There are nearly 50 million African Americans in the U.S. today. Though the African American population continues to rise, their share of the nation’s wealth isn’t keeping up, according to the National Community Reinvestment Coalition’s recent African American Racial Wealth Divide Snapshot.

In 2018, the annual median income of African Americans reached a little over $41,000 — a high watermark, but considerably below the national average of about $62,000 and far below the median White income of over $70,000.

Similarly, despite a record low Black unemployment rate of 6.5%, African Americans still lag beyond the national unemployment rate of about 3.9%. In this, they’re much closer to other historically marginalized groups like Native Americans, for whom unemployment is about 6.6%.

In an encouraging sign, education levels have been on the rise for African Americans.

High school graduation rates increased from 67% in 2010 to 78% in 2017 — the largest increase for any racial group. Over the same period, the share of Black students getting a bachelor’s degree increased from 17% to nearly 22%. However, these numbers still lag far behind comparable numbers for White Americans.

But here’s where we get to what really matters.

Income, employment and education are only part of what makes up economic well being. When it comes to measuring real household security, few measures are better than net worth — and it’s here we see the most stark racial wealth divide of all.

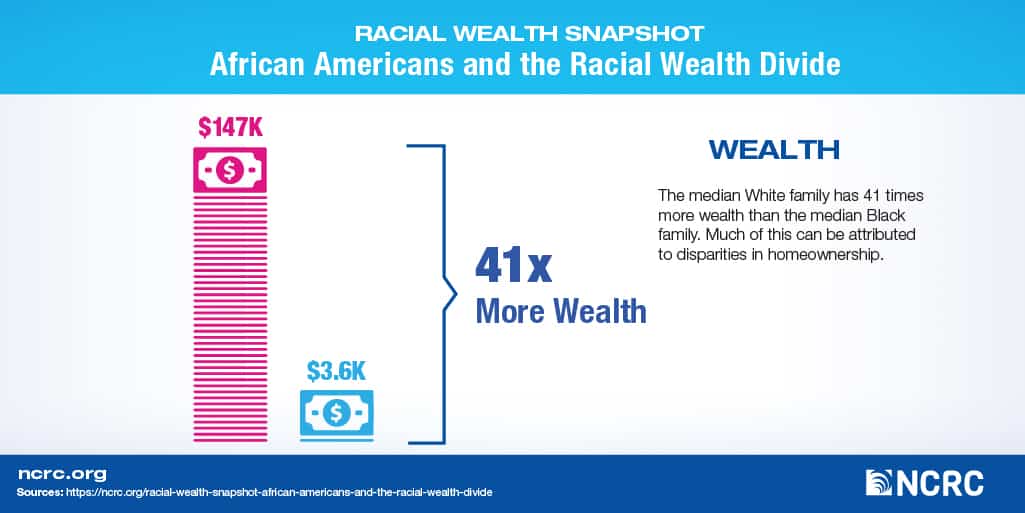

While White households have a median family net worth of $147,000, Black households have a mere $3,600. In other words, the median White family has 41 times more wealth than the median Black family.

Well into the 21st century, then, the African American journey to equality in the United States is still quite distant, particularly as it relates to economics and wealth. As we took a look last month at Black history, we need to acknowledge a major historical legacy: the structural regeneration of debt and poverty.

And we need to start repairing the harm that’s been done.

How? For starters, by using the more than $700 billion in tax benefits aimed at wealth development to go to low-wealth households instead of disproportionately benefitting the wealthiest Americans, thus reinforcing wealth inequality.

More broadly, we need a deeper understanding of the racial wealth divide and its systemic roots — from slavery to segregation to ongoing discrimination and lack of opportunity today.

Dedrick Asante-Muhammad is NCRC’s Chief of Race, Wealth and Community.

Jamie Buell is an Race, Wealth and Community intern.