March 19, 2021

RE: OMB Standards for Delineating the Metropolitan and Micropolitan Statistical Area, OMB-2021-0001

To Whom it May Concern:

The National Community Reinvestment Coalition (NCRC) and the undersigned organizations oppose the Office of Management of Budget’s (OMB’s) proposed re-definition of metropolitan and micropolitan areas. Under the proposal, a metropolitan statistical area would be re-designated as a micropolitan area if it has a population of between 50,000 to 100,000 people.[1] The OMB does not offer any rationale except a vague reference to population growth. The OMB neglects that the Community Reinvestment Act (CRA), the Home Mortgage Disclosure Act (HMDA), Department of Housing and Urban Development (HUD) programs such as Section 8 vouchers[2] and other government programs use income levels in metropolitan statistical areas (MSAs) to apply fair lending regulations and provide public subsidies to traditionally underserved communities in MSAs. This proposal would result in a substantial loss for undeserved and under-invested communities that benefit from programs and laws established to rectify past discrimination and continued under-investment. This change is detrimental in any circumstance but particularly counterproductive as the nation recovers from the pandemic.

The undersigned organizations work daily to increase capital and credit to communities of color and low- and moderate-income neighborhoods. Our organizations range from housing counseling agencies, nonprofit developers, small business technical assistance providers to advocacy organizations. We depend on CRA, data disclosure law, fair lending laws and federal housing and community development programs that would be adversely impacted by your proposed changes to the definition of metropolitan areas. Accordingly, we ask the OMB to refrain from making this change and coordinate any contemplated changes of this nature with the federal bank agencies that are undertaking CRA reform efforts and with the Consumer Financial Protection Bureau that has jurisdiction over the regulations implementing HMDA.

The OMB definitional change would impact 144 MSAs. These impacted areas include a total population of more than two million people. This is a wide-ranging change across the country affecting the revitalization prospects of neighborhoods, impacting the quality of life and economic prospects of a significant number of people. The OMB proposal cannot proceed with this proposal because its current analysis completely overlooks the profound economic impacts of the proposed change.

Census tracts would lose designation as CRA eligible low- and moderate-income tracts, leading to declines in residential lending

A CRA impact that the OMB proposal does not consider is how census tract income levels would be changed in both the impacted areas and the non-metropolitan areas in those states as a result of designating smaller metropolitan areas as micropolitan areas. The CRA eligibility of a census tract is determined by comparing the tract’s median income level with the median income level in a metropolitan statistical area (MSA) or the statewide non-metropolitan level. Low- and moderate-income (LMI) levels are defined as up to 80% of area median income levels.[3]

When the impacted areas are redesignated as micropolitan statistical areas, the non-metropolitan median family income for the entire state will be recalculated. The impacted areas tend to have higher median income levels than the non-metropolitan area in the state. When the impacted areas are added to that calculation, often, the non-metropolitan median family income for the state will be lower than the previous income levels used to calculate CRA eligibility for census tracts in the impacted areas. The result, in a number of cases, is that tracts that were LMI and eligible for CRA-related loans, investments or bank services are no longer eligible for these activities. The relatively small numbers of rural tracts that gain CRA eligibility do not offset the loss to existing census tracts in the impacted areas.

Under the OMB’s proposal, NCRC estimates that 498 census tracts would no longer be considered LMI and would lose CRA eligibility, as further detailed below in the appendix. In contrast, there would be a gain of only 83 tracts as CRA eligible. Since a considerably higher number of tracts would lose CRA eligibility, the net impact of a change in a technical definition of MSAs would be the loss of considerable numbers of CRA retail loans and investments across the country. Previously, Federal Reserve economists estimated that these types of definitional changes could result in 10% to 20% less retail lending in tracts that were formerly classified as LMI.[4] Applying this estimate to home and small business lending, NCRC estimates that the OMB’s proposed changes would lead to a loss of between $3.6 billion to $7.2 billion in retail lending over five years (see appendix below for more details). The losses occur across the country but are particularly severe in states with precarious economic conditions including Michigan, Georgia, Alabama, Mississippi, South Carolina and Kentucky.

