— Key Takeaways

- Latino borrowers show strong interest in homeownership, despite facing barriers and disparate treatment in the mortgage market.

- Closing costs and interest rates were substantially higher for Hispanic borrowers than for non-Hispanic White borrowers.

- Latino borrowers were underserved by banks. They relied on mortgage companies for more than 70% of their home purchases, a far higher share than most other groups.

- Hispanic borrowers were not a homogenous group. In most cases, they reported identifying with at least one additional subgroup, including Cuban, Mexican, and Puerto Rican. Specific communities were especially dependent on government- backed lending programs such as VA and FHA.

- This review shows the importance of measuring progress for segments of the Latino community, including Afro-Latinos, who face persisting barriers or have long been overlooked in the mortgage market.

— Key FINDINGS

In 2019, the majority of Latino[1] applicants were seeking loans to buy a home.

- Over 470,000 Hispanics became homeowners.

- More than half (58%) of loans Hispanics received were to help finance a home purchase. This exceeded the percentage of home purchase loans received by non-Hispanic Whites and borrowers nationally.

- Over 60% of loans made to Hispanics were conventional products, and just over 30% were loans insured by government programs including FHA, VA and RHS.

Patterns of home lending to Latinos varied by geography and among Hispanics who identified as Cuban, Puerto Rican and Mexican.

- The majority of loans that were made to Hispanics were concentrated in the states of Texas, California, Florida, Illinois and Arizona. In addition, Latinos made up a substantial share of the mortgage market in states including New Mexico, Nevada, Colorado and New Jersey, as well as Puerto Rico.

- In California, Texas and Arizona, the majority of Hispanic homebuyers identified as Mexican, while in Florida, most homebuyers were Cuban or Puerto Rican, and in New Jersey and New York, most homebuyers were Puerto Rican.

- While one in three Hispanic borrowers overall relied on government loans programs, over half (52%) of Puerto Rican borrowers received a government-insured loan. This highlights the differences in credit needs among different Hispanic groups.

Despite gains, Latinos continued to face barriers and disparate treatment in the mortgage market.

- Hispanics paid a significant premium to borrow money.

- Hispanic homebuyers paid 43% more to close on a home purchase loan than non-Hispanic White applicants and 30% more in interest.

- This amounted to $1.5 billion in additional closing costs for Hispanic homebuyers in 2019 compared with non-Hispanic Whites.

- 20% of Hispanic applicants were denied a loan in 2019, 43% higher than the denial rate for non-Hispanic White applicants.

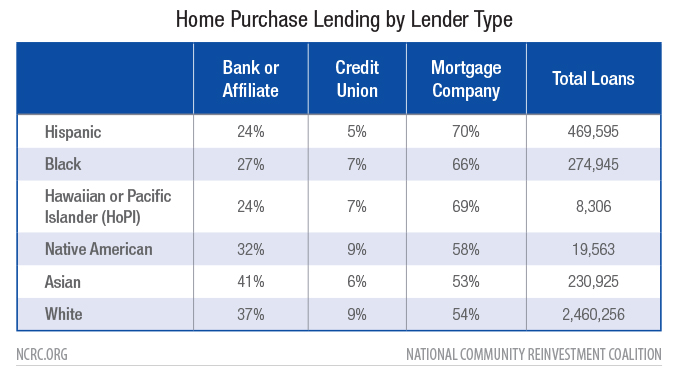

- Latino borrowers were underserved by banks. In 2019, just 24% of home purchase loans to Hispanic applicants came from a bank. This was the lowest level of bank lending to any race in 2019. Instead, these borrowers relied on mortgage companies for over 70% of their home purchases, a far higher share than any other group.

Agatha So, MSW, Senior Policy Analyst, Economic Policy Project, UnidosUS

Jason Richardson, Director, Research & Evaluation, NCRC

Executive Summary

Homeownership has long been a cornerstone of the American dream for the Latino community, and Latinos have a majority of their assets invested in their homes. Furthermore, Latinos place a high value on homeownership. In a recent poll, conducted with registered Latino voters, 70% who rent their homes reported a desire to buy a home in the future. Recent research suggests that Latinos aspire to be homeowners at a higher rate than other groups in the U.S. Yet, many Latinos continue to be locked out of homeownership opportunities. In the same poll, more than 50% of Latino voters reported that saving for a down payment or having the level of credit needed to buy a home were out of reach.

