INTRODUCTION

The Community Reinvestment Act (CRA) has leveraged trillions of dollars of loans, investments and services for low- and moderate-income (LMI) borrowers and communities. Since 1996, banks have made more than $1 trillion in community development loans, which finance affordable housing, economic development projects and community facilities for LMI communities. Likewise, banks have issued more than 27 million small business loans totaling just over $1 trillion in LMI communities since 1996.1

This success is due in part to banks’ accountability to local communities required by CRA. Under CRA, federal examiners evaluate and rate bank lending, investment and services to LMI borrowers and neighborhoods. Examiners are required to consider public comments when conducting their evaluations. The geographical areas on CRA exams are called assessment areas (AAs), which are generally metropolitan areas or rural counties where banks have branches. Examiners conduct performance context analysis, which determines the impacts of demographic and economic factors on credit needs in AAs. Public comments about needs and conditions inform examiner performance context analysis. It is this emphasis on local needs and conditions that is key to CRA’s success in leveraging a high level of loans and investments that are responsive to the needs of LMI communities.

Although the designation of AAs have effectively promoted bank lending and investment, changes in the industry have prompted calls for reform to AA designation procedures. An increasing amount of lending has been occurring outside of branch networks via brokers, the internet and loan officers located outside of branches. Community organizations and some banks have proposed designating AAs in geographical areas beyond branches where banks make a substantial amount of loans.

Another issue with AAs has been bank interest in pursuing community development loans and investments beyond AAs. Current CRA examination procedures have allowed banks to make loans and investments in states and regional areas containing their AAs, provided they have first satisfied the needs in their AAs. In other words, a bank is permitted to make a community development loan in the same state or regional area that contains their AAs. Consideraton of community development outside of AAs has created considerable debate as some stakeholders believe that these procedures are not applied consistently, are not flexible enough and therefore remain a constraint.

This study scrutinized the CRA exams of the top 50 largest banks in terms of assets. It focused on whether AAs appear to constrain community development lending and investing. Changes to a regulation, including AA procedures, that has achieved success in promoting bank responsiveness to local needs must be executed carefully and must be informed by study and data analysis. This report built upon a previous National Community Reinvestment Coalition (NCRC) white paper, CRA and Geography, that was released in 2017.2 References will be made to the previous report.

SUMMARY OF FINDINGS AND RECOMMENDATIONS

A sizable number of the top 50 banks requested and received favorable CRA consideration for community development lending and investing beyond their AAs. In the case of investments, approximately half of the banks received favorable consideration for investments beyond their AAs. Given this high percentage, it is questionable whether a complete overhaul of AA procedures are necessary. Instead, this paper recommends an incremental approach. Through improved data collection on community development lending and investments, the agencies can evaluate whether AAs are receiving sufficient community development lending and investments at regular intervals in between CRA exams and can then pre-qualify banks for outside AA community development financing. In addition, NCRC recommends that the agencies annually develop a list of underserved counties that banks can serve outside of their AAs.

NCRC major findings include:

- Three-fourths of the CRA exams reviewed by NCRC were conducted in a timely manner (approximately every three years) described in examination procedure memos.3 The outliers involve exams conducted by the Comptroller of the Currency (OCC). At the time of this research (first quarter of 2019), the most current OCC exams for the largest six banks in the country were either 2011 or 2012.

- A high percentage of the large banks in this sample earned the highest rating: 30% of the banks had Outstanding ratings. The percentage of Outstanding ratings was very high on the Investment Test (60%).

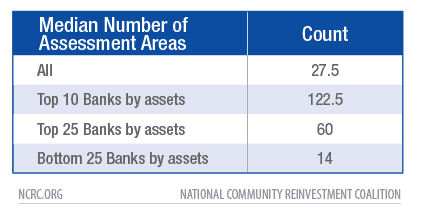

- The top 10 banks had a median number of 122.5 AAs. There was a significant decline in AAs after the top 10 banks. When considering the top 25 banks by asset size, the median number of AAs was 60. The median number of AAs of the bottom 25 banks was 14.

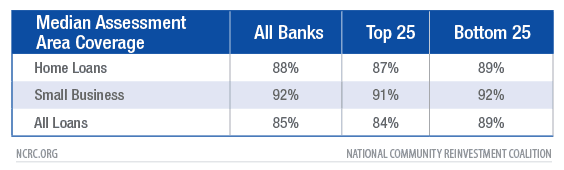

- AAs covered the great majority of home lending and small business lending by the banks in this sample. The caveat, however, was that the CRA regulation did not allow lending by affiliates to be considered when calculating the percentage of AA lending. A high percentage of affiliate activity was considered on CRA exams, but affiliate retail lending was considered less frequently than affiliate community development activity.

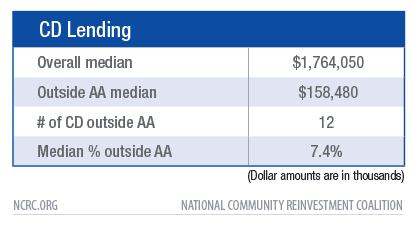

- The median amount of community development lending was $1.7 billion, and the median amount outside of AAs was $158 million. The median amount of community development investment was $351 million, and the median amount outside of AAs was $50.9 million.

