November 8, 2018

Reforming the Community Reinvestment Act Regulatory Framework

Docket ID OCC-2018-0008

To Whom it May Concern:

The National Community Reinvestment Coalition (NCRC) maintains that the Community Reinvestment Act (CRA or Act) has been one of the most valuable laws for increasing access to capital and credit for low- and moderate-income (LMI) communities. NCRC and our 600 community-based member organizations frequently comment on CRA exams and merger applications because the process of public input is key to directing banks and federal agencies to addressing unmet needs in LMI communities and communities of color. Federal Reserve Governor Brainard and former FDIC Chairman Martin Gruenberg have recently remarked on the critical role of community input and stakeholder collaboration encouraged by locally-based CRA exams.[1]

Any CRA reform effort needs to tread carefully and build upon CRA’s success in order to ensure that the progress in reinvestment continues. The genius of CRA’s law is democratic input and accountability on a local level. When Congress enacted CRA in 1977, it sought to remediate redlining and other market failures that impeded lending and investing in LMI communities and communities of color. As envisioned by the CRA, the antidote to redlining was CRA exams scrutinizing lending on a state and local level.

The Office of the Comptroller of the Currency’s (OCC’s) proposed reforms and concepts would impede the effectiveness of public input by diminishing the importance of evaluations of bank records of meeting needs in local areas. The direction in which OCC seems to be going is contrary to the foundational goals and requirements of the CRA.

CRA needs an update, not an overhaul that removes the emphasis on rating and evaluating performance on a local level. CRA has been enormously successful in motivating banks to increase their lending, investing, and services in LMI communities, but the full potential of CRA has not been realized due to growing gaps in CRA’s coverage.

NCRC believes that addressing these gaps include the following:

- The geographical areas on CRA exams called assessment areas need to be updated to include areas with substantial amounts of lending and other business activity in addition to areas with bank branches.

- Banks now have the option of including affiliates on CRA exams, instead of affiliates being automatically covered. This treatment results in significant amounts of lending not being scrutinized by CRA exams.

- A third gap in CRA coverage is the lack of evaluation of lending to communities of color, although the CRA hearings in 1977 leading up to the passage of CRA featured extensive testimony and concern about the lack of lending in communities of color.

- Other needed reforms to address gaps and imperfections in the CRA regulations include reforms to the ratings, improvements in consistency and benchmarks, improved data, and consideration of community benefits agreements on merger applications and CRA exams.

The challenge and opportunity in CRA reform is successfully addressing the gaps in CRA coverage while not disturbing the core mechanisms of public input, transparency, and local accountability. The OCC’s proposals would significantly erode these core mechanisms of CRA. In particular:

- The OCC suggests interpreting the statutory reference to “community” in a far more expansive way that would include within the scope of “CRA-qualifying activities” credit for more aggregated activities without an examination of local credit needs (“non-local”) and for more activities not focused LMI borrowers and communities (“non-LMI”).

- The OCC then suggests determining a bank’s CRA rating based on one ratio composed of an inflated numerator capturing a redefined “community” with far more non-local and non-LMI activities that will, by definition, reduce a bank’s accountability for performance at the neighborhood level and mute differences in performance across local areas.

OCC Redefinition of Community Contravenes Language of CRA Statute

The OCC contemplates a redefinition of “community” that contravenes the plain language of the CRA and the Congressional intent to combat redlining.

At the root of the agency’s “transformational approach to the CRA regulatory framework” are assertions and questions about the agency’s longstanding interpretation of “community” and how the existing regulatory framework implements the law’s references to it.[2] “Community” is currently implemented through an assessment area framework – with banks delineating assessment areas within their branch and deposit-taking ATM footprint. Examiners then evaluate banks’ performance and assign one of four ratings to their record of meeting various credit needs – lending for all banks, and community development/investment and services for others as well.

Regardless of a bank’s structure and scope, local community assessments must occur

The concept of a local community evaluation is connected repeatedly to mandatory sections of the law regarding the scope of agency assessments. The neighborhood focus is required in each of the geographic areas of a bank’s footprint. Aggregation is certainly not expressed, nor is it implied. To the contrary, the language drives toward assessments in localities by use of the word “community” and the inclusion of “neighborhoods” in the context of “entire communities.” “Separate written evaluation[s]” within states and multistate metropolitan areas are “required” pursuant to sections a, b and c (See 12 USC 2906(d) (1) and (2)). Sections 2903 and 2906 mandate community and neighborhood assessments. The Congressional lens was focused on bank activity in small geographical areas.

The structure of the Act precludes the use of aggregating CRA qualifying activities in a manner that would diminish the local analyses

The only exception to the local community assessment contemplated by the act is set forth in

12 USC 2902(4) which states:

- (4) A financial institution whose business predominantly consists of serving the needs of military personnel who are not located within a defined geographic area may define its “entire community” to include its entire deposit customer base without regard to geographic proximity.

Thus, geographic proximity is required in all other instances of the “entire community” as used in the Community Reinvestment Act pursuant to the legal principle of Expresio unius est exclusio alterus (to express or include one thing implies the exclusion of another).[3] In the case of the CRA, the law taken as a whole reveals Congressional intent to focus on the local community as the subject of the mandatory assessment of meeting the needs of LMI neighborhoods.

The local focus also hews most closely to Congressional intent – to ferret out and remediate bank redlining of specific neighborhoods

U.S. Senator William Proxmire, the principal author of the Act, made clear a key purpose of the law was “to eliminate the practice of redlining by lending institutions.”[4] He described redlining as the actual or figurative drawing of a red line on a map around the areas of a city, sometimes in the inner city, sometimes in the older neighborhoods, sometimes ethnic and sometimes black, but often encompassing a great area of their neighborhood.

- The data provided by that act (HMDA) remove any doubt that redlining indeed exists, that many credit-worthy areas are denied loans. This denial of credit, while it is certainly not the sole cause of our urban problems, undoubtedly aggravates urban decline.[5]

Any reform that results in exams that do not carefully scrutinize access to credit in underserved neighborhoods across local communities circumvents the clear intention of Congress to evaluate and rectify the redlining of communities. The CRA requires each of the regulators “to use its authority when examining financial institutions, to encourage such institutions to help meet the credit needs of the local communities in which they are chartered…” The statute goes on to define exactly how regulators are to use their authority consistent with CRA, including to: “assess the institution’s record,” “prepare a written evaluation,” state the “agency’s conclusions,” “discuss the facts and data supporting such conclusions,” and assign a rating with “a statement describing the basis for the rating.”

The statute and the law’s drafters contemplated that regulators would evaluate and discuss why they concluded that the bank was doing more than meeting their charter obligations in bank law “to demonstrate their deposit facilities serve the convenience and needs of the communities in which they are chartered to do business.” CRA was enacted to require regulators to come to a conclusion about and rate whether the bank is “meeting the credit needs of its entire community, including low- and moderate-income neighborhoods.” In other words, the regulators must determine that the bank is not redlining neighborhoods in the communities they are serving, plain and simple, and that they are making affirmative and ongoing efforts to help meet the credit needs of LMI neighborhoods. And, deeming bank activities as CRA-qualifying “in the aggregate, at the bank level” would not allow them to reach a conclusion on whether that is occurring based on any facts and data.

Based on this analysis, it would be improper to define “community” to include aggregated, non-local activities or include them in a metric-driven, one-ratio or other approach to banks’ core CRA rating.

