Executive Summary

- NCRC developed a new ratings system for quantitative measures on banks’ community development financing under CRA. Our suggested ratings could increase community development lending and investment between $15 billion to $28 billion annually.

- This type of financing is critical to communities as they recover from the COVID-19 pandemic. In response to the pandemic, the federal banking agencies have emphasized community development financing that builds or expands health clinics, increases the food supply, increases internet access as well as financing small businesses and affordable housing.

- NCRC finds a large number of banks that make little or no community development lending, suggesting that a more strenuous ratings system can significantly increase this important resource for communities.

- For each quantitative performance measure, NCRC’s suggested ratings reform would award ratings based on how a bank compares to the aggregate peer (a category of banks with similar asset levels or business models).

Introduction

The Office of the Comptroller of the Currency’s (OCC)’s two most recent comptrollers, Joseph Otting and Brian Brooks, claim without evidence that the OCC’s Community Reinvestment Act (CRA) reform proposal will generate more loans and investments for community development, particularly for communities ravaged by COVID-19. The National Community Reinvestment Coalition (NCRC), along with the great majority of the commenters on the OCC’s final CRA rule, disagree, explaining that the OCC’s proposal will divert funding away from low- and moderate-income (LMI) neighborhoods by broadening the range of activities that count to include those that have tangential benefits for LMI neighborhoods.[1]

Instead, NCRC has recommended an approach that will make CRA ratings more rigorous. This white paper describes NCRC’s suggested rating system and discusses our forecasts of increased dollars for LMI neighborhoods. The paper focused on community development (CD) financing. CD financing targets affordable housing, economic development projects and community facilities in LMI neighborhoods. In response to COVID-19, the agencies have recently emphasized financing that provides health clinics, increased broadband access or improves the food supply to LMI neighborhoods.[2]

NCRC provides forecasts based on two scenarios of how banks would respond to NCRC’s grading scale. The baseline of CD lending and investing for large banks (above $1.252 billion in assets) and intermediate small banks ($313 million and $1.252 billion in assets) is $159 billion for 2018, the last year for which data is available.[3] We estimated that banks will respond to a more rigorous rating scale by increasing their annual CD financing by $15 billion to $28 billion. While these forecasts cannot be rigorously tested, CD financing would increase significantly under exams that increase accountability since such a large number of banks now offer little to no CD lending and investing.

The distribution of performance was skewed with several banks making little or no community development (CD) loans or investments and several making such loans at relatively high levels. NCRC suspects that the agencies have been lax in their examination of CD financing, in that:

- the agencies have not sufficiently reviewed and mandated improvements to bank reporting of CD finance data

- a number of banks with high levels of CD financing likely are loading up on types of large-scale financing that is not the most responsive to community needs

Background

Community development financing involves projects that have a neighborhood-wide impact. CRA examines retail lending to individual homebuyers, homeowners and small business owners. In addition, CRA exams for intermediate small and large banks scrutinize CD financing which is also needed to revitalize and stabilize neighborhoods by providing affordable housing, economic development, small business development and community facilities like health clinics needed by neighborhood residents.

On an annual basis, the Federal Financial Institutions Examination Council (FFIEC) provides the public with aggregate levels of CD lending and CD lending totals for banks that undergo exams as large banks or intermediate small banks. The FFIEC does not collect data on CD investments, which include investments in Low Income Housing Tax Credits (LIHTC) or Small Business Investment Corporations (SBICs). NCRC estimated investment levels for each bank by using the Federal Reserve database on a sample of CRA exams that has annual CD lending and investing levels.[4] We calculated that investments, on average, were 35% of CD loans.

Proposed NCRC Rating System

As described in previous reports and comment letters, NCRC has suggested an approach that awards a rating on a quantitative performance measure based on how a bank compares to its aggregate peer or peer group of lenders. The percentages below indicate how a bank’s ratio of CD financing divided by deposits compares to the peer. For example, if the peer group issued CD financing that was 1.5% of deposits, a bank would score outstanding if its ratio of CD financing to deposits was greater than 100% of the aggregate peer of 1.5%.

Below are possible ranges relative to the aggregate peer performance:

- Outstanding: greater than 100% because the bank would be better than its peers.

- High Satisfactory: 80% to 99% because the bank would be approximately in line with its peers.

- Low Satisfactory: 60% to 79% because the bank would be below its peers, but not so far below to be considered not satisfactory.

