July 31, 2023

The Honorable Sandra Thompson

Federal Housing Finance Agency

Office of Multifamily Analytics and Policy

400 7th Street SW, 9th Floor

Washington, D.C. 20219

RE: Federal Housing Finance Agency’s Request for Input on Multifamily Tenant Protections

Dear Director Thompson:

The National Community Reinvestment Coalition (NCRC) appreciates the opportunity to submit written comments to the Federal Housing Finance Agency (FHFA) to support greater protections for tenants in enterprise-backed multifamily housing.[1] NCRC and its grassroots member organizations create opportunities for people to build wealth and participate more fully in the nation’s economy. We work with community leaders, policymakers and financial institutions to champion fairness and end discrimination in lending, housing and business. NCRC was formed in 1990 by national, regional and local organizations to increase the flow of private capital into traditionally underserved communities. NCRC has grown into an association of more than 700 community-based organizations that promote access to fair and affordable housing, basic banking services, entrepreneurship, job creation and vibrant communities for America’s working families.

We thank FHFA and the Administration for their steps to institute protections for renters in the housing market, including housing supported by the Government-Sponsored Enterprises (GSEs or Enterprises), specifically here Fannie Mae and Freddie Mac. Housing supported by the Federal Home Loan Bank System similarly should advance affordable, fair and quality housing for rental households. Policies that provide for safe, healthy and affordable homes for renters should be a high priority alongside strong support for affordable homeownership, and should be systematized as part of FHFA’s oversight of the Enterprises, adherence to their statutory missions and their obligations to serve low- and moderate-income households and to safeguard against discrimination, and as a component of FHFA’s affirmatively furthering fair housing (AFFH) mandate.

Below, we highlight a number of areas where FHFA should take action to provide for strengthened tenant protections. We urge FHFA to ensure that these protections are extended throughout housing supported by the GSEs and to use its full authority to implement the regulatory and oversight mechanisms needed to ensure compliance by housing providers (including private equity firms, which have often had a pernicious effect on the affordable housing market). FHFA should institutionalize new and robust requirements that protect tenants and should do so by exercising the full set of regulatory and oversight tools available. This includes requiring standard lease terms for Enterprise-backed loans; establishing a landlord registry that tracks performance with regard to housing quality, fair housing and tenants’ rights; audits and monitoring (including for discriminatory patterns, for example in tenant screenings and evictions); and setting stronger criteria for eligibility for Affordable Housing Goals and Duty to Serve performance (e.g., strong housing quality standards and protective lease terms). As we also noted in our response to FHFA’s recent RFI on the Fair Lending, Fair Housing, and the Equitable Housing Finance Plans Proposed Rule, the Equitable Housing Finance Plans should be required to identify and respond to problems facing renters.[2]

Tenant protections, racial equity, and fair housing

Affordable, fair, and healthy housing for renters is a matter of nationwide concern. Renters are especially vulnerable to housing insecurity and economic exploitation given rising costs and a severe shortage of affordable housing. These market dynamics make it acutely important that FHFA take action to provide for broad protections for rental households. FHFA acknowledged in its 2023-2024 multifamily affordable housing goals rule that affordable housing is becoming less affordable.[3] Fewer available rental units qualify as affordable for low-income families due to steady declines in affordable originations, higher rents and rising interest rates, which contribute to higher purchase prices.[4] This is an ongoing and acute problem, especially for the most vulnerable households. According to a March 2023 report from The National Low Income Housing Coalition, the shortage of affordable rental housing for extremely low-income renters increased from 2019 to 2021.[5] In 2019, the shortage of affordable rental housing was 6.8 million but increased to 7.3 million in 2021.[6]

Further, renters’ rights are a racial equity issue. People of color are more likely than White people to rely on rental housing. Data reveals that most Black people are renters. According to 2019 American Community Survey (ACS) 5-year estimates, the Black homeownership rate was only about 41.8% while the rental rate was about 58.2%.[7] Although American Indians and Alaska Natives are less likely to be renters than Black people, rental housing is still a significant source of their housing. According to 2019 ACS 5-year estimates, American Indians and Alaska Natives had a homeownership rate of about 54.3% and the rental rate was about 45.7%.[8] The homeownership rate for Latinos was similar to the homeownership rate for American Indians and Alaska Natives. 2019 ACS 5-year estimates revealed that the Latino homeownership rate was about 47.3% and their rental rate was about 52.7%.[9] In other words, the data revealed that slightly over half of Latinos were renters in 2019. 2019 ACS 5-year estimates also revealed Asian people’s relatively low homeownership rates. The Asian homeownership rate was about 59.6% while the rental rate was about 40.4%.[10] In other words, about four-in-ten Asian people rented their own homes. Based on this data, all people of color have a relatively low homeownership rate and depend on rental housing compared to White people whose homeownership rate was 71.9% and the rental rate was 28.1%.[11]

Housing insecurity resulting from a lack of affordable housing and insufficient tenant protections can have severe consequences, especially for populations that lack access to the cushion of intergenerational wealth due to historical and ongoing discrimination. One such consequence is the risk of homelessness. Many Blacks and Latinos already endure high rates of homelessness relative to their share of the American population. In 2019, Black people comprised about 14.2% of the U.S. population and Latinos were about 18.4% of the population.[12] That same year, Blacks and Latinos were overrepresented amongst homeless individuals compared to their portion of the population. The 2019 Homelessness Assessment Report found that about 40%—or almost half—of all homeless people in 2019 were Black.[13] That year, Latinos comprised over a fifth (22%) of the homeless population.[14] In other words, 62% of homeless individuals are Black or Latino. The statistic is also severe for families. A stunning 52% of homeless families with children are Black.[15]

Given such disparities, tenants’ rights are often an aspect of fair housing rights, and strong policies to protect tenants from housing insecurity, unfair treatment, and unhealthy housing are one important avenue for furthering fair housing (alongside measures to address segregation and remedy discrimination).