Agency and industry proposals to diminish CRA examination and focus on LMI communities and people would dilute CRA’s effect and undermine its purpose

A major theme in the advocacy to broaden CRA in a manner that is contradictory to the goals of the law is to include more non-LMI activities or general community building activities that benefit middle- and even upper-income communities, but may have some marginal benefit for LMI communities. This theme is inconsistent with the purpose of the Act or the economic rationales behind it.

Clearly, redlining motivated CRA’s passage, but also the concern about high capital export from local communities where banks were taking deposits. The law is designed to give banks an incentive to look for lending and investing opportunities in their local markets and to overcome the “market failures” that limited lending and investing in LMI areas. Banks were bypassing profitable lending opportunities locally in favor of far off investments, to the detriment of local housing, small business, and small farm credit needs. Senator Proxmire cited that newspapers in New York City had an elaborate series of stories on the amount of disinvestment in the City, pointing out that only 11 percent of the money deposited in Brooklyn remained in the borough. In the District of Columbia, researchers found that about 90 percent of the deposits are loaned and invested outside of the community. Chicago, Los Angeles, and St. Louis also experienced this high degree of deposit flight.[6]

A 2000 baseline report on CRA by the U.S. Treasury Department captured the Congressional thinking around capital export and local revitalization efforts:

- Congress intended the CRA to increase credit access and revitalize inner-city communities that were deteriorating with the movement of investment and development elsewhere. In addition, Congress recognized that the success of federal community development, housing assistance and mortgage insurance programs enacted at the same time as the CRA…would depend in large part upon the availability of private capital, particularly as made available through local financial institutions.[7]

The CRA was designed to strengthen these public economic development efforts by facilitating “efforts between private investments and federal grants and insurance in order to increase the viability of our urban communities.”[8]

Importantly, the law requires the regulators to examine whether banks are overcoming the market failures and informational externalities associated with the lack of investment in LMI communities.

CRA’s regulatory framework must be targeted to and focused on LMI borrowers and communities to correct for market failures and externalities

The U.S. Treasury explains well the positive, negative, and related informational externalities that exist when banks, which decide where to lend and invest, do not bear the full costs nor reap the full benefits of their actions. As Treasury states:

- There are significant positive externalities, for example, associated with lending in areas where there are frequent numbers of transactions, such as middle-class or relatively affluent neighborhoods. These transactions produce a steady stream of information about market values for other lenders (and appraisers) to consider when making their credit decisions. A larger number of transactions increases confidence in the appraised value of individual properties, and increases the liquidity of other investments in the neighborhood, thus improving the values of properties that serve as collateral for mortgages. This process lowers lenders’ transactions costs, thereby lowering the cost of credit for all borrowers in the area.

- The reverse is true for neighborhoods where there are relatively few transactions. In particular, to the extent that lenders do conduct appraisals in LMI neighborhoods, these appraisals can be more costly and less accurate because “comparable” transactions and appraisers familiar with such neighborhoods are not available. Loans in these areas are therefore riskier, and lenders will compensate by charging higher rates of interest or requiring larger down payments. The stiffer terms on such loans can cause some borrowers either to borrow less or to drop out of the market altogether. For LMI neighborhoods, the end result can be a downward spiral – less lending, fewer appraisals, even less lending, and so forth – producing an effect that resembles redlining.[9]

Being the first institution to enter a new or previously underserved market or investing in an innovative but high-impact LMI project, when other lenders are unwilling to lend, present related informational externalities and can result in delays and perceived risk. Lender expectations of this sort can cause a potentially viable market to suffocate from lack of credit. In the process, borrowers who may otherwise be credit-worthy will be denied credit because of the absence of entry by competitive lenders.

- Therefore, the CRA can be understood as a vehicle for facilitating coordination and for assuring banks that they will not be the lone participants in thinly-traded markets…the Act can produce positive information externalities and allow all lenders – both those covered by the CRA and those not covered by the CRA – to better assess and price for risk.[10]

Congress recognized these market failures and externalities. Accordingly, CRA requires regulators to examine the data and assess whether banks are, in fact, overcoming these failures in a “continuing and affirmative” way. Since the law was enacted, banks have made good strides to doing just that. They have taken numerous steps, including entering loan pooling arrangements, undertaking lending consortiums, partnering with local groups, community development corporations, community development financial institutions (CDFIs) and others to break down the barriers that impede the efficient flow of capital into LMI communities.

The CRA was designed and the existing regulatory framework to-date has executed the law in a way to overcome redlining and other market failures. Regulators must not deviate from these important policy goals, but could strengthen their focus on and targeting to LMI communities in banks physical and digital footprint.

Research Supports Updating Current CRA Regulations, Not Transforming Them

Evidence supports the effectiveness of the current regulatory approach (Questions 1-6 of the ANPR). A large body of research has demonstrated overwhelmingly that CRA has leveraged significant increases in lending and reinvestment in LMI communities. Recently, Lei Ding and colleagues at the Philadelphia Federal Reserve Bank concluded that when census tracts lose CRA eligibility, the number of home purchase loans decreases between 10 to 20 percent.[11] Similarly, Raphael Bostic, President of the Federal Reserve Bank of Atlanta, and colleagues show that CRA increases small business lending in CRA-eligible census tracts compared to tracts with income levels just over the CRA-income thresholds.[12] In addition, a number of Federal Reserve studies show that CRA eligible home mortgage lending was significantly safer and sounder than high cost lending with high default rates issued by independent mortgage companies in the years preceding the financial crisis.[13]

The existing assessment area framework increases safe and sound lending and investing in LMI areas

Studies have concluded that the CRA assessment areas described in the regulation increase lending. In commemoration of the 25th anniversary of CRA in 2002, the Joint Center for Housing Studies at Harvard University conducted a major research study on CRA, finding that banks make a higher percentage of their home purchase loans to LMI borrowers and census tracts in their assessment areas than outside of their assessment areas from 1993 through 2000. In addition, rejection rates for LMI applications were 8 percentage points lower in assessment areas than outside assessment areas.[14]According to Harvard, the positive impact of assessment areas on lending was the equivalent to a 1.3 percentage point reduction in unemployment. In other words, CRA scrutiny of lending in assessment areas was equivalent to a significant nationwide reduction in unemployment in terms of increasing lending to LMI people and communities.[15]

Likewise, Federal Reserve economist Daniel Ringo examined the impacts of changes in the boundaries of metropolitan areas on assessment area lending. In 2003, the Office of Management of Budget changed metropolitan area boundaries for a number of metropolitan areas in the United States, causing a significant number of census tracts to be either deleted or added to bank assessment areas. In the newly added LMI census tracts to bank assessment areas, Ringo found that lending by even a single bank increased overall lending in one LMI census tract by two to four percent from 2003 to 2004. Also, bank lending increased further over time as banks intensified their efforts in these new assessment area tracts. Moreover, Ringo found that the impact was greatest for low-income borrowers, those with less than 50 percent of area median income, than for moderate-income borrowers, those with between 50 to 80 percent of area median income. He hypothesizes that banks face less competition in extending loans to low-income borrowers than to moderate-income borrowers, so efforts to increase lending to these customers–prompted by the addition of census tracts to banks’ assessment areas–were more effective at filling unmet demand.[16]

Research suggests losses of local lending and investing without transparency and scrutiny by regulators and the public

In one of the few studies to measure community development (CD) lending and investing, NCRC finds that intermediate small banks (ISB) issue an annual level of CD lending and investing of $3 billion, which about equals that of the Department of Housing and Urban Development’s (HUD’s) Community Development Block Grant program. Moreover, the levels of CD finance issued by ISB’s with Outstanding, Satisfactory, and the failed ratings are statistically significantly different, suggesting that ratings are effectively differentiating among differences in performance and thus likely motivating improvements in performance.[17]

The positive outcomes documented by this study are driven by the public accountability mechanisms of CRA. CRA is a powerful motivator for banks to increase lending because a bank’s performance in LMI communities in its assessment areas is evaluated and rated in a transparent manner subject to public comment.