Introduction

In the years preceding the COVID-19 pandemic outbreak and economic recession in the U. S., the Hispanic homeownership rate was on the rise. In the second quarter of 2020, the Hispanic homeownership rate was 51.4%, the highest point since the Census Bureau began tracking it in 1994. Meanwhile, home equity levels also increased for Latino homeowners. In 2016, for the first time since the Great Recession of 2008, Latino homeowners saw gains in wealth. And then they did again in 2019. But because of persisting wealth disparities and systemic inequities, Latinos have disproportionately lost jobs and income during the pandemic. Much of the Latino community is at great risk of losing their homes and wealth gains in the fallout from the current crisis.

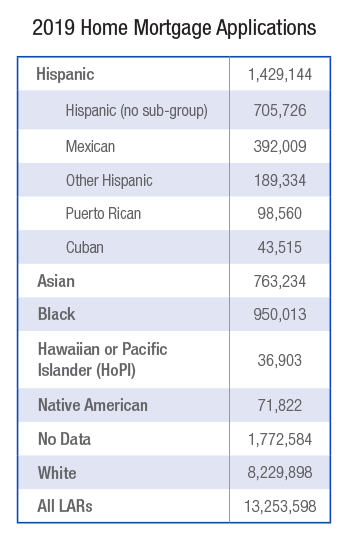

In 2019, Home Mortgage Disclosure Act (HMDA) data included expanded racial data, including sub-groups of the census categories of Hispanic. Lenders were asked to collect data on which racial sub-group borrowers identified with on their mortgage applications. This was a result of the 2015 HMDA Rule by the Consumer Financial Protection Bureau (CFPB). Hispanic, Asian and Hawaiian or Pacific Islander (HoPI) borrowers now have the option to identify themselves as a part of several different sub-categories. Applicants and co-applicants can select up to five different ethnicities and five different races that they identify with as well. For Hispanic applicants, this means that they can choose from Mexican, Cuban or Puerto Rican. If the borrower indicates that they identify with another Hispanic group (for example, Nicaraguan), then the lender is permitted to refer to the applicant as belonging to a fourth group, “Other Hispanic.”

In this analysis, we examined the HMDA records for Hispanic loan applicants, with particular attention to the variations in loan originations, loan type and costs between Hispanic applicants and overall applicants, as well as between Hispanic subgroups. We also examined HMDA records for Afro-Latinos, applicants that identified any combination of Hispanic and African American on their application.

This descriptive analysis was intended to better understand the structural or other factors that drive variation in home lending patterns for Latinos, especially in geographic regions with significant and growing Latino populations.

Previous research has underscored the importance of Latino homeownership for a healthy national housing market. For example, in the decade preceding the COVID-19 pandemic outbreak in the U.S., Hispanics accounted for more than 40% of household growth, and growth in Latino homeownership accounted for nearly 60% of overall homeownership growth. Furthermore, between 2015-2019, Hispanics were the only racial/ethnic group to increase their homeownership rate for five consecutive years.

Meanwhile, analyses of home lending trends to Latinos since the Great Recession, indicated that Latinos’ recovery in the mortgage market was mixed and uneven. For example, the mortgage denial rate for Latinos has decreased. Yet, Latino borrowers faced disparities in mortgage access, in particular when seeking conventional mortgages. Latino borrowers were also more likely than White borrowers to be denied a mortgage because of issues with debt-to-income ratio (DTI) and credit.

Research from the last decade has started to explore the differences in homeownership rates for Hispanic subgroups. For example, between 2000-2010, the homeownership rate for Cubans declined by less than one percentage point, while the rate for Salvadorans experienced an increase of 10%. Very little research exists about the experiences of Afro-Latinos in the mortgage market. A vital part of the Latino community, Afro-Latinos, identifying as individuals of African descent from Latin America or individuals who have one parent of African descent and another of Latino descent, comprise 24% of U.S. Latinos.