Key tenant protections and recommendations

1) Require source of income protections throughout Enterprise-backed housing

The purpose of the Housing Choice Voucher (HCV) program (more commonly known as Section 8) is to deconcentrate poverty by allowing families to choose where they want to live in the private market.[16] Exclusion from rental housing limits voucher holders’ ability to access safe, decent, and affordable housing, and thwarts the underlying fair housing aims of the HCV program.[17] Rejecting prospective tenants because they use housing vouchers limits housing choice, particularly for Black renters. Such discrimination can also impede the ability of voucher holders to access safe and healthy housing at all, especially in tight housing markets.

According to Fannie Mae, Black renters are overrepresented among voucher holders relative to their share of the renter population. Black people are 20% of the renter population, but comprise 48% of voucher holders.[18] Rejecting renters who use vouchers to pay their rent can thus have an outsized negative impact on Black renters, as well as harm other low-income households. Discrimination on the basis of source of income may violate state or local law that provides protections on this basis, or it may reflect disparate treatment if Black and White holders are treated differently.

Another way that some landlords mistreat renters who use vouchers is by charging them excessive fees. A March 9, 2023 press release from HUD’s Office of the Inspector General (OIG) to “advance environmental justice in HUD-assisted housing” revealed that some landlords who participate in HUD’s rental assistance programs charged voucher holders more than non-HUD-assisted tenants in rent, utilities or other fees.[19] In 2022, the U.S. Attorney found that a group of Newark, Delaware landlords violated the False Claims Act by charging voucher holders more in fees and rent compared to tenants who do not receive assistance to live in comparable apartments.[20] As a requirement of participating in the HCV program, landlords are required to certify that they will not engage in this discriminatory practice.[21] In March of this year, a Holyoke landlord also violated the False Claims Act after she received utilities payments from a low-income tenant that violated her agreement with HUD while she participated in the Section 8 program.[22] Both instances demonstrate how some landlords may deprive low-income households of already precious resources by preying on their vulnerable status as low-income people who are also housing insecure.[23] This indicates the need for an overall strengthening of regulatory and enforcement protections for voucher holders, so that they are treated fairly and are able to attain housing and exercise choice on the market.

Fannie Mae has initiated a pilot program that incentivizes landlords to accept voucher households. The Expanded Housing Choice Initiative provides landlords in North Carolina and Texas with financial incentives for accepting applications from prospective renters who will use vouchers to pay part of their rent.[24] These incentives include lower loan pricing, flexible loan terms, lower tenant turnover rates and a dependable rental income due to these HUD-supported vouchers.[25] We applaud this initial step, but more must be done. FHFA should institute source of income nondiscrimination requirements throughout all Enterprise-backed multifamily housing by requiring this as a condition for loan purchase or other support. This would bring federal support for the private housing market into better alignment with federal investments and policy priorities relating to subsidized housing, and with fair housing considerations.

2) Require anti-eviction, anti-rent gouging, and anti-junk fee measures

We recommend that standardized tenant protections be required across all properties with Enterprise-backed multifamily loans, as also called for by advocacy groups including the Homes Guarantee, National Housing Law Project, National Low Income Housing Coalition, and others. As pointed out in an October 2022 letter spearheaded by the California Reinvestment Coalition (now known as Rise Economy) and co-signed by NCRC and other housing rights advocacy groups, with regard to loan purchases counting toward the Enterprises’ Affordable Housing Goals, whether a unit is counted “affordable” should depend on whether it is a sustainable, stable, habitable affordable dwelling.[26] “Affordable” should not only be a consideration at the moment of acquisition, while in fact leading to displacement or poor living conditions. To ensure that the Enterprises are in fact financing long-term, quality affordable units, FHFA should provide for standard tenant protections such as those noted below. Further, these requirements should apply to all developments supported by the Enterprises, given that federal support (whether direct or indirect) should not be supplied to housing providers that fuel housing instability, displacement or unsafe conditions in the interest of profit.

These protections should be set forth in standardized lease provisions, with oversight to ensure compliance (for example, through auditing, as FHFA does for manufactured housing ground lease protections).