Extrapolating Ding’s estimates of losses in home mortgage lending of 10 to 20 percent due to a removal of CRA scrutiny, NCRC estimates that the loss nationally in home mortgage lending would be of a magnitude of $44 to $89 billion over five years. Bostic’s research suggests that a large loss would also occur in small business lending, which NCRC’s estimates to be between $8 and $16 billion. The total loss in home and small business lending over a five year time period would range from $52 to $105 billion. Moreover, the losses would be dramatic on a state and Congressional district level as documented in NCRC’s recent study.[18] In sum, eliminating the local evaluation of CRA lending in assessment areas would significantly reduce CRA lending over several years. The impact would be lasting and severe.

Updating Geographic Scope of CRA Assessment Areas: Bank Branches and Digital/Business Footprint

Because of the effectiveness of assessment areas, the current procedure of delineating assessment areas for geographical areas containing bank branches must be retained. In order to rigorously evaluate non-traditional banks that make loans via non-branch means, assessment areas also must be established for areas in which these banks make a considerable number of loans and/or engage in a significant amount of business activity.

Most bank lending is still conducted in assessment areas. Research by Federal Reserve economist Neil Bhutta finds that assessment areas captures about 70 percent of home purchase lending for large banks.[19] Likewise, in examining the 100 largest banks, NCRC found that assessment areas captured a great majority of their lending (91 percent of their home and small business lending).[20]NCRC’s report relied upon the percentage of loans in assessment areas reported by CRA exams, which do not consider lending by affiliates when calculating the portion of loans in an assessment area.[21] Therefore while NCRC’s percentage might be an over-estimate, it is consistent with Bhutta’s finding that for the largest banks, current assessment area procedures capture the great majority of their lending.

Since the current procedures capture the majority of traditional bank lending, reforms should adopt an additive approach instead of implementing wholesale changes. In particular, reforms should focus on non-traditional banks that are making large volumes of loans using non-branch means including brokers and the internet. For several years, NCRC has urged the agencies to update assessment area procedures to expand the number of assessment areas to account for lending beyond branches. This is a straightforward approach that retains assessment areas where branches are located and adds assessment areas to encompass geographical areas where banks lack branches but are engaged in significant lending or other business activity (see Question 13 of the ANPR which asks how to expand assessment areas). This approach does not nationalize the scope of the evaluation of banks’ CRA performance (which would result in dilution of the data) because it retains the required local focus in the new assessment areas.

Both the OTS and the OCC have examined non-branch lending by supplementing the existing assessment area framework

A number of CRA exams have adopted the NCRC approach. The former Office of Thrift Supervision (OTS) supervised several lenders without traditional branch networks. The OTS relied upon the Interagency Question and Answer (Q&A) document allowing examination of retail lending outside of assessment areas provided the retail lending inside the assessment areas has adequately responded to needs. However, good lending performance to LMI borrowers outside of the assessment areas would not compensate for poor lending performance in the assessment areas according to the Q&A.[22]

The OTS 2009 CRA exam of Citicorp, a non-traditional thrift located in Wilmington, DE that made loans through 77,000 agents located throughout the country, included analyses of 10 metropolitan areas and three non-metropolitan areas with the largest percentage of lending outside of the Wilmington assessment area.[23] Likewise the OTS examined Capital One’s lending in 20 areas beyond its one assessment area. These 20 areas comprised 25 percent of the thrift’s lending.[24]

A more recent exam of the Bank of the Internet further develops and refines procedures for considering loans outside of assessment areas.[25] Since assessment area lending in San Diego accounted for 1 percent of total lending activity, an examiner with the OCC evaluated retail lending in six states outside the San Diego assessment area.[26] Bank of the Internet’s activity in these six states accounted for 30 percent of total deposits and 56 percent of home mortgage and small business lending.[27] The retail lending in the states outside of the San Diego assessment area was factored into the rating for the lending test.[28]

NCRC illustrates how assessment areas would work for the Lending Club, an online lender (fintech) with no branches that has made loan data by geographical area available on its webpage. In Congressional testimony, NCRC calculated that more than two thirds of Lending Club’s lending during 2012 and 2013 was in 15 states, making it feasible to designate those states as assessment areas. NCRC also used Texas as a case study of designating local assessment areas.[29] NCRC found five metropolitan areas with more than 1,000 loans each and one area, North Texas that could possibly be considered a rural area. The five metropolitan areas ranged in size and location across the state and included Houston, Austin, Ft. Worth, Dallas, and San Antonio. El Paso is the seventh largest area by loan volume with more than 500 loans. Using Lending Club as an example, NCRC demonstrated that it is feasible to select assessment areas for states, metropolitan areas, and rural counties where a substantial amount of lending occurs.

Capturing the great majority of retail lending via assessment area coverage is imperative for rigorous grading.

To address CRA grade inflation, assessment area reform should ensure the vast majority of bank lending and investing is examined

NCRC has found that when the great majority of lending is not captured by assessment areas, CRA ratings are inflated. In our study of the one hundred largest banks, NCRC revealed that inflation was the largest concern when assessment areas covered less than 50 percent of retail lending but also occurred when assessment areas covered less than 75 percent of lending.[30] When exams allow banks to focus more intently on a lower percentage of their loans, it is easier to score well on the lending test. While this may benefit assessment areas containing the minority of a bank’s loans, it results in less lending overall in LMI communities as demonstrated by the Federal Reserve-sponsored studies cited above. When ratings are inflated due to inadequacies in assessment area procedures, local needs will remain unmet. An approach that elevates the one ratio and diminishes the weight assessment areas contribute to the overall CRA rating will result in local needs being ignored and unmet.

Inexplicably, the ANPR does not seem to build upon the precedent of Bank of the Internet and other exams that incorporate supplemental areas covering substantial amounts of lending executed via non-branch means. Instead, it discusses how lending, investing, or other activities outside of areas with bank branches can be considered in “the aggregate.”[31] In other words, if a bank made a $5 million investment and issued $10 million of loans to LMI borrowers outside of its branch network, the $15 million could be added to a one ratio. In contrast, if the $15 million of loans and investments occurred in one state, that state could be designated as an assessment area, and the lending and investing could be judged in the traditional manner to see how responsive it was to the needs in that state. An “aggregate” consideration of activity outside of branch networks would be inadequate and would fail to determine how responsive the activity was to local needs, as called for by the CRA.

A one ratio focused exam would also negate the recent attention the OCC has devoted to concerns that rural areas and smaller cities receive primarily “limited scope” or cursory consideration on CRA exams. The OCC stated in a bulletin issued over the summer that assessment areas could become “full scope” areas with more weight if “the bank’s activity represents a significant portion of total industry activity in an assessment area relative to deposit or loan market shares.”[32] Also, public comments about a bank’s performance in a specific assessment area can be a factor elevating the area to full scope status. These changes plus the OCC adoption of a practice of rotation of assessment areas as full scope areas provide more opportunities for often overlooked geographical areas to be full scope. However, these advances will be under-cut if the OCC subsequently diminishes the importance of assessment areas on CRA exams.