- Needs to Improve: 40% to 60% because the bank would be at approximately half the level of its peers.

- Substantial Noncompliance: 39% and lower because the bank would be far below the level of its peers.

Findings

Baseline

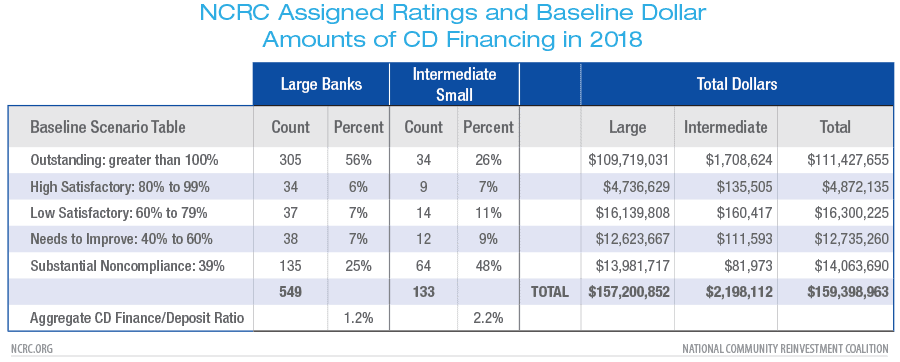

In 2018, 549 large banks and 133 intermediate small banks reported CD lending data. NCRC calculated that the large banks offered $157.2 billion in CD financing and the intermediate small banks offered $2.2 billion in CD financing for a grand total of $159.4 billion in CD financing as shown in Table 1.

Table 1 also shows how NCRC’s ratings system would distribute ratings to the banks on a CD measure. It is important to remember that the CD measure is just one of several measures that would be on a CRA exam. For purposes of this paper’s forecasting exercise, we assumed that a bank would want to pass its CD measure so it would have a better chance of passing its CRA exam. Table 1 shows baseline results of how the banks performed in 2018. Subsequent tables describe scenarios that analyze how banks might react to the NCRC’s ratings scale and how ratings and CD dollar amounts could change.

The bottom row of the table shows that the aggregate ratio of CD finance to deposits was 1.2% for large banks and 2.2% for intermediate small banks. The aggregate ratio refers to adding the CD finance dollars for all banks in a given category and dividing it by deposits for all banks in the category. The ratio for large banks was smaller, probably because their deposit base was often much larger than intermediate small banks.

In the table, banks rated Outstanding have ratios of CD finance divided by deposits greater than 1.2% for large banks or 2.2% for intermediate small banks. A finding that jumped out from the table is the high portion (56%) of large banks scoring Outstanding. They were either engaging in a high number of CD loans or investments, large dollar values of these activities, or both. Without more detailed publicly available data on CD lending, it’s hard to know what is driving the increase in dollars but average loan size for CD lending data has been increasing over the years.[5] Like large banks, a high portion (28%) of intermediate small banks are also scoring Outstanding under NCRC’s rating system. In contrast, about 10% of banks have received the overall Outstanding ratings in recent years.[6]

Although Outstanding ratings would increase under NCRC’s proposed rating system, CRA ratings would not be inflated since these ratings would apply to just one part of the CRA exam. As Table 1 shows, banks’ most recent CD lending practices would produce a low percentage of Satisfactory-rated banks and high percentages of banks with failed ratings. Only 13% of large banks and 18% of intermediate small banks would be rated as either High or Low Satisfactory on the CD part of the exam. In contrast, about 88% to 90% of banks have received overall Satisfactory ratings in recent years.[7]

On the other ends of the scale, an extraordinary 25% of large banks and 48% of intermediate small banks would receive Substantial Noncompliance ratings from NCRC’s rating system. Overall, less than 1% of banks receive this overall rating on an annual basis under the current system.

