Online Event Archive Recorded November 3, 2023

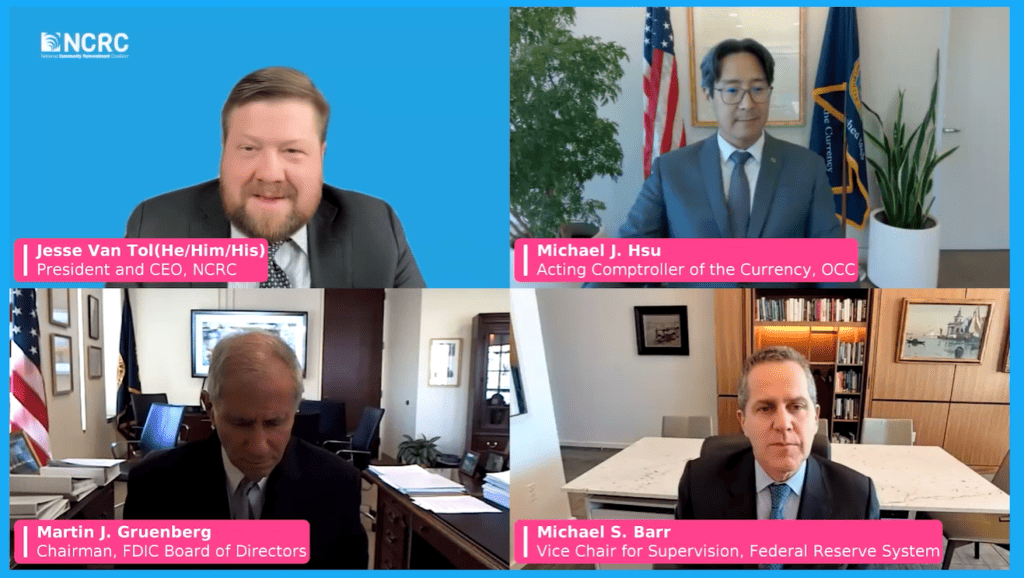

Acting Comptroller of the Currency Michael Hsu, Chairman of the FDIC’s Board of Directors Martin Gruenberg and Federal Reserve Vice Chair for Supervision Michael Barr joined NCRC President and CEO Jesse Van Tol to discuss the new Community Reinvestment Act (CRA) rules.

Speakers:

Michael Hsu, Acting Comptroller of the Currency

Martin Gruenberg, Chairman of the board of directors of the FDIC

Michael Barr, Vice Chair for Supervision of the Federal Reserve

Jesse Van Tol, President and CEO, NCRC

Transcript:

NCRC video transcripts are produced by a third-party transcription service and may contain errors. They are lightly edited for style and clarity.

Van Tol 0:14

Good afternoon and welcome, everyone. I’m Jesse Van Tol, the President and CEO of NCRC. And we’re delighted to be here. As you all know, last week, the Community Reinvestment Act, rules were released the first significant overhaul of the laws implementing regulations since the 1990s. Thrilled to get to talk about what this will mean for the communities you serve, with the leaders of the agencies that undertook that really significant rulemaking. We have here today, Michael Hsu, Acting Comptroller of the Currency, Martin Gruenberg, chair of the FDIC, and Michael Barr, Vice Chair of supervision at the Federal Reserve. Thank you all, for joining us today. And congratulations on this historic achievement. major undertaking. Before we get started, I just want to acknowledge this is the start of unpacking this 1500-page rule. The three agencies spent several years working on this, and we’re now moving into the marathon after the marathon, where NCRC members and others will be working to evaluate, assess and analyze the rule, we’ll certainly be following up with our members about the changes to the rule, what it means for the work we’re doing to build a just economy, and how it might open the door to some new possibilities for all of us. For those of you on this webinar, some things to be on the lookout for during the webinar, I’ll be asking some questions of the three agency heads. But we’ll also be sharing some polling questions with you. To give you a chance to weigh in on what you’re most interested in hearing about from NCRC related to the new rule. We want to help make sure we’re responsive to what you need to understand this enormous rule. And on Thursday, December 7, at 1:30 pm, we’ll be taking a deeper dive into this rule with our members. So for those of you who are NCRC Members, please join us then. If you’re not a member, that gives you a month to join us as a member, we’d be happy to have you will also be scheduling a follow-up session with the regulatory staff who worked on this rule to dive even deeper into the rule. And we’ll be producing written content breaking down particular aspects of the rule over the course of the next several months. And your participation in the surveys today will absolutely help us inform where we put our focus for that content. Finally, we want to make sure you have to just economy conference this spring. Join us April 2 to 4, as we’ll be teeing up important conversations there as well. Now that we’ve got all of that in, let’s dive in, we have these three gentlemen for an hour on on this historic rulemaking. So we’ll just jump in. First, with a question to Chair Greenberg. You know, this was a significant undertaking. What updates to CRA do you think will be the most successful in achieving the goal of expanding access to credit investment banking services for borrowers with low- and moderate-incomes and in LMI communities?

