— OVERVIEW

Piedmont Business Capital commissioned this paper to examine how the COVID crisis is affecting African American entrepreneurship throughout the country and in their region of Piedmont in North Carolina.

— Key Takeaways

14% of all firms in the Piedmont area are Black-owned.

Although African Americans have less wealth and income levels than their White counterparts, African American business owners were more likely to use personal funds to aid their business through financial hardships.

Low level of wealth for African American households greatly limits the ability for African Americans to self-capitalize into entrepreneurship and even support Black entrepreneurs who want Black customers as their base.

Due to previous discouragement and discrimination in traditional financial institutions, business owners of color were more likely to turn to fintech and online lenders during the PPP loan application period. However, fintech lenders were initially barred from PPP lending — disproportionately affecting the business owners of color who were more likely to turn towards online lending.

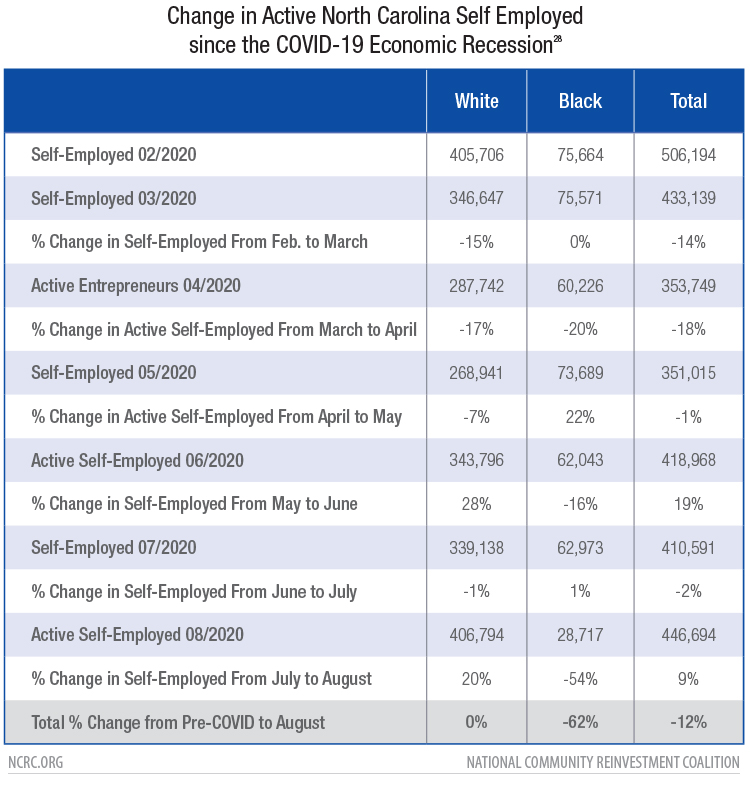

Although all self-employed entrepreneurs in North Carolina experienced great fluctuations in active employment rates from March to August, White entrepreneurs enjoyed a complete return to pre-COVID active entrepreneurship rates by August. On the other hand, rates of Black self-employed entrepreneurs that are actively working experienced a 62% decrease by August from pre-COVID rates of active employment.

Dedrick Asante-Muhammad, Chief, Race, Wealth and Community, NCRC

Jamie Buell, Racial Economic Equality Coordinator, NCRC

Introduction

COVID, Entrepreneurship and Piedmont

COVID-19’s earliest reported cases in the United States can be charted back to January 2020. However, the national economic shutdown came later in mid-March. As the entire country was mandated to put a pause on business and work in an attempt to control the virus, some communities and business owners were hit harder than others. COVID-19’s detrimental impacts on business owners were felt immediately. Within the first weeks of April 2020, when mandated business shutdowns began across the country, 3.3 million business owners, or 22% were no longer working.[1] These impacts are exacerbated when examining across race, gender and immigration status. African American business owners were hit hardest, as 41%, or 440,000 of Black business owners were found to be no longer working in April.[2] Latino business owners also experienced major losses, with 32% no longer working between February and April 2020. Immigrant business owners experienced a similar loss of work with 36% of owners no longer operating. Only about 15-20% of the U.S. Census Small Business Pulse Survey respondents reported that they have enough cash on hand to cover the next 3 months of operations.

Piedmont Business Capital commissioned this paper to examine how the COVID crisis is affecting African American entrepreneurship throughout the country and in their region of Piedmont in North Carolina. We are still early in the COVID crisis and there is much research and analysis to do on how it is worsening underlying inequalities that affect African Americans and African American entrepreneurship. This white paper is meant to be an early step in understanding and addressing the challenges of African American entrepreneurship and what can be done to ensure that the future recovery strengthens everyone.

