May 29 2019

RE: NCRC Comment Letter on Robinhood’s Charter Application

To Whom it May Concern:

The National Community Reinvestment Coalition (NCRC) maintains that Robinhood’s charter application has not demonstrated a significant commitment to meeting the convenience and needs of the community to be served as required by the Community Reinvestment Act (CRA) and the Office of the Comptroller of the Currency’s (OCC) licensing manual.[1]Robinhood has developed an incomplete plan for its CRA responsibilities that does not adequately serve the credit and deposit needs of the communities, including low- and moderate-income (LMI) communities. NCRC, our members and allies oppose Robinhood’s charter application and urge the OCC to deny it.

Receiving a bank charter is a privilege, not a right. On-line lenders have proliferated, exploiting unproven and untested marketing and underwriting approaches that raise significant questions regarding disparate impact, fair lending, abusive lending practices and safety and soundness. Robinhood is one of these online financial institutions that have yet to prove that it is responsible and inclusive. Its track record of deceitful advertising and its incomplete application disqualifies it from the privilege of a bank charter.

Robinhood states boldly in its application that its mission is “to Democratize Our Financial System,” and that Robinhood “was established to expand capital markets access and its many benefits to everyone.”[2] Robinhood states that it will offer services with no monthly fee and can achieve affordable services through its internet platform and consumers’ use of their smartphones. Robinhood will “eliminate expenses that make many other brokerages costly, such as manual account management and storefront locations.” With its comparative advantage of less expensive operations, Robinhood’s bank will seek to “provide consumer banking services not only to its existing brokerage customers (6 million existing customers) but also to customers who are new to Robinhood.”[3]

Despite Robinhood’s bold declaration, its CRA plan does not come close to “democratizing” the financial system. Its main product offering will be a secured credit card, which is expensive for LMI borrowers. It does not indicate a suite of products for LMI customers or how it will graduate users of secured credit cards to more affordable products. It also does not indicate how it will connect LMI consumers to its brokerage services or provide any description of entry-level products for these customers. Instead of democratizing the financial system, Robinhood’s bank seems mainly to be a convenience for its existing and more affluent customers.

Federal bank agencies have touted mobile and online banking as a means of serving traditionally underserved populations. The agencies have devoted considerable time amending the Interagency Question and Answer (Q&A) document on CRA in order to encourage and evaluate online banking. Yet, Robinhood’s application has not provided any data indicating that its online and mobile service is effectively serving LMI populations. If the OCC does not require a rigorous CRA plan from Robinhood with specific goals for serving LMI borrowers and communities, an approval of an inadequate plan will merely exacerbate the digital divide and encourage more fintechs to apply for bank charters without any ironclad plans for serving LMI communities.

Robinhood states in its application that “a number of factors demonstrate that the bank will have ample institutional capacity to pursue its CRA goals. These factors include Robinhood’s culture of inclusiveness, the bank’s capital base, the low credit and liquidity risk profiles of the bank and projected profitability of the bank in its second year of operations.”[4] However, these broad and bold assertions are not backed up by a substantial CRA plan.

In contrast to Robinhood’s CRA plan, NCRC believes the OCC should consider the following as minimum requirements for an online lender applicant creating a rigorous CRA plan. Such a plan must be comprehensive, qualities lacking in Robinhood’s proposed plan:

Towards a substantial CRA plan that utilizes the talents and expertise of the applying institution

A non-bank applying for a bank charter must apply its talent and expertise in serving the LMI population. Robinhood’s major line of business is brokerage services. Yet, its major commitment in its CRA plan consists of offering secured credit cards and deposit accounts. While we do not expect Robinhood to turn immediately thousands of LMI customers into investors trading stocks through Robinhood’s mobile phone application, a company that boasts of democratizing the financial system should have well-thought-out plans in place for introducing stocks and investments to LMI customers. Instead, a secured credit card is an expensive product of dubious value if it is not accompanied by an explanation of how to graduate from this product into more affordable products. The cursory description of the secured credit card is a feeble attempt to satisfy a CRA requirement instead of a thoughtful plan for encouraging LMI customers to enter the financial mainstream and take advantage of a range of deposit, credit and investment products. Robinhood also makes passing references to offering unsecured consumer loans and deposit products without describing goals in terms of numbers and percentages of loans made to LMI consumers and how these products would help LMI people enter into the financial mainstream and take advantage of investment opportunities.[5]