Gruenberg 4:06

Jesse, first thanks for the question. And let me say a word about NCRC’s role and leadership in regard to advocating for the Community Reinvestment Act. Your organization has really been the foundation of community group advocacy and attention to the rulemaking of CRA and the implementation of CRA. And we certainly hope and expect you will continue to play that role. Finalizing this rule was a big challenge. Implementing it effectively in order to realize its potential is really the challenge in front of us now. We told our respective staffs they could take a night off, get a good night’s sleep, and then start thinking about implementation. So we certainly expect to be working with you and in many in your organization as we, as we work hard to realize the possibilities of the rulemaking. And, and the possibilities are very large. And I’ve used the word transformational to describe this rulemaking. And I don’t think it’s, it’s an overstatement. It’s easily the most consequential rulemaking since the last major revision in 1995. But in some ways, you really have to go back to the enactment of CRA in 1977, to consider the consequences of this rule. Because from its inception, CRA was really focused on and built around the facility-based assessment area. And that was the focus and the limitation of CRA. And, as we all understand, the nature of the business of banking over the last 25 years, has changed dramatically. And a significant amount of the lending that banks do is no longer tied to a branch, to a facility-based assessment area. So if we didn’t make CRA relevant to the lending that banks do, not tied to a branch, but still may be quite significant in many communities around the country, over time, CRA would become increasingly irrelevant. We have banks today with one branch, with no branches, yet with nationwide lending activity. And if we don’t have a means of capturing that lending activity and holding it accountable to serving all of the neighborhoods in a given community, then the relevance and significance of CRA would really diminish over time. And that’s really what we do with the retail lending assessment areas. I think if there are two things, there is a bunch of stuff, and I want to give others a chance to talk, but the two things that are really transformational are the making CRA relevant to communities where the bank may not have a physical location, and developing a detailed set of metrics and benchmarks that will now complement the qualitative evaluations that are done both will can will be of great importance. I don’t want to undervalue, the importance of the qualitative review. But at the same time having a set of metrics and benchmarks that can be used to evaluate and hold banks accountable for their community lending activity is really an additional new dimension of CRA. You put those two things together, and you really begin to get a sense of the consequence of this rule. There’s a lot of other stuff. But why don’t why don’t I stop there? And I guess it’s my colleagues may have something to add as well.

Van Tol 8:27

Yeah, and welcome anybody into this conversation. That’s really right. If you had done nothing else, is really the first time in CRA’s entire history, that the regulatory framework will assess all lending done under CRA, between retail lending assessment areas and the outside retail lending assessment areas. You’re for the first time assessing all lending and it can’t be understated, both how necessary that was to modernize CRA, and ensure its ongoing relevance, but also how impactful that will be. So Michael, Michael, the two Michaels, I guess I needed a better way to handle that. If you have thoughts, please chime in.

Barr 9:11

I might say just just a couple words. First of all, let me join Chair Gruenberg and thanking NCRC, and your member organizations, and all the individuals and banks and civil rights groups and community organizations, and social service agencies all around the country, who worked with NCRC and other commenters to provide input into the proposal and then into the final rule. The input that we got from the public from communities and as Marty said, especially from NCRC proved invaluable to us in making this the rule that it is today. And that kind of community input is going to be really essential in the next phase of implementation. Community engagement is always been at the core of what CRA is about. And with this new framework, that’s going to continue to be the case. So we need community engagement to continue through this implementation process. And I think that’ll benefit us as regulators, it’ll benefit communities that will benefit the banks who are serving their entire communities. So I really, really want to emphasize that. Let me just also mention one other aspect of the final rule that I think will be really helpful to people. We’ve heard over the years that both banks and community groups need greater clarity about what counts and what doesn’t count for CRA purposes. And so one of the things this rule does is set out a set of illustrative practices that are going to be eligible for CRA consideration. And also provides a process that can confirm if somebody’s unsure about whether something counts or doesn’t count. They can come ask us, and we’ll say yeah, that’s, that’s good that counts for CRA, and share that with others. So I think both illustrative list and the process for confirming eligible activities will be really useful both to communities and banks in the years ahead.