The Economics of African American Entrepreneurship Pre-COVID

Entrepreneurship is often heralded as a great path toward wealth development and central to the American economy. What is much less focused on is the reality of entrepreneurship for most Americans. For communities facing asset poverty, entrepreneurship is another economic pathway filled with barriers stemming from historic discrimination and contemporary inequality.

Eighty percent of all businesses, and 96% of Black-owned businesses, have no paid employees.[3] Most entrepreneurs rely on personal savings and net worth to launch their enterprises but as a recent report by the Institute for Policy Studies notes, the median wealth for African Americans pre-COVID was $3,661 compared to $151,272 for White Americans.[4] The very low level of wealth for African American households greatly limits the ability for African Americans to self-capitalize into entrepreneurship and even support Black entrepreneurs who want Black customers as their base.

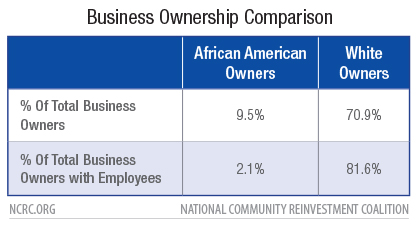

Although the Black population comprises nearly 13% of the total U.S. population, the latest U.S. Census Survey of Business Owners found Black Americans comprise only 9.5% of business owners, and only 2.1% of firms with employees. These rates of business ownership are greatly disparate with White business ownership rates, who own 70.9% of all businesses and 81.6% of the firms with employees, yet whose population comprises 62.8% of the U.S. population.[5]

Corresponding with the extremely low levels of wealth in the African American and Hispanic community, Black and Hispanic small business owners have lower credit scores than White and Asian small business owners. Twenty percent of Black and 15% of Hispanic owners have credit scores below 620, compared to 9% of Asian and 7% of White small business owners. In contrast, significantly larger shares of White and Asian owners reported personal credit scores of above 760; 43% and 39% did so, respectively, compared with 20% of Hispanic and 14% of Black small business owners.[6] Even though Black and Hispanic small business owners have lower credit scores than their White and Asian counterparts, they were more likely to use their credit scores when obtaining financing — 52% and 51% of Black and Hispanic owned firms did so, respectively, compared to 45% of White and 43% of Asian owners.[7] Similarly, 28% of Black and Asian owners and 29% of Hispanic owners relied on personal funds as the primary funding source, compared to 16% of White owners.[8]

In comparison to all other types of firms, Black-owned firms reported greater financial challenges in paying operating expenses, credit availability and making payments on debt. To remedy these financial challenges, Black-owned firms used personal funds more frequently than all other firms: 80% of Black-owned firms reported using personal funds to address financial challenges, while in comparison, 67% of White, Asian and Hispanic-owned firms reported using personal funds to address financial challenges.[9]

While systemic and historic barriers to accessing capital are primary issues for African American entrepreneurship, interpersonal discrimination also impacts African Americans’ success and sustainability as entrepreneurs. In 2019, to assess branch-level treatment of small business loan borrowers, NCRC utilized mystery shopping, or matched-pair testing. Sixty different locations of 32 different banks underwent matched pair testing. The study found that Black testers were the only group whom bankers asked about their education level. Hispanic testers were asked significantly more often about their credit card debt than White and Black testers. Furthermore, both Hispanic and Black testers were asked about their credit report significantly more than White testers. In addition to being disproportionately questioned about education and credit history, bank personnel provided Black and Hispanic testers with substantially less information about the loan products. Information on loan fees was provided 64% of the time to White testers, and only 29% of the time to Black and 20% of the time to Hispanic testers. Upon closing of the appointment, White testers were more often offered a business card and thanked for coming in.[10]

The findings of the matched pair testing illustrate there is still racial bias in financial access, leading to minority borrowers being discouraged to pursue loan products. The quality of experience with bank customer service representatives matters, particularly if poor service creates impediments for members of communities that have historically been denied equal access to credit. Furthermore, the disparity in information provided about loan products provides more understanding as to why minority borrowers may experience greater difficulties in paying back loans or even defaulting on loans.