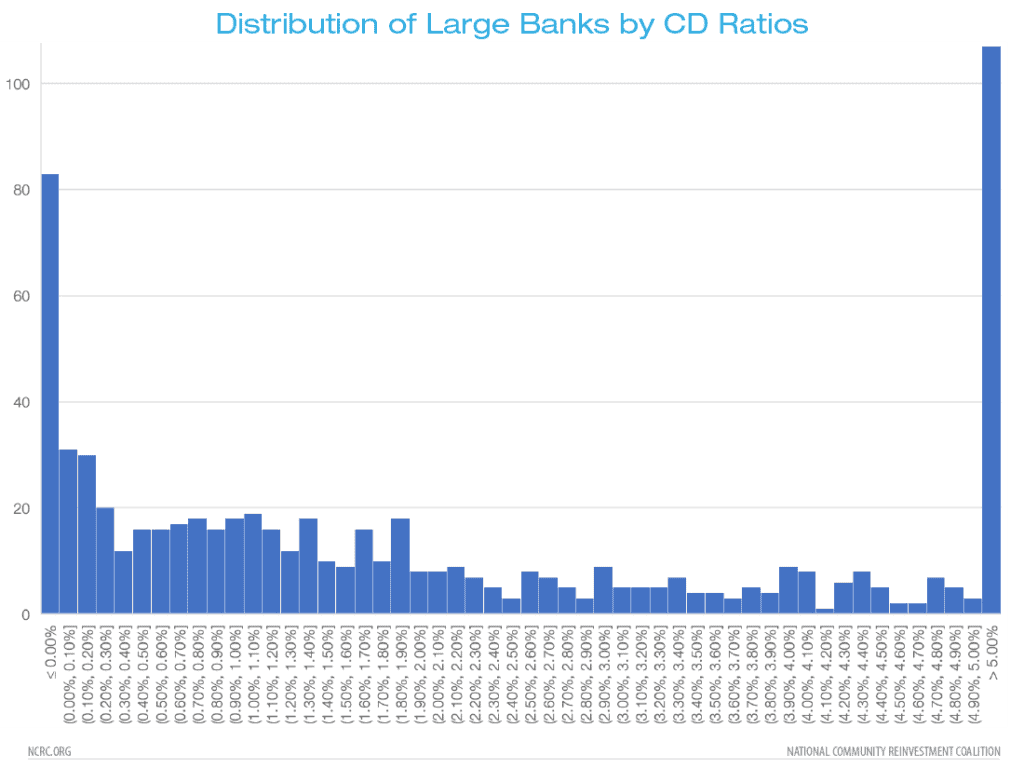

The unusual shape of the histogram for large bank ratios in Table 2 below helps explain the odd ratings distribution. More than 80 banks did not offer any CD finance. On the other end of the scale, 107 banks had CD to deposit ratios above 5%. The high ratios for Outstanding banks was consistent with Outstanding banks offering about $111 billion or 70% of the total CD financing as shown in Table 1. Table 2 shows clearly that several banks offered high levels of CD finance while several offer little to none. In contrast, the numbers of banks offering middling levels of CD finance, which would merit the Satisfactory ratings, were small.

Of the 90 banks not offering any or miniscule amounts of CD lending in 2018, FDIC-regulated banks numbered 42, followed by 30 OCC banks and 18 Federal Reserve banks.[8] While the FDIC might have been the most lenient in terms of CD financing, the high number of banks offering zero or nominal amounts of CD financing suggests that CRA examination of CD lending was lax across all agencies. An interagency Q&A on CD lending pointed to the lax nature of examining CD lending. Regarding levels of CD lending, it stated:

For example, in some cases community development lending could have either a neutral or negative impact when the volume and number of community development loans are not adequate, depending on the performance context, while in other cases, it would have a positive impact when the institution is a leader in community development lending.[9]

The allowance for a neutral impact and lowered expectations if examiners determined that economic conditions made CD lending difficult in banks’ assessment areas has resulted in banks passing their lending tests and CRA exams even if they made little or no CD lending. In contrast, NCRC’s rating system would be a quantitative and more transparent measure that would not be as tolerant of banks that completely forgo CD lending. The CRA exam would also have qualitative components under NCRC’s proposal as described in our comment letter to the OCC. The quantitative measures would count for 70% to 80% while the qualitative components would count for 20% to 30% of the grade, making it unlikely that banks that offer few or zero CD loans could pass muster on their tests.

The limited qualitative component would be necessary to ensure that CD lending, like all CRA activities, are responsive to a community’s needs. For example, the total dollar value alone lacks basic information on the categories of CD lending such as whether the lending was for affordable housing, economic development or community facilities. If a bank was located in an area with very high levels of unemployment but only engaged in CD lending for affordable housing, a high score on a quantitative measure would be counterbalanced by a lower score on qualitative measures. As mentioned above, the average size of CD loans has increased over the years. Again, the paucity of data does not allow the public to judge whether larger loan sizes per se are responsive to local community needs or finance lower-priority activities.