Van Tol 11:29

I think that’s right. And you know, you hear certainly much has been made of the 1500-page rule. People say, Wow, that sounds complex. And I think for your average CRA officer looking at a transition period, maybe it seems like there’s a lot of unknowns. But now there’s a lot of knowns, there’s a lot of clarity and transparency. And Michael Hsu, I know, that was a important factor for all of us, but also acknowledged the role the OCC played in pushing that concept and framework forward.

Hsu 12:05

Yeah, I want to echo first of all, what Marty and Michael said about the role of NCRC in the groups and really helping us to get this to the final rule. You know, I often say to folks here, ‘faster, alone, farther together.’ And you can do things quickly all by yourself. But it’s really when you when you take all of that input, you get a better product, that takes a little bit more time. But it’ll last and I think that’s that’s been very, very important to us is that we’ve got a rule that’s durable. And that it can last. One thing I would maybe kind of add to what Marty and Michael highlighted in terms of really critical things that I feel like just really, really critical about this final rule. When we set out to do this, our overarching objectives were to modernize and to strengthen the CRA. And Marty did a great job of explaining the modernization part, because that’s, that’s absolutely critical. But we also want to strengthen it. And when people ask, Well, what do you mean by strengthen it? You know, I boil it down to three things more, better, faster. Like there has to be just more activity, it has to be better targeted to the communities, and it should be faster. And you know, Michael touched on this last on fasters. That certainty was sometimes hung things up, particularly on community development activities, either from the banks or for community groups, does it qualify? Does it not qualify? And one of the things that we did in the rule was to provide a bit more clarity and confidence on that. Now, the 95 rules guide, kind of four CD areas, now we’ve got 11. And that includes things like, you know, disaster preparedness, weather resiliency activities, native lands. And then as Michael hinted at, the goal is to publish a non-exhaustive illustrative list of activities. That will be updated periodically, and we’ve got a process, a formal mechanism to submit requests, and it’s the expectation that we three agencies work together on that. And I think that again, that will strengthen, make it durable and allow for the kind of certainty that can enable more and more engagement and better outcomes for everybody.

Van Tol 14:22

I think that’s right. And, you know, you hear you hear certainly some, even complaints about this rule that, that because it’s long, maybe it seems like it’s complex, but actually something can be clear and transparent. And to your point, Michael, more more, more rigorous, more difficult. I think the articulated goal of the three agencies all along was to raise the bar, while also making it clearer, and creating more certainty, and I certainly think you’ve done that. Michael Hsu, I want to drill into you know, certainly much has been made as the retail ending assessment areas. A retail lending assessment and we’re going to talk more about that, but you brought into the conversation, you know, the updates to the CRA definition of community development is going to have a significant impact on banks, community development portfolios. incorporating climate resiliency is fairly significant. But what what impact do you think it will have overall on banks interest in other areas, including health services, community solar projects, impact on native lands? It does, in some ways broaden the aperture but also, perhaps improves the qualitative factor and focus as well?

Hsu 15:46

That’s exactly right. That’s exactly right. Because there are two things you want to accomplish, which is that your community development is an evolving concept. And so you want to make sure we’ve got kind of the flexibility and broad enough aperture to cover those. And at the same time, we want rigor, we need rigor to ensure that those dollars have maximum impact on communities of need, you know, the LMI communities. And that, that striking that balance, we think we’ve done that through both some process that we put in place, and also with some specificity on some of the substance. And that does require that adds to the page count. But I like like you said, Jesse, that we think that that page count is well worth it, because it provides that certainty which can enable those those dollars to flow.

Van Tol 16:37

Thank you, I’ll see if your colleagues have any more to say about that before I move on.

Gruenberg 16:44

Yeah, Michael, that you want to go first? I’d add the changes to the community development test, are also quite fundamental. Because we’re really now in a sense, unleashing the ability of banks to serve underserved communities anywhere in the country, and get CRA credit. And the two things, two fundamental things we tried to do with the CD test is one, add flexibility, so that a bank can go to a rural community, it can go to a native lands community, it can go to any underserved community in the country, and get credit, at the same time to focus Ed credit on actually serving low- and moderate-income communities. Under this final rule, I do like saying that I’ve been saying proposed rule for so darn long, under this final rule, you only get CD credit, if the benefit of the community development activity, whether alone or an investment, you can demonstrate that 50% or more of it, than if it’s a low-income community, a low-income households. So at the same time, we’re trying to target it on the historic mission of CRA and create flexibility, so that banks really can have the aspiration of serving bank deserts, communities around the country that lack access to services, wherever I think the opportunity side of this rule for banks and community organizations to be forward-leaning in thinking about new and creative ways to serve communities and use CRA as an incentive. And leverage for that, as you know, is really, to me one of the exciting things about the rule.