Measurable goals

A CRA plan must have measurable goals so that the public can judge the extent of concrete benefits for the LMI community. Commitments to provide loan or bank deposit products without measurable goals can result in a lending institution declaring that a minimal number of products for LMI populations over the CRA plan time period meets the requirements of the CRA plan. In addition, measurable goals provide a substantive opportunity for the public to comment on the adequacy of the CRA plan.

For its mobile banking, Robinhood should adopt benchmarks based on the specific guidance on how CRA examiners evaluate alternative delivery systems in the Interagency Q&A.[6] The Interagency Q&A advises that CRA examiners scrutinize whether a financial institution’s alternative delivery systems are effectively delivering services to LMI populations by considering a variety of factors including: ease of access; cost to consumers; a range of services delivered; ease of use; a rate of adoption and use; and reliability of the system.[7] Robinhood should establish specific performance measures and goals for the LMI community for these factors. Factors like the rate of adoption and use and the reliability of the system should have separate metrics and goals for rural as well as urban areas and for previously under-phoned and under-banked populations.

Federal bank agencies have an opportunity to use its recent Q&A guidance and insist that Robinhood’s CRA plan incorporate these metrics for its loan and deposit products so that the public can discern whether Robinhood’s charter application would specifically meet the convenience and needs of LMI communities instead of the vague promises in its current application. Robinhood should provide the public with metrics that indicate the volume and percent of its products that will be offered to LMI borrowers and communities. It is not enough to simply list the numbers of accounts because a large number could still be a low percentage of the company’s portfolio.

Financial education

The community development service section of Robinhood’s application does not present a comprehensive plan for utilizing Robinhood’s talent and expertise to democratizing the financial system or to closing the digital divide. The application lists three organizations – Oakland Public Education Fund, the San Franciscans for Municipal Fiber and the Bay Area Financial Education Foundation – that Robinhood will contemplate partnering with for the purposes of supporting financial education for students and increasing access to the internet. However, specifics of how these partnerships would work and how many LMI consumers and communities they would serve are not described. The public does not know whether granting a bank charter to Robinhood will provide tangible net benefits to underserved communities.

The application has a table showing staff growth over three years and hours that will be devoted to volunteer opportunities. The table suggests that each staff person will devote about 28 hours per year for volunteering in the community. The volunteering appears to be helter-skelter with no thought about how an integrated and comprehensive plan will maximize financial education for underserved populations.

Since Robinhood has a national footprint, the company should have identified community organizations and local public agencies in key states, urban areas and rural counties that it could partner with in terms of offering financial education and introduction to investment products. It could develop a thoughtful plan for offering webinars and in-person lectures with its partners. It could also determine how to maximize the effectiveness of 28 hours per staff person for volunteering. This staff time should be dedicated to the webinars and financial education initiatives across the country.

Outcomes should be developed in terms of how many students will be in financial education courses. Robinhood could work with its partners in developing additional goals such as how many students will be able to increase their savings, improve their creditworthiness, access bank products and access investment products. Community organizations and other financial service providers will be able to provide Robinhood with insights into how many students they could serve and what skills the students can gain based on their experience using additional staff and/or grants.

Community development investments to increase broadband access

Robinhood should also consider investments in improving broadband access. The Federal Communications Commission’s (FCC’s) 2016 Broadband Progress Report concluded that 10% of Americans across the country still lack access to adequate broadband Internet service. While only 4% of people living in urban areas lack adequate broadband services, 39% and 41% of residents of rural and tribal areas, respectively, lack access.[8] It is important for Robinhood to acknowledge the “digital divide” and work toward closing this gap through its CRA plan. The Federal Reserve Bank of Dallas extols using CRA qualified investments in broadband as an effective means of closing the digital divide and providing LMI individuals access to safe and sound banking products.[9]

Affiliates and subsidiaries must be included

Fintechs like Robinhood often have affiliates or subsidiaries that will offer financial products. Although the CRA regulation allows for optional inclusion of affiliates on CRA exams, it is incumbent upon fintechs to explain how its entire suite of products will serve the convenience and needs of communities. The application should answer questions like how can the products work together to meet community needs?