The total CD financing levels were so high for some banks with Outstanding ratings that it seems as though the large size of financing deals likely inflated ratings. Alternatively, the agencies may not have been scrutinizing the data submitted by the banks sufficiently. NCRC found high ratios of CD financing divided by deposits including one as high as 39%, which should trip into safety and soundness concerns.

The final OCC rule would exacerbate the incidence of large deals by designating a ratio of total CRA activity divided by deposits as the dominant measure on CRA exams, instead of one of several measures.[10] In particular, NCRC was concerned that financing large-scale infrastructure projects such as interstate bridges could skew the CRA evaluation ratio upwards.[11] An unresolved question due to data limitations is the extent to which this is already occurring.

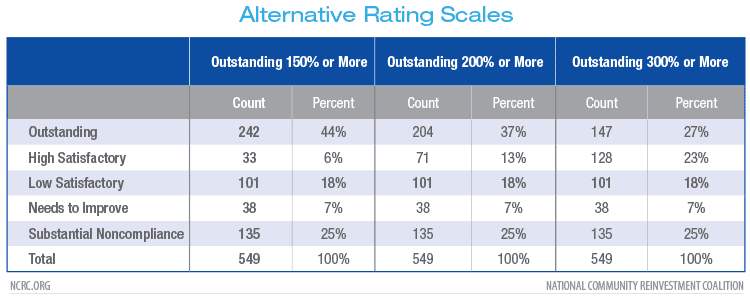

Table 3 shows that NCRC’s suggested rating system would have to be adjusted upwards by a significant amount in order to reduce the incidence of Outstanding ratings to 27%, which would still be high. The right hand side of the table shows the number and percent of banks in each rating category when Outstanding is more than 300% the aggregate peer. High Satisfactory would be greater than 125% to 300% of the peer, and Low Satisfactory would 60% to 125%. In the other two scales, the low end for High Satisfactory would remain at 125% and its high end would be adjusted to be just below the low end for Outstanding.

Despite possible issues on the high end of the performance, the findings suggest that considerable room for improvement is possible. In addition to the high numbers of banks with zero levels of CD financing, 189 banks have ratios below .5% of total CD financing which is less than one half of the aggregate ratio for large banks.

Scenarios

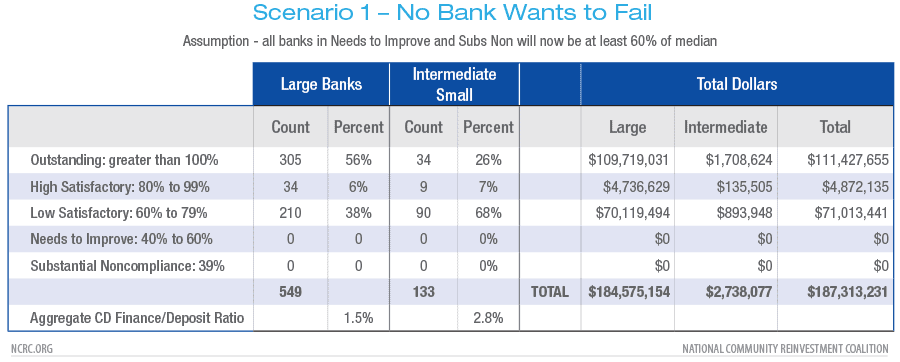

NCRC estimated that our ratings system would prompt several of the low-performing banks to improve performance. Since a third of large banks and more than half of the intermediate small banks would receive the two lowest ratings under NCRC’s proposed system, many of them would want to improve so that they will not be failing a major part of their exam. In Scenario 1 displayed in Table 4, NCRC assumed that all failing banks would want to pass. This was consistent with 98% of banks currently passing their CRA exams. Under this scenario, banks in the Substantial Noncompliance and Needs-to-Improve categories would want to boost their performance and earn, at least, a Low Satisfactory rating. They would adjust their CD to deposits ratio to at least 60% of the aggregate peer level. The table shows that total CD finance would increase from approximately $159 billion to $187 billion for an increase of $28 billion on an annual basis.