While there are modest gains in some rural counties and in a few micropolitan areas, these gains could be rendered moot depending on the outcome of CRA regulatory reform efforts currently undertaken by the Federal Reserve Board, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC). The agencies are considering the designation of additional underserved or distressed census tracts as CRA eligible, which may number considerably more than the tracts that would benefit from the OMB’s re-definition of smaller metropolitan areas. Therefore, the most effective and efficient course of action would be for the OMB to coordinate its regulatory activities with those of the federal bank agencies so that the total impacts can be more accurately determined in advance.

The proposed change would reduce the number of HMDA reporting banks, making CRA and fair lending enforcement difficult

In addition, the OMB definitional change would interfere with HMDA’s statutory mandate to hold lenders accountable for serving community credit needs in a non-discriminatory manner. HMDA requires banks with at least one branch in an MSA to report data, provided that the banks also meet lending level thresholds.[5] By re-defining smaller MSAs to be micropolitan areas, the proposed OMB change would exempt 99 banks from reporting HMDA data. These banks, on average, report 191 applications and/or loan purchases on an annual level. This is a high level of lending activity that needs scrutiny by concerned members of the public and regulatory officials. Members of the public would be unable to access the loan data if this change is implemented. At the same time, examiners of federal or state agencies conducting fair lending and CRA exams would need to access the banks’ internal loan data in the absence of HMDA data, a step that is more burdensome, less efficient and less effective for both the examiners and the banks.

Deleterious impacts on eligibility on housing and transportation and economic development projects

The CRA lending and investment activity of banks in LMI census tracts are often complemented by public sector programs receiving federal subsidies. These federal programs usually provide regular subsidies to areas designated as MSAs. Funding that could be lost include millions of dollars of transportation and transit funding,[6] community development block grants and subsidies for economic development.[7] In addition, metropolitan planning organizations (MPO) used by smaller MSAs would experience decreases in important funding should these areas lose their MSA status.[8] MPOs conduct careful cross-county planning for major transportation and other infrastructure projects. Critical data sources could also be lost to these smaller MSAs, including those that consider employment and workforce trends such as the Current Employment Statistics (CES) program.[9] The data and funding sources that could be lost to smaller MSAs are important complements to the CRA financing of banks and help increase the effectiveness of the CRA activity.

Conclusion: the OMB has not estimated the impacts of its proposed changes

It is clear that the OMB has not estimated the economic impacts of its proposed changes in the designation of smaller MSAs as micropolitan areas. These changes would likely reduce CRA-related financing of banks in these areas by significant amounts. Compounding these adverse impacts is the deletion of HMDA reporting responsibilities of almost 100 banks, meaning that they would likely decrease their lending by ceasing to be publicly accountable as HMDA reporters. Their lending data would no longer be publicly available for scrutiny by stakeholders to determine if these lenders are meeting their reinvestment and fair lending responsibilities under the law. Furthermore, vital public subsidies offered by federal transportation and community development programs and data collection efforts would no longer be available to the smaller MSAs, hindering their ability to bolster the CRA efforts of their banks. The total impact is a weakening of economic rebuilding efforts, just as our country is recovering from a pandemic and attempting to address racial inequities exacerbated by the pandemic.

Thank you for the opportunity to comment on this important matter. If you have any questions, please feel free to ask Josh Silver, Senior Advisor at jsilver@ncrc.org or myself at jvantol@ncrc.org.

Sincerely,

Jesse Van Tol

CEO

The following undersigned organizations support the views expressed in this letter

National Organizations

Americans for Financial Reform Education Fund

Center for Responsible Lending

Consumer Action

Main Street Alliance

NACEDA

National Association of American Veterans, Inc.