A recent American Banker article states, “’The company’s banking arm, Robinhood Bank, would be separate from the brokerage service,” a Robinhoodspokesperson said. “Yet both are intended to be offered to clients as part of a package of services. The cash management feature in brokerage accounts would still be available through Robinhood Financial LLC, a broker-dealer.’”[10] It would be a disservice to LMI communities if Robinhood targets these communities with a high-cost secured credit card only while shutting off these communities from wealth building services through its brokerage business. The CRA plan must require that the “package of services” offered by the bank and its affiliates are offered to all communities.

Fair lending and consumer protection commitment

Robinhood and other fintechs must include a section in their application detailing how they will comply with consumer protection and fair lending laws. Robinhood, in particular, needs to describe its compliance activities since it engaged in unfair and deceptive practices. Recently, it advertised incorrectly that one of its brokerage products had the backing of the federal government. According to a recent article in the American Banker, “The company had suggested its backing from the Securities Investor Protection Corp. was akin to the Federal Deposit Insurance Corp., but criticism from bankers, SIPC and others forced Robinhood to backtrack.”[11] In light of this, the general public needs to know how Robinhood will refrain from this deceptive marketing in the future and adhere to its billing in its application as “Honest – Transparent, easy to understand, no ‘gotchas’.”[12]

In addition, fintechs have come under intense scrutiny regarding fair lending concerns associated with their unorthodox underwriting. Algorithms and machine learning have been alleged to judge consumers’ creditworthiness based on characteristics like particular colleges attended that can exclude protected classes and create disparate impacts not justified by business necessity. Fintechs are under an obligation to describe in detail how their unusual underwriting will not be exclusive. Since Robinhood seeks to become a bank, it must outline how it will seek to “democratize” access to financial products.

Assessment area cannot be narrow but must include areas where a substantial amount of business is conducted

Robinhood’s plan establishes the metropolitan area of San Francisco as its assessment area because the bank is headquartered there. This narrow assessment area is not truly responding to credit and deposit needs where Robinhood is conducting business and will thus fall short of meeting the convenience and needs requirement for a charter application. Robinhood’s application states that the “bank will serve a national market from inception, as it will be drawing many of its initial customers from the established, national customer base of its brokerage firm.”[13] Accordingly, NCRC believes that Robinhood’s CRA plan ought to be national in reach.

It is a contradiction in terms for a branchless fintech to establish its assessment area where its headquarters is. In this case, Robinhood is acting as if its headquarters location is a branch and as such, the headquarters location will make loans in its contiguous community. But the headquarters is not a branch and will not be used for making loans. This sleight of hand mocks the intention of CRA to serve credit and banking needs wherever a lender is conducting business.

Instead of designating San Francisco as its sole assessment area, Robinhood needs to identify areas (urban and rural) that receive considerable amounts of its business activity. If it is not yet offering unsecured consumer loans, it can make a commitment that it will map the future geographical distribution of these loans as well as deposits. This mapping exercise would help identify future assessment areas. The CRA regulations do not prohibit a branchless bank from establishing assessment areas beyond its headquarters. Assessment areas can include areas where substantial amounts of lending activity occur.[14]