Van Tol 19:00

And he really I mean, you’ve made it more flexible, broadened the aperture and also said you can go beyond the assessment but also more focused. And that you know, you get more credit, for example, if you’re doing community development investment in areas of persistent poverty, that was a concept NCRC really encouraged and appreciative of, of your efforts to incorporate that. Michael Barr anything to add before I move on?

Barr 19:29

Jesse, I would just say, you know, one of the areas that people have asked us to provide greater clarity on and relates to the Community Development mission more broadly, is support for CDFIs and minority depository institutions and low-income credit unions, women-owned credit unions, and the rule provides clear support for bank engagement with these really wonderful innovative organizations all around the country, many of whom I see are joining the call. Now on. And I think that kind of clarity, we really helpful in the bank and the partnerships between banks and CDFIs, who are really not only doing great work on the ground, in local communities, but also are often the ones that have innovative approaches, that once they test them out, others, including large banks, small banks, medium-sized banks will then take the strategy and deploy it, and that means more capital is getting into low-income communities. So I think that’s just another feature of the rule that I think it’s worth highlighting.

Van Tol 20:37

You know, one of the maybe critiques we have of the final rule, of course, redlining was critical, the history of CRA redlining was largely a race-based phenomenon. And in the final rule, and indeed, in the proposal, race wasn’t made an explicit part of the performance test, but you have incorporated concepts that relate to integration relate to serving underserved communities broadly. We’ve seen state and CRA laws incorporate race into the construct, what do you see as the major obstacles, but also opportunities to think about how we address all underserved communities, given the loss focus on low- and moderate-income communities?

Barr 21:30

Well, Jesse, it’s an excellent question. Look, let me start by saying what all your members know, but I’ll just say out loud, you know, the role of race has been central in our financial system there for far too long. There has been discrimination in our financial markets, in our housing markets. That was true in government programs, and in true in the private sector. So there is a very long and really tragic history of discrimination in this country. And the Community Reinvestment Act was one of the set of laws that Congress passed in order to begin to attack this problem of discrimination, alongside the Equal Credit Opportunity Act, and the Home Mortgage Disclosure Act, and the Fair Housing Act, and other provisions designed to get at discrimination. We were able, in the final rule, to in some targeted ways, make sure that we understood the role of race in our society, on what one of the important things that we were able to do. And the final rule, for example, is make it clear that all special-purpose credit programs, or programs designed to overcome that history of racial discrimination qualify under the Community Reinvestment Act for consideration. A second thing we were able to do in the final rule is to provide transparency to the public. So under the final rule, Home Mortgage Disclosure Act data will be provided assessment area by assessment area, and that’s a way for the community to understand how banks are performing, using that element of transparency. We also have a provision as is the case under the current rule that if a bank engages in illegal or discriminatory credit practices, that those practices will be taken into account in the CRA evaluation. We have limits on the ability of banks to set their assessment area, they can’t do that in a way that is evasive of basic principles of fairness, including on issues of race. So these are examples of the way we’ve been able to take that into account. And as I mentioned in the prior answer, we also have an explicit call-in for minority depository institutions, making it clear that supporting minority depository institutions is an eligible activity under the CRA. So we were able to bring these factors in but we understand that, you know, CRA is only one of a broader set of tools that are necessary to help get at the problem of racial discrimination in our society.

Van Tol 24:42

Thank you. So to you know our studies, our research continues to show evidence of discrimination and discouragement for underserved businesses, including businesses owned by by women and people of color. So real Like to two components, Michael Barr; one is really business lending, which has always been a part of CRA, but in the future with the incorporation of 1071 data is going to have a finer analysis to it. So in a way, maybe there’s been a perception that home mortgage lending was more important than the concept of CRA in the past, sort of a business lending clearly on on a level playing field within CRA today. But also what impact do you see the final rule having on those kinds of underserved businesses?