Piedmont, Racial Economic Inequality and African American Entrepreneurship

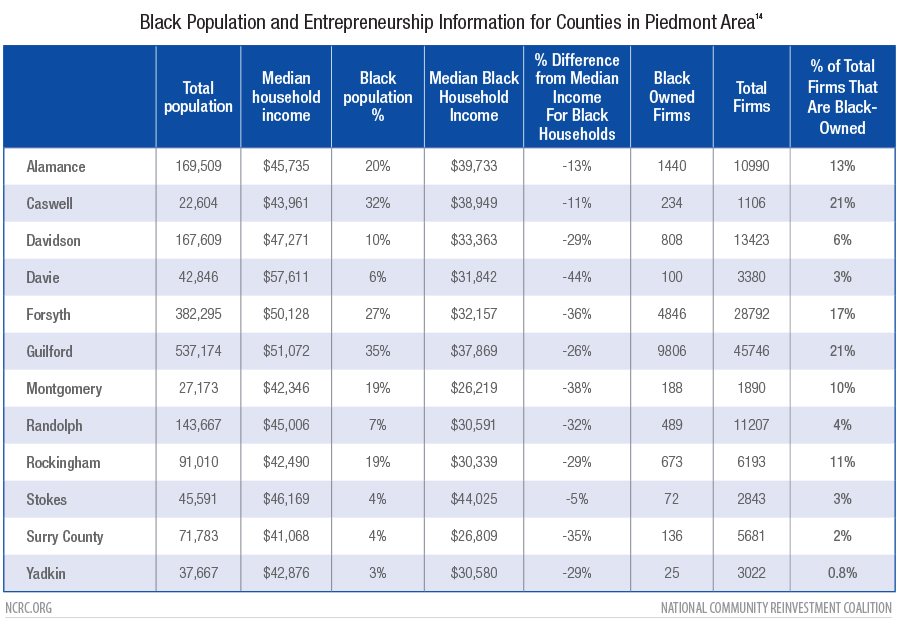

The Piedmont area faces similar issues of racial economic inequality. Piedmont is in the north-central region of North Carolina, surrounding the cities of Greensboro, Winston-Salem and High Point. The Piedmont area is estimated to have 1.7 million residents and includes 12 counties, though the largest 5 counties contain 80% of the population. African Americans are about 22% of the population in North Carolina. Similarly, African Americans are 26% of the population for Greensboro-High Point, the largest metro area in Piedmont. [11] In terms of racial economic inequality, the Piedmont area reflects what is found throughout the country, with Black homeownership at 41% compared to White homeownership of 73% (in the Greensboro-High Point metro area). In terms of income, African Americans make 64% of Whites, with a median salary of about $35,000, compared to White median salary of about $55,000 — and an unemployment rate twice that of Whites. [12]

In the Piedmont area of North Carolina, as is true throughout the country, some of the greatest economic disparity is found in entrepreneurship. In the total Piedmont area, 14% of all businesses are Black-owned, while African Americans comprise 22% of the total Piedmont Triad population. Nationwide, the average business revenue for African Americans is $73,000 compared to $642,000 for Whites, meaning Black business revenue is only 11% of Whites. In the Greensboro-High Point area of Piedmont, average Black business revenue at $53,363 is only 9% of White business revenue.[13] In the “Firms With or Without paid employees” graphic we see that the total revenue for all Black firms across the country is about $450 billion, which is just 1% of the total revenue for White businesses at almost $33 trillion. [14]

Data collected from: 2012-2016 U.S. Census Bureau American Community Survey

How Economic Marginalization Has Worsened the Impacts of COVID-19 on African Americans

Although COVID-19 is undoubtedly a public health crisis, socioeconomic conditions have exacerbated the pandemic’s effects. This is especially seen in the disparate rates of infection and deaths of Black Americans. Researchers have pointed to multiple reasons for these disparities. First, African Americans are more likely to live in low-income households, increasing the risk of COVID-19 illness. These households are also more likely to work in industries that have remained open during nonessential business closures, such as grocery stores or food services. McKinsey & Company found that African Americans are overrepresented in nine of the 10 lowest wage jobs that are considered high-contact, essential services. For example, Black Americans comprise 39% of psychiatric aides, 33% of nursing assistants, 16% of cooks and restaurant workers and 15% of childcare workers, to name a few roles.[15]

COVID-19’s Disparate Health Impacts on Black Americans

COVID-19 has hit Black Americans the hardest. According to NPR’s analysis of COVID-19 demographic data across the United States, when adjusting national COVID-19 mortality rates for age differences among races, Black Americans’ mortality rates are 3.7 times higher than White mortality due to COVID-19. Not only have Black individuals been impacted by COVID-19 at higher rates, but Black communities as a whole have also been greatly impacted. Millet et al.’s (2020) study of differential impacts of COVID-19 on disproportionately Black communities found that although only 20% of American counties are disproportionately Black, 52% of COVID-19 cases and 58% of COVID-19 deaths occurred in disproportionally Black counties.