Data and Methods

All data used in this report is derived from the 2019 HMDA dataset. NCRC downloads this data from the CFPB and combines it with FFIEC census data, HMDA reporter panel data and OMB CBSA definitions for analysis. Race and ethnicity were identified using NCRC methodology. Unless otherwise noted, the loans used in this report include 2019 applications on owner occupied, 1-4 unit, site built homes. Some outliers have been removed when calculating loan costs, impacting ~1% of the dataset.

About half of Hispanic applicants in 2019 identified at least one subgroup. We have grouped those that did not indicate a subgroup as “Hispanic (no sub-group).” Definitions of the other groups can be found in the CFPB HMDA documentation.

In 2019, there were a total of 17.5 million Loan Application Registers (LARs) reported by mortgage lenders under the Home Mortgage Disclosure Act (HMDA). It is estimated that this data covers about 88% of all mortgage activity in the country. Over 13.2 million loan applications were reported in 2019 for single family properties resulting in 8.2 million originations. Of those applications, there were 1.4 million where the borrower identified as Hispanic which yielded 817,000 originations. The volume of loan applications from Hispanics was the second largest of any racial group after non-Hispanic White applicants.

Loan Purpose

Of the 817,000 loans made to Hispanic applicants in 2019, almost 470,000 of them were to finance a home purchase. This represented over 58% of all Hispanic loans and far exceeded the national average of 47%. By comparison, just 45% of non-Hispanic White borrowers in 2019 were buying a home, with the rest either refinancing or taking a home improvement/home equity loan.

2019 originations by loan purpose and race and Hispanic sub-group.

However, among the diverse communities that make up the Hispanic population, there was variation in the reason these borrowers were seeking financing.

Nationally, Puerto Rican and Cuban borrowers were far more likely to be buying a home in 2019 than any other group, reporting home purchase loans 67% and 64% of the time, respectively. By contrast, other Hispanic borrowers – those borrowers that identify as Hispanic but not as Cuban, Mexican or Puerto Rican – reported a home purchase loan just 55% of the time.

Top States

Home lending to Hispanics occurs throughout the United States but is concentrated in Texas, California, Florida, Illinois and Arizona.

2019 originations to Hispanic borrowers by state.

California, Texas, Florida and Arizona clearly lead other states in the total number of loans going to Hispanic applicants. However, in Puerto Rico and New Mexico, Hispanic borrowers hold the largest market share. In particular, the 13,412 loans originated to Hispanic borrowers in New Mexico comprised 35% of the total loans made across the entire state. For home purchase loans, this market share increases slightly to 37%. This level of market power is likely to increase, and could mean that Hispanic applicants in New Mexico will have a different experience in the home loan market than Hispanics have in other states. For example in Texas, where Hispanics received over 100,000 more loans than Hispanics received in New Mexico, Hispanics hold a smaller share of the market. In 2019, Hispanic borrowers received only 22% of all loans made across the state of Texas. A state level analysis of loan origination rates and costs for Hispanic communities would be an interesting question for future study.

States where Hispanic borrowers have the largest share of the market. 2019 originations. (Puerto Rico, where Hispanic applicants account for over 97% of all borrowers has been excluded from this visualization)

In addition, the Hispanic market differs greatly across the states. In four of the top five states for Hispanic lending, Mexican borrowers heavily dominate the market. However, in Florida they play a relatively small role in mortgage lending, with Cuban, Puerto Rican and Other Hispanic borrowers sharing the market.

Hispanic sub-group market shares in states with the most loans to Hispanics.

Loan Type

Since the Great Recession, government programs from the Veterans Administration (VA) or the Federal Housing Administration (FHA) have been a critical source of financing for cash-strapped, credit-eligible borrowers—especially Latinos—who are less likely to have wealth passed down from previous generations. However, in 2019, over 60% of loans originated to Latino borrowers were conventional loans, which means these loans were not backed by government insurance programs.

2019 originations by loan type.