Barr 25:43

Jesse, let me start by saying I agree with you that small business lending is absolutely critical. Small businesses are the lifeblood of their communities, and really essential for job creation all over the country. And so it’s really critical that we have a rule as we do, that supports small business lending. Small business lending, as you also point out, has a history and current practice in many respects, of having racial discrimination still present. I’ve seen that in my, in my own research, my own academic research, I’ve seen that persistence of discriminatory impact on minority business owners. And so I do think we need to focus on strategies that help ensure that banks are meeting the needs of small businesses around the country. We do that in a variety of ways in a rule, we especially call out for some consideration, small business lending, that banks do, it’s especially evaluated. We include a small business metric in the retail lending assessment area approach alongside one for home mortgages, we have a special focus on very small businesses. And these businesses are often disproportionately minority-owned. Very small businesses are given extra consideration under the rule. So these are examples of ways that I think that the final rule will significantly support banks being encouraged to lend to small businesses.

Van Tol 27:35

And I’ll just note on both of these previous two points, CRA is not the end all be all when it comes to either encouraging more credit to small businesses or addressing the racial inequities we see in our society. So certainly, we have advocated for enhancements on the fair lending side, and on other types of restorative practices and policies to address racial wealth inequality.

Barr 28:07

And you know, as you mentioned, that the CFPB’s 1071 rule is also going to shine a light very much in this area.

Van Tol 28:19

Marty or Michael Hsu, anything to add on these two topics?

Gruenberg 28:26

No, I think Michael covered it pretty well. But I think small business was very much a focus of the rulemaking and particularly smaller businesses.

Hsu 28:40

Yeah, the only thing I would add is that we recently hosted an SPCP, a special-purpose credit program event, with CFPB, and HUD and FHFA. And a couple of things were striking about that, you know, of course, those are, those are really encouraged and incentivized within the final rule. But part of that, which, this loops all the way back to something that Michael, you had opened with, folks really wanted, felt it was very important to remind us of the historical legacy, that we are operating in, the context that we’re operating in. And I think that that’s important for us as regulators to know and to recognize, and for community organizations to constantly remind us because that is an important way to kind of keep the right level of attention on all of these issues across all the range of tools that we have, because we’ve got CRA and just you just mentioned this, you know, enforcement for eco fair housing like that’s all of those work together to really address the racial wealth gap, which is something we all care about.

Van Tol 29:53

Absolutely. Michael Hsu, what are the big challenges with updating the CRA is that it’s been so long since it was last updated. And now we have a final rule. So we have an update to the rule. But you know, the banking industry is a rapidly evolving industry. There are some things left to implement. How the rule gets implemented is really important. And then how you think about potential future updates the rule, whether that’s regulatory guidance along the way, or, you know, at some point in the future, I’m sure your staff would say very far into the future, another rulemaking. But in the pace of change is such that, you know, we could look forward 5-10 years from now and say, gee, we really need to revisit some things. How are you all thinking about ensuring across the three agencies that as you implement it, one, you remain consistent with each other, and to that CRA stays up to date and responsive to community needs going forward?

Hsu 31:11

Well, Jesse, I love how we’re a week in and you’re already talking about the next. So I would say, a lot of time, care and attention was put into modernizing this role in making sure that we’re not just calibrating it to the banking system today. But there is some room to accommodate the banking system of the future. That was very conscious. And that was, you see that, I think Marty did a great job of articulating some of the key features of that, in the role when his opening comments. To your point, I’ll loop back to the faster alone farther together, interagency collaboration on getting this final rule done, was really, really critical. And as we implement, you know, the team can continue to work together, there’s, I think there’s recognition that insistent implementation is in everyone’s interest. And now, implementation is different than rulemaking. And in some ways, it’s a it’s a broader group of examiners to draw a broader group of folks. We’ve already folks are already working hard, you know, they were allowed, they celebrated a little bit, which was, we’re all still celebrate celebrating in a way, because this is long overdue. But to your point, getting the implementation is really, really critical. And the better we can implement, I think the less there’ll be a need to do kind of rule revisions. At the same time, we’re going to be very attentive to changes in the banking system change that we can’t predict how the banking system is going to change. We need to make sure that communities are served. And I think it’s really good to anchor back to the core, you know, the foundations of the statute, which is that banks need to serve everybody was committed in their communities that they operate in, especially low- and moderate-income neighborhoods and individuals. So that will animate how we approach it. And we will depend a bit on yourself and your member organizations and your peers, to let us know, you know, our communities being are those needs being met.