National NeighborWorks Association

State Organizations

Alabama

ACHR

Black Legacy Advancement Coalition

Fair Housing Center of Northern Alabama

California

Adon Business Concepts

California Coalition for Rural Housing

California Housing Partnership

People’s Self-Help Housing

Sister to Sister 2, Inc dba Serenity House

The Greenlining Institute

Vermont Slauson EDC

Delaware

Delaware Community Reinvestment Action Council, Inc.

Florida

Affordable Homeownership Foundation

Goldenrule Housing & Community Development Corporation

Metro North Community Development Corp

Georgia

Georgia Advancing Communities Together, Inc.

Illinois

Chicago Community Loan Fund

Housing Choice Partners

Universal Housing Solutions CDC

Woodstock Institute

Indiana

HomesteadCS

Northwest Indiana Reinvestment Alliance

Prosperity Indiana

Kentucky

River City Housing, Inc.

Louisana

Jane Place Neighborhood Sustainability Initiative

Maryland

Housing Options & Planning Enterprises, Inc.

Michigan

Black Legacy Advancement Coalition

Fair Housing Center of Metropolitan Detroit

GenesisHOPE

Minnesota

MICAH- Metropolitan Interfaith Council on Affordable Housing

Missouri

Credit & Homeownership Empowerment Services, Inc.

Metropolitan St. Louis Equal Housing and Opportunity Council

Old North St. Louis Restoration Group

New Jersey

New Jersey Citizen Action

Urban League of Essex County

New York

Empire Justice Center

Fair Finance Watch

North Carolina

Community Link Programs of Travelers Aid Society of Central Carolinas Inc

Ohio

Empowering and Strengthening Ohio’s People (ESOP)

Homes on the Hill, CDC

Oregon

CASA of Oregon

Housing Oregon

Pennsylvania

Affordable Housing Centers of Pennsylvania

Ceiba

Chester Community Improvement Project

Community Design Collaborative

Texas

Southern Dallas Progress Community Development Corporation

TCH Development, Inc

Virginia

Greater Charlottesville Habitat for Humanity

Washington

Beacon Development Group

Low Income Housing Institute

Wisconsin

Metropolitan Milwaukee Fair Housing Council

West Virginia

CommunityWorks in West Virginia

Appendix: Impact of Proposed Changes by the OMB to Micropolitan Designation of Towns

Key Findings

- All fifty states and territories are impacted by the proposed reclassification, with a total impacted population of nearly 2.2 million people in the MSAs that would be classified as micropolitan areas.

- 4,489 census tracts, or 5.9% of all tracts nationally, are in the MSAs re-classified as micropolitan areas.