The wrong approach on Varo Bank

On August 31, the OCC granted preliminary conditional approval of Varo’s application to become a nationally chartered bank. Varo is all mobile financial technology company (fintech) with no branches and offers deposit accounts, credit cards, home equity loans, and consumer loans nationally. Varo is seeking a charter as a national bank, which will make it subject to CRA. That is distinct from fintech’s approved under the OCC’s new fintech charter, which have CRA-like financial inclusion obligations. In its application, Varo designated one assessment area, the Salt Lake City-Provo-Orem, Utah combined statistical area (CSA), where its headquarters office is located. The approval order states that the Salt Lake City CSA is the most “expansive” assessment area that can be delineated under existing CRA regulations. We disagree. Varo should be required to delineate locally-based assessment areas and be examined in areas where their lending and other business activities constitute the great majority of their lending and other activities.[33]

A Fairer Way to Consider Activities Outside of Assessment Areas

Even if the OCC were to adopt NCRC’s suggestions for expanding the number of assessment areas, banks will still seek to satisfy needs, particularly for community development lending and investment, in areas beyond their assessment areas. If a bank still sought to engage in community development financing beyond its assessment areas, objective guidelines could be developed to assess whether a bank was adequately meeting needs in its assessment area in at least a satisfactory manner (See ANPR question 14).

The guidelines could include consulting a number of quantitative measures. First, the previous CRA exams could be consulted to benchmark bank current performance in its assessment areas compared to its past levels of lending and investing. If a bank had performed in at least a Satisfactory manner on its previous exam and its current level of community development lending and investment per its deposits was the same or higher as its previous level, then it is likely on the right path towards meeting needs in its assessment area. Second, per our data recommendations below, annual community development data would be available for a bank’s peers in the bank’s assessment area. The agencies would therefore check to make sure the bank was at or above peer levels of community development financing.

As a final check, NCRC urges examiners to listen to community groups and local residents comment on whether a bank is meeting needs in assessment areas for the types of lending and investing it seeks to offer outside of assessment areas. If a high number of comments indicate a bank is not meeting needs, on an absolute basis and/or in reference to peers, then the bank should finish meeting needs in its assessment area first. The agencies could issue formal determinations in between exam cycles about whether a bank can venture beyond its assessment areas, which could be publicly available so that community stakeholders can approach banks that are allowed to satisfy needs beyond assessment areas. The Treasury Department recommended this type of determination process, the OCC talked about it with stakeholders, but for some unexplained reason did not bring it up in the ANPR.[34]

The agencies could also expand the number of distressed areas that banks could be permitted to serve after they have met needs in assessment areas. The agencies could develop a list of underserved and distressed counties on a national basis that banks could receive consideration for serving (see Question 16 of the ANPR). The model for such a list is the current list for rural counties that are distressed and underserved. In developing a national list of counties, factors to be considered could include economic factors such as poverty and unemployment rates. In addition, measures of bank activity could be included such as home or small business loans per capita. Counties with loans per capita significantly lower than national medians would qualify as undeserved. In addition, NCRC urges the agencies to develop a database of community development lending and investing on a county level based on data collected during CRA exams. Such a database could also identify underserved counties based on levels of community development financing per capita.

NCRC believes that our approach to allowing banks to engage in activities beyond assessment areas is more objective than the current ad hoc and opaque system. It makes it more possible for community groups and other local stakeholders serving distressed and underbanked areas to reach out to banks and be confident that community development financing can be secured from them. It could alleviate the stress that arises over the current ambiguity and thus augment the current system rather than needlessly overhauling the examination regime and making it less responsive to local needs.

The U.S. Treasury on the Right Track: Automatic Inclusion of Affiliates on CRA Exams

In its memo to the federal banking agencies in the spring of 2018, the U.S. Treasury Department stopped short of calling for mandatory inclusion of affiliates but urged the agencies to evaluate their “approach to affiliates in order to ensure that performance evaluations accurately reflect the CRA-eligible activity of the overall bank.”[35] CRA exams allow banks to either include or exclude their mortgage company affiliates on CRA exams. And, it is hard to think of a process that is not more prone to abuse. The natural tendency is for affiliates to be included on evaluations if they are responsibly lending to LMI borrowers and neighborhoods and to be excluded from exams if they are not.

An example of optional inclusion enabling abusive practices is Suntrust Mortgage Company, which Suntrust excluded from its CRA exam of 2013. The U.S. Justice Department, HUD, and the Consumer Financial Protection Bureau (CFPB) reached a $1 billion settlement with the mortgage company over widespread abuses associated with underwriting FHA mortgages and mortgage servicing that occurred in the time period covered by the CRA exam.[36] Yet, because of the optional treatment of affiliates, Sunstrust’s CRA exam did not consider the mortgage company’s lending practices and whether these practices should result in a ratings downgrade. The optional treatment is inconsistent with the interconnectedness of affiliates and their parents. Suntrust’s CRA exam states, “SunTrust Mortgage Company is the primary originator of home purchase and refinance loans for the organization.”[37] In most cases, the affiliates’ activities are inextricably connected with the banks. The optional treatment must end.

Alternatively, regulators could adjust the CRA rating of the bank if the affiliate is engaged in activity that is at wide variance from the bank such as abusive lending or not lending to modest income populations while the bank is offering a higher percentage of their loans to these populations. Disparate patterns like this could very well reflect gaming exams.[38]

Conduct CRA exams at the holding company level

Currently, CRA exams are conducted separately for banks that are affiliates and are under control of the same holding company. These exams can be confusing for the general public and often do not completely reflect the extent to which the entire holding company responds to community needs. An exam at a holding company level may encourage the holding company to strategically plan how their individual banks could better complement each other’s efforts and the company’s total commitment to community reinvestment. The same reasoning applies in the case of non-bank affiliates that are often retail lender specialists while the bank affiliates can complement their retail lending with strategic community development loans or investments in targeted neighborhoods.

Within Statutory and Constitutional Parameters, CRA Exams Must Address Dearth of Credit in Minority Communities

Persistent and glaring racial disparities in lending manifest themselves year after year and decade after decade. The current trend is that minorities receive disproportionately few loans, while in the years leading up to the financial crisis, minorities received disproportionately high levels of subprime loans.

Last year, the journal Reveal released a well-publicized report documenting ongoing racial disparities in lending across several metropolitan areas.[39] The HMDA data has also shown a multi-year stagnation in lending to minorities. For example, lenders have issued between 5 to 6 percent of their home purchase loans to African-Americans in each of the last ten years although African-Americans are about 13 percent of the population.[40] Likewise, a couple of years ago, NCRC released Home Mortgage and Small Business Lending in Baltimore and Surrounding Areas.[41] After controlling for neighborhood characteristics such as the percent of owner-occupied units, median family income, median home value, and unemployment levels, NCRC found that the percentage of African-Americans in neighborhoods was significantly and negatively correlated with the number of loans from 2011 through 2013.

An earlier NCRC study, Foreclosure in the Nation’s Capital: How Unfair and Reckless Lending Undermines Homeownership, shows that after controlling for various neighborhood characteristics, loan characteristics, and borrower characteristics including creditworthiness and payment-to-income ratios, minorities were still more likely to receive subprime loans and experience foreclosures than white borrowers.[42] During the height of subprime lending, NCRC released annual reports called Income is No Shield against Racial Disparities in Lending which showed that even when controlling for income, people of color disproportionately received high cost loans.[43]

We believe the regulators could do more within a CRA regulatory framework to facilitate the flow of more safe and sound credit to minority borrowers and communities.

