The Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) are proposing regulatory changes to the Community Reinvestment Act (CRA) that make it easier for banks to get an “Outstanding” rating while underserving people and communities with low- and moderate-incomes (LMI) that it was meant to help.

Under the new proposed CRA list of qualifying activities, financing for affordable rental housing intended for middle-income households in “high-cost” counties would qualify as CRA credit to banks under their community development obligations.[1] What this means is that banks will get as much credit financing the construction of affordable rental housing designed for middle-income individuals and families as they would for rental housing focused on low-income individuals and families.

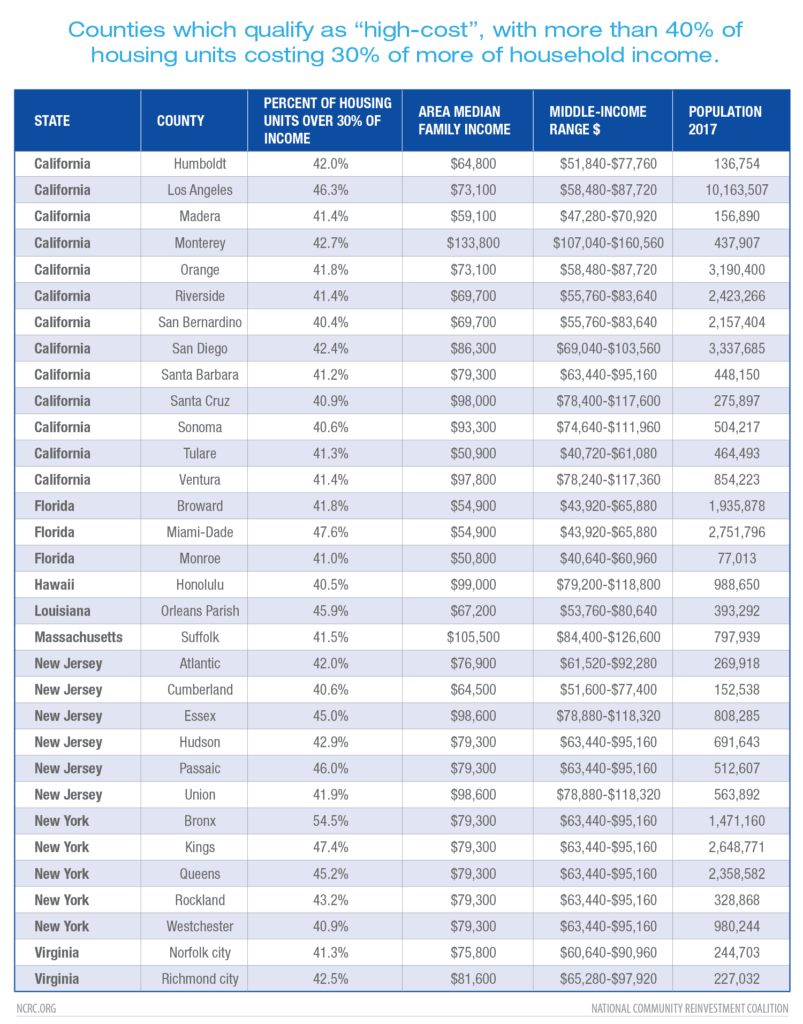

This change would impact 32 counties across the U.S., including some of the most populous ones, encompassing 43 million people or 13% of the United States population. The impacted places are cities like Los Angeles, San Diego, Miami and most of metropolitan New York. The list encompasses not only cities, but places like Humboldt, Madera and Tulare counties in California. These areas are included not because of high housing costs but most likely because low-income levels are driving up cost burden ratios. These are rural places of high poverty, in which low-income housing is crucial. What will be the incentive for banks to provide community development loans or investments to build rental units for low- and moderate-income families in these areas, when they can finance more profitable rental housing for middle-income families and get the same credit?

The list shows the impacted counties, and the income range for what qualifies as middle-income in these areas:

(Source: American Community Survey 1-year table B25106 and S0101, FFIEC Median Family Income report 2019 https://www.ffiec.gov/medianincome.htm)

[1] High-cost is defined in the proposed regulation as a county in which 40% or more of the households pay 30% or more of their monthly income for housing.