The Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) have proposed changes that would dramatically alter the Community Reinvestment Act (CRA) examination of banks. Their proposal would create a metric, called the CRA evaluation measure, that would be the dominant measure for determining a bank’s rating. As long as a bank passed its lightly weighted retail lending test, the bank’s overall CRA rating would be what it had achieved on the evaluation measure.

The CRA evaluation measure consists of a ratio of CRA lending activities divided by total deposits. Per the agencies’ proposal, a bank’s ratio of activities to deposits would need to be 11% to earn Outstanding and 6% to earn Satisfactory. Ratios below 6% would result in the bank failing its exams.[1]

A critical question is whether this ratio would stimulate increased retail lending to low- and moderate-income (LMI) borrowers and communities. The National Community Reinvestment Coalition (NCRC) devised a method to estimate the percentage of retail lending to LMI people and communities that would be needed for a bank to achieve the ratios associated with Outstanding and Satisfactory. (A further explanation of the methodology is in the appendix below).

NCRC found that the use of a CRA evaluation measure as proposed by the agencies would likely result in lower percentages of retail loans to borrowers and communities with LMI. This is contrary to an important objective of CRA reform, which should be to boost safe and sound retail lending to underserved communities.

Methodology

This study estimated the percentage of retail lending for LMI borrowers or communities at the enterprise level, consisting of lending for all of the geographical areas in which banks operate A forthcoming analysis will examine the impact of the proposed rule changes in specific metropolitan areas.

Using call report data for each bank, NCRC downloaded deposit data that would form the denominator of the CRA performance measure.[2] NCRC then multiplied the dollar amount of deposits by 11%, the portion of deposits needed to be devoted to CRA activities including retail lending for LMI borrowers and communities in order for a bank to obtain an Outstanding rating. NCRC also multiplied deposits by 6%, the portion of deposits needed to be devoted for CRA activities including retail lending for LMI borrowers and communities in order for a bank to obtain a Satisfactory rating.

Under the Notice of Proposed Rulemaking (NPRM), the FDIC and OCC required banks to devote a minimum of 2% of their deposits to community development activities.[3] In order to focus on retail lending alone, NCRC subtracted an additional 2% from the dollar amounts derived by multiplying deposits by 11% or 6%. This adjusted figure would then be the dollar amount of deposits that a bank would need to devote to LMI retail lending. The tables below also show the unadjusted figures when the analysis did not account for community development activities. The adjusted and unadjusted figures provide a possible range of percentages needed for retail lending.

NCRC created a sample of 15 very large banks for which community development lending and investing levels from recent exams were tabulated. NCRC also calculated the banks’ percentage of branches that were in LMI tracts. NCRC adjusted the level of their deposits that needed to be devoted to retail lending for LMI borrowers and communities by subtracting community development financing and a fraction of their branching in LMI census tracts per the procedure set forth in the NPRM.[4] For a second sample of 100 large banks, NCRC applied the community development minimums of 2% and a fraction of their branching in LMI census tracts.

Formula in brief

- Calculated dollar amount of deposits required for Outstanding and Satisfactory ratings

- Adjusted to take into account community development minimums or levels in sample of 15 very large banks

- For a subset of banks, adjusted for % of branches in LMI tracts

- Divided dollar amount of deposits by dollar amounts of retail lending

NCRC divided the dollar amount of deposits needed for LMI retail lending by the total dollar amount of retail lending for each bank obtained from call reports. The result of this ratio would be the percent of lending for LMI borrowers and communities needed for either Outstanding or Satisfactory ratings. NCRC calculated median percentages of LMI retail lending needed for passing ratings for various categories of banks.