Just Cause Eviction Standards

Landlords who receive Enterprise-backed loans should be required to provide just cause for evictions.[27] In most states and municipalities, it is not mandatory for landlords to provide a reason for evicting tenants with or without a lease.[28] When a tenant receives an eviction notice, they may choose to move out or ”self-evict” instead of going to landlord-tenant court.[29] Tenants who choose to go to court have no laws to protect them from being evicted at the end of their leases.[30] An eviction judgment can make it difficult for tenants to obtain housing in the future.[31] In the section on tenant screening below, we further describe the ways in which evictions impact Black women in particular, and the ways in which they can often reflect landlords’ unfair, subjective, or economically exploitative behavior. Evictions can result in serious and lasting negative consequences to the households that experience them, such as homelessness, health risks and educational and job impacts.[32] Requiring landlords to provide just cause for evictions will help limit these harms and promote broader housing security.

Anti-Rent Gouging Protections

As the California Reinvestment Coalition and other housing rights advocates have described, landlords, including private equity firms, often increase rents on affordable rental units to unaffordable rates.[33] Essentially, the federal government is financing private equity firms and others who transform affordable housing into unaffordable housing. According to a recent study that the National Housing Law Project highlights in its own comment letter on tenant protections for Enterprise-backed multifamily housing, rents have skyrocketed over the 21st century.[34] From 2001 through 2021, the median rent increased by 17.9%, far outpacing the median rental household income, which rose by only about 3.2%.[35]

As noted in the RFI, the Enterprises have taken some initial steps toward rent stabilization in pilot form, through voluntary rent restriction programs that aim to preserve affordable housing.[36] Freddie Mac’s Tenant Advancement Commitment and Workforce Housing Preservation offer flexible terms to landlords who agree to preserve a portion of a multifamily property’s units as affordable housing for a specific length of time.[37] Fannie Mae’s Sponsor-Initiated Affordability program provides landlords with favorable credit terms in exchange for restricting rents in 20% of units for tenants who earn incomes at or below 80% of the area median income.[38] We appreciate these steps, while also calling for broader, consistent requirements throughout housing supported by the Enterprises. The FHFA should implement anti-rent gouging protections to maintain affordable rental units’ affordable status.

Prohibitions on Junk Fees

Junk fees make rental housing more expensive and can create economic hardship. NCRC welcomed the Biden Administration’s recent announcement of its intent to take steps to protect tenants from such fees.[39] Junk fees are separate from rent, but are still mandatory costs that renters have to pay.[40] As documented in separate surveys that the National Consumer Law Center and National Housing Law Project conducted, junk fees commonly include but are not limited to: rental application fees, administrative fees for processing rental applications, one-time nonrefundable fees in lieu of security deposits, insurance fees, excessive late fees, and fees for processing utility charges. [41] Unfortunately, many of these fees are impossible to avoid.[42] If a tenant cannot afford to pay these junk fees, the fees may convert to rental debt.[43] Even after tenants leave their apartments, rental debt can lower tenants’ credit scores.[44] In turn, this negative information as part of their credit report can make it difficult for tenants to rent apartments in the future; most landlords reject prospective tenants who owe money to former landlords and have lower credit scores.[45] These practices disproportionately negatively impact people of color, as 65% of people with rent arrears are people of color.[46] Model leases terms for Enterprise-backed housing should require transparency in fees and prohibit abusive fees.

3) Require use of equitable tenant screening criteria

The process by which tenants are chosen can be highly subjective, and can result in disproportionately negative outcomes for renters of color. Landlords often rely on credit scores, eviction records, criminal records and criteria such as source of income to determine whether or not to extend an offer to prospective tenants.[47] Screening criteria often becomes stricter or more relaxed depending on the housing market; in a market with more available rental units, landlords are more likely to relax these criteria compared to a market with fewer units where they more strictly adhere to these criteria.[48] Conversely, in a market with many qualified applicants, a criminal conviction or past eviction can make it harder for those applicants to find an apartment.[49]

FHFA should require Enterprise-backed multifamily properties to follow best practices for tenant screening, so as to avoid discriminatory impacts and to promote broader and more equitable access to housing.

Criminal Records in the Tenant Screening Process

Since people of color are disproportionately impacted by the criminal justice system, denying housing based on a criminal record can often, but not always, serve as a proxy for race or can have a disproportionate impact on the basis of race. Banning people with criminal records from applying for housing can disproportionately impact Black and Latino applicants due to their overrepresentation in the criminal justice system.[50] Black people are incarcerated in state prisons at about 5 times the rate of White people, while Latinos are incarcerated at 1.3 times the rate of White people.[51]

Further, reports have found that housing providers treated Black people and White people with criminal records differently. For example, the Equal Rights Center conducted 60 matched pair tests in Washington, D.C. and Northern Virginia to determine whether Black women with criminal records were treated differently than White women with criminal records.[52] Its report found that White women received more favorable treatment than Black women in approximately 47% of the tests.[53] A report from the Greater New Orleans Fair Housing Action Center (GNOFHAC) had similar results. The Center conducted 50 paired tests of housing providers in the Greater New Orleans Area to investigate whether Black prospective tenants with criminal records were treated differently than White prospective tenants with criminal records.[54] The Center's findings were disturbing:

-

- African American testers experienced differential treatment almost 50% of the time.[55]

- 42% of housing providers discriminated based on race in the way that they explained or applied criminal background screening policies.[56]

- These disparities expressed themselves in the four following ways [57] :

- White testers were informed about more lenient policies than Black testers.[58]