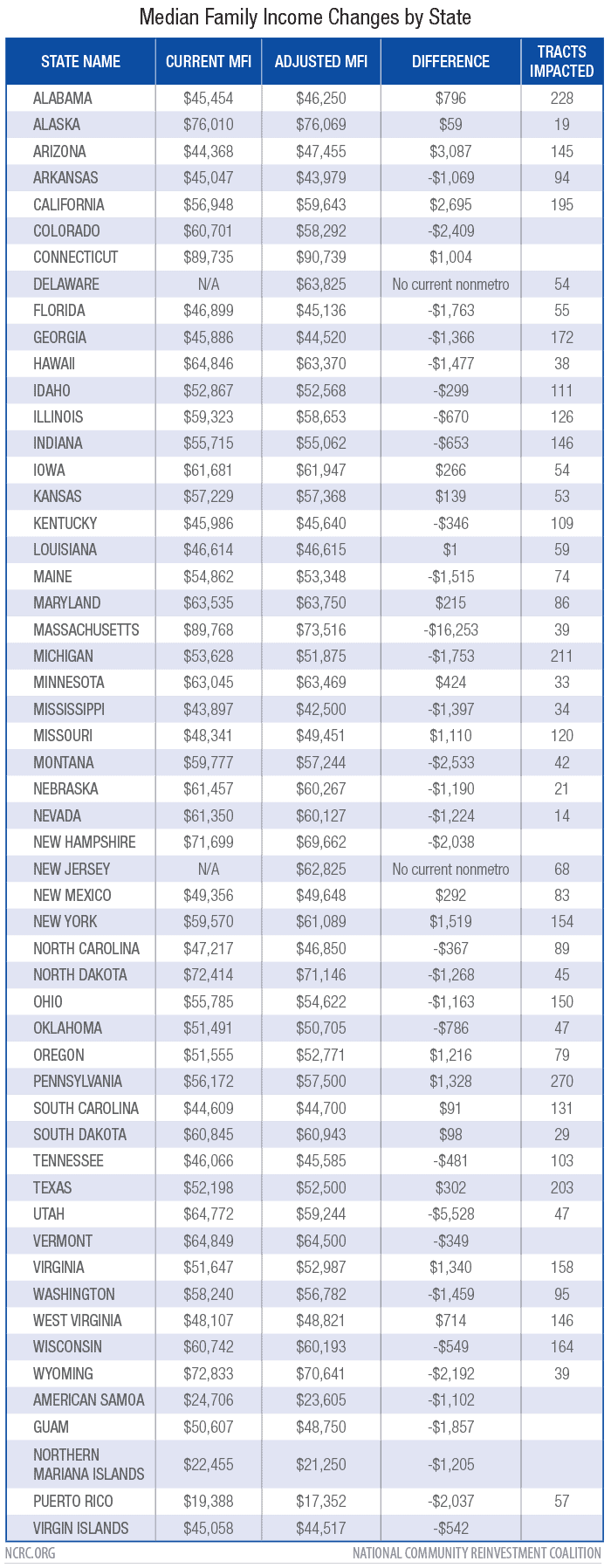

- Results in changes to the statewide median family income ranging from a decrease of $16,252 in Massachusetts to an increase of $3,087 in Arizona.

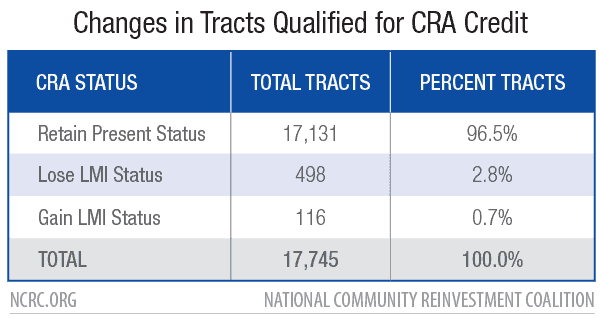

- CRA qualifications of 498 census tracts are lost. The gain of qualifications in 116 census tracts is lessened, however, when CRA-defined underserved or distressed non-metropolitan middle-income tracts are accounted for in the analysis. In total, there is a net gain of CRA qualified tracts of only 83. Overall, there is a net loss of 415 CRA qualified tracts.

