Minority-owned businesses are vital to economic growth, but discriminatory lending hinders access to credit.

The death of George Floyd while in police custody has ignited long developing and smoldering embers of rage and frustration with systemic inequalities in criminal legal systems.

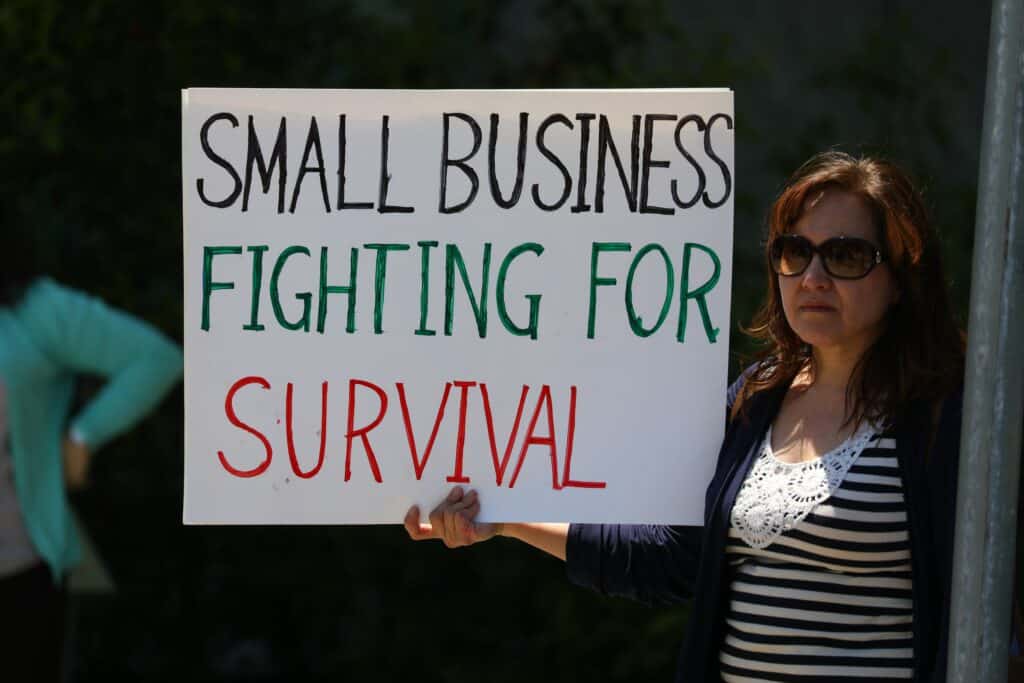

These systemic inequalities also exist outside of the justice system, where they pervade economic and administrative systems. Regulators and lawmakers should address these inequalities to allow small businesses of color the same opportunities that their white counterparts enjoy. Since most minority-owned businesses are small businesses, lenders’ treatment of these minority-owned small businesses is crucial to ensuring economic justice in the United States—especially in the wake of the COVID-19 pandemic and ensuing recession.

Small businesses are critical to the vitality and growth of the U.S. economy. Defined as firms that have less than 500 employees, small businesses account for 99.9 percent of all U.S. firms and nearly half of all private-sector employment. The Consumer Financial Protection Bureau estimates that these firms collectively represent a $1.4 trillion market. In 2014, the 30.7 million small businesses in the United States generated close to half of the U.S. gross domestic product.

Against this backdrop of small business activity, the success and growth of small businesses of color transform individual lives and society. For example, minority-owned businesses create equity in local commerce. Small businesses and entrepreneurs have long helped build wealth in our society. Successful business ownership translates into many financial benefits for people of color, including meaningful savings, property ownership, credit building, and generational wealth.

As racism continues to affect hiring, career opportunities, and upward mobility for people of color in 2020, entrepreneurialism is a real alternative to traditional employment. Minority-owned small businesses are also more likely to hire from the local community, providing jobs to local residents and stabilizing neighborhoods. Businesses that reflect their local communities often foster a sense of pride in the people that live there. Without access to capital, non-white entrepreneurs are less likely to launch new businesses and more likely to fail if lending dries up.

The market and societal shocks resulting from the global COVID-19 pandemic and protests over police brutality have created civil unrest and highlighted racial tensions that heighten the urgency and importance of understanding the challenges that racial minority-owned small businesses face. One area in which researchers have investigated these issues is in the availability of assistance for small businesses—in particular, small businesses owned by people of color—through the Paycheck Protection Program (PPP).