- White testers were provided with better customer service than Black testers.[59]

- White testers were encouraged to apply despite a criminal record while no such encouragement was provided to Black testers.[60]

- Exceptions were made to criminal background policies for White testers but not Black testers.[61]

The U.S. Department of Housing and Urban Development (HUD) has issued fair housing guidance to housing providers about prospective tenants with criminal records. In 2016, HUD advised housing providers against issuing blanket bans against people with criminal records. Instead of disqualifying all applicants with criminal histories, HUD clarified that housing providers should consider whether an arrest resulted in a conviction.[62] If an arrest resulted in a conviction, the HUD guidance states that the housing provider should consider the nature of the crime committed, so as to assess whether its consideration can reasonably be justified, and should give individualized consideration to the circumstances of the applicant (as a less discriminatory alternative to generalized exclusion).[63]

Eviction Records in the Tenant Screening Process

Prior eviction proceedings or actual evictions can pose another barrier to Black and Brown people accessing rental housing. This barrier is especially significant because as many as 5 million Americans are evicted or have their homes foreclosed on annually.[64] According to a 2020 report, Black people are most impacted by eviction–they comprise both the majority of eviction filings and judgments.[65] From 2012 to 2016, Black renters had the highest share of eviction filings and judgments relative to their share of the adult renter population across 1,195 counties in 39 states.[66]

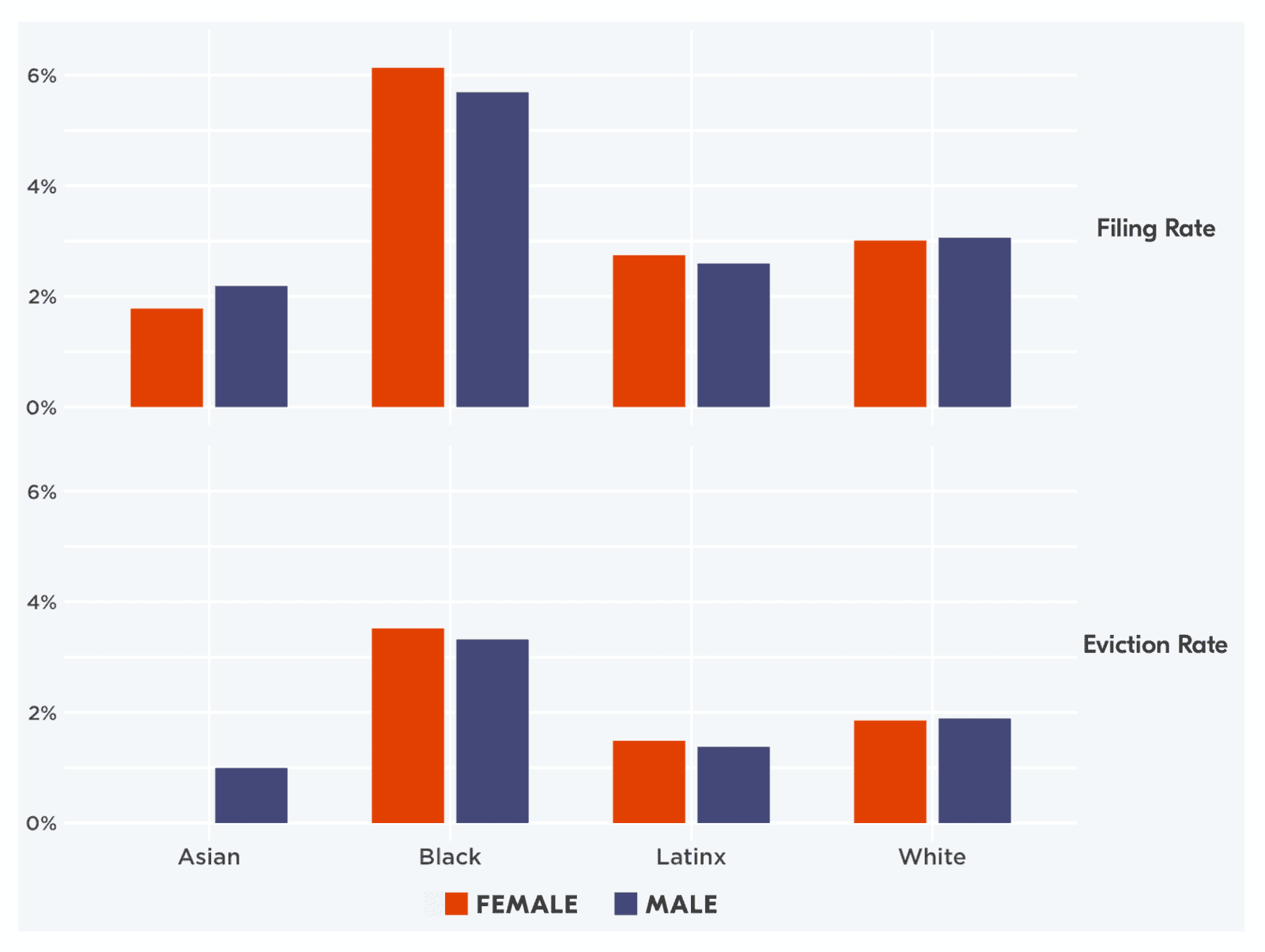

A report from The Eviction Lab corroborates this perspective and further disaggregates this data by race and gender. It demonstrates that Black women have both the highest eviction filing rate and eviction judgment rate (see the graph from The Eviction Lab below).