To make these factors worse, low-income households greatly suffer structural disparities such as access to medical insurance, low-wealth levels and income volatility.[16] People of color not only are more likely to live in low-income households, but also multigenerational households. Multiple family members of various ages intermingle in a household; adults may be caretakers of not only their children, but also grandparents. With multiple generations living together and also working in essential businesses, the likelihood of a household contracting COVID-19 is worsened.[17]

Structural inequalities with long standing, historical roots have impacted the health conditions of Black and Brown communities at large, now making them more susceptible to COVID-19’s deadly nature. Douglas Massey’s (2004) article, “Segregation and Stratification: A Biosocial Perspective,” discusses how the residential segregation and socioeconomic inequality of Black communities are directly associated with increased risk for coronary heart disease, chronic inflammation and cognitive development. The chronic and acute daily stressors faced in Black communities, in which is disproportionately a concentration of poverty and violence, as well as a lack of sufficient resources to cope with such stressors, invokes a biological response similar to fight/flight response. The constant stress of being in such environments increases levels of cortisol and other glucocorticoid hormones, which can eventually lead to diseases such as inflammatory disorders or heart disease.[18]

As now seen in the disparate rates of COVID-19 illness and death in African Americans, structural inequalities have direct impacts on the physical wellbeing and safety of marginalized communities. The United States’ history of segregation and redlining has had economic and health impacts that still persist to this day. NCRC’s report, “Redlining and Neighborhood Health,” found historically redlined neighborhoods to be related to: increased minority presence, higher prevalence of poverty, greater overall social vulnerability, poor mental health, and a life expectancy 3.6 years lower than non-redlined neighborhoods. In relation to COVID-19, the report also found statistically significant associations between historically redlined neighborhoods and pre-existing conditions for heightened risk of morbidity in COVID-19 patients like asthma, COPD, diabetes, hypertension, high cholesterol, kidney disease, obesity and stroke.[19] Historic discrimination and disenfranchisement of majority-minority communities resulted in not only socioeconomic impacts, but also public health issues, all of which have been worsened under the COVID pandemic.