- The median percent of community development loans over three years compared to assets was 2.29%. For investments, it was .8%. Banks below the median percentage of investments per assets made a much greater percentage of their investments (median of 22%) outside of their AAs than banks above the median percentage of investments (9%).

- This investment pattern outside of AAs was contrary to the intent of the Interagency Question and Answer (Q&A) document that states that outside AA investment is allowed when banks are adequately meeting needs within their AAs. Indications of the reverse situation: poorer performers, at least as measured by investments compared to assets, were seeking to boost their ratings by turning to outside AA investments. A further indication of gaming was the very high percentage of Outstanding ratings on the Investment Test. Reform proposals must consider the likelihood of gaming and must ensure that banks are making investments outside AAs only when they have met local needs in AAs. In contrast, community development leading did not present this type of gaming.

CHARACTERISTICS OF SAMPLE

The research for this report was conducted in the first quarter of 2019, during which time the CRA exams were retrieved. Some banks in this report may have subsequently had a more recent exam. As described below, the substantial majority of CRA exams occurred between 2015 and 2017.

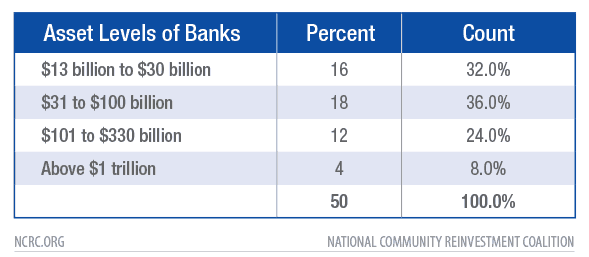

Asset sizes

The sample consists of 50 of the largest banks in terms of asset size — including the top four banks in the country — each with more than $1 trillion in assets at the time of their most recent CRA exams. The next 12 banks have assets between $104 billion and $330 billion. The next 18 banks range in assets from $30 billion to $90 billion. The last 16 banks have assets ranging from $13 billion to $28 billion.

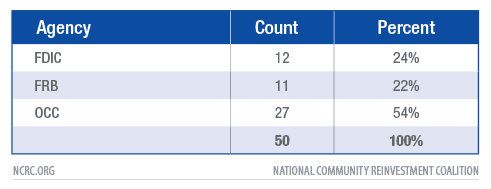

Agencies conducting exams

Of the 50 banks, the OCC examined 27 (54%). The Federal Reserve Board (FRB) evaluated 11 (22%) and the Federal Deposit Insurance Corporation (FDIC) conducted exams for the remaining 12 (24%).

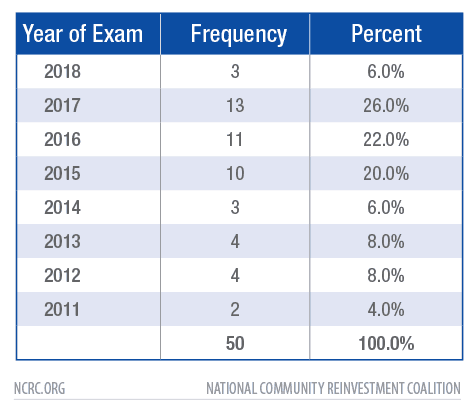

Frequency of exams

CRA exams are typically on a three-year cycle. Since this report was researched in the first quarter of 2019, the agencies would be performing exams in a timely manner if the great majority of exams were conducted between 2016 and 2019. The agencies conducted a little over half of the exams (54%) between 2016 and 2019, with another 20% completed in 2015. Seven exams (14%) occurred between 2014 and 2013, while six more (12%) occurred in 2011 and 2012.

The OCC conducted the six oldest exams with two occurring in 2011 and four in 2012. Among the seven exams occurring in 2013 and 2014, the OCC conducted four, the FDIC conducted two and the FRB conducted one.

Overall, about three-fourths of the exams occurred between 2015 and 2018, which is within an acceptable time period in terms of holding banks accountable. The OCC conducted a disproportionate number of the remaining 25%. In the last few years, the OCC implemented reforms in order to produce more timely exams, but continued progress is needed.

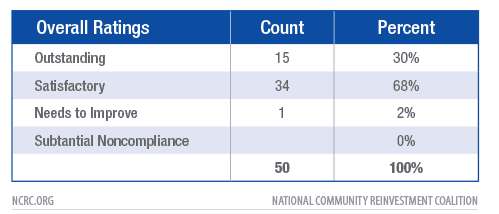

Ratings distribution

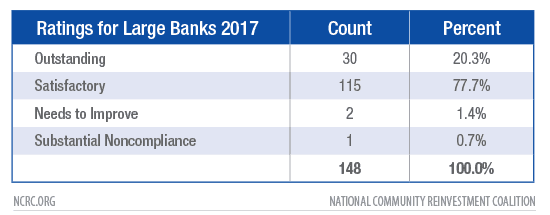

A relatively high percentage of banks (30%) received the highest possible rating of Outstanding. Almost 70% received Satisfactory. Only one bank failed its exam.