In 1977, Congress sought to address what still plagues the nation today – gaping racial wealth inequality stemming from redlining and other market failures

The 1977 hearings featured extensive testimony documenting lack of lending in communities of color. For example, representatives of neighborhood-based Advisory Neighborhood Commissions (ANCs) in Washington DC testified that people of color had difficulty obtaining conventional bank loans and that the down payment requirements were often 25 percent of the loan amount. As a result, homebuyers had to rely on mortgage companies offering higher fee Federal Housing Administration (FHA) loans with higher default rates.[44] In addition, the ANCs protested the application of American Security and Trust Company to establish a branch in Washington DC, asserting that the institution would make loans west of Rock Creek Park in predominantly white neighborhoods but would redline communities of color east of the park. They reported that bank branch personnel in communities of color would often state that they lack the authority to make loans.[45] Lastly, they reported that a survey of small business owners found that just 12 percent had loans though 49 percent applied.[46]

Additional witnesses reported the difficulties of communities of color in accessing loans. Gale Cincotta of National People’s Action reported that 93 percent of the homebuyers in the Logan Square neighborhood with a high percentage of Hispanics had high down payment FHA loans while 90 percent of the buyers in an adjacent neighborhood had low down payment conventional loans.[47]Similarly, the Massachusetts Commissioner of Banks confirmed that lower income neighborhoods had to rely on more expensive mortgage companies.[48] Finally, the Connecticut Commissioner of Banks reported that in eight cities banks provided evening and weekend hours in their branches in suburban neighborhoods but not urban neighborhoods. When the banking department placed a moratorium on bank applications, more than 20 institutions changed their practices.[49]

While the 1977 CRA hearings effectively documented conditions of redlining and unequal access to lending in the 1970s, the phenomenon of redlining extends decades prior to the 1930s. The Federal government under the Roosevelt Administration’s Home Owner’s Loan Corporation (HOLC) drew maps of city neighborhoods and differentiated them according to risk as perceived by industry professionals working for the Federal government. The highest risk and “hazardous” neighborhoods were overwhelmingly minority and lower income. With federal government approval, these neighborhoods were then systematically redlined by lending institutions for decades. In a recent report, NCRC found that the neighborhoods classified as “hazardous” have remained predominantly minority and lower income.[50]

Stronger fair lending reviews and specific standards for community development consideration should better account for race

Before the reforms to CRA regulations in the mid-1990s, lending to people of color was often considered in Factors D and F on CRA exams. For example, the 1996 Federal Reserve Bank of Richmond exam of Signet Bank analyzed the percentage of applications to minorities for the bank, its affiliated mortgage company, and all lenders in assessment areas in Maryland, Virginia, and Washington DC. Denial rates to minorities to whites were also analyzed. The fair lending review conducted a statistical analysis of rejected white and minority loan applications in order to assess whether denials were due to illegal discrimination.[51] Similarly a 1995 OTS CRA exam of CenFed Bank examined applications and originations of the bank compared to demographics, concluding that while the agency could not find evidence of discrimination, the bank’s percent of applications and originations to Hispanics was considerably below the percent of the population that was Hispanic.[52]

The agencies can and must improve examination of lending to people and communities of color on CRA exams. NCRC’s preference would be for lending, investments, and services to people of color and communities of color analyzed in a manner similar to lending, investments, and services to LMI borrowers and communities on CRA exams. Consideration of lending to minorities on CRA exams would facilitate bank compliance with fair lending laws by also requiring an affirmative obligation to serve minorities. Lenders would be less likely to engage in redlining and other racially discriminatory practices, lessening compliance costs for lenders and creating a more robust and competitive lending market in communities of color.

The agencies should include an “other populations or area category” described in Question 16 of the ANPR that would consist of underserved census tracts in the banks’ assessment areas. These tracts would be identified via data analysis as those with lowest loans per capita or and/or deposits per capita. Many of these tracts would likely be predominantly minority. CRA exams should also include a more robust fair lending section along the lines of exams conducted before the changes to the CRA regulations in the 1990s.

HMDA and other data have consistently shown racial disparities in access to lending and banking. During the foreclosure crisis, predominantly African-American middle income communities such as those in Prince George’s County, MD were afflicted with predatory, non-bank lending because they experienced a shortage of traditional bank lending.

CRA Grade Inflation has Undermined the Power of the Law

Since 1995, 98 percent of banks, on average, have passed their exams.[53] If anything, CRA grading needs to be more vigorous with a success rate lower than 98 percent. If the pass rate was not this high, CRA would be even more effective in motivating increases in loans, investments, and services to LMI communities. In response to ANPR Questions 3, the agencies can be considerably more creative to make the ratings more objective, fair, and transparent.

The ratings distribution makes it difficult to discern significant differences in CRA performance when almost all the banks in the country are essentially receiving an A or B on their CRA exams. Distinctions in performance are more apparent on the component tests and on a state level, since banks can also receive the ratings of High and Low Satisfactory in addition to Outstanding, Needs-to-Improve, and Substantial Noncompliance.

The agencies have discretion to alter their existing point system to provide further distinctions among bank performance. Currently, the agencies use a scale of one to 24 as a point system.[54] It is quite difficult to understand how a point system of one to 24 was developed to capture bank performance on various exam components. Instead, a point scale of 100 would make much more intuitive sense and would correspond to exam weights. For example, since the large bank exam weighs the lending test at 50 percent, the lending test score can have a possible range of one to 50. Likewise, since the investment test and service test are each weighed at 25 percent, they can have a range of one to 25 points each.

A 100 point scale would better differentiate between the four assigned ratings

The overall ratings would be more differentiated if they were accompanied by a publicly released score. For example, an Outstanding rating could be achieved if a bank had a score of 90 to 100, while a Satisfactory rating could be achieved if a bank had a score of 70 to 90. An Outstanding rating accompanied by a score of 90 would not be as remarkable as an Outstanding rating accompanied by a score of 99. Likewise, a Satisfactory rating accompanied by a score of 70 is just barely passing while a Satisfactory rating accompanied by a score of 89 is essentially a High Satisfactory rating.

The 100-point scale has the potential to add significantly more meaning and nuance to CRA ratings. In addition, the 100-point scale could be applied to ratings assigned to states and multi-state metropolitan areas in order to more effectively point out state and metropolitan areas where a bank performs well in addition to areas where it must make efforts to improve its performance.

The overall objective for ratings reform is not only to reduce the unjustifiably high pass rate but also to avoid a certain rating category from capturing the great majority of banks. It does not make sense that 90 percent of banks have been rated Satisfactory over the last several years. This bucket should be split into at least two since common sense would dictate that it is unlikely that 90 percent of banks would perform in the same manner. More refinement to the rating system would result in buckets that have less lopsided distribution and would result in even more responsible loans, investments, and services to LMI borrowers and communities. If for instance, 45 percent of the banks with Satisfactory ratings found themselves in a lower point category, a number of these would not want this lackluster rating and would be motivated to perform better.

Benchmarks in the CRA Tests Need to be More Objective, Promote Consistency, and Enable Better Comparison among Peers

Since the last major reform of the CRA regulations in 1995, the agencies have shied away from clearer benchmarks within the CRA component tests. Perhaps, they fear that benchmarks will be interpreted as an attempt at credit allocation. However, benchmarks can be clearer if they are established in reference to aggregate industry performance and demographic data. These benchmarks would not be a form of credit allocation since they assess a bank’s performance relative to its peers rather than establishing a certain percentage or quota. Moreover, they would make ratings more objective, consistent, and fair (ANPR Question 3).