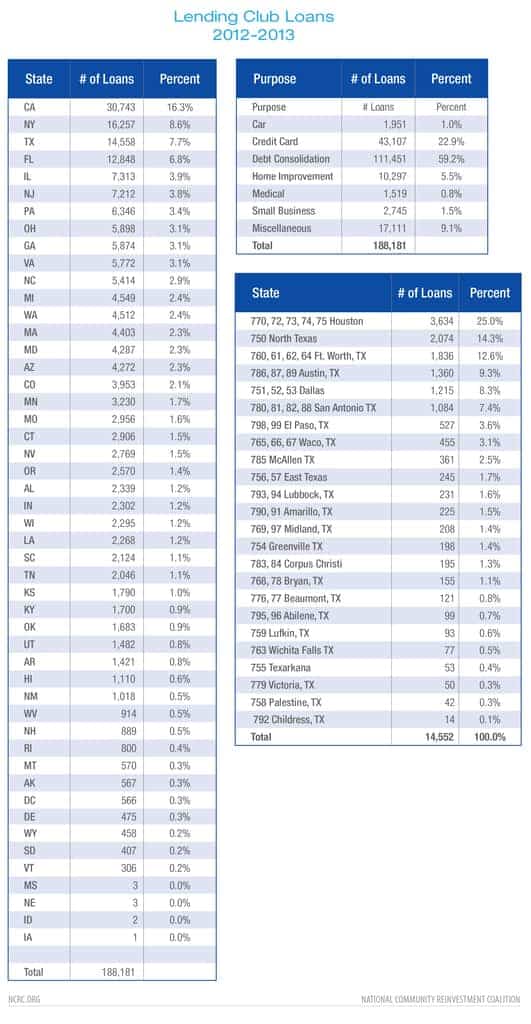

Using loan data, NCRC believes that the agencies can require non-traditional banks and fintechs to create assessment areas that capture the vast majority of their loans. An example of lending by state for Lending Club during the time period of 2012 and 2013 shows that assessment areas can be meaningfully created for an online lender (a two year time period is a typical time period covered by a CRA exam).[15] Lending Club makes data on its lending activity by state and for three-digit zip codes publicly available.

Several states have sizable numbers of Lending Club loans in this time period even before Lending Club’s substantial lending increases of more recent years. During 2012 and 2013, Lending Club made more than 188,000 loans; most of these were consumer-related loans and/or refinancing and consolidation of outstanding debt (see table below). Another table below on lending by state reveals that heavily populated states including California, New York, Texas and Florida had the highest percentage of loans. Ten states each had more than 3% of Lending Club’s loans.[16] On the other end of the scale, 28 states each had less than 1.5% of Lending Club’s loans. In sum, it is quite feasible for at least the top ten or twenty states to constitute assessment areas; these states had high numbers of loans and reasonably high percentages of Lending Club’s loans.

To further investigate how assessment areas would work for a non-traditional bank, NCRC tabulated loans by three-digit zip code and metropolitan areas for Texas, one of Lending Club’s high volume states. We found five metropolitan areas with more than 1,000 loans each and one area, North Texas, that could possibly be considered a rural area. The five metropolitan areas range in size and location across the state and include Houston, Austin, Ft. Worth, Dallas and San Antonio. El Paso is the seventh largest area by loan volume with more than 500 loans.

Using Lending Club as an example, designating metropolitan areas and rural counties as assessment areas for non-traditional lenders is feasible and can include a diversity of areas. The designation of assessment areas must also include rural and tribal areas since these areas are particularly lacking access to broadband service as discussed above. If fintechs do not make efforts to serve rural areas, the digital divide disadvantaging rural communities will only widen.

see https://pe.usps.com/archive/HTML/DMMArchive20070717/print/L002.htm

Conclusion

Robinshood’s charter application cannot be approved by the OCC. The current CRA plan does not illustrate a willingness to meet credit and banking needs in all areas in which Robinhood does business as required by the convenience and needs factor for charter approval. In addition to a lack of a robust CRA plan, Robinhood does not offer an explicit and ironclad commitment to responsible and fair lending in its charter application. We ask the OCC to reject this application and implement a high standard for any non-bank seeking the privilege of a bank charter.

Thank you for the opportunity to comment on this important matter. This letter represents the perspective of NCRC and the undersigned organizations. If you have any questions, you can reach me or Josh Silver, Senior Advisor, on 202-628-8866.

