though he had the lower economic profile.

Only three out of the four testers received a follow-up email from the bank after the interaction. These testers were: the White High SES tester, the Black High SES tester and the White Low SES tester. The Black Low SES tester did not receive any follow-up email. There was also a difference in the information provided by the banker on the items that each applicant would need to submit when applying for the same type of loan.

Tester #1

The White High SES tester was provided the following list in the email:

- Link to complete business loan application

- Link to complete personal financial statement

- Request for last year’s completed business and personal federal tax returns

- Request for 2020 YTD profit and loss statement

- Request for current balance sheet

- Request for debt schedule

- Request for aging A/R and A/P report

- Request for copy of current drivers license

- Request for articles of incorporation and operating agreement

- Request for certificate of good standings

- Request for explanation of how COVID-19 has impacted the business

In addition, the White High SES tester was given information in the email about the small business line of credit features and benefits and features of opening a deposit/checking account with the bank.

Tester #2

The Black High SES tester was provided with the following list in the email:

- Request for 2019 business tax return

- Request for 2019 personal tax return

- Request for current balance sheet

- Request for year to date profit and loss statements

- Link to complete business loan application

- Link to complete personal financial statement

- Request for copy of photo ID

The list given to the Black High SES tester was not as robust as the list given to the White testers. The list provided to the Black High SES tester asked for significantly less information and only met the minimum requirements as listed on the bank’s web site. This is an example of disparate treatment. The High SES Black tester was not provided with the same information even though his profile was stronger than the High SES White tester. Submission of this application may not result in an immediate outright denial for incompleteness; it would result in greater scrutiny and a longer approval time to provide the additional documents that the White High SES applicant would provide at the time of initial submission. In addition, this tester was not given any additional information about the products and benefits of opening an account with the bank, which the White High SES tester received.

Tester #3

The White Low SES tester was provided the following list in the email:

- Link to complete business loan application

- Link to complete personal financial statement

- Request for last 2 year’s completed business and personal federal tax returns

- Request for 2020 YTD profit and loss statement

- Request for current balance sheet

- Request for debt schedule

- Request for aging A/R and A/P report

- Request for copy of current drivers license

- Request for explanation of how COVID-19 has impacted the business

The White Low SES tester was provided a similar but not identical list of information compared to the White High SES, and significantly more information than either Black testers received. The Low SES White tester was not told to provide two documents: (1) articles of incorporation/operating agreement and (2) a certificate of good standing, which was told to the White High SES tester. They were also asked for 2 years of completed business and personal federal tax returns, whereas the White High SES tester was asked for one previous year’s tax returns. The White Low SES tester was not told about information and benefits of opening an account with the bank.

There was a difference in treatment between the two White testers based on SES. By providing the lower SES White tester – who had a better profile than the High SES White tester – with less information, the financial institution would likely scrutinize the application more and increase the length of time before approval.

Tester #4

The Black Low SES tester never received a follow-up email from the bank.

Comparing the treatment between the two Low SES testers, we see a difference based on race as the Black Low SES tester did not receive any information about documents that need to be provided if they were to apply for a loan even though the profile was of a more qualified applicant compared to the White Low SES. This test also revealed the difference in treatment by SES between the two Black testers as the High SES Black tester received an email and the Low SES Black tester did not.

Discouragement/Encouragement

Market Analysis:

Discouragement manifests in many different ways and ranges from overt to subtle actions. A more subtle but very effective action is the consumer behavior concept of warmth. There are various behaviors enacted by financial institution employees throughout the interaction that can leave customers either encouraged or discouraged about applying for a loan. A loan customer may evaluate the warmth of the loan officer, such as their willingness to be friendly, respectful, helpful and caring. We asked the testers to document the actual behaviors that took place during the interaction. We measured whether the loan officer demonstrated warmth behaviors toward the prospective customer (e.g., Did they use your name? Did they ask how they can help you?). These warmth perceptions from the employee can lead to perceptions of the lender and the service they are willing to provide.

We conducted 2 (race: White, Black) × 2 (customer SES: low, high) analysis of variance (ANOVA) on each of the outcome variables. ANOVA is a statistical tool to analyze the differences among means. The graph below demonstrates the warmth behaviors.

Overall, the Black Low SES testers were discouraged because they received fewer actual warmth behaviors during their transactions with the loan officer. The warmth experienced by the tester demonstrates the desire of the employee to continue this relationship – the opposite of discouragement.