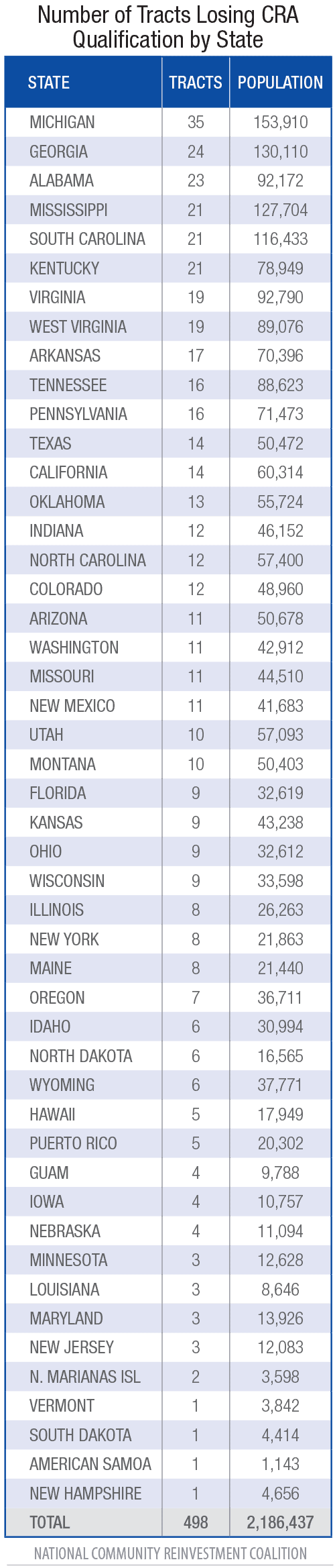

- Most impacted are the states of Michigan, Georgia, Alabama, Mississippi, South Carolina, and Kentucky, each with over 20 tracts, and a population of nearly 700,000 living in those tracts.

- 99 banks would no longer report HMDA data, making it difficult for the public and for regulators to monitor their CRA and fair lending records.

Introduction

On January 19, 2021, a notice and request for comment, docket OMB-2021-0001, was posted relating to a proposed change by the Metropolitan and Micropolitan Review Committee to the Office of Management and Budget. The change would impact the definitions of metropolitan and micropolitan statistical areas, increasing the population size threshold of metropolitan statistical areas from 50,000 up to 100,000. Current metropolitan statistical areas with populations between 50,000 and 99,999 would change to micropolitan statistical areas. This proposal is estimated to impact the classification of 144 currently designated metropolitan areas.

The rationale for this change is that the current standards were established with the 1950 decennial census. However, the OMB offers little justification for this change, other than noting a population increase in the country. Additionally, the proposal states:

Metropolitan and Micropolitan Statistical Areas are not designed as a general-purpose geographic framework for nonstatistical activities or for use in program funding formulas. The CBSA classification is not an urban-rural classification; Metropolitan and Micropolitan Statistical Areas and many counties outside CBSAs contain both urban and rural populations.

This disregards the fact that the metropolitan statistical areas are used by agencies, specifically The Department of Housing and Urban Development (HUD)[10] and the Federal Financial Institutions Examination Council (FFIEC),[11] in order to establish median family income thresholds in programs. The FFIEC relies upon HUD median family income thresholds to define census tracts that qualify as LMI under the Community Reinvestment Act (CRA). The median family income calculations are made at the metropolitan statistical area and statewide non-metropolitan levels. Thus, the proposed change will impact the qualification of census tracts under the CRA.

Under the CRA income definitions, a low-income tract in a metropolitan area has a median income that is up to 50% of the median for a metropolitan statistical area, and a moderate-income tract has a median income that is between 50% and 80% of that of a metropolitan statistical area. If a tract is in a rural county, the comparator used is the median statewide non-metropolitan income level to determine if a tract is low- or moderate-income.

Methodology

In order to assess the impact of the proposal, we conducted a nationwide analysis involving the recalculation of state-level median family income. We used the FFIEC 2020 census data as the basis for the recalculation.[12] First, we used the list of 144 metropolitan statistical areas likely to change their classification to identify all census tracts within their boundaries. This includes 4,489 census tracts, or 5.9% of all tracts nationally. These tracts were combined with the existing non-metropolitan tracts within each state and territory, increasing that count to 18,056. Once this set of impacted census tracts was established, we recalculated statewide non-metropolitan median family income using the FFIEC 2020 census tract level median family income. This resulted in changes to the statewide median family income ranging from a decrease of $16,252 in Massachusetts to an increase of $3,087 in Arizona (Table 1).

