By holding banks accountable for serving local communities, the Community Reinvestment Act (CRA) has leveraged trillions of dollars of responsible loans, investments and services for traditionally underserved communities. The Office of the Comptroller of the Currency (OCC) issued damaging changes to its CRA regulations in May. The two other federal banking agencies, the Federal Reserve Board and the Federal Deposit Insurance Corporation, are still considering changes to the CRA regulation and examination procedures.

The agencies should not undermine the effectiveness of CRA by designing new exams that do not effectively hold banks accountable for meeting credit needs of local communities. The following are principles for reform of CRA rules. NCRC would oppose any additional regulatory changes to CRA that contradict these principles, just as we have opposed the OCC final rule.

As we recover from the COVID-19 pandemic, CRA should increase accountability to local communities, which need to focus their revitalization efforts on improving health care facilities, increasing food supply and preserving and expanding small businesses that have suffered during the pandemic. CRA reform that diverts attention from local needs will thwart the nation’s recovery from this crisis.

NCRC has always advocated for applying CRA broadly throughout the financial industry. This expansion would require an act of Congress. While this is discussed below, the focus of these principles are areas we expect the federal bank agencies to consider in any proposals to reform CRA regulations set by the agencies. Reforming CRA should not become a pretext for relaxing CRA.

Local Geographic Focus Should be Strengthened

CRA exams should retain a local geographical focus. Congress passed CRA in response to the redlining of communities. Currently, CRA exams judge bank performance in assessment areas or geographical areas that contain bank branches and deposit-taking ATMs. These assessment areas work for many banks that do most of their lending through branches. However, other banks make loans through non-branch means such as the internet. Also, several financial technology companies (fintechs) are applying to the federal banking agencies for bank charters; fintechs make all of their loans through the internet. Assessment areas should expand to include geographical areas where banks and fintechs are gathering deposits or making loans outside of their branch networks. Rural areas and smaller metropolitan areas should receive more attention on CRA exams. Thus, it is not acceptable to obliterate assessment areas in CRA exams or create a nationwide assessment area for large lenders. This would be contrary to the purpose of CRA to prevent redlining. Moreover, removing local assessment areas from CRA exams would decrease lending to low- and moderate-income communities since research has found that assessment areas have bolstered lending in modest-income communities. CRA should continue to adhere to its original purpose to ensure that local community needs are met. Do not remove “community” from CRA.

Data Should be Enhanced to Hold Banks Accountable for Addressing Local Needs

Data on community development lending and investing should be improved so that the public can track this activity on the census tract and county levels and hold banks accountable for financing health clinics, grocery stores and other projects that revitalize and stabilize communities recovering from the pandemic. The federal bank agencies and the Consumer Financial Protection Bureau should coordinate work on small business lending data required by Section 1071 of the Dodd Frank Wall Street Reform and Consumer Protection Act. Under Section 1071, publicly available data would become available that captures the extent to which banks are making loans to micro-businesses, women and minority-owned businesses so they can re-establish themselves in the wake of the pandemic. Improved data would also further the ability of members of the public to comment on the CRA performance of banks. The OCC’s final rule restricted the public availability of data, including new data to be collected by banks.

Bank Activity to People of Color and Communities of Color Should be Considered on CRA Exams

Bank lending, investing and service to people and communities of color should also be considered on CRA exams, which now only consider low- and moderate-income borrowers and communities. Communities of color were the original communities redlined when Congress passed CRA and remain disproportionately victimized by predatory lending and a lack of prime, conventional lending. NCRC has developed one possible option for including communities of color on CRA exams, which involves identifying underserved census tracts and requiring CRA exams to scrutinize lending in these tracts. NCRC estimated that lending in communities of color would increase by about $10 billion over five years if the agencies adopted this approach.

Public Participation Should be Enhanced

The heart and soul of CRA is public participation. The public has the right to comment on CRA exams and merger applications. No stakeholder has better insights into local community needs than community residents. If banks do not seriously consider the comments of community residents, they will not effectively respond to local credit needs. Any attempts by the regulatory agencies to truncate public participation requirements is not only counterproductive but is contrary to the intent and purpose of CRA. The agencies should facilitate public comment on CRA exams and merger applications by providing improved contact information for staff to whom to send comments and whom can answer questions. In contrast, the final OCC rule does not explicitly state that public comments on bank CRA performance will be considered on CRA exams like they are considered now.

Maintain the Importance of Branches

Currently, the CRA service test places primary emphasis on bank branches while still considering alternative service delivery. The OCC finalized rule will significantly dilute the provision of branches and deposit and retail services to low- and moderate-income communities. A large body of research documents that home and small business lending increases to low- and moderate-income borrowers in areas with more branches. Deemphasizing bank branches on CRA exams will cause banks to pay less attention to neighborhoods where they receive deposits and therefore would increase instances of redlining. Moreover, lending and bank services to low- and moderate-income people would likely decline.

Focus Should be on Low- and Moderate-Income Neighborhoods, No Credit for Large Infrastructure Projects or Police Stations

The OCC has expanded the range of activities that can qualify on CRA exams to include financing initiatives that may have citywide benefits but that are not necessarily focused on low- and moderate-income neighborhoods. For example, large infrastructure projects such as interstate bridges now would count in OCC CRA exams. No one disputes the necessity for infrastructure but CRA has not been used to finance these types of projects and they do not significantly benefit low- and moderate-income people. Further, the final OCC rule would allow banks to finance public safety facilities including police stations, which are highly controversial and contested institutions currently. CRA should not be diluted to divert resources away from neighborhoods that were the original impetus for CRA.