Blanket policies against renting to prospective tenants with previous evictions can have a disproportionately negative impact on Black renters, who tend to be evicted at the highest rates compared to other groups. Moreover, some landlords may file evictions without intending to evict tenants as a way to earn additional revenue.[67] Furthermore, if eviction proceedings took place years ago and the tenant has not had any issues paying their rent since then, or faced an eviction due to particular circumstances of economic distress (such as a job loss), the presence of an eviction on a housing record should not automatically disqualify them. An eviction may also have occurred because the tenant was the victim of domestic violence. In his book Evicted, sociologist Matthew Desmond found that many women were evicted when the police were called to a property.[68] Some tenants were left with an untenable problem: they could choose to live with their abuser or call the police but accept an eviction. In some states, there are laws prohibiting evictions due to domestic violence-related police reports.

4) Strengthen oversight of private equity and monitor ownership and performance

Private equity firms have been shown to misuse enterprise-backed loans to profit from limited supplies of affordable housing while rendering them unaffordable (by raising rents, i.e. “repositioning”), and often unhealthy and uninhabitable.[69] For example, an October 2022 letter spearheaded by one of our member organizations—the California Reinvestment Coalition—underscored the ways in which Federal Home Loan Mortgage Corporation, or Freddie Mac’s, Small Balance Loan (SBL) program inadvertently facilitates the mismanagement of apartment buildings.[70] The underwriting standards do not require the borrowers to use the loan to address maintenance issues.[71] Furthermore, the loans are underwritten in ways that “assume extremely low expense levels and extremely high debt service labels.”[72] In other words, most of the loan pays the debt and leaves little money for maintenance to operate the building safely.[73] This issue is so pronounced that private equity firms comprise 85% of Freddie Mac’s twenty largest financing apartment complex purchases by a single borrower.[74]

The CRC et al. letter, cosigned by NCRC and others, highlighted numerous problems exhibited by private equity offenders. For example, in 2016, Emerald Equity Group purchased almost $500 million in rent-controlled apartments in more than 80 buildings in working-class neighborhoods of color in the Bronx and East Harlem, New York.[75] By the following year, Freddie Mac’s SBL program fully refinanced the portfolio at a total of more than $320 million.[76] Unfortunately, tenants who lived in these properties did not share Emerald Equity’s prosperity. Under Emerald Equity’s management, tenants endured harassment, rat infestations, gas and hot water shutoffs, stolen security deposits, aggressive buyout offers coupled with threats to report undocumented tenants and the deregulation of rent-regulated apartments to raise their rents.[77] Emerald Equity’s neglect and predation are only a snapshot of private equity’s harmful impact on housing in New York City. In 2021, underwriting for Freddie Mac-financed properties that private equity owned in New York, Brooklyn and the Bronx comprised 31%, 26%, and 39% of rental income, respectively.[78] In other words, private equity landlords used most of the rent dollars that Freddie Mac provided through its loan to pay their debt and left little money to operate their properties safely.[79]

Such issues point to the need for stronger regulation and oversight. As noted in the letter from California Reinvestment Coalition (Rise Economy) and others, it is difficult to hold LLCs legally accountable because anonymous shell companies or trusts—not named individuals—own many of these dilapidated properties.[80] Shielding individual names from ownership records makes it difficult to learn who owns what property.[81] As underscored in the California Reinvestment Coalition’s letter, there has been some progress made at the local level towards obtaining property ownership information. At the local level, New York City, Philadelphia and Washington, D.C. have all enacted beneficial ownership statues and ordinances.[82] Still, the nation lacks a national beneficial ownership registry. FHFA should establish such a registry, requiring landlords to disclose their identities and tracking landlord performance with regard to tenant treatment, fair housing and property maintenance.

Further, as stated above, standard lease provisions and measures such as audits should be used to provide for stronger tenant protections, to counter the risk of displacement, excessive cost pressure, and vulnerability to poor living conditions.

5) Enforce housing quality standards so as to ensure healthy, habitable housing

As noted above, housing habitability presents a major concern for low-income renters, including in buildings owned by private equity landlords (who may willfully allow properties to fall into disrepair). Housing quality standards and strong monitoring and enforcement to ensure safe, healthy homes for all is a critical component of FHFA’s oversight role. Habitability issues are also often intertwined with the need for other renter protections, such as just cause eviction, as renters are vulnerable to eviction when withholding rent.

Thank you for your consideration of our recommendations on these important issues. We can be reached via Nichole Nelson (Senior Policy Advisor) at nnelson@ncrc.org or Megan Haberle (Senior Director of Policy) at mhaberle@ncrc.org for further discussion.

Best regards,

Jesse Van Tol

President and CEO

National Community Reinvestment Coalition

[1] Federal Housing Finance Agency, “Tenant Protections for Enterprise-Backed Multifamily Properties: Request for Input,” May 2023, https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/Multifamily-Tenant-Protections-RFI.pdf.