Findings

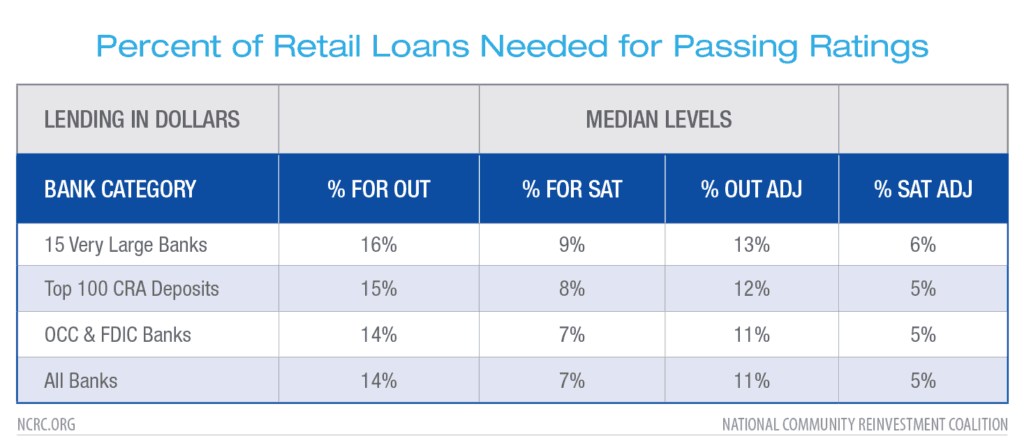

Overall, a low percentage of loans for LMI borrowers or communities would be needed to obtain CRA ratings of Outstanding or Satisfactory. In Table 1 below, the columns “% Out. adj.” and “% Sat adj.” (these columns subtract required community development minimums from deposits) revealed that all banks would need to issue a median of just 11% of their retail loans to either LMI borrowers or communities in order to obtain an Outstanding rating. All banks would need to make a median level of 5% of their retail loans to LMI borrowers or communities to obtain a Satisfactory rating. Retail lending refers to home, small business/farm and consumer lending (see appendix for further details).[5]

Compared to smaller banks, larger banks would need to increase modestly their percentage of retail lending for LMI borrowers and communities. For example, the “Outstanding ajd.” columns revealed that the top 100 banks in terms of deposits would need to issue a median level of 12% of their retail loans to LMI communities and borrowers in order to achieve an Outstanding rating compared to 11% for all banks regulated by the OCC and the FDIC.

Very large banks consisted of a sample of 15 banks. The very large banks had similar requirements for retail lending as the top 100 banks in terms of deposits: median levels of 13% and 6% of their loans to LMI borrowers and communities for Outstanding and Satisfactory, respectively.

The first two columns of Table 1, “% for Out.” and “% for Sat.” show the percentage of loans for LMI borrowers and communities required for Outstanding and Satisfactory ratings, respectively, when not adjusting for community development financing and branching. NCRC displayed the unadjusted results since a lack of publicly available data prevented a precise calculation for community development financing for each bank. The adjusted and unadjusted columns present a range of the likely percentages of retail loans for LMI borrowers and communities needed for passing ratings. This report focused on the percentages in the adjusted columns.

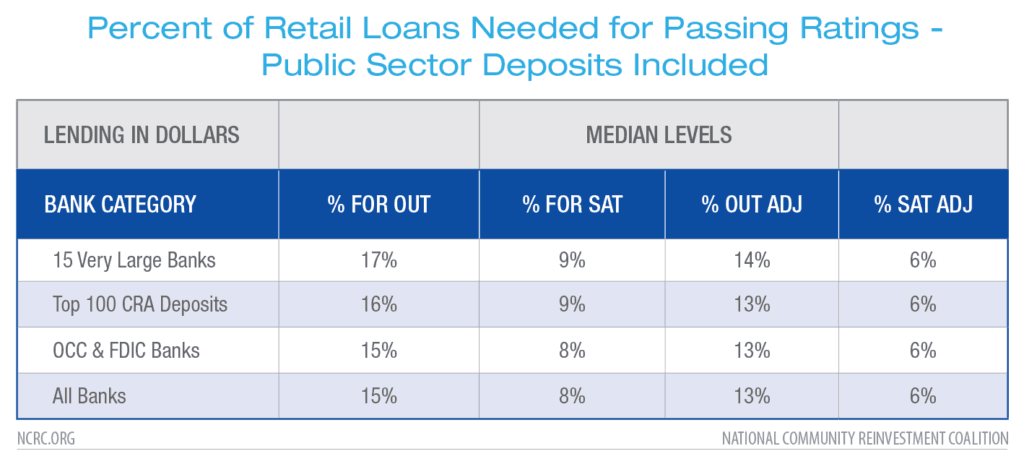

Table 2 shows the percentages required for Outstanding and Satisfactory ratings when deposits were not adjusted by subtracting municipal deposits. The FDIC and OCC proposed to subtract brokered deposits, foreign-based deposits and municipal deposits from the base of deposits to be utilized for CRA purposes.[6] The Call Report data has an entry for public sector deposits but it combines municipal, state, county and local housing authority deposits. Since it was not possible to isolate municipal deposits for this analysis, NCRC performed the calculations including public sector deposits as well as excluding them. The requirements become modestly more stringent when including public sector deposits, for example, increasing from 14% to 15% for retail loans for LMI borrowers and communities required for Outstanding for all banks in the “% for Out.” column (compare Table 1 & 2).