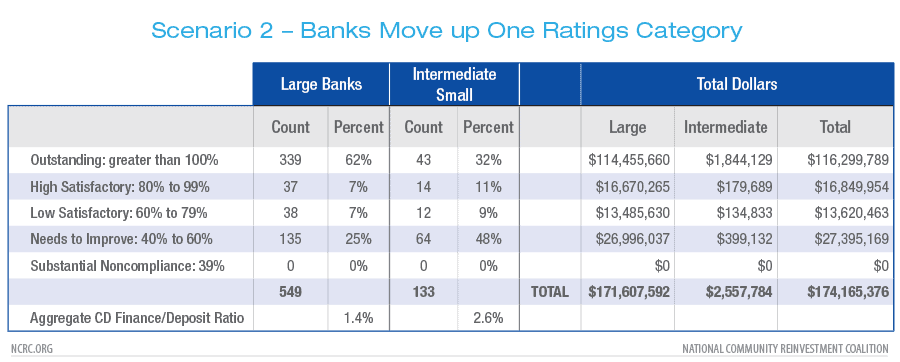

Table 5 below shows Scenario 2, which assumed that banks would respond to the NCRC ratings system by moving up one ratings category. The total annual CD finance dollars would increase from $159 billion to $174 billion or $15 billion more. Scenario 1 generated a higher estimate because it assumed that no bank would want to fail while Scenario 2 produced several banks in the Needs-to-Improve category.

Conclusion

This white paper illustrates that rigorous CRA reform would generate significant increases in CD lending and investing for communities devastated by the COVID pandemic. A new and more rigorous rating scale would surely motivate the large numbers of banks that provide zero or nominal dollars in CD financing to make more CD loans and investments. NCRC estimated a range of $15 billion to $28 billion more in annual CD financing. Tougher CRA enforcement will result in significantly more CD financing. This paper also found the need for enhanced data reporting since it is hard to tell if the high dollar amounts of CD financing made by banks on the Outstanding end of the scale were the most responsive to local needs.

[1] Josh Silver, Comments On Proposed CRA Rule: Pause And Go Back To Drawing Board, April 22, 2020, https://ncrc.org/comments-on-proposed-cra-rule-pause-and-go-back-to-drawing-board/

[2]Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, Joint Statement on CRA Consideration for Activities in Response to COVID-19, https://www.occ.gov/news-issuances/bulletins/2020/bulletin-2020-19a.pdf; Federal Reserve Board, Consumer Affairs Letters, CA 20-10: Community Reinvestment Act (CRA) Consideration for Activities in Response to the Coronavirus, https://www.federalreserve.gov/supervisionreg/caletters/caltr2010.htm

[3] Federal Deposit Insurance Corporation, Federal Reserve Board of Governors, Office of the Comptroller of the Currency, Agencies release annual CRA asset-size threshold adjustments for small and intermediate small institutions

, December 21, 2017, https://www.federalreserve.gov/newsevents/pressreleases/bcreg20171221a.htm

[4] Federal Reserve Board, CRA Analytics Data Tables, https://www.federalreserve.gov/consumerscommunities/data_tables.htm

[5] NCRC calculations of CD lending data obtained from the FFIEC webpage. The average loan size ranged from $2.2 million to $2.7 million from 2010 through 2014 and $3.4 million to $3.8 million from 2015 through 2018.

[6] NCRC produced a table with CRA ratings from 1990 through 2019, see Josh Silver and Jason Richardson, Do CRA Ratings Reflect Differences In Performance: An Examination Using Federal Reserve Data, NCRC May 27, 2020 https://ncrc.org/do-cra-ratings-reflect-differences-in-performance-an-examination-using-federal-reserve-data/

[7] Ibid.

[8] Due to the high number of banks involved, this report does not review actual CRA exams to derive totals for either CD lending or investing. Without reviewing each of the 90 CRA exams for banks that did not make CD loans, it is not possible to know how many of these banks also did not offer qualified investments. Reviewing the exams would be a difficult task since many of the exams would not necessarily cover the year 2018. We would still have to make some assumptions about 2018 investment levels in the cases of exams not covering that year.

[9] See Q&A §__.22(b)(4)—2: on page 48538, Interagency Q&A on the Community Reinvestment Act, Federal Register, Vol. 81, No. 142, Monday, July 25, 2016

[10] NCRC, Analysis Of The OCC’s Final CRA Rule, June 15, 2020, https://ncrc.org/analysis-of-the-occs-final-cra-rule/

[11] Ibid.