Gruenberg 33:29

Jesse, if I can add to that, because one of the things I like about this rule is its flexibility and adaptability. So that, you know, with, with these retail lending assessment areas, they can accommodate many different kinds of business models for banks. Some banks have a retail branch network, but still do significant lending. beyond it. Some banks have a very limited network, some banks have none, and do all of their lending online, but on a regional or nationwide basis. This rule can apply CRA to all of those different kinds of business models, which I really think is critical, and will allow this rule to remain relevant, I hope for quite a while I’m not eager to run back to the row writing table here. But then, similarly on the CD side, you know, providing the flexibility for banks to go to any community as long as it’s focused on serving LMI communities and get credit for a variety of activities. And, you know, in the services area alone, we’ve really expanded it. So that you know, it’s not just traditional banking services, but it could be job training and workforce development. It can be Health care that’s serving the community. There’s a large range of activities that can benefit from Community Development Credit. And, Michael, I think, and Mike mentioned before, you know, we’re going to have a, a evolving list of eligible activities, so that it’s not static, but can evolve over time, as banks and communities, see new opportunities or new needs. So hopefully, this isn’t some sense of living, a living and an adaptable rule that will provide greater flexibility to allow banks to serve communities across the country in different ways, as the economy and the financial system evolves. So I think that’s an important dimension of this. And by the way, let me add the importance of engagement by community organizations in this work, you know, the input of community groups who are closest to the ground, in terms of the needs of local communities, providing that input to the agencies and to the institutions, as they seek to implement this rule, I think is really quite critical. And they’re really, it should be a partnership. That’s a word that’s used a lot. But the agency’s with the bankers, with the community organizations, pooling our resources and knowledge to maximize the possibilities here.

Van Tol 36:46

One of the really critical things, if I could just double press on click on this for a second, because I think there’s some things in the rule, there’s a section which says that, with regards to the transition, as people transition from the old rule to the new rule, each agency will come up with its own approach. And I understood that to mean, well, you’ve got the very real consideration of each and every bank, each and every exam, each and every schedule that you’re on. Each agency’s got to navigate that with the banks that they supervise. But I think it created some anxiety that, oh, as we go here, the agencies are going to diverge again. And what I hear you all saying is really, look, there’s first of all flexibility built into the thing, but a commitment to work on these things together on an ongoing basis.

Barr 37:47

Yeah, let me let me just reiterate that so it’s absolutely clear, we are 100% committed to working together on implementation, we already are looking ahead to implementation and working together, we’re going to stay tightly joined at the hip, not only on the process for saying what activities are eligible in the future, but all the hard work that’s required, we have to do examiner training, we have to develop an examiner manual, we have to develop tools that communities can use and banks can use to understand the performance context. We want to have dashboards that are accessible to the public and to the banks. So all of this work is going to require the three of us staying three organizations us personally, but the three organizations staying, you know, quite closely joined at the hip. And we’re firmly committed to doing that.

Van Tol 38:49

And as you said, the role of training really critical, important and important that people remain engaged along the way in this process. And certainly NCRC, we’ll be doing so. Marty, coming back to you, I’m sure you’ve heard some first impressions of the final rule, since its release. Anything that struck you so far about what you’ve heard any misconceptions, you think should be clarified, or points of emphasis that you think are evading people’s notice?

Gruenberg 39:24

It’s a little early, Jesse. People, to a certain extent, are still digesting the rule. So I sort of want to give people a little time. But I think I think the general reaction we’ve received is quite positive, certainly from the community organizations and civil rights groups, but I think initial feedback from the banking community, I think, has been fairly positive, although I want to, as I say, give them some opportunity to, to work their way through it. I think the thing the point I made previously, it is an ambitious rulemaking after 25 years, it should have been an ambitious rulemaking because so much has changed, that we really needed to adapt CRA. But what I really find appealing and perhaps it’s underappreciated is the amount of flexibility it gives to institutions to find new and innovative ways to serve LMI communities and to get CRA credit for it. And it’s a much more flexible rule than CRA has been in the past. And I honestly think the opportunity for banks and community organizations to partner with each other to take advantage of the opportunities that this rule provides, is something that, you know, is perhaps underappreciated. You know, I’ve been around a disturbingly long time, and I can actually remember, my first job, shortly after CRA was enacted. I was working for my local congressman in the Bronx. And I went to a meeting that was called by one of the community organizations where they invited the bankers. And, you know, these were groups of people who really did not know each other before. And one of the things CRA did over its history and NCRC, I think is an important example of this, is really bring community organizations and the banking industry together in a collaborative way. And I think this rule will provide more flexibility to take advantage of that, and I’m not sure people yet fully appreciate the possibilities there.