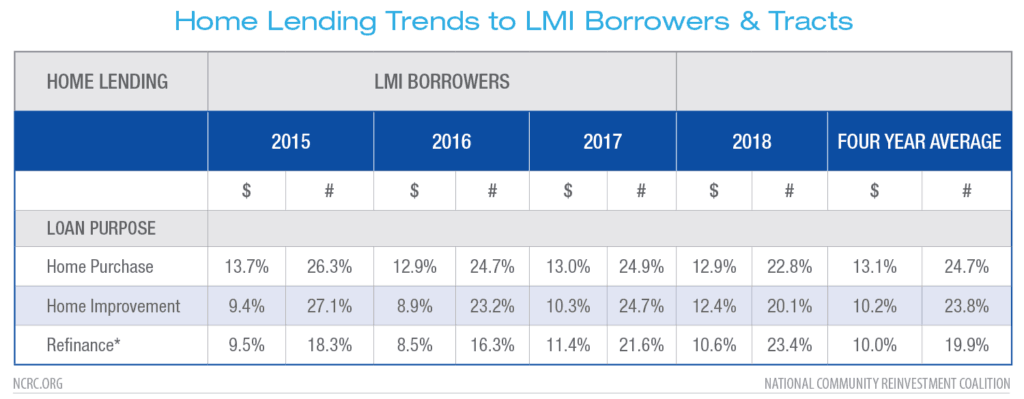

Comparing the portion of retail loans needed for Outstanding and Satisfactory to retail lending for LMI borrowers and communities in the recent past further reinforced the conclusion that the CRA evaluation measure established modest targets that would be unlikely to boost retail lending for LMI populations. For home lending, the percentage of loans for LMI borrowers over the last four years for which data was available ranged from 13.1% for home purchase lending to 10% for refinance lending (the CRA evaluation measure would use dollar amounts of loans so percentages in terms of dollar amounts to LMI borrowers were used for the analysis calculations). Table 3 shows both loan count and dollar amount percentages.

The percentages of 10% to 13% for LMI borrowers were approximately in the range required for Outstanding ratings for various categories of banks, however, they were considerably above the ranges required for Satisfactory ratings. Thus, for about 90% of banks that typically earn Satisfactory ratings in recent years, no additional effort would likely be required in terms of retail home lending to pass muster for the CRA evaluation measure. Also, they could most likely decrease their home lending for LMI borrowers and still achieve a passing rating.

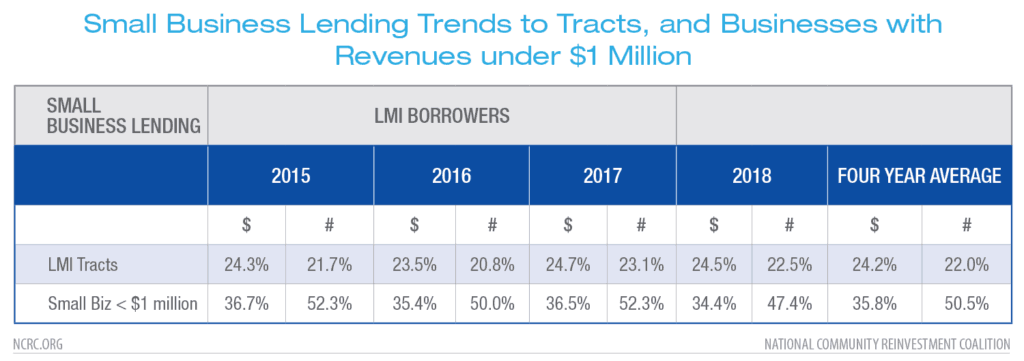

For small business lending, banks would most likely be able to relax considerably their lending in LMI tracts and to the smallest businesses with revenues under $1 million. The four-year average, in terms of percentage of loan dollars, was 24.2% of bank loans in LMI tracts and 35.8% of bank loans to small businesses with revenues less than $1 million (see Table 4). The percentage of loans for the smallest businesses in recent years was more than twice the upper estimates of the percentage of retail loans needed for an Outstanding rating under the CRA evaluation measure while the percentage of loans in LMI tracts was also much larger than the percentage of loans needed for an Outstanding rating.