Numerical guidelines with some qualification could correspond to the lending test’s ratings

On the retail lending test, a common performance measure is the percent of loans to LMI borrowers. The CRA exams provide extensive data on this performance measure and usually report whether the bank’s percentage of loans to LMI borrowers is above or below the aggregate percentage (all lenders in the geographical area). The reader is left with the impression that when a bank has a higher percentage of loans to LMI borrowers than the aggregate, its performance on this criterion is at least Satisfactory or is Outstanding. Likewise, when the percentage is below the aggregate percentage, the performance would be Low Satisfactory or worse.[55] The shortcoming, however, is that the exams establish no range for performance that correspond to the various ratings. For example, if a bank’s percentage of loans to LMI borrowers was higher than one standard deviation from the aggregate percentage, perhaps this should correspond to High Satisfactory or Outstanding. Also, perhaps Outstanding performance would be reserved for banks that are not only above one standard deviation but are within a certain number of percentages points to a demographic statistic such as the percent of households that are LMI in the area.

Currently, Appendix A to the regulations does not provide clear guidance as to how performance on the various criteria correspond to various ratings. For instance, for the criterion of lending to LMI borrowers, Outstanding is described as “an excellent distribution, particularly in its assessment area(s), of loans among individuals of different income levels and businesses (including farms) of different sizes, given the product lines offered by the bank.” High Satisfactory corresponds to“a good distribution, particularly in its assessment area(s), of loans among individuals of different income levels.” These vague descriptions do not provide sufficient guidance to either banks or community groups.

Numerical guidelines should not be regarded as a guarantee that a certain rating on a criterion would be attained. Numerical guidelines such as those for LMI borrowers described above would be qualified with an explanation that final judgment of performance on a criterion also depended on assessment of performance context. However, stakeholders could still be reasonably confident that numerical ranges for the various ratings would apply most of the time. Also, stakeholders would be confident that if a bank landed in a range that would be normally reserved for Outstanding performance, it would most likely not score lower than Satisfactory. A deviation from an expected rating would occur rarely and would only apply in outlier situations such as for geographical areas where housing was quite affordable, meaning that several lenders were able to make a high percentage of loans to LMI borrowers.

Among other steps, investment test ratios should be benchmarked to peer performance with quantitative and qualitative criteria appropriately weighted in the rating

On the investment test and the community development lending part of the lending test, CRA examiners currently use ratios such as investments compared to assets but will not benchmark these ratios to peer performance.[56] The lack of benchmarking makes it difficult for a reader of CRA exams to verify that performance merits the rating received. Alternatively, for the quantitative criterion of the dollar amount of investments, the rating could be determined in relation to peer performance (ANPR Question 8).

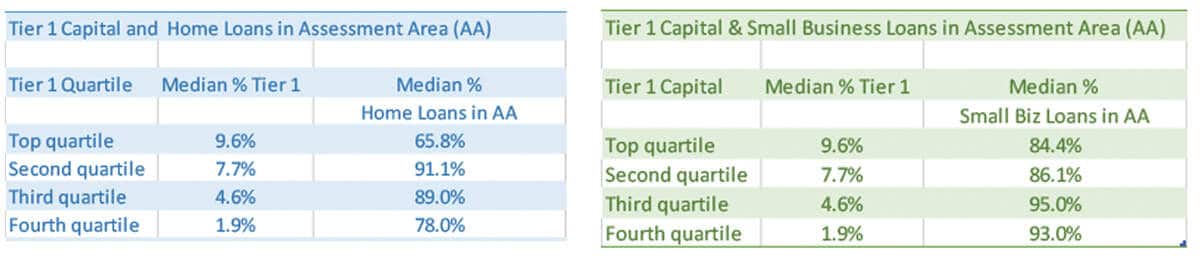

For instance, NCRC computed the level of community development (CD) financing (loans and investments) on the most recent CRA exams of the top 25 banks ranked by asset size. We found that the median level of CD financing per Tier 1 capital was 17.9 percent and median for CD financing per assets was 1.2 percent. The top quartile of either of these ratios could be considered Outstanding, the second quartile could be Satisfactory, and the lower two quartiles could be the failed ratings for the quantitative criterion. Then the qualitative criteria, including responsiveness to needs and the level of innovation, would be judged based on performance context analysis and comments of community groups and other stakeholders submitted to the CRA examiner. The final rating for a community development test would be determined by weighing the quantitative and qualitative criteria. The weights could be 65 percent for the quantitative criteria and 35 percent for the qualitative criteria (the qualitative criteria would be more subjective so it is probably sensible for it to be weighed less than 50 percent).

In another change to introduce more efficiency and objectivity on CRA exams, the agencies should consider converting the investment test on the large bank exam to a community development test. The community development test would consider both community development loans and investments. The community development test already exists for the intermediate small bank exam. Moreover, the form of community development financing should not depend on whether a bank needs to scramble for more investments or community development loans in order to pass its current lending or investment tests. The form of financing should be dictated by efficiency and affordability, not by which test a bank needs to pass. In order to ensure that a bank is not completely shirking either community development lending or investments, lending and investments must be analyzed separately on the test. Finally, the service test on a large bank exam should still analyze community development services since CD services are distinct from loans and investments.

The OCC must align with the Federal Reserve Board and FDIC so that CRA rating, examinations, and remedial standards are consistent

ANPR Question 2 asks whether the current CRA regulations are applied consistently. Consistency has been undermined by the OCC’s recent unilateral changes to CRA implementation and would be further undermined without coordination with the other regulators on CRA rulemaking. Over the last year, the agency has stretched out CRA exams for large banks and weakened fair lending and merger reviews of banks. The OCC must rescind these changes and align any future changes with the Federal Reserve Board and the Federal Deposit Insurance Corporation (FDIC) in a manner that comports with the CRA.

In a recent bulletin, the OCC describes a 48 month cycle for large banks with more than 30 rating areas and 36 months for those with less than 30 areas.[57] This is a stretch out for OCC banks with more than 30 areas. The Treasury Department documented that OCC time periods for all large banks was previously 36 months. This was already on the high end compared to the other agencies that had time periods ranging from 12 to 36 months for large banks. Less frequent CRA exams reduce accountability and incentives for banks to perform in a consistently vigorous manner in fulfilling their CRA obligations.

The OCC has also issued a memo that dilutes the negative impact of discrimination and violation of consumer protection law on a bank’s CRA rating.[58] The memo states that if a legal violation occurred in a type of lending not considered on a CRA exam, the violation will not impact the CRA rating. If such a violation is widespread, however, it must result in a ratings downgrade because the bank, overall, is not meeting credit needs in a responsible manner. Also, the memo states that double downgrades will be rare and reserved for particularly egregious violations. The language is too restrictive and does not place enough discretion for examiners to determine when and how violations should result in double downgrades.

The OCC has also made it easier for banks with failed CRA ratings to grow through mergers with other financial institutions or acquiring branches.[59] Previously, a bank with a failed rating would be presumed not to be able to secure approval for its merger or branch application. The recent OCC memo provides such a bank with a potential path to approval if it can point out vague benefits associated with approval. Since only about two percent of banks fail on an annual basis, these institutions are exceptionally poor CRA performers. Currently, the only penalty for a failed CRA grading is the possibility of denial of merger or branch applications; one of only a few sticks that motivate banks to pass their CRA exams. A presumption that applications will be denied for failed CRA performance must remain the regulatory practice. The only exception that NCRC would support would be in cases where the bank seeks to open a new branch in an LMI census tract, or tract that is majority people of color, in order to facilitate increased lending and services to the underserved.