Entrepreneurship Disparities Worsened by COVID-19

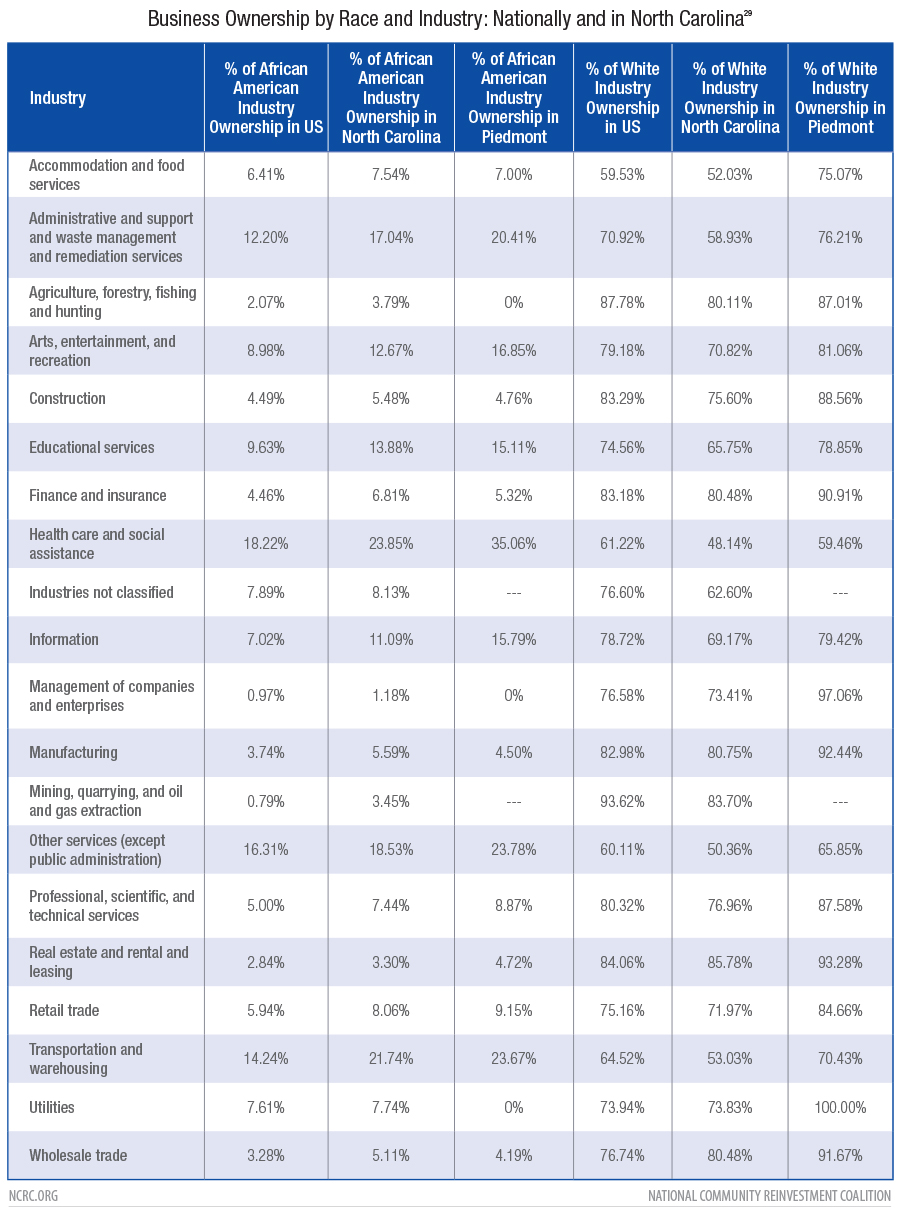

Small businesses owned by people of color have been irreparably harmed by COVID-19. The U.S. Census Bureau’s 2018 Annual Business Survey estimated that African Americans owned 124,004 firms, with 32% of these firms in the healthcare and social services industry. These industries have been among those hardest hit by COVID-19. To further exemplify the intersection of race and industry, McKinsey & Company found that the five sectors most impacted by COVID-19 closures represent almost 40% of revenues for Black-owned businesses. These five sectors are leisure and hospitality, retail trade, transportation and utilities, constructions and “other services,” such as drycleaning and laundry, personal care, pet care or photo finishing services.[20] Color of Change and UnidosUS conducted a national survey of Black and Latino Small-Business Owners in light of COVID-19, finding that among Black and Latino small businesses that are still open and operating, nearly half expect to close within the next 6 months if current conditions remain the same. Furthermore, although 51% of Black and Latino small business owners requested less than $20,000 in funding, only 12% received full assistance requested.[21]

In an attempt to relieve small business owners’ burdens during COVID-19 and to save firms across the country, the Paycheck Protection Program was established under the CARES Act. Designed to cover payroll costs, interest on mortgages, rent and utilities, the PPP loans can be fully forgiven if business owners use the funds as intended and if employee headcount remains the same.[22] However, just like many other loan structures, the design and availability of PPP loans were not as equitable as was necessary. The PPP fee structure heavily discourages small loans to smaller businesses and, in particular, non-employer firms. Additionally, although the loans can be fully forgiven, the documentation requirements necessary to ensure loan forgiveness are much more difficult to execute for small businesses lacking a lawyer, accountant or other compliance staff. Minority-owned firms have a greater lack of access to capital and resources necessary to prevent the PPP loans from converting to long-term debt, further exacerbating pre-existing racial wealth gaps, and driving minority entrepreneurs further into debt.[23]

Businesses owned by people of color are likely to have fewer employees and less revenue than White-owned businesses. Non-employer businesses are far more likely to be owned by people of color. Nearly 96% of Black-owned firms were non-employers, and 91% of Latino-owned firms were non-employers. In comparison, 78% of White firms are non-employer businesses. As a result, they were less likely to qualify for larger [PPP] loans that would yield the higher fees that would make them a priority for lenders at the outset of the program. Businesses owned by people of color are even more likely to have no employees, putting them at an even greater disadvantage to larger businesses that could garner higher fees.[24]

Similar to NCRC’s matched-pair testing of lending discrimination, the Fed’s study found Black business owners are also more likely than White owners to report being discouraged from applying or not applying for financing, because they believe they will be turned down. Among Black employer firms, 37.9% reported being discouraged, compared to 12.7% of White-owned firms. In addition to being actively discouraged from traditional financial avenues, Black-owned firms are more likely to lack an existing and healthy banking relationship. Although 28% of Black nonemployer firms and 54% of Black employer firms applied for financing in the last 12 months, only 1 in 10 Black nonemployer firms, and 1 in 4 Black employer firms had a recent borrowing relationship with a bank. In comparison, 25% of White nonemployer firms and 45% of White employer firms had applied for financing in the past 12 months, and 1 in 4 White-owned nonemployer firms had a recent borrowing relationship with a bank.