[2] Letter from Megan Haberle, Senior Director of Policy, Josh Silver, Senior Fellow, and Nichole Nelson, Senior Policy Advisor, National Community Reinvestment Coalition to Sandra Thompson, Director, Federal Housing Finance Agency, June 26, 2023, https://www.ncrc.org/ncrc-letter-to-fhfa-re-fair-lending-fair-housing-and-equitable-housing-finance-plans-proposed-rule/.

[3] Federal Housing Finance Agency, 12 CFR Part 1282 RIN 2590—AB21, “2023-2024 Multifamily Enterprise Housing Goals,” 78843.

[4] Ibid.

[5] The National Low Income Housing Coalition, “The Gap: A Shortage of Affordable Homes,” March 2023, 3, https://nlihc.org/sites/default/files/gap/Gap-Report_2023.pdf.

[6] Ibid., 3 and 9.

[7] U.S. Census Bureau, Table B25003B: Tenure (Black or African American Alone Householder), 2019: ACS 5-Year Estimates Detailed Tables, United States, https://data.census.gov/table?q=B25003B:+TENURE+(BLACK+OR+AFRICAN+AMERICAN+ALONE+HOUSEHOLDER)&tid=ACSDT5Y2019.B25003B.

[8] U.S. Census Bureau, Table B25003C: Tenure (American Indian and Alaska Native Alone), 2019, ACS 5-Year Estimates Detailed Tables, United States, https://data.census.gov/table?q=B25003C:+TENURE+(AMERICAN+INDIAN+AND+ALASKA+NATIVE+ALONE+HOUSEHOLDER)&tid=ACSDT5Y2019.B25003C.

[9] U.S. Census Bureau, Table B25003I: Tenure (Hispanic or Latino Householder), 2019, ACS 5-Year Estimates Detailed Tables, United States, https://data.census.gov/table?q=B25003I:+TENURE+(HISPANIC+OR+LATINO+HOUSEHOLDER)&tid=ACSDT5Y2019.B25003I.

[10] U.S. Census Bureau, Table B25003D: Tenure (Asian Alone Householder), 2019, ACS 5-Year Estimates Detailed Tables, United States, https://data.census.gov/table?q=B25003D:+TENURE+(ASIAN+ALONE+HOUSEHOLDER)&tid=ACSDT5Y2019.B25003D.

[11] U.S. Census Bureau, Table 25003H: Tenure (White Alone, Not Hispanic or Latino Householder), 2019, ACS 5-Year Estimates Detailer Tables, United States, https://data.census.gov/table?q=B25003H:+TENURE+(WHITE+ALONE,+NOT+HISPANIC+OR+LATINO+HOUSEHOLDER)&tid=ACSDT5Y2019.B25003H.

[12] U.S. Census Bureau, B02009: Black or African American Alone or in Combination with One or More Races (based on 2019 1-Year ACS Estimates), https://data.census.gov/table?q=B02009:+BLACK+OR+AFRICAN+AMERICAN+ALONE+OR+IN+COMBINATION+WITH+ONE+OR+MORE+OTHER+RACES&tid=ACSDT1Y2019.B02009; U.S. Census Bureau, Table B03002: Hispanic or Latino Origin by Race, 2019, ACS 1-Year Estimates, Detailed Tables, United States, https://data.census.gov/table?q=B03002:+HISPANIC+OR+LATINO+ORIGIN+BY+RACE&tid=ACSDT1Y2019.B03002; and U.S. Census Bureau, B01003 Total Population (based on 2019 1-Year ACS Estimates), https://data.census.gov/table?q=B01003:+TOTAL+POPULATION&tid=ACSDT1Y2019.B01003.

[13] U.S. Department of Housing and Urban Development Office of Community Planning and Development, “The 2019 Annual Homeless Assessment Report (AHAR) to Congress,” 10, https://www.huduser.gov/portal/sites/default/files/pdf/2019-AHAR-Part-1.pdf; Karma Allen, “More Than 50% of Homeless Families are Black, Government Report Finds,” ABC News, January 22, 2020, https://abcnews.go.com/US/50-homeless-families-black-government-report-finds/story?id=68433643; and Chelsey Cox, “The Majority of Homeless Families in America are Black, HUD Study Finds,” USA Today, January 24, 2020, https://www.usatoday.com/story/news/2020/01/24/majority-homeless-families-black-hud-report/4570857002/.

[14] U.S. Department of Housing and Urban Development Office of Community Planning and Development, “The 2019 Annual Homeless Assessment Report (AHAR) to Congress,” 10.

[15] Ibid., 1 and 22; Allen, “More Than 50% of Homeless Families are Black, Government Report Finds,”; and Cox, “The Majority of Homeless Families in America are Black, HUD Study Finds.”

[16] U.S. Department of Housing and Urban Development, “Housing Choice Vouchers Fact Sheet,” https://www.hud.gov/topics/housing_choice_voucher_program_section_8#hcv01; United States Department of Housing and Urban Development, Office of Inspector General, “Newark Landlords Agree to Pay $430,000 to Settle Allegations of Collecting Excess Rent in Sparrow Run,” May 2, 2022, https://www.hudoig.gov/newsroom/press-release/newark-landlords-agree-pay-430000-settle-allegations-collecting-excess-rent; and Kayla Canne, “‘We don't take that:’ Why Illegal Discrimination Toward Section 8 tenants Goes Unchecked in NJ,” Asbury Park Press, October 25, 2021, https://www.app.com/in-depth/news/investigations/2021/10/26/section-8-nj-housing-choice-voucher-discrimination-law-new-jersey/5602044001/.