Table 1. Median family income for non-metropolitan areas of states with current and adjusted levels which include metropolitan statistical areas that are changed to non-metropolitan areas, with the numbers of census tracts impacted. (Source: Author’s calculation based on FFIEC 2020 Census flat file)

Next, we examined the impact of the new median family income thresholds on the set of census tracts qualified as LMI under the CRA. Table 2 shows the result, with a loss of the CRA qualifications for 498 census tracts, and the gain of qualifications in 116 census tracts. However, if the qualification of rural middle-income census tracts as distressed or underserved is considered, only 83 census tracts would be newly CRA qualified if the proposed reclassification of metropolitan statistical areas were to take place.[13] Overall, the OMB definitional change would result in a substantial loss of CRA-qualified tracts nationally.

Table 2. Changes in CRA qualification status with new nonmetropolitan state median family income applied. LMI tracts are low- to moderate-income and are qualified for credit under CRA. MUI tracts are middle- to-upper income tracts and are not qualified for CRA credit, unless a middle-income tract meets requirements as distressed or underserved. (Source: Author’s calculation based on FFIEC 2020 Census flat file)

Numbers of Census Tracts Losing CRA Eligibility as LMI Tracts

To better understand the impact on states, the tracts and their residents projected to lose their CRA qualifications were analyzed (Table 3). All fifty states and territories are impacted by the proposed reclassification, with a total impacted population of nearly 2.2 million people. Most impacted are the states of Michigan, Georgia, Alabama, Mississippi, South Carolina, and Kentucky each with over 20 tracts, and a population of nearly 700,000 living in those tracts.

Table 3. Changes in census tract CRA low- to moderate-income (LMI) classifications based on projected median family income changes at the state-level. (Source: Author’s calculation of new state-level median family income levels based on FFIEC 2020 Census flat file)

In this map, we show the counties that contain census tracts that will either gain or lose LMI status. Here we have excluded tracts that are considered underserved or distressed and qualify for CRA credit regardless of their LMI status. The color-coding indicates the midpoint of the range of the dollar amounts of loans that each county is expected to gain or lose over the next five years.

In the chart here, we focus on the effect of this change on the impacted MSAs, again showing the range of dollar amounts in retail lending lost based on a study from the Philadelphia Federal Reserve Bank, which estimates that census tracts that lose CRA eligibility experience a 10%-20% decline in retail lending.[14] This is not intended to be a figure with pinpoint accuracy, but represents the range of expected outcomes that could be experienced in these areas. Some caveats to bear in mind are that the Federal Reserve study examined the impact on home lending due to changes in CRA eligibility of census tracts in just one MSA while we are assuming the impacts occur across the country in both home and small business lending. We have also assumed that tracts which gain LMI status will see an increase in lending. Given that most of these tracts are in remote, rural areas this is likely to impact any benefit they might see from becoming LMI.

In this more detailed table, we look at the possible losses per MSA, and include the net number of tracts that we believe will gain or lose CRA eligibility, the population of those census tracts, and the estimated small business and mortgage lending losses those places might experience.

Banks Ceasing to be HMDA data reporters

Using the June 2020 FDIC branch location file, NCRC also reviewed the impacted areas to see which banks have branches located solely in these MSAs and cross-referenced them with HMDA data based on their Federal Reserve RSSD number. This is not a perfect methodology: credit unions are excluded from this data, and banks that report HMDA data via an affiliate of which we do not have knowledge might be missing. Under HMDA reporting rules, a bank ceases to report if it does not have a branch in a metropolitan area. Thus, banks would not report in cases in which they only have branches in metropolitan areas that were re-classified as micropolitan areas.

Within those limitations, we have identified 99 banks that appear to both report HMDA data and have branches located solely in the impacted areas. Combined, in 2018 and 2019, those banks reported a total of 64,510 Loan Application Registers (LAR). Just one of these banks, Magnolia Bank of Magnolia, Kentucky, reported a substantial number of LAR with 28,672. The rest of the lenders in this dataset averaged 191 LAR. Eighty-one of these banks reported more than 100 LAR records; 22 reported between 500 and 1,000 LAR records; 35 reported between 200 and 500 LAR records.