Based on the best estimates from government data, during the first phase of PPP—when competition for aid was fiercest—banks made 75 percent of PPP loans to businesses in communities where most residents were white. By comparison, 68 percent of the U.S. population lives in majority-white areas. Even if we set aside the disproportionate distribution of PPP loans, our research on discrimination against small business owners in banking indicates that Black borrowers are at a disadvantage even before they submit a loan application.

Our research has gauged banks’ treatment of potential borrowers by how enthusiastically bank employees encourage minority borrowers to apply for various loans, the kinds of products these employees offer, and the type of information the employees ask the borrowers to provide. We have also found that banks tell white customers more frequently than Black customers that they would qualify for a loan.

In addition to race, gender plays a role in loan qualification. Banks tell male customers who are either Black or white that they would qualify for loans more frequently than they tell female customers who fall into either category. In our study, not a single bank encouraged a Black female customer to apply for a loan by assuring her she would qualify. Keep in mind that in our research, we developed similar profiles for Black and white testers in terms of creditworthiness. We even made the creditworthiness of the Black testers higher than the white testers.

Banks also offered Black customers different products than white customers. In one case, a bank employee offered a white customer not just a PPP loan, but also a $100,000 business line of credit. The same bank did not offer a similar package to the Black customer who presented a similar but slightly better overall borrower profile. These differences in treatment between white and Black testers are particularly troubling because the combined effect of these various differential treatments may lead to feelings of discouragement and despondency among entrepreneurs of color in the financial marketplace.

The Equal Credit Opportunity Act provides fair lending protections for borrowers of all credit products, “including extensions of credit to small business.” This contrasts with the other fair lending laws, such as the Fair Housing Act and the Home Mortgage Disclosure Act, which focus exclusively on mortgage borrowers. Section 1071 of the Dodd-Frank Act is the only fair lending law that exclusively focuses on small businesses. When consumers initiate a loan application, this provision in Dodd-Frank requires banks to collect data on both the demographics of the borrower and information on the credit product. Publishing these data will enable the identification of discriminatory lending patterns by exposing where and to whom lenders offer different types of small business credit.

This September, the Consumer Financial Protection Bureau took an important first step in issuing and implementing a rule for Section 1071 by publishing potential proposals for public review and comment as required by the Small Business Regulatory Enforcement Fairness Act. We are a long way from any collection and release of these data, however, because lenders will likely have at least two years to make their data public after the Bureau issues any final rule.

In addition, the fragmented—and sometimes overlapping—regulation of small business lenders can make effective oversight and enforcement challenging and confusing. Within a single law, oversight and enforcement responsibilities may fall on a single agency or be shared among many different agencies. There exist at least six different federal agencies that have regulatory authority over financial institutions that issue small business loans, in addition to individual state regulators.

This patchwork framework risks leaving gaps in important protections for small business entrepreneurs. The U.S. Congress and federal regulators need to recognize that small business owners—especially women and people of color who own small businesses—need similar protections and disclosures as mortgage consumers. Small businesses are not as financially sophisticated as big corporations, and they do not have easy access to attorneys and accountants.

Despite the continuing and mounting evidence that minority-owned small businesses need better access to credit, there remains controversy over the best approach to resolve this problem. But sensible regulations such as those that apply to mortgages should really not be controversial.

Based on our research, banks are losing money because they do not identify profitable small business owners of color. Instead, they discourage small business owners of color from lending and treat them poorly. Banks that recognize troubling lending practices and take action to resolve this disparate treatment should enjoy greater profitability as they make loans to underserved, yet credit worthy minority-owned small businesses.

We recognize, of course, that some may question the need for government action to push banks to lend to minority-owned small businesses. Critics may also argue that if serving minority-owned businesses is that profitable, then many banks already should be “doing the right thing” out of self-interest, and other banks would need to mimic them to catch up. Others have presented evidence that firms that take the lead in adopting a corporate social responsibility approach to the marketplace—by treating minority-owned small businesses equitably—not only make a profit but also encourage competitors to follow suit.

But our research and that of others clearly shows that norms of equity are not diffusing widely enough. Banks are not ensuring that all their employees treat prospective borrowers the same, regardless of their race and gender. Sensible regulation is needed to secure equal economic opportunity to all small businesses.

This is a pivotal point in history. Federal and state governments and the banking industry have a potentially transformative opportunity today to show that minority-owned small businesses matter, too.

A version of this article was previously published by The Regulatory Review.

Jerome D. Williams is a professor of marketing at Rutgers University-Newark.

Sterling Bone is a professor of marketing at Utah State University.

Glenn Christensen is an associate professor of marketing at Brigham Young University.

Anneliese Lederer is the director of Fair Lending and Consumer Protection at the National Community Reinvestment Coalition.

Photo by Gene Gallin on Unsplash