[17] National Housing Law Project, “Source of Income Discrimination,” November 17, 2017, https://www.nhlp.org/resources/source-of-income-discrimination-2/ and Fair Housing Council of Oregon, “Learn About the Protected Class of Source of Income,” https://fhco.org/learn-about-the-protected-class-of-source-of-income/.

[18] Fannie Mae, “Housing Choice Voucher Program Explained,” 2022, https://multifamily.fanniemae.com/media/15531/display.

[19] United States Department of Housing and Urban Development, Office of Inspector General, “HUD OIG Announces Environmental Justice Initiative,” March 9, 2023,

https://www.hudoig.gov/newsroom/press-release/hud-oig-announces-environmental-justice-initiative.

[20] United States Department of Housing and Urban Development, Office of Inspector General, “Newark Landlords Agree to Pay $430,000.”

[21] Ibid.

[22] United States Department of Housing and Urban Development, Office of Inspector General, “Holyoke Landlord Agrees to $15,000 Settlement for False Claims Act Violations,” February 8, 2023, https://www.hudoig.gov/newsroom/press-release/holyoke-landlord-agrees-15000-settlement-false-claims-act-violations.

[23] United States Department of Housing and Urban Development, Office of Inspector General, “HUD OIG Announces Environmental Justice Initiative.”

[24] Federal Housing Finance Agency, Tenant Protections for Enterprise-Backed Multifamily Properties: Request for Input,” May 2023, 5-6 and Fannie Mae, ”Expanded Housing Choice Initiative,” https://multifamily.fanniemae.com/financing-options/specialty-financing/expanded-housing-choice-initiative.

[25] Fannie Mae, “Expanded Housing Choice Initiative.”

[26] Letter from Jyotswaroop Bawa, Chief of Organizing and Campaigns, Jamie Buell, Research Analyst Chief of Legal, and Kevin Stein, Strategy, California Reinvestment Coalition to Clinton Jones, General Counsel, Federal Housing Finance Agency, October 17, 2022, 2 and 10, https://ourfinancialsecurity.org/wp-content/uploads/2022/10/10.17.22-housing-CRC-FHFA-Comment-Letter-on-MF-Affordable-Housing-Goals.pdf and Rise Economy, https://rise-economy.org/ (in the logo in the header of the website, it says,” Rise Economy Formerly California Reinvestment Coalition.”).

[27] July 31, 2023 Letter from the National Low Income Housing Coalition to the Federal Housing Finance Agency, https://nlihc.org/sites/default/files/FHFA-National-Sign-On-Letter.pdf.

[28] Ibid. 2.

[29] Ibid.

[30] Ibid.

[31] Ibid.

[32] Abdullahi Tunde Aborode, “Threats of Evictions in the USA: A Public Health Concern,” Annals of Medicine & Surgery, 82 (October 2022), https://journals.lww.com/annals-of-medicine-and-surgery/Fulltext/2022/10000/Threats_of_evictions_in_the_USA__A_public_health.147.aspx.

[33] Letter from Jyotswaroop Bawa, Chief of Organizing and Campaigns, Jamie Buell, Research Analyst Chief of Legal, and Kevin Stein, Strategy, California Reinvestment Coalition to Clinton Jones, General Counsel, Federal Housing Finance Agency, October 17, 2022, 9.

[34] July 31, 2023 Letter from the National Housing Law Project to the Federal Housing Finance Agency, 17, https://www.nhlp.org/wp-content/uploads/NHLP-Response-to-FHFA-RFI.pdf and Peggy Bailey, “Addressing the Affordable Housing Crisis Requires Expanding Rental Assistance and Adding Housing Units,” Center on Budget and Policy Priorities, Figure 2, https://www.cbpp.org/sites/default/files/10-27-22hous.pdf.

[35] Ibid.

[36] Federal Housing Finance Agency, “Tenant Protections for Enterprise-Backed Multifamily Properties: Request for Input,” 5.

[37] Ibid., 5; Freddie Mac,” Tenant Advancement Commitment,” https://mf.freddiemac.com/docs/product/tenant_advancement_commitment.pdf; and Freddie Mac Multifamily,” Workforce Housing Preservation,” https://mf.freddiemac.com/docs/workforce-housing-preservation.pdf.

[38] Federal Housing Finance Agency, “Tenant Protections for Enterprise-Backed Multifamily Properties: Request for Input,” 5.

[39] “Biden-?Harris Administration Takes on Junk Fees in Rental Housing to Lower Costs for Renters,” https://www.whitehouse.gov/briefing-room/statements-releases/2023/07/19/fact-sheet-biden-harris-administration-takes-on-junk-fees-in-rental-housing-to-lower-costs-for-renters/.