These numbers represent a significant level of lending activity including applications, denials, originations and purchases of loans. In a decision NCRC opposed, the Consumer Financial Protection Bureau (CFPB) eliminated HMDA reporting for lenders with 100 or fewer originations (NCRC argued that the previous threshold of 25 loans appropriately achieved the objectives of cost reduction without interfering with HMDA’s statutory mandate requiring disclosure of data on lending activity).[15] Nevertheless, the agency regarded lenders above this threshold as significant lenders. It would appear that a good number of the lenders that would be exempted due to the OMB definitional change would meet the CFPB classification as significant lenders.

Fair lending and CRA reviews of banks with high numbers of applications, originations and purchases of loans would become exceedingly more difficult to undertake. Members of the public could not examine HMDA data of these banks. Examiners of the federal agencies could not do an initial analysis of HMDA data but would need to gather the banks’ internal loan files, which is less efficient and more labor intensive for both the examiners and the banks. The OMB definitional change would interfere with HMDA’s statutory mandate to hold lenders accountable for serving community credit needs in a non-discriminatory manner.

[1] Recommendations from the Metropolitan and Micropolitan Statistical Area Standards Review Committee to the Office of Management and Budget: Changes to the 2010 Standards for Delineating Metropolitan and Micropolitan Statistical Areas, posted by the Office of Management and Budget on Jan 19, 2021, https://www.regulations.gov/document?D=OMB-2021-0001-0001

[2] For more on how HUD determines income limits, see https://www.huduser.gov/portal/elist/2020-April-14.html

[3] See the CRA regulation, § 345.12 Definitions (m) Income level, https://www.fdic.gov/regulations/laws/rules/2000-6500.html#fdic2000part345.12.

[4] Lei Ding and Leonard Nakamura, Don’t Know What You Got Till It’s Gone: The Effects of the Community Reinvestment Act (CRA) on Mortgage Lending in the Philadelphia Market, Working Paper No. 17-15, June 19, 2017, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2991557

[5] Consumer Financial Protection Bureau, HMDA Institutional Coverage, https://files.consumerfinance.gov/f/documents/cfpb_2020-hmda-institutional-coverage.pdf

[6] Comment submitted to the OMB, https://www.regulations.gov/comment/OMB-2021-0001-0016

[7] Comment submitted to the OMB, by the Texarkana USA Regional Chamber of Commerce, https://www.regulations.gov/comment/OMB-2021-0001-0052

[8] Comment submitted to the OMB by the Hinesville Area Metropolitan Planning Organization, https://www.regulations.gov/comment/OMB-2021-0001-0038

[9] Comment submitted to the OMB submitted by Wyoming Department of Workforce Services, https://www.regulations.gov/comment/OMB-2021-0001-0056

[10] U. S. Department of Housing and Urban Development, Estimated Median Family Incomes for Fiscal Year (FY) 2020, Notice PDR-2020-01, https://www.huduser.gov/portal/datasets/il/il20/Medians2020r.pdf

[11] Federal Financial Institutions Examination Council, FFIEC Median Family Income Report, https://www.ffiec.gov/Medianincome.htm

[12] Federal Financial Institutions Examination Council, FFIEC Census Windows Application, https://www.ffiec.gov/censusapp.htm

[13] For background on how distressed and underserved tracts are defined for CRA purposes, see https://www.ffiec.gov/cra/distressed.htm. Some of the rural tracts gaining CRA eligibility under the OMB’s proposal were already CRA-qualified since they were considered distressed or undeserved.

[14] Lei Ding and Leonard Nakamura, op. cit.

[15] Consumer Financial Protection Bureau, Executive Summary of the 2020 Home Mortgage Disclosure Act (Regulation C) Final Rule, April 2020, https://files.consumerfinance.gov/f/documents/cfpb_hmda_executive-summary_2020-04.pdf