The reliance on government insured lending varies greatly among different Hispanic borrowers as well, highlighting differences in the experience each community has when they encounter the mortgage market. While all Hispanic groups use government programs such as the FHA, VA and Rural Housing Service (RHS) more than non-Hispanic Whites, the use of these is not uniform. In particular, Puerto Rican borrowers rely more on government backed loans. Use of conventional lending varies greatly by state and loan purpose as well.

Government loan program use by Hispanic sub-group. 2019 originations.

Since the Great Recession, bank lending to low- and moderate-income borrowers declined, while non-bank lending increased significantly. This trend has significance for future homebuyers, including Latinos. Non-bank lending has not fully offset the effects of the gap left by banks, which have reduced their home lending activities to borrowers with modest incomes. Historically, Latinos have benefited from the impact of civil rights laws like the Community Reinvestment Act (CRA), designed to curb discrimination in the housing market, and encourage banks to serve the credit needs of local communities, including home loans. Many non-bank lenders are not held to the same standards as banks, including those governed by the CRA, that ensure mortgage borrowers have access to high-quality loans, and are protected against predatory terms or can avoid unsustainable loan options.

As reported by several housing counselors within UnidosUS’s affiliate network who serve Latino consumers, Latino borrowers are often targeted to receive or steered toward an FHA mortgage. Many of the companies offering these loans are not banks. In 2019, Hispanic homebuyers were disproportionately served by mortgage companies. Over 70% of home purchase originations to Hispanic applicants were made by mortgage companies. In fact, Hispanic homebuyers received more loans to buy a home from mortgage companies than any other racial group. In contrast, only 24% of loans made to Hispanics to help them buy a home were made by banks. Hispanic borrowers were also among the most underserved by banks among racial groups that year. In 2019, only Hawaiian or Pacific Islander borrowers received a smaller share of bank-originated home loans, at 23.8%. This disparity matters, nonbanks generally change higher interest rates and closing fees for a variety of reasons. The effect of this is that as a whole Hispanic borrowers pay more for credit, hurting their ability to build wealth at the same rate as their non-Hispanic borrowers.

Loan Purchases

The secondary mortgage market also plays an important role in facilitating borrowers’ access to a mortgage. Mortgage entities like Fannie Mae and Freddie Mac (together, the GSEs) purchase mortgages made by lenders, and design mortgage programs with features like lower down payment requirements that make home lending more affordable to communities that have historically been priced out of homeownership opportunities. Through these affordable loan programs, lenders are provided liquidity and guidance on eligible loan terms and conditions to encourage them to serve borrowers from lower wealth or low-income communities.

These programs also have an impact on Latinos’ access to conventional products, which may also affect mortgage payments over the life of the loan, including better interest rates and opportunities to cancel mortgage insurance fees. In 2019, one-quarter of loans originated to Hispanic borrowers were purchased by the GSEs, another 17% included FHA loans that were securitized by Ginnie Mae, and 35% in the category of Other, which included loans purchased by investors or other lenders.

Loan Costs and Interest Rates

The cost of a loan can vary greatly based on a variety of factors, including the loan amount, property value of the home, the borrower’s credit profile, as well as the size of the down payment the borrower can provide upfront. Also, there are substantial variations in the closing costs and interest rates paid by the borrower based on the type of loan, with FHA, VA and RHS loans typically reporting much higher closing costs.While government programs like FHA require a lower down payment and offer an option to qualify with a lower credit score (i.e. less than 700), FHA also charges mortgage insurance fees upfront and throughout the life of the loan. For groups that rely heavily on these programs, including Hispanic borrowers, this means the loan is more expensive.

Closing costs, rate spread and interest rates. 2019 originations on site built, 1-4 unit, owner occupied homes.

Overall, in 2019, Hispanics paid more to borrow money than White borrowers. For instance, in closing costs on 30-year home purchase loans made on single family owner occupied homes, Hispanic homebuyers paid an average of $6,521, almost twice as much White buyers, who paid $3,187 at the closing of their mortgage in 2019. Over 436,000 Hispanics bought a home that year using a 30-year mortgage, paying about $1.5 billion in additional closing costs, when compared to White borrowers. New Hispanic homeowners also pay more in interest than White homeowners. Over the life of those loans made in 2019, this adds up to $2.4 billion in additional costs paid by the 2019 Hispanic homebuyer cohort, when compared with non-Hispanic Whites.

