CNNMoney, March 16, 2018: 10 years after the financial crisis, have we learned anything?

The 2008 global financial collapse began a decade ago today with JPMorgan’s fire-sale rescue of Bear Stearns. Many more failures would follow from losses on mortgage investments – including those suffered by millions of Americans and communities across the nation.

As President and CEO of the National Community Reinvestment Coalition, John Taylor warned Congress as early as 2000 that predatory and fraudulent lending was fueling a housing bubble.

“We’re sitting here, 10 years later, with a short-term memory that doesn’t seem to recall how we got into that mess,” he said in an interview with CNNMoney on the lessons we have — and have not — learned from the financial crisis.

“Thinking about it now, I can feel myself being angry about it. Because we fought when we saw these things happening. We brought it to the attention of both Democrats and Republicans. In the end, it took the nation’s economy having to collapse before they felt the need to do something.”

This week, the U.S. Senate marked the anniversary of the Great Recession by pretending it never happened. Instead, it passed a hurtful plan to roll back consumer protections, including bank data reporting requirements put in place to prevent another financial collapse.

The bank lobby and ultra-conservative members of Congress supporting the bill were joined by 16 Democrats who also voted for it. Read our full statement on the bill here.

As the Senate bill makes its way through the House, Chairman Jeb Hensarling (R-TX) intends to use S2155 as a vehicle to drive bank deregulation and Dodd-Frank rollback. NCRC is especially concerned about amendments reviving language from the Financial Choice Act, which we strongly opposed last year with the support of our members.

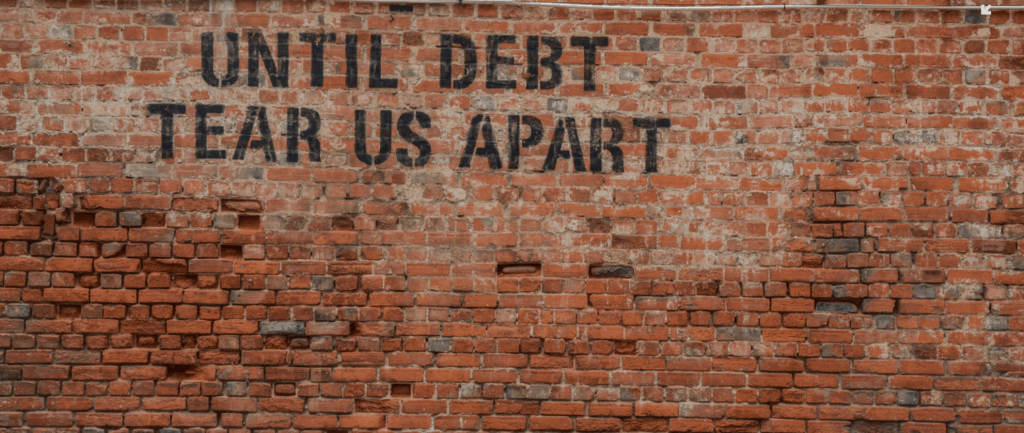

This is an attack on transparency in our financial system. So now, let the real fight begin.

Photo by Alice Pasqual

on Unsplash