Van Tol 42:07

Some of the kinds of things I’ve heard just to kind of go deeper on this, you know, is the new rule, just about quantity as opposed to quality. We’ve already started to address this, the qualitative versus quantitative factors wanted to give you all a chance to follow up on that point.

Barr 42:26

I’m happy to say just a word or two about that, Jesse, I think that the important thing to us and this is consistent with what Mike and Marty have said, the important thing to us is that this is actually helping communities. And so that requires, in part, a quantitative approach, you can go with metrics, what’s going on, and whether banks are actually serving their entire community by looking in a quantitative way in a way that is transparent in a way that permits comparability across institutions. But also qualitatively, we want to know that this at work actually matters, that banks are doing innovative work, that banks are doing work that genuinely serves the community. And that requires qualitative inputs. And importantly, as we’ve been saying, especially inputs from the community that is being served, because that’s how you know whether the work is good. Is it is it actually serving the community? So community input is going to be essential. It’s why I mentioned at the outset that I think community input is also really important as we get into this implementation phase. Because we want to make sure as we’re training examiners, as we’re writing our exam books, as we’re doing the work online, that we get community input into that so it actually is useful to the communities that the statute is intending banks to serve.

Van Tol 43:53

Thank you, Mike. Michael Hsu, anything that has struck you as a misperception? Something that’s been unappreciated so far with the caveat is, as Chair Gruenberg said that people are still reading the thing. It’s still pretty early. But and, you know, there were a lot of concerns, even heading into the final rule that in combining, for example, committee development, lending and investment in the CD tests that it might disincentivize investment that’s been addressed in the final rule, things that people had fears and anxieties about that we think have been addressed, but anything that’s sticks out to you on that level.

Hsu 44:34

Well, like Marty, I think people are still digesting it, but one tagline you hear a lot is 1,500 pages, 1,500 pages. That seems to be the one factoid people have latched on to to implicitly criticize it. I think that it’s useful to think of it in the way that we talked about it earlier is that we really are trying to provide clarity, like that clarity, you know, community reinvestment is complicated. There’s there’s lots of different aspects to this. And we want to provide clarity on each of those parts. And by providing that clarity, there’s just a little bit both providing the flexibility that Marty was talking about, but also the certainty so that banks and community groups know that that investment that loan, that activity is going to help folks and is going to qualify. And it gets back to what Michael just referenced, we want to make sure that the outcomes are more activity is better targeted, and we can do it more quickly. And ultimately that’s going to be …if it takes 1500 pages to do that then that what it takes. I think that as folks digested that, that will be less of a fact, that will be less relevant to the fact then the fact that we really try to lay out pretty clearly how these things should go.

Van Tol 45:52

And I do point out to people, you know, the preamble is the bulk of the 1500 pages, the actual sort of legal rule language itself, a small minority of that, but very helpful to understand what was considered what wasn’t considered. So we’re going to return now, Michael Barr, to this to this really this notion of the retail lending assessment area is something that I think it’s gotten a lot of attention, a lot of conversation, you know, now evaluates lending done outside of branch networks. And that’s pretty significant. So for any large bank that hits a certain threshold, in a particular market and do more than 20% of their loans outside of the branch network, they’re now going to have a retail ending assessment that was scaled back to a degree in the proposal. Why was this needed change? Why is it the purpose of CRA? And what were the trade-offs? You also considered a deposit-based framework and opted to go with a retail-ending assessment area framework? What were the trade-offs that you considered as you did that?

Barr 47:13

Well Jessie, let me let me start getting a bigger picture way. We really took a ‘both and approach’ to looking at this. So it’s still the case that facility-based assessment areas, these are the areas around branches and deposit-taking at the end, those areas are still really, really critical to the rule. And we kept that focus that has been the focus of have on the rule for quite some time. So that approach stays. And then we add to it this more flexible approach for the activity that’s occurring outside of retail assessment, outside of the branch network. And as you pointed out, it really applies that section really applies for banks that are doing that predominantly, if they’re not doing at least 80% of their activity within their branch network, that rule applies. So it picks up activity that is important for some institutions, most institutions in the country do most of their lending within their facility-based assessment area. But it does have that flexibility, that Marty pointed out that in the future, as the system evolves, we’ll be able to, under the rule, capture that set of activity. Then we also pick up additional national lending through the outside lending areas. And that picks up quite a bit of activity. It’s not either in the retail lending assessment area or the facility-based assessment area. And then as we mentioned, nationwide, you can get consideration for community development activities. So that’s a way of making sure that the rule stays relevant. As the financial sector evolves. If there’s more online banking, if there’s more out-of-network, out-of-branch area lending. The rule automatically adjusts to pick up that kind of activity. And so I think that’s really, really quite critical for our approach, you know, in thinking about where to land on this, you know, there are lots of trade-offs involved. But we thought that the approach that we took, continues to have the focus on facility-based assessment areas overall, and only picks up retail lending assessment areas, if a bank is doing a significant amount of its lending outside of those facility-based areas, and that seemed to us a reasonable balance.