Better Data Reporting Would Reduce Grade Inflation and Improve Consistency

NCRC believes that improvements in data reporting would reduce grade inflation overall and improve the consistency of performance measures and benchmarks on CRA component tests. (ANPRQuestions 29 and 30). The most rigorous parts of the CRA exam currently are those that rely on annual HMDA and CRA small business loan submissions. The annual submissions improve the ability of CRA examiners to track performance over time and consider in their ratings decisions whether performance was constant or inconsistent over time. In addition, the public availability of the HMDA and small business loan data allows community groups and other stakeholders to provide their analysis of lending trends to the CRA examiners, which most likely results in examiners catching aspects of performance that they may have overlooked and thus results in more rigorous ratings.

Community development data should be collected annually and publicly disseminated

Similar to HMDA and small business data, the community development lending and investment data must be submitted annually and publicly by banks on a census tract level, a county level, and for the assessment areas. The community development data should also be reported separately for the major categories of community development including affordable housing, community services, economic development, and activities that revitalize and stabilize LMI census tracts. CRA exams often contain tables breaking out community development financing into the major categories. Community development loans, investments, and grants should be reported separately since each of these types of financing respond to different needs and contain different levels of explicit or implicit subsidies. Finally, the number of applications and denials of community development loans should be publicly reported. NCRC member organizations have described instances of arbitrary denials, which might be reduced if transparency is improved via data disclosure.

With annual data broken out by geographical area and purpose, examiners, community groups, and banks can track bank performance on a timelier basis and correct areas of weaknesses considerably before CRA exams. Annual submission of community development finance data would also facilitate determinations of whether banks are meeting community development needs in their assessment areas and thus whether they would receive consideration for community development financing outside of their assessment areas. In addition, annual submission would enable the regulatory agencies to create a database that could show which counties are well served and which are underserved based on the dollar amount of community development financing per capita. This would help establish a list of underserved counties across the country that banks would be allowed to serve provided they have met needs in their assessment areas. Finally, asset levels and Tier One capital levels must be reported annually so that the dollar amount of community development financing can be compared to bank capacity in a timely manner.

As any community development financing data reporting is implemented, the agencies must carefully oversee data collection and community development activities to ensure that the financing is not displacing or harming LMI people. For example, in high cost areas of the country, abusive multifamily lending in LMI tracts has facilitated the displacement and eviction of LMI tenants. In response to concerns raised by NCRC members and others, banks have implemented reforms to their multifamily lending practices and state agencies have issued guidelines to ensure responsible multifamily lending.[60] For example, New York state advises banks to conduct due diligence of landlords and property owners, assess if appraisals are accurate, and analyze loan terms and conditions to make sure that current rents would not have to increase substantially in order for property owners to repay loans.[61] CRA examiners must monitor banks and penalize them on CRA exams if they are financing abusive activities in LMI census tracts and also disallow community development data being reported that include predatory financing.

Regulators should make some improvement to small business lending data now notwithstanding the CFPB forthcoming Section 1071 rulemaking

The small business loan part of the lending test is not as rigorous as the home lending section because the small business data is not as refined. Some stakeholders complain that home lending receives priority over small business lending. This perception is fueled by the limited amount of small business lending data available to examiners. To improve the rigor of the small business part of the test and to improve the ability of examiners to determine if banks are serving the smallest businesses, small business data must be improved to include more categories rather than just above and below $1 million in revenue. Adopting the categories used by the Census Bureau, the revenue categories reported should include businesses with annual revenues $50,000 and below, $50,000 to $100,000, $100,000 to $500,000, $500,000 to $1 million, $1 million to $5 million, and $5 million and above.[62] Improved data on the revenue size of the small business would enable examiners and the public to know whether the bank was lending to the smallest businesses as well as serving businesses in LMI tracts (which is another criterion on the lending test).

When the revenue of the small business is unknown, it must be reported that way instead of the current method of reporting that does not differentiate loans in which revenue is unknown and known. The ratios currently on exams that express loans to businesses with less than one million dollars in revenues as a percent of all loans can be quite inaccurate when banks make substantial amounts of loans to businesses with unknown revenues. There is no way presently to subtract the number of loans with revenues unknown from the denominator.

Similarly, originations must be reported separately from refinances so that examiners can separately analyze whether banks are meeting needs for originations and refinances. Lastly, credit card loans must be reported separately from non-credit card loans so that examiners and community groups can assess whether banks are satisfying the needs for larger and lower cost loans in addition to shorter term credit card loans with higher interest rates. The federal bank agencies should not wait for the implementation of Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act to make refinements to the small business data and improve its ability to assess bank performance. CRA is significantly handicapped in its ability to assess banks’ responsiveness to the credit needs of small businesses. This retards economic growth in underserved communities and is also unfair to banks that specialize in small business lending and want exams that showcase their responsiveness to the needs of small businesses.

Community Benefits Agreements and Conditional Approvals Must Be Considered on CRA Exams and No Safe Harbors

The CRA regulation must formally recognize the relationship between the merger application process and CRA exams. A bank merger can dramatically change a bank’s ability to meet credit needs. Bank merger law expressly seeks to avoid reductions in banks’ abilities to meet credit needs by requiring banks to provide a public benefit as a result of their merger. In order to avoid outcomes in which mergers decrease banks’ abilities to meet credit needs, CRA exams must regularly evaluate whether banks are meeting goals established in either conditional merger approvals or community benefit agreements (CBA). CRA exams are a natural follow-up examination to determine whether banks are meeting their commitments made during mergers.

NCRC appreciates that the OCC’s June 2018 memo instructs CRA examiners to determine whether banks are meeting the goals in CRA plans required in conditional merger approvals.[63] Conditional merger approvals issued by the OCC and the other federal agencies require plans with goals in cases in which the merging banks need to improve their performance in lending, investing, and/or providing services. Consequently, compliance with CRA plans should logically influence the bank’s rating on its next CRA exam.

CRA examiners must also assess bank compliance with CBAs. CBAs serve the same purpose as conditional approvals in that they ensure that bank CRA performance improves instead of regressing. In some cases, CBAs can avoid the need for conditional merger approvals. Community groups and banks negotiate CBAs when banks are seeking to acquire other banks or improve their CRA ratings. CBAs are forward-looking commitments establishing specific lending, investment, and service goals over a multi-year time period. Since 2016, NCRC and banks have negotiated $86 billion in CBAs.[64]

The Treasury Department recognizes CBAs as an “effective tool” to “demonstrate how the approved application would benefit the communities served.”[65] However, the Treasury Department also seemed to confine its recommendation regarding the value of CBAs to banks with Low Satisfactory or below ratings. To the contrary, CBAs are beneficial for a wide array of banks. One of the key benefits of CBAs is that they encourage banks to engage in partnerships with community organizations and other stakeholders in an effort to bolster its lending and investment in LMI communities.

The agencies should codify that CBAs and conditional merger approvals will receive follow-up evaluation in CRA exams. The CBAs and conditional merger approvals must contain verifiable goals targeting LMI people and people of color and LMI communities and communities of color. NCRC and our member organizations have had experience with so-called voluntary commitments and even conditional merger approvals in which the dollar amounts appear impressive but the income targeting is unclear (no income definitions were used or the income definitions did not correspond with CRA’s income definitions). Also, half or more of the lending and investing promised were not directed at LMI communities.

A CRA rating must not become a safe harbor providing expedited merger approvals or automatic approvals. Periodically, proposals will surface that Outstanding ratings should confer an easy merger approval process since they indicate impressive CRA performance. This position blithely ignores the mandate in merger application law that a bank provide a prospective or future public benefit arising from the merger. Congress created this requirement because mergers can dramatically change the capacity of a bank to lend and provide services to communities. In the wake of significant institutional change, Congress wanted to insure that mergers provided public benefits in the form of more, not less, lending and bank services to the public.