This disparity illustrates not only that Black entrepreneurs are applying for financing at equal or higher rates than their White counterparts, but also that they are being denied at higher rates.[25] A lack of an existing banking relationship makes it difficult to secure lending and financing, especially when applications are met with frequent denials. Perceiving a higher probability of funding success from online lenders, Black-owned employer and nonemployer firms are relatively more likely to turn to online fintech providers for funding. Online fintech lenders eliminates the interpersonal discrimination that may occur at a bank branch with a loan officer, and more widely use alternative credit data sources that may be beneficial to minority borrowers. Minority firm owners sought PPP funds through Fintech providers; however, Fintech providers were not initially authorized to lend PPP funds though they collectively dispersed $4.7 billion in funds through June 30th.[26] Considering that African American business owners were systematically barred from PPP funding due to its design, Fintech’s unauthorized ability to lend PPP funds further contributed to African American entrepreneurs’ lack of access to capital during COVID-19.

The Federal Reserve Bank of New York also notes that “Black business activity is geographically concentrated in the U.S. and is correlated with Black population density. Research shows that Black populations are typically clustered in metropolitan hubs and the number of cities that are majority-Black has grown over the past decade. Forty percent of receipts from Black-owned businesses are concentrated in just 30 counties, roughly 1% of all counties in the country.” The Federal Reserve Bank of New York found roughly two-thirds (19 of 30) of counties where Black-owned businesses are concentrated are areas with the highest numbers of COVID-19 cases. Given the high geographic concentration of firm activity and the Black population in general, business disruptions in these particular places can have outsized effects on African American well-being at large.”[27] In comparison, the study found a negative correlation between White business density and COVID-19 incidence; meaning that areas with higher shares of White-owned firms tend to have lower shares of COVID-19 cases.[28]

Throughout the COVID pandemic thus far, self-employed entrepreneurs in North Carolina experienced a total 12% decrease of those who were actively working. All races of self-employed entrepreneurs experienced great fluctuations in active employment rates, likely due to the back-and-forth business reopening and closures. White entrepreneurs, however, enjoyed a complete return to pre-COVID active entrepreneurship rates by August. On the other hand, rates of Black self-employed entrepreneurs that are actively working experienced a 62% decrease by August from pre-COVID rates of active employment.

Pathways to Strengthen African American Entrepreneurs

COVID-19’s global health pandemic and consequential economic recession has exacerbated historic disenfranchisement of African Americans. The racial wealth divide and inequitable access to capital has made entrepreneurship more difficult and less sustainable for African Americans than their White counterparts. Under COVID-19’s health and economic impacts, African American workers and business owners alike have been disproportionately harmed and systemically excluded from relief efforts. The design of the PPP program created large disparities in service, especially among Black entrepreneurs, who overwhelmingly own nonemployer firms and lack existing bank relationships. The needs and issues of both nonemployer business owners and employer business owners must be considered as solutions to the economic impacts of COVID-19. It is imperative that adequate and purposeful steps are taken to remedy both the historic and current disenfranchisement that African Americans, entrepreneurs and average workers have been subject to.

National Pathways for Stronger African American Entrepreneurship

Expanding loans and grants for non-employer businesses.

As Congress seeks to find new policy remedies for the economic impacts of COVID-19, if more business loans are disbursed, non-employer firms must be included in its design. Since the vast majority of African American entrepreneurs do not have employees, it is imperative that these business owners are included in any future grant or loan program to attempt to bridge the economic disparities worsened during COVID-19.

Expanding unemployment for self-employed business owners and independent contractors.

Currently, self-employed individuals and independent contractors are only capable of applying for Federal Pandemic Unemployment Assistance (PUA) in the state of North Carolina. Although the PUA program includes the additional $600 weekly unemployment, which was granted nationwide, the maximum weekly amount of benefits allotted is only $350, in comparison to traditional unemployment’s weekly $600 amount. An equivalent amount of relief should be provided to self-employed individuals. Self-employed individuals should be included within traditional unemployment as the pandemic, and its economic impacts, persist.

Expanding Fintech lending by partnering with local nonprofit organizations.

As highlighted previously, trust and accessibility is imperative to access to capital for not only African American entrepreneurs, but all minority consumers. Nonprofit organizations may play a predominant role in communities where Black-owned businesses are concentrated and are equipped to serve community members. Fintech companies can partner with nonprofit organizations to provide direct outreach to potential consumers and can facilitate the lending process. Fintech loans, however, sometimes loan at higher interest rates so it is imperative that local non-profits serve as guardian to protect against predatory practices.

Increasing micro-loan and grant investment.

Many Black-owned businesses, both employer and nonemployer, are not highly lucrative operations, and may only need modest funds to establish and operate their firms. Micro-loans and grants must expand in availability and accessibility to adequately serve Black-owned small businesses.

Strengthening procurement contracts among larger businesses.