Sincerely,

Jesse Van Tol

CEO

Undersigned Organizations

National

Consumer Action

National Association of American Veterans, Inc.

Alabama

HICA! The Hispanic Interest Coalition of Alabama

HUB COMMUNITY DEVELOPMENT CORP(HUBCDC)

Titusville Development Corp.

Delaware

Delaware Community Reinvestment Action Council

Edgemoor Revitalization Cooperative, Inc.

Florida

Affordable Homeownership Foundation/Squirrels Nest

Community Enterprise Investments, Inc.

Georgia

The D&E Group

Georgia Advancing Communities Together, Inc.

H.O.P.E. Through Divine Intervention

National Housing Counseling Agency

Illinois

Woodstock Institute

Indiana

Continuum of Care Network NWI, Inc.

Northwest Indiana Reinvestment Alliance

Kentucky

Comprehensive Valuation Services, LLC

The Louisville Urban League

Massachusetts

Community Service Network Inc,

Michigan

Community Action Agency

Mississippi

Housing Education and Economic Development (HEED)

Minnesota

Asian Economic Development Association

Missouri

Metropolitan St. Louis Equal Housing and Opportunity Council

R.A.A. – Ready, Aim, Advocate

New Jersey

New Jersey Citizen Action

New Mexico

Southwest Neighborhood Housing Services

United South Broadway Corporation-Fair Lending Center

New York

Inner City Press

PathStone Enterprise Center

Ohio

County Corp

Homes on the Hill, CDC

Home Repair Resource Center

Ohio CDC Association

Ohio Fair Lending Coalition

The PTEF, Inc

Working In Neighborhoods

Pennsylvania

Ceiba

Oregon

Casa of Oregon

Texas

Harlingen CDC

Wisconsin

Metropolitan Milwaukee Fair Housing Council

Movin’ Out, Inc.

[1] Comptroller’s Licensing Manual, Charters, September 2016, p. 96, https://www.occ.gov/publications/publications-by-type/licensing-manuals/charters.pdf,

[2] Interagency Charter and Federal Deposit Insurance Corporation Deposit Insurance Application for Robinhood, Bank, NA Submitted to the Office of the Comptroller of the Currency, April 19, 2019, p. 2.

[3] Robinhood Application, p. 2.

[4] Robinhood Application, p. 11.

[5] Robinhood Application, p. 5 of CRA plan, which is page 46 of application.

[6] Community Reinvestment Act; Interagency Questions and Answers Regarding Community Reinvestment Act Guidance, OCC, Board of Governors of the Federal Reserve System, FDIC, Fed. Reg. 81, 142 at 48506, https://www.gpo.gov/fdsys/pkg/FR-2016-07-25/pdf/2016-16693.pdf

[7] Interagency Q&A at 48542.

[8] Broadband Progress Report, Federal Communications Commission, Jan. 29, 2016, https://www.fcc.gov/reports-research/reports/broadband-progress-reports/2016-broadband-progress-report

[9] Closing the Digital: A Framework for Meeting CRA Obligations, Federal Reserve Bank of Dallas, July 2016, https://www.dallasfed.org/assets/documents/cd/pubs/digitaldivide.pdf

[10] Hannah Lang and Rachel Witkowski, Robinhood Angered Banks, Now it Wants to be One, April 22, 2019, American Banker, https://www.americanbanker.com/news/robinhood-angered-banks-now-it-wants-to-be-one Also, see page 2 of Robinhood application.

[11] Hannah Lang and Rachel Witkowski, Robinhood Angered Banks, Now it Wants to be One.

[12] Robinhood Application, p. 2.

[13] Robinhood Application, p. 10.

[14] See § 345.41 (c) (2), Assessment area delineation, of the FDIC CRA regulation via https://www.fdic.gov/regulations/laws/rules/2000-6500.html#fdic2000part345.41

[15] See https://www.lendingclub.com/info/statistics.action for summary data tables and to download data.

[16] These states are CA, NY, TX, FL, IL, NJ, PA, OH, GA,VA.