A past rating does not ensure that future performance will remain at the same level, particularly when mergers can have profound impacts on bank management and structure. Secondly, even a bank with an Outstanding rating can have inconsistencies in its performance on component tests or across assessment areas that must be addressed during mergers. Thirdly, performance could have declined since the previous CRA exam that can be several years old. This necessitates data analysis and public input in order to most accurately assess the performance of a bank. Any proposal to short circuit the application process or limit public comment will violate the OCC’s responsibilities under bank merger law.

Instead of so-called safe harbors, low ratings such as Low Satisfactory in any assessment area should trigger a public hearing requirement so that all parties have time to thoughtfully consider how bank performance can improve after a merger. Under a point system that NCRC proposes above, a point range such as 70 to 80 suggesting Low Satisfactory as a rating overall or in any assessment area should also trigger public hearings.

The OCC’s Metric-Based Framework Is a Misnomer and the One Ratio Would be Complex, Burdensome, and Not an Adequate Measure of Responsiveness to Local Needs

The OCC describes a one-ratio concept as a metric-based approach to CRA exams. This clever sounding phraseology makes it appear that the one ratio would be somehow more objective than the performance measures currently used on CRA exams. However, the one-ratio would make CRA exams less objective by replacing a set of performance measures that capture variations in local performance in meeting credit needs with reliance on one measure that fails to capture the complexity and nuances of bank performance across its assessment areas (Questions 7 through 9 in the ANPR).

The One Ratio is a Step Closer to Credit Allocation – An Approach Rejected by Senator Proxmire

During 1977 when Senator Proxmire was promoting CRA on the Senate floor and in hearings, he was insistent that CRA encourages banks to respond to local needs and was not intended as method of credit allocation. The one- ratio would be a step towards credit allocation by expressing a ratio of the dollar amount of CRA activity divided by Tier I capital or some other denominator reflecting bank capacity. If the OCC then established ranges of ratios corresponding to the various ratings, this would resemble a quota. The one ratio would be just one measure upon which most of the rating would depend and would earn a bank a certain rating depending on what ratio the bank attained. In contrast, the current CRA exams rate banks on several measures in several assessment areas. The measures are relative comparing banks to each other and to demographic benchmarks. The measures enable banks to compensate for poor performance in certain areas or activities with better performance elsewhere. A bank rating is not dependent on one test or quota but on how well it performs, in the aggregate, on several measures across local areas.

The first version of the CRA legislation contained specific requirements to serve primary service areas. The primary service area was defined as a compact area covering branches from which a bank expected to obtain more than one half of its deposit customers.[66] Then, when a bank applied to merge or open a branch, it would have been required to indicate what proportion of customer deposits would be reinvested in primary service areas.[67] Some Senators and bank representatives criticized this provision as cumbersome and bureaucratic.[68] They also stated that it would prevent banks from addressing other unmet needs in other areas including rural communities (that presumably would have lower levels of deposits). In response, Senator Proxmire re-worked the legislation and introduced it without this provision. Instead, agencies were required to examine banks and rate them based on how well they met credit needs. The one ratio would be reverting back towards the original discarded ratio, which was replaced by a more flexible array of measures and metrics.

Throughout the pivotal year of 1977, Senator Proxmire repeated his mantra that CRA was not credit allocation but a requirement to meet local credit needs. He states:

- It (CRA) does not provide for credit allocation. To criticize reinvestment incentives as a form of credit allocation is disingenuous. It would not allocate credit, nor would it require any fixed ratio of deposits to loans. But it would provide that a bank charter is indeed a franchise to serve local convenience and needs, including credit needs.[69]

- A public charter conveys numerous economic benefits and in return it is legitimate for public policy and regulatory practice to require some public purpose, without the need for costly subsidies, or mandatory quotas, or a bureaucratic credit allocation scheme.[70]

The Numerous Flaws of a One-Ratio

Like a ratio requirement in the first version of the CRA legislation, the one ratio has some deceptive appeal based on its surface simplicity. The one ratio would consist of the dollar amount of a bank’s CRA activities (loans, investments, and services to LMI borrowers and communities) divided by the bank’s assets. The ratio is supposed to reflect CRA effort compared to a bank’s capacity and would influence a bank’s CRA rating.[71] The same level of effort or dollar amount of CRA activities would not earn a bank with a larger amount of resources the same CRA rating as a bank with a smaller amount of resources.

The OCC has promoted the one ratio as a means to inject more certainty and clarity into CRA exams. The idea behind the one ratio is that it will immediately signal to banks whether they are in compliance with CRA and can expect to pass their next CRA exam. However, before applying this concept to CRA, we must pause and remember the purpose of the law.

The CRA statute reminds us that banks “have continuing and affirmative obligations to help meet the credit needs of the local communities in which they are chartered.”[72] The key word is local. One ratio cannot tell an examiner, a bank, or a member of the public how responsive a bank is to its various service areas. Current CRA exams ensure banks are responsive to local needs by establishing assessment areas where branches take deposits. CRA exams scrutinize to what extent a bank makes loans and investments and offers services to LMI people and communities in its various assessment areas.

When reaching conclusions about performance, exams also assess to what extent a bank responds to different needs in its assessment areas. For instance, preserving affordable housing is a priority need in a metropolitan area experiencing rapid housing price increases whereas financing small businesses and job creation is a priority need for a metropolitan area with high unemployment. If a bank does well in job creation initiatives in the high unemployment metro area, but not so well in financing affordable housing in the expensive metro area, it would probably receive higher marks for its performance in the area with high unemployment than the expensive area. The exam then tallies performance across assessment areas to develop an overall rating. Differences in responsiveness to local needs therefore gets factored in exams with assessment areas.

Assessment areas allow examiners to conduct performance context analysis and determine to what extent banks are responding to differing priority needs. A CRA exam focused on the one ratio is incompatible with performance context analysis (ANPR Question 9). Moreover, an exam focused on the one ratio would not be effective in considering public input regarding local needs (ANPR Question 11). Examiners are currently required to consider community comments on local needs and how well banks are responding to them. Examiners take these comments into account when reaching conclusions about bank performance in assessment areas. A one-ratio focused exam, in contrast, would not explicitly factor community input into the conclusions of performance for each assessment area. At the very least, trying to factor in community group comments about bank performance and needs in several assessment areas into a one ratio analysis is an extraordinary difficult, cumbersome, and convoluted exercise that is hard to fathom. There is no better way to determine if banks are fulfilling their responsibilities under CRA than to listen carefully to local residents and consider their perspectives when reaching conclusions and ratings for various assessment areas. The one ratio-centered exam, in short, violates the intent and purpose of CRA to require banks to respond to local needs as articulated by community residents.

The OCC suggests that the ratio could be adjusted to provide more weight to activities that are particularly responsive to distressed communities with high needs for credit. For instance, an investment of $1 million in a distressed community can be weighted by a factor of two, meaning it will count for $2 million in the numerator of the ratio (ANPR Question 10).While this may sound appealing, consider how complicated and subjective it would be to do this weighting for banks, particularly large banks, which serve upwards of 20 states and hundreds of counties.

The other downside is that generous and frequent weighting (multiplying loans and investments by 2 or more) could easily result in half or less the dollar amount of loans and investments. The current system, while not perfect, can better adjust for responsiveness by weighing the importance of performance in each assessment area, including distressed areas. This avoids crude outcomes like one half the number of loans and investments equaling the same ratio due to weighting.