Applying the chi-square analysis to the specific warmth behavior that “a tester was offered to be sent or emailed an application,” we found a statistically significant difference in whether the loan officer offered to email the tester a loan application. The disparity was mainly an SES effect as there was no statistical difference when comparing the two high testers to each other and the two low SES testers to each other. Between the two Black SES testers, we found a statistically significant difference that the Black High SES tester received this offer (p<0.001) compared to the Black Low SES tester. The High SES White tester was offered this encouragement marginally significantly more often (p<0.10) than the Low SES White tester. Further analysis revealed that the High SES Black tester received this encouragement more often (p<0.01) than the Low SES White tester and similar for the White High SES tester compared to the Black Low SES tester (p<0.01). This chi-square analysis highlights the ANOVA analysis and reveals the manifestation of the warmth behavior.

Encouragement

At the end of the survey, testers are asked if the representative encouraged them to apply for a loan product during the call. This survey question revealed that the two High SES testers were encouraged to apply statistically significantly more often than the Low SES testers (p<0.05 for White SES effect and p<0.001 for Black SES effect). This SES effect was seen further when looking at the level of encouragement that was statistically significant for the White High SES tester compared to the Black Low SES tester (p<0.001) and the Black High SES to the White Low SES (p<0.05). There was no significant difference between White High SES compared to Black High SES and White Low SES compared to Black Low SES. Once again, this SES effect was seen as a compounding effect for Black testers more frequently.

Fair Lending Review Example:

Both testers spoke with different employees. The White High SES tester reported that he was told the length of the loan, the annual fee, the prime rate and the interest rate range. Most importantly, the White High SES tester was offered the opportunity to begin an application over the phone at the time of this contact. The Black High SES tester reported that he did not receive information about interest rates for the line of credit as “he couldn’t give me an estimate. He didn’t want to set the expectations high in the event that I’m not approved for that rate.” Furthermore, this tester was not told about approval times, fees, nor offered to begin an application at that time.

This test revealed a difference in treatment based on race as the Black tester was discouraged from applying in two ways. First, the Black tester was not provided any information on fees, interest rates and approval times, which are required to make an informed decision. Second, the White tester was encouraged to start the application process at this interaction while this offer was not extended to the Black tester.

Once the White Low SES tester provided the bank employee with the purpose of the call, he was informed that “the loan banker was on vacation until next Monday…She asked if it was okay for me to wait until Monday, and she said she’d make sure XXX got the message.” The Black Low SES tester reported when he informed the financial institution of the purpose of the call he was asked “if I have a banking relationship with XXX, and I told him I have YYY currently. He told me that I would want to apply for a small business loan with YYY as it would be easier.”

Again, we observed a difference in treatment based on race. The discouragement in this test occured when the Black tester was told to return to their current bank instead of seeking a loan from this bank. While the White tester had their expectations managed and were encouraged to continue to engage with the financial institution by being informed that the loan officer was unavailable at this time because they were on vacation.

Furthermore, the tests revealed a difference in how overt the discouragement was depending on perceived SES. The lower the perceived SES, the more overt the discouragement. The bank employee in the first test was less overt in his discouragement by providing some information to this Black tester but displayed his implicit bias through the words “didn’t want to set expectations,” which can create doubt in the tester’s mind that they may not be qualified for a loan product and thus may be discouraged from applying for credit. The bank employee in the Low SES test explicitly discouraged the Black tester by telling him to seek out a credit product from another bank.

Recommendations:

The testing continued to reveal the difference in treatment that occurs to different testers. To combat this treatment based upon race and SES, we offer the following recommendations:

Include implicit bias training in fair lending training

Financial institutions need implicit bias training. This type of training will help employees realize their own biases and their effects on consumer behavior. It is implicit bias that is causing the difference in the treatment by SES.

Matched-pair testing as a component of fair lending compliance

Financial institutions need to use matched-pair testing in their fair lending compliance processes to ensure that they are not violating fair lending laws and not discouraging applicants from applying for loans. The testing and the results can be used to improve employee training.

Additional research on SES

This is the first study of its type. Still, more studies are needed to better understand the interconnectedness between race and SES, and its outcomes and how to combat it. Implicit bias and its discriminatory effects need to be studied in the mortgage arena as well.

Consistency in email material distribution

Financial institutions should ensure that there is consistency in emails that are sent to prospective applicants. This is a potential fair-lending issue as well as a general compliance issue.

Increased supervision by the prudential regulators

The regulators need to review with greater scrutiny the documents that financial institutions release to the public. They also need to ensure that institutions have policies in place to send out consistent content emails.

Conclusion:

While higher SES status statistically improved encouragement for Black testers, Black testers still experienced differences of treatment based on race when compared to White testers. This difference revealed the role that implicit bias has as a barrier to accessing credit. While we have some tools to prevent discrimination, further research and observation must be completed to better understand and ensure that implicit bias does not play a role in the journey to access both small business and consumer credit.

Testing continues to illuminate how illegal discrimination occurs in the small business lending marketplace. Financial institutions need to implement stronger compliance programs that have a matched-pair testing component. Furthermore, regulators need to conduct reviews of the documents that financial institutions release into the public sphere.