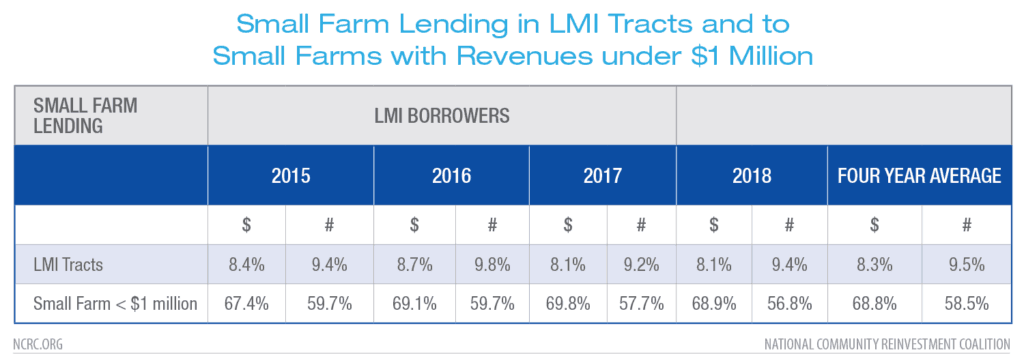

Banks would likewise relax their small farm lending. Table 5 revealed a four-year average of 8.3% of bank small farm loans in LMI tracts (LMI tracts are most likely under-counted in rural areas since absolute income levels are lower than urban areas. This is one reason why percent of loans in LMI tracts was lower in rural than urban areas). Nonetheless, the 8.3% figure is generally higher than percentages needed to obtain Satisfactory ratings (see columns in the tables above regarding adjustments for community development lending and branches). Moreover, a very high percentage (almost 69% of loan dollars) serve small farms with revenues less than $1 million. This substantial portion of loan dollars for the smallest farms would most likely decline under the CRA evaluation measure approach because it provides motivations for larger loans.

These findings are tempered by two considerations. First, the publicly available data does not reveal the percentage of consumer and credit card loans for LMI borrowers, so this analysis was unable to compare that with the CRA evaluation measure requirements. Second, the OCC and FDIC proposal would also institute a retail test requiring comparisons between banks in terms of their percentage of loans to LMI borrowers and communities. The retail test might compensate somewhat for what appears to be a relaxing effect of the CRA evaluation measure. However, the retail test would not only compare banks against a demographic benchmark but would compare banks against each other. A bank would only need to pass either a demographic or peer comparator. Thus if all banks were induced by the CRA evaluation measure to relax their retail lending to LMI borrowers and communities, they could still pass their retail test. Despite consideration of the caveats, the proposal still appears to be a prescription for relaxing LMI retail lending.

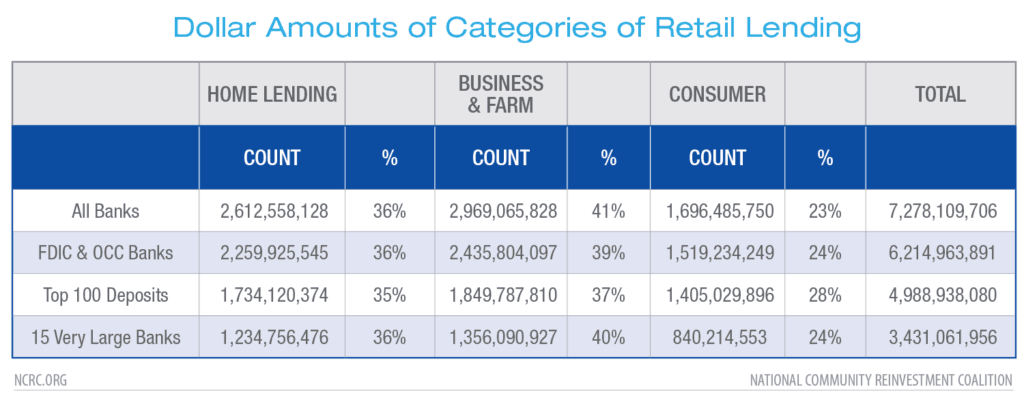

In addition, Table 6 revealed that total home, business and farm lending constituted about three fourths of total retail lending for each category of banks. Unless the percent of credit card and consumer lending to LMI borrowers and communities is quite low, it would seem that the CRA evaluation measure expectations for percent of dollars of retail lending for LMI borrowers and communities would be too low.