Five banks were downgraded due to violations of fair lending or consumer compliance laws. CRA examiners found violations in the case of four other banks but did not downgrade them. The CRA regulations provide examiners with discretion regarding whether banks will experience downgrades. The examiners are to judge the extent of the violations and whether the banks took corrective action.

Component test ratings distribution

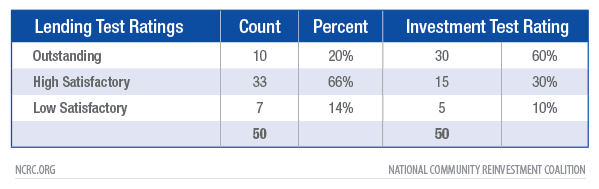

As discussed below, this report focused on community development lending and investing. The two-component tests of the large bank exam that scrutinize these activities are the lending test (for community development lending) and the investment test (for qualified investments that this paper will call community development investments).

The component tests have possible High and Low Satisfactory ratings in contrast to the overall ratings. The table below shows clearly that very large banks had an easier time scoring Outstanding on the Investment Test as opposed to the Lending Test. A high percentage (60% of the very large banks) scored Outstanding on the Investment Test. In contrast, 20% of the same banks received Outstanding on the Lending Test. In other words, very large banks in this report were about three times more likely to receive the highest rating on the Investment Test than the Lending Test. None of the banks received Needs-to-Improve or Substantial Noncompliance on the component tests.

This study was not able to conclusively judge whether the ratings on the investment test were inflated, but such a high Outstanding rating was unsettling. Would a lower percentage of Outstanding ratings stimulate either more investments or investments more responsive to the needs of AAs? Below, we considered evidence about whether Investment ratings are inflated and could be made more rigorous.

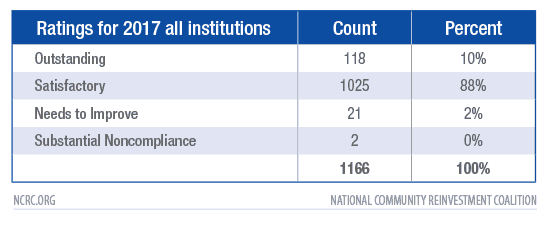

Overall industry ratings

The very large banks in this study also fared quite well compared to all other banks receiving ratings during 2017,4

which was chosen as a comparison year since the plurality of the study’s banks (26%) were examined during it. Just 10% of all banks of all asset sizes examined during 2017 received the highest rating of Outstanding. Narrowing the sample size, 20% of large banks (with assets above $1.226 billion) had Outstanding ratings.5  The very large banks in this study beat out their slightly smaller counterparts, with 30% receiving Outstanding ratings. A significant policy issue is whether this ratings distribution is warranted or whether lower percentages of Outstanding ratings for the largest banks would stimulate them to make more loans and investments in LMI communities.

The very large banks in this study beat out their slightly smaller counterparts, with 30% receiving Outstanding ratings. A significant policy issue is whether this ratings distribution is warranted or whether lower percentages of Outstanding ratings for the largest banks would stimulate them to make more loans and investments in LMI communities.

.

Assessment areas

The very largest banks had a much greater number of AAs than their peers. The top 10 banks had a median number of 122.5 assessment areas. The top three banks by asset size were further separated from the rest and even from the top 10 in terms of the numbers of AAs, ranging from 388 to 209.

The number of AAs fell off considerably beyond the top 10 banks. When considering the top 25 banks by asset size, the median number of AAs was 60. The median number of AAs of the bottom 25 banks was 14.

Thirty-four banks had below 50 AAs, and 26 banks had below 30 AAs. The relatively small number of AAs for even the top 50 banks was informative for policy purposes. Some stakeholders have cited the regulatory burden of CRA. However, it would seem that the number of geographical areas assigned as AAs for the largest banks in the country with tens of billions of dollars of assets is a reasonable examination scope that these banks can withstand without undue cost.

Evaluating how many AAs are full scope furthers understanding of how comprehensive CRA exams are. Full scope AAs undergo more comprehensive exams and are weighted more in determining ratings than so-called limited scope AAs. The median percentage of AAs that were full scope was 36%. In other words, just one-third of the AAs underwent a comprehensive examination. The largest banks by asset size had a smaller portion of AAs being full scope. The top 10 banks had a median percentage of 24%, while the bottom 25 had a median percentage of 45%.

While stakeholders will differ on the optimal percentage of full scope AAs, it would seem that half or more than half of the largest banks AAs should be full scope without undue burden. For the bottom twenty-five, more than half would appear to be feasible since they have considerably fewer AAs. More full scope AAs would make CRA exams more rigorous. Also, another objective would be to ensure that smaller metropolitan areas and rural areas have a fair share of AAs that are full scope. As indicated in NCRC’s previous study, rural areas were much more likely to be designated as limited scope AAs.6 The OCC instituted random methods for assigning full scope status to AAs, which provided better odds for rural and smaller metro AAs to be full scope.7 In addition, CRA examination procedures state that examiners should consider a bank’s market share in determining full scope status.8 A large bank can