[40] Ariel Nelson, “Re: Request for Information Regarding Fees Imposed by Providers of Consumer Financial Products or Services, Docket No. CFPB-2022-0003,” National Consumer Law Center, 2, https://www.nclc.org/wp-content/uploads/2022/09/CFPB_2022_0003_comments.pdf.

[41] Ibid., 3-5 and July 31, 2023 Letter from the National Housing Law Project to the Federal Housing Finance Agency, 23.

[42] National Consumer Law Center, “Request for Information Regarding Fees,” 2.

[43] Ibid.

[44] Ibid.

[45] Ibid.

[46] Ibid.

[47] Wonyoung So, “Which Information Matters? Measuring Landlord Assessment of Tenant Screening Reports,” Housing Policy Debate, August 30, 2022, 5 and 18-19, https://doi.org/10.1080/10511482.2022.2113815 and U.S. Department of Housing and Urban Development, “Office of General Counsel Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records by Providers of Housing and Real Estate-Related Transactions,” April 4, 2016, 4-5, https://www.hud.gov/sites/documents/HUD_OGCGUIDAPPFHASTANDCR.PDF.

[48] Anna Resoti, “‘We Go Totally Subjective’ : Discretion, Discrimination, and Tenant Screening in a Landlord’s Market,” Law & Social Inquiry, 45, no. 3, August 2020, 627, https://www.cambridge.org/core/journals/law-and-social-inquiry/article/we-go-totally-subjective-discretion-discrimination-and-tenant-screening-in-a-landlords-market/1AABF71AEA176ADA1F8D93E7C424C4D2/share/3f4060bf42159f964bbd50055a9db16a78f9789a#pf24.

[49] Ibid.

[50] U.S. Department of Housing and Urban Development, “Office of General Counsel Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records,” April 4, 2016, 2.

[51] Ashley Nellis, “The Color of Justice: Racial and Ethnic Disparity in State Prisons,” The Sentencing Project, 2021, 6, https://www.sentencingproject.org/app/uploads/2022/08/The-Color-of-Justice-Racial-and-Ethnic-Disparity-in-State-Prisons.pdf.

[52] Equal Rights Center, “Unlocking Discrimination: A DC Area Testing Investigation About Racial Discrimination and Criminal Records Screening Policies in Housing,” 2016, 16, https://equalrightscenter.org/wp-content/uploads/unlocking-discrimination-web.pdf.

[53] Ibid.4,6, and 20.

[54] Greater New Orleans Housing Action Center, “Locked Out: Criminal Background Checks as a Tool for Discrimination,” 3-4, https://lafairhousing.org/wp-content/uploads/2021/12/Criminal_Background_Audit_FINAL.pdf.

[55] Ibid., 4, 17, and 18.

[56] Ibid., 4 and 18.

[57] Ibid., 4.

[58] Ibid., 4 and 18.

[59] Ibid. 4, 18, and 20.

[60] Ibid., 19, 21-22, and 25.

[61] Ibid., 4, 18, and 22.

[62] U.S. Department of Housing and Urban Development, “Office of General Counsel Guidance on Application of Fair Housing Act Standards to the Use of Criminal Records,” April 4, 2016, 6.

[63] Ibid.

[64] Tim Robustelli, Yuliya Panfil, Katie Oran, Chenab Navalkha, and Emily Yelverton, “Displaced in America,” New America, Executive Summary, https://www.newamerica.org/future-land-housing/reports/displaced-america/executive-summary.

[65] Peter Hepburn, Renee Louis, and Matthew Desmond, “Racial and Gender Disparities Among Evicted Americans,” Sociological Science, 7, 2020, 649, https://sociologicalscience.com/download/vol-7/december/SocSci_v7_649to662.pdf.

[66] Ibid., 649, 650, and 654-655.

[67] So, “Which Information Matters?” 17-18.

[68] Matthew Desmond, Evicted: Poverty and Profit in the American City, (New York, NY: Penguin Random House, 2016), 68.

[69] Eileen Markey, “How Freddie Mac Helps Private Equity Profit from Tenant Misery,” The Nation, June 13, 2023, https://www.thenation.com/article/society/freddie-mac-private-equity-housing/.

[70] Letter from Jyotswaroop Bawa, Chief of Organizing and Campaigns, Jamie Buell, Research Analyst Chief of Legal, and Kevin Stein, Strategy, California Reinvestment Coalition to Clinton Jones, General Counsel, Federal Housing Finance Agency, October 17, 2022.

[71] Ibid., 6.

[72] Ibid.

[73] Ibid.

[74] Ibid., 4-5 and Heather Vogell, “When Private Equity Becomes Your Landlord,” ProPublica, February 7, 2022, https://www.propublica.org/article/when-private-equity-becomes-your-landlord?utm_medium=social&utm_source=twitter.

[75] Letter from Jyotswaroop Bawa, Chief of Organizing and Campaigns, Jamie Buell, Research Analyst Chief of Legal, and Kevin Stein, Strategy, California Reinvestment Coalition to Clinton Jones, General Counsel, Federal Housing Finance Agency, October 17, 2022, 5.

[76] Ibid.

[77] Ibid.

[78] Ibid., 6.

[79] Ibid.

[80] Ibid., 7.

[81] Ibid.

[82] Ibid., 8.