Together, these higher closing costs and interest rates also represent a major barrier for Hispanic borrowers to be able to build wealth. By paying more fees and a higher rate at closing, Hispanic homebuyers are not able to build equity as quickly as White and Asian borrowers, who typically pay less in closing costs and get lower interest rates. While several factors influence the costs and rates at closing, and some borrowers will pay off their mortgages before the 30-year mark, the fact remains that this is wealth lost to the Hispanic community and not passed down to future generations.

Loan Denials

A loan application can result in several different types of outcomes, including an origination, a denial by the lender or one of several other statuses that doesn’t result in a loan being made. For this reason, it is important to look at both denial rates and the rate of loan origination for mortgage records.

Origination and denial rates, 2019 HMDA, owner occupied, 1-4 unit site built properties.

Nationally, Hispanics were denied a mortgage at a rate that was nearly six percentage points higher than the rate for non-Hispanic Whites, and the third highest among other applicant groups. While differences in denial rates were smaller between Hispanics and non-Hispanic Whites when applying for a home purchase or refinance loan, the gaps were more stark between the two groups when applying for a home equity or home improvement loan. For example, in 2019, Hispanics were denied a loan to buy a home at a rate of 10%, four percentage points higher than the rate for non-Hispanic White applicants. In contrast, when applying for a home improvement loan, Hispanics were denied at a rate of 56%, which was 24 percentage points higher than White applicants.

Denial rates among Hispanic borrowers also varied. For example, in 2019, Cuban and Other Hispanic applicants were denied at rates that were higher than for Hispanic borrowers overall, at 24% and 26%, respectively. This trend was consistent for these applicants when they applied for loans to buy a home, home improvement or to refinance.

There were also differences in denial rates for all Hispanic borrowers in states where the population was significant, or where Latinos made up a large share of the mortgage market. In California, where Hispanics make up nearly 40% of the population, the denial rate on home purchase loans for Hispanics was 8%, just two percentage points higher than for Whites. The differences in denial rates between Puerto Rican, Mexican and Cuban, and Other Hispanic amounted to only one or two percentage points.

In Florida, home to over five million Hispanics, the difference in denial rates between Hispanics and Whites was more significant. In 2019, Hispanic applicants were denied a mortgage towards a home purchase at a rate of 13%, which was five percentage points higher than for Whites. While Cuban and Puerto Rican borrowers were a major share of the market, the differences in denial rates for these borrowers, as compared with Mexican and Other Hispanic borrowers in the state, amounted to just one or two percentage points.

In Texas, where over 11 million Latinos live, the denial rate for Hispanic borrowers applying for a home loan was 10%, which was four percentage points higher than the rate for Whites. While Mexican borrowers make up a larger share of the mortgage market, the differences in denial rate between these borrowers and Puerto Ricans, Cubans, and Other Hispanic borrowers, amounted to just one percentage point.