Larger businesses can spur revenue and firm activity for Black-owned small businesses by expanding their procurement contracts and supplier diversity. Utilizing local firms can stimulate local Black-owned businesses and local economies.

Creating business directories for local Black-owned firms.

Local governments, chambers of commerce or media outlets should compile business directories for local Black-owned firms. Especially in the wake of national unrest and outrage over long withstanding racial injustice, individuals are seeking to divest from large corporations and spend money with local Black-owned and minority-owned businesses. Compiling directories of local African American businesses can further stimulate revenue and attention for African American entrepreneurs.

Piedmont’s Procurement Pathway for Stronger African American Entrepreneurship

Higher Education Contracting/Procurement.

The Piedmont area is home to a number of higher education institutions, many of them historically Black colleges & universities (HBCU). This offers a chance to strengthen procurement with local Black-owned businesses and firms. Local HBCU’s have the potential to offer business counseling, business development and mentorship programs for young student entrepreneurs as well as entrepreneurs in the area. Philanthropic money from the education institutions can be devoted to procurement with local Black-owned businesses to create partnerships between Black entrepreneurs and students who aspire to become their own business owners.

Tech Company Procurement.

The Piedmont area also has a flourishing tech industry, which also offers the potential for strengthening procurement contracts with local Black-owned businesses. Tech companies in the area should strengthen their supplier diversity standards to contract with local Black-owned services and businesses, as well as strengthen their hiring and contracting of African Americans. Similar to local education institutions, tech companies have the capability to devote philanthropic funds to promoting and publicizing local Black-owned businesses and ventures. Online databases and directories of Black-owned businesses can be created, and Black-owned services procured by companies can be promoted and publicized.

City and local government Procurement and Contracting.

Relief programs, such as the PPP loans and Pandemic Unemployment Assistance (PUA) program, are beholden to Congressional legislation. However, local city governments can do their part to aid in the survival and success of local Black-owned businesses. Local governments can strengthen their own supplier diversity and devote procurement to local Black-owned businesses for necessary operational services. Local governments can also create programs, guides or directories to secure and trusted financial partners that can assist African American entrepreneurs through the process of business ownership, and relief through the COVID-19 recession.

Appendix

Business Ownership by Race and Industry: Nationally and in North Carolina[29]

———–

[1] Fairlie, M. (May 2020). “The Impact Of Covid-19 On Small Business Owners: Evidence Of Early-Stage Losses From The April 2020 Current Population Survey”. P. 1. Stanford Institute for Economic Policy Research. Retrieved from https://siepr.stanford.edu/sites/default/files/publications/20-022.pdf

[2] Ibid., p. 1.

[3] Association for Enterprise Opportunity (AEO) (2017). “The Tapestry of Black Business Ownership in America: Untapped Opportunities for Success”, p. 7. Retrieved from https://aeoworks.org/images/uploads/fact_sheets/AEO_Black_Owned_Business_

Report_02_16_17_FOR_WEB.pdf

[4] Institute for Policy Studies (June 2020). “White Supremacy Is The Preexisting Condition: Eight Solutions To Ensure Economic Recovery Reduces The Racial Wealth Divide”. P. 8 – 9. https://ips-dc.org/white-supremacy-preexisting-condition-eight-solutions-economic-recovery-racial-wealth-divide/

[5] National Community Reinvestment Coalition (September 2019). Disinvestment, Discouragement, and Inequity in Small Business Lending. p. 8. Retrieved from https://ncrc.org/wp-content/uploads/2019/09/NCRC-Small-Business-Research-FINAL.pdf

[6] Small Business Credit Survey: Report on Minority Owned Firms (December 2019). Fed Small Business. P. 6. Retrieved from https://www.fedsmallbusiness.org/medialibrary/fedsmallbusiness/files/2019/20191211-ced-minority-owned-firms-report.pdf

[7] Ibid., p. 6.

[8] Ibid., p. iv.

[9] Ibid., p. 4.

[10] NCRC (2019). “Disinvestment, Discouragement, and Inequity in Small Business Lending”. P. 30 – 34. Retrieved from https://ncrc.org/wp-content/uploads/2019/09/NCRC-Small-Business-Research-FINAL.pdf

[11] United States Census, 2012 Population Estimates: Combined Statistical Areas. Retrieved from https://www.census.gov/programs-surveys/metro-micro/data/tables.2012.html

[12] Prosperity Now (2019). North Carolina Outcome Scorecard. Retrieved from https://scorecard.prosperitynow.org/data-by-location#state/nc

[13] United States Census, 2012 Survey of Business Owners. Data retrieved from Prosperity Now Scorecard: Outcome Measures, North Carolina. https://scorecard.prosperitynow.org/data-by-location#state/nc