Van Tol 50:00

I’ll invite others in on this point. And also you’re gonna have new data. I mean, I think that’s really important new deposit data, new Community Development data, which also, I think informs the evolution of the rule in the future.

Gruenberg 50:17

Now, that’s why we come back to the it’s really a transformative change here. Getting the data so that we can develop benchmarks for performance will add a rigor to the evaluation in the retail lending area, as well as the branch-based. There will importantly complement the qualitative review. And I think both of these are important. The database, metrics and benchmarks capture a lot of the activity, but they don’t tell you the whole story. And there can be shortcomings in the data and things the data doesn’t capture. So you really need a qualitative aspect, which is provided in the rule, to complement imbalance, imbalance balance the data. And similarly, we talk a lot about the retail lending assessment areas. But as Michael pointed out, the foundation of bank activity remains in the branch-based area. And we do not want to lose our focus on that we rule specifically provides a valuation of banks, location of branches and LMI communities or a decision to shift the branch out of an LMI community that goes into the CRA evaluation. And we don’t want to look at only the physical location, but actually offering products and services beyond the branch location that are responsive to communities, including low-cost transaction accounts without overdraft fees to, you know, to get CRA credit and expand access to the banking system. So, you know, we’ve, we’ve tried to make this a balanced rulemaking, if possible, to strengthen CRA and in all of its dimensions, and then add a few.

Van Tol 52:23

Terrific. And I think I think that’s so important. One of the things we think is the way in which this rule moves the conversation forward in the past, you know, if a community organization were to comment on CRA performance, you sort of had to divine how the examiner came up with the exact grade and a lot of the debate was about well, what level of lending constitutes excellent or good? Or, you know, these sort of descriptive words that were used? I think now the conversation really shifts to okay, here’s a, here’s an expected level in terms of a clear benchmark. Now, can we really talk about the quality responsiveness impact of that lending? And clearly, you’ve raised the bar, I think the final rule estimates that, you know, if you were to retroactively apply it 10% of banks would get it needs to improve probably many of those banks will improve their performance and not reach that outcome, which I think is a real positive. So we’ve reached our time here, I want to thank the three of you all again, for your leadership, a major step forward, obviously, and certainly if you’ve been paying attention to the chat, lots of issues of interest, lots of future issues that people want to make sure addressed. And certainly, we’ll be doing a much deeper dive, we had here just an hour with the three of you to start to digest this rule, understand your thinking, what was important as people read it, so I just want to I just want to thank the three of you, again, for your leadership and acknowledge your staffs’ leadership. You know, we all get to sit here at the end and sit on the webinar, but for all of your staff, my staff, our members, many of people spent hundreds of hours, 1,000s of hours, formulating this rule, offering their input into this rule, a process that in its very nature involve compromise and considering different perspectives and it’s a significant achievement to have navigated that that process has died under its own weight several times before, so to stand here at the finish line, as you’ve all said, a very significant moment. So thank you, again for your work to bring CRA into the 21st century. Something that in the short term raises lots of questions about transition and how do we know how we’re going to do before we do it for the first time, but I think in the long term brings a lot of clarity, transparency, and indeed, simplicity if I might even use that word to certain factors within CRA while raising the rigor in difficulty and other ways that we think are very responsive to community. Not that we’re pleased with all aspects, certainly things we advocated for didn’t make it, I think we will continue the conversation about racial equity in the context of CRA and in other contexts as well. But just want to acknowledge those as well. So those of you on the webinar, we appreciate your participation. Today, I want to remind you that this is just the beginning, you’ll receive a follow-up email from us. We appreciate your weighing in on what was most important to you. And we want to remind our members to register for our deep dive, December 7 webinar and all of you to invite you to join us, April 2 to 4 in Washington, DC at the 2024 Just Economy Conference, we expect we’ll have ongoing conversations about all of this. And then a reminder to follow us on social media. So once again, just want to thank the three principals of the agencies today for taking time out of their very busy schedules on short notice to be here with us. And with that we will close. Have a great weekend, everyone.