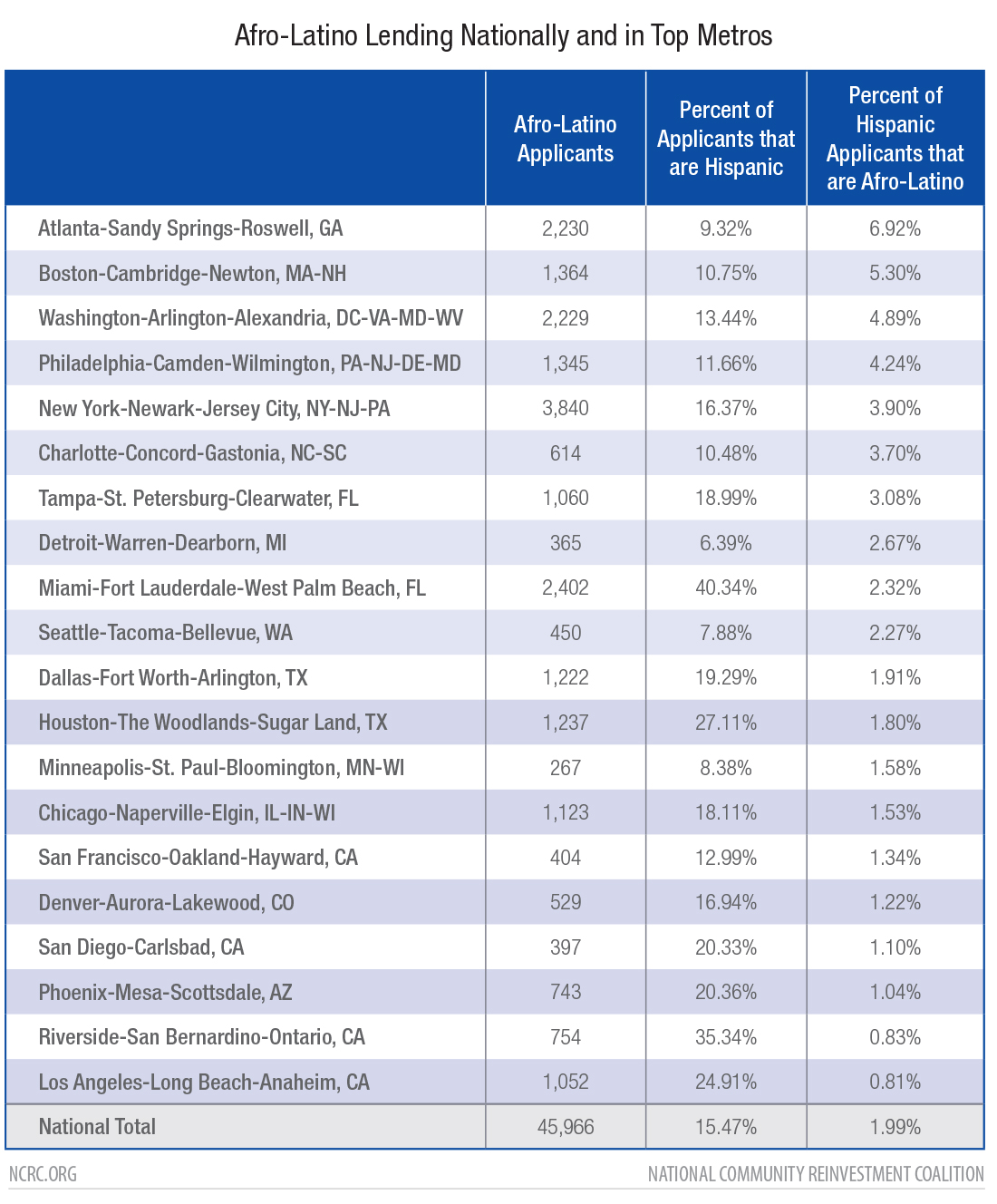

According to the U.S. Census Bureau, in 2017, there were over three million people in the U.S. who identified as Afro-Latino, and the majority live on the East Coast and in the South, in states that include New York, California and Florida. According to the Pew Research Center, people identifying as Dominican and Puerto Rican make up large segments of the Afro-Latino population.

In light of the growing evidence that racism and discrimination persists in our nation’s home lending system, Afro-Latinos likely face additional structural barriers in the home mortgage market, compared with Hispanic borrowers overall. According to a 2019 poll by the Pew Research Center, Hispanics with darker skin reported experiencing higher rates of discrimination than reported by lighter-skinned Latinos. Furthermore, Afro-Latinos face additional economic disparities, including higher unemployment and poverty rates, than their non-Black Hispanic and Latino counterparts.

In 2019, approximately 47,000, or 2% of all Hispanic mortgage applications, were submitted by an applicant or co-applicant that reported both a Hispanic ethnicity and Black race (i.e. Afro-Latino, for the purposes of this section). Following with the trends in population growth, the majority of Afro-Latino applicants were concentrated in major metropolitan areas in the South and along the East Coast of the U.S.

Afro-Latino Lending Map, 2019 application where the applicant or co-applicant reports both a Hispanic ethnicity and Black race.