Conclusion

The CRA evaluation measure would likely encourage banks to decrease their retail lending to LMI borrowers and communities. After taking into account community development financing minimum requirements (and branching for a sample of very large banks), the percentage of retail lending for LMI borrowers and communities (expressed in dollars) ranged from 11% to 14% for Outstanding ratings and 5% to 6% for Satisfactory ratings for banks of various sizes under different assumptions regarding deposits. In comparison, the aggregate percentage of bank loans for LMI borrowers, census tracts and small businesses and farms during the last four years ranged from 10% to 24% to 68%. Comparing actual bank lending to CRA evaluation measure requirements suggests a large likelihood of banks relaxing their lending to LMI borrowers, communities and very small businesses.

Caveats to this analysis included the lack of publicly available data on the percent of consumer, credit card and automobile lending for LMI borrowers and communities. However, NCRC analysis found that unless the percentage of consumer lending for LMI borrowers and communities are very low, the conclusions of the analysis are unlikely to change since consumer lending is typically about one fourth of retail lending offered by banks. Another caveat involved data limitations associated with Call Report data that the agencies proposed using for CRA evaluation measure calculations. As discussed above and in the appendix, the Call Report data is not compatible with some of the choices the agencies have made in their definitions of retail lending and deposits. NCRC ran the numbers using two definitions of deposits to account for these shortcomings. Also, our choices regarding retail lending are described and most likely err on the side of increasing the percentages of LMI retail lending required under the CRA evaluation measure.

Overall, the agencies’ lack of transparency in assessing the impacts of the proposed rule and the CRA evaluation measure supports the position that the proposed rule must be rescinded. This analysis, despite data shortcomings, revealed an unjustified approach taken by the CRA evaluation measure that would likely result in less lending to LMI borrowers and communities. The FDIC and OCC must join with the Federal Reserve and propose a rule in which the data is complete and can support a transparent analysis of the likely impacts of the proposed rule.

Appendix

Retail Lending

Included Categories

Below are the choices this analysis made regarding Call Report categories to include as retail lending. The choices were made to conform as closely as possible to the definition of retail lending in the NPRM.

- Residential one-to-four unit family construction lending[7]

- Residential one-to-four unit family loans for home buyers or owners

- Commercial and industrial loans including those to small businesses

- Non-farm, non-residential loans secured by owner’s property. Property secured loans including those to small businesses

- Loans secured by owner’s farm land

- Farm loans to finance agricultural production and other loans to farmers

- Credit card loans

- Automobile loans

- Other loans to individuals that are not credit card or automobile loans. This includes single payment, installment and student loans.

Excluded Categories

A number of loan categories were excluded from retail lending. The excluded categories were:

- General construction loans

- General real estate lending

- Non-farm, non-residential property secured loans in which the property appeared to be owned by larger corporations and chains. This also included cases where the primary source of repayment would be rental income associated with the property.

- Multifamily residential real estate. This is excluded because this type of lending would be considered community development lending under the NPRM and would not be on the proposed retail lending test. The NPRM refers to HMDA loans to individuals in estimating CRA evaluation empirical benchmarks.[8] Most multifamily lending is to corporate owners.

- A consumer lending category that would have led to duplication since credit card lending was included in the category described above.

- A Call Report category called “related plans” that included loans related to overdrafts. CRA should not encourage this type of transaction so NCRC chose to exclude it.

Sample of Fifteen Very Large Banks

NCRC tabulated levels of community development lending and investment of 15 very large banks using their most recent CRA exams as of fall of 2018 when NCRC conducted a previous analysis. NCRC annualized the community development lending and investment for this analysis. The brevity of the current NPRM comment period precludes an update of this analysis. NCRC multiplied the community development financing by two per the procedure described in the NPRM.[9] Incomplete information in the CRA exams preclude a precise application of the NPRM multiplier. However, applying a multiplier of two for all community development activity most likely did not change results significantly since the median level of community development for the 15 banks was close to 2% or the community development minimum required by the NPRM.

[1] Office of the Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC), Joint Notice of Proposed Rulemaking (NPRM), Community Reinvestment Act (CRA) regulations, Docket ID OCC-2018-0008 & RIN 3064-AF22, https://www.regulations.gov/document?D=OCC-2018-0008-1515, p. 1218.

[2] See https://www7.fdic.gov/sdi/main.asp?formname=customddownload to download Call Report data. The most recent data at the time of this analysis was from December 2019.

[3] NPRM, p. 1218.

[4] NPRM, p. 1221.

[5] NPRM, p. 1219.

[6] NPRM, p. 1218.

[7] NPRM, p. 1211.

[8] NPRM, p. 1221.

[9] NPRM, p. 1214.