Discrimination and Violations of Consumer Protection Law Should be Penalized on CRA Exams

The OCC issued a memo that dilutes the negative impact of discrimination and violation of consumer protection law on a bank’s CRA rating. Instead of being emulated by the other agencies, this approach should be rescinded. A bank is not serving credit needs in a responsible manner if it is engaging in illegal and harmful activities on a large scale, behavior which now results in ratings downgrades.

Banks Cannot Be Allowed to Merge after They Fail CRA Exams

The OCC has also made it easier for banks with failed CRA ratings to be allowed to merge or engage in other activities that require an application to federal agencies. Since only about 2% of banks fail on an annual basis, these institutions are exceptionally poor CRA performers. Currently, the only penalties for failed CRA ratings is the possibility of denial of merger or branch applications. This is one of the few sticks that motivates banks to pass their CRA exams. A presumption that applications will be denied for failed CRA performance should remain the regulatory practice.

Avoid Simplistic Measures of Performance

The existing CRA examination criteria have been developed over several years and reflect a careful balance regarding the importance of various activities for low- and moderate-income communities. The OCC implemented a radical overhaul of examination criteria such as reducing CRA performance to a simple formula that compares the sum of CRA activities to bank deposits. This ratio would encourage banks to focus on big deals like large infrastructure and ignore needs like smaller dollar business loans needed for recovery from the COVID-19 pandemic. By also allowing for generous credit anywhere in the country, the OCC’s ratio measure eliminates the focus of CRA exams on local needs that vary across a bank’s footprint. While objective measures of performance can be improved on CRA exams, a reduction of CRA to only a few formulas would contradict the original local focus of the law.

Refine CRA Ratings and Combat CRA Grade Inflation

Only about 2% of banks fail their CRA exams annually, while about 90%t are judged to have Satisfactory performance and close to 10% are judged to have Outstanding performance. This rating system fails to identify banks with various levels of CRA performance. The agencies should either introduce another rating category to the current four ratings or supplement the ratings with a point scale that can reveal more distinctions in performance. This would not only be fairer for communities but would also reward banks that are currently doing better than their peers but whose performance is not reflected adequately by the ratings. Further, the quantitative measures should be improved on CRA exams to assign ratings or points for each measure based on how well a bank performs compared to peers and demographic benchmarks. Qualitative measures should be improved to more effectively measure responsiveness to needs.

Affiliate Activities Should be Automatically Considered

A number of banks own mortgage companies that are included now on CRA exams only at the option of banks. This approach can lead to manipulation of CRA exams and the exclusion of mortgage companies when they engage in abusive practices or do not lend to low- and moderate-income borrowers. Affiliates should be automatically considered in CRA exams. In contrast, the OCC’s final rule removed even optional consideration of affiliate activity in most cases. In addition, NCRC believes that CRA should be applied broadly throughout the financial industry to include mortgage companies, credit unions, insurance companies, securities firms and investment banks. The broad expansion of CRA would require an act of Congress.

Community Benefit Agreements Should be Recognized

Community benefit agreements (CBAs) are negotiated between banks, NCRC and community groups and commit banks to specific levels of loans, investments and services to low- and moderate-income and minority communities over a multiple year time period. Banks have signed CBAs in the context of merger applications or to improve lackluster CRA performance. The agencies should not act to discourage CBAs and should recognize and promote them as a valuable means to improve CRA performance.

Josh Silver is NCRC’s senior policy advisor.

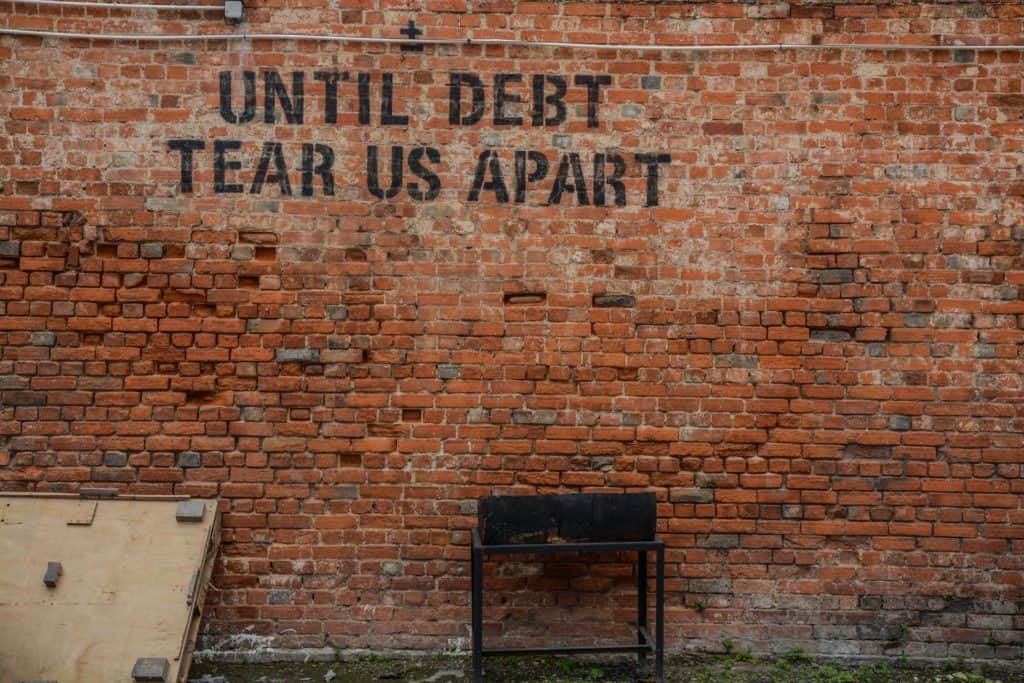

Photo by Alice Pasqual on Unsplash