Among the areas studied, the most applications were received in the metro areas of New York City, Atlanta, Washington, D.C., and Miami. In the New York-Newark-Jersey City metro area, over 3,000 Afro-Latinos applied for a mortgage. While Hispanic applicants consisted of less than 1% of mortgage applicants in the area, Afro-Latinos made up about 4% of all Hispanic applicants overall in the area. The same was true of Afro-Latino applicants in the Atlanta-Sandy Springs-Roswell metro area, where Hispanic applicants were less than 1% of applicants. In 2019, over 2,000 Afro-Latinos applied for a mortgage, representing about 7% of all Hispanic applicants in the area.

Even in metro areas including Boston, Orlando and Dallas, where about 1,000 Afro-Latinos applied for a mortgage, these applicants represented a substantial share of Hispanic applicants.

Notably, the metro areas where Afro-Latinos are applying for a mortgage are among the most expensive in the nation. More research is needed to understand the experiences of Afro-Latinos, who are likely facing barriers of high housing prices and borrowing costs when encountering the mortgage market.

These trends demonstrate the growing importance of Afro-Latinos in these mortgage markets, as well as a signal of growing interest in homeownership among these communities.

Discussion

If we aspire to better serve communities of color, including Latinos, and ensure equitable access to good credit, more research and data are needed to understand the experiences of communities within specific markets, and by ethnic population. Data is also needed to drive improvements in policy, especially federal housing policy, to respond to persisting disparities in mortgage lending faced by communities of color.

A simple look at Latinos using national level data does not reveal the critical differences among Latino communities, especially communities that have long been overlooked by lending institutions. Instead, to get a clearer picture of how Latinos access credit, and to identify where opportunities exist to serve new homebuyers – it is necessary to look within specific geographic markets and disaggregate by ethnicity. The collection of the HMDA data by sub-group is an important advancement in gaining a better understanding of Latino communities home lending patterns and credit needs, and this collection must be preserved and expanded.

Federal housing policy must be adjusted to reflect the diverse home lending needs among Latinos, and recognize the diversity within the broader community. The housing finance system, including private industry and public stakeholders, must take affirmative steps to create an environment that creates pathways to affordable homeownership for Latinos and other communities of color. These steps can include improvements to government lending programs that reduce loan costs to ensure that Latinos have access to a range of mortgage options that are safe and affordable. Strengthening civil rights laws, including CRA, to encourage banks to lend in their communities and address discriminatory practices, is a step in the right direction to ensure Latinos fair access to homeownership opportunities, whether they feel more comfortable applying for a loan at their local bank or shopping for a mortgage online.

There has been substantial pressure from industry representatives and some regulators to restrict the collection of this data. Within the last four years, the CFPB finalized several rules that limit the reporting of home lending activities carried out by banks and mortgage lenders. In 2018, Congress successfully rolled back the reporting of some of the expanded data required by the Dodd-Frank Wall Street Reform and Consumer Protection Act for smaller lenders. Lenders have complained about the burden of collecting and reporting data, and the Trump Administration responded by substantially rolling back these requirements. However, borrowers appear to not find it burdensome to report, and have shared their race and ethnicity, as well as sub-group, accordingly. In the 2019 HMDA data recently released by the CFPB, over half of Latino applicants that applied for a loan selected at least one sub-group. This data collection should not only be preserved for Latino and AAPI communities, but also expanded to all ethnic groups such as the African and Caribbean populations.

As evidenced by the 2019 HMDA data, Latinos played an outsized role in growing the mortgage market. Specifically, Latinos continued to lead in the volume of mortgage applications that allow them to buy a home. With the advent of 2019 HMDA data, we also have the opportunity to explore a range of experiences by Hispanic borrowers in the mortgage market, many of whom have been typecast as only “FHA” borrowers. This research brief is a call to action for further research of Latinos in the mortgage market. This review of home lending data amplifies the importance of measuring progress and tracking persisting disparities faced by Latinos. It also amplifies the importance of capturing the data and measuring progress for critical segments of the Latino community, including Afro-Latinos, who face persisting barriers or have long been overlooked in the mortgage market.

[1] NCRC uses the term Hispanic and Latino interchangeably.