[14] Data collected from: 2012-2016 U.S. Census Bureau American Community Survey; https://linc.osbm.nc.gov/explore/dataset/nc-count-by-ethnicity/table/?disjunctive.area_name&disjunctive.ethnicity and

U.S. Census Bureau, 2012 Economic Census: Survey of Business Owners. Retrieved from https://www.census.gov/quickfacts/fact/table/randolphcountynorthcarolina/SBO001212 and https://linc.osbm.nc.gov/explore/dataset/business-and-industry- linc/information/?disjunctive.area_name&disjunctive.year&disjunctive.variable

[15] McKinsey & Company (April 2020). “COVID-19: Investing in Black Lives and Livelihoods”. P. 6. Retrieved from https://www.mckinsey.com/~/media/mckinsey/industries/public%20sector/our%

20insights/covid%2019%20investing%20in%20black%20lives%20and%20livelihoods/covid-19-investing-in-black-lives-and-livelihoods-report.pdf

[16] Raifman, Matthew A., and Julia R. Raifman (April 2020). “Disparities in the Population at Risk of Severe Illness From COVID-19 by Race/Ethnicity and Income.” American Journal of Preventive Medicine 59 (1):p.138. https://doi.org/10.1016/j.amepre.2020.04.003.

[17]McKinsey & Company (April 2020). “COVID-19: Investing in Black Lives and Livelihoods”. P. 6. Retrieved from https://www.mckinsey.com/~/media/mckinsey/industries/public%20sector/our%

20insights/covid%2019%20investing%20in%20black%20lives%20and%20livelihoods/covid-19-investing-in-black-lives-and-livelihoods-report.pdf

[18] Massey, D. (2004). Segregation And Stratification: A Biosocial Perspective. Du Bois Review: Social Science Research on Race, 1(1), 7-25. Retrieved from https://doi.org/10.1017/S1742058X04040032

[19] National Community Reinvestment Coalition (September 2020). “Redlining and Neighborhood Health”. Retrieved from https://ncrc.org/holc-health/

[20] McKinsey & Company (April 2020). “COVID-19: Investing in Black Lives and Livelihoods”. P. 15. Retrieved from https://www.mckinsey.com/~/media/mckinsey/industries/public%20sector/our%

20insights/covid%2019%20investing%20in%20black%20lives%20and%20livelihoods/covid-19-investing-in-black-lives-and-livelihoods-report.pdf

[21] Color Of Change & Unidos US (May 2020). “Federal Stimulus Survey Findings: First COVID-19 Survey of Black and Latino Small-Business Owners Reveals Dire Economic Future”. Retrieved from https://colorofchange.org/press_release/first-covid-19-survey-of-black-and-latino-small-business-owners-reveals-dire-economic-future/

[22] U.S. Small Business Administration (2020). “Coronavirus Relief Options: Paycheck Protection Program”. Retrieved from https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

[23] Center for Responsible Lending (May 2020). “The Paycheck Protection Program Continues to be Disadvantageous to Smaller Businesses, Especially Businesses Owned by People of Color and the Self-Employed”, p. 2. Retrieved from https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-cares-act2-smallbusiness-apr2020.pdf?mod=article_inline

[24] Ibid., p. 1.

[25] Federal Reserve Bank of New York (August 2020). “Double Jeopardy: Covid-19’s Concentrated Health And Wealth Effects In Black Communities”. P. 6. Retrieved from https://www.newyorkfed.org/medialibrary/media/smallbusiness/DoubleJeopardy_

COVID19andBlackOwnedBusinesses

[26] Ibid. p. 6

[27] Ibid., p. 6.

[28] United States Census Current Population Survey Basic Monthly, in North Carolina. Uses “Main job: Class of worker” variable. Under this category, business owners are classified under “self-employed, incorporated” and “self-employed, nonincorporated”. These numbers may not be completely accurate as it may include self-employed individuals who are not official firm owners (independent contractors, uber/lyft drivers, etc) but still have nonemployer entrepreneurial ventures.

[29] U.S. Census Bureau, 2012 Survey of Business Owners. Retrieved from https://data.census.gov/cedsci/table?g=0400000US37&tid=SBOCS2012.SB1200CSA01&hidePreview=true &

https://data.census.gov/cedsci/table?tid=SBOCS2012.SB1200CSA01&hidePreview=true

[30] U.S. Census Bureau, 2012 Survey of Business Owners. Retrieved from https://data.census.gov/cedsci/table?tid=SBOCS2012.SB1200CSA01&hidePreview=true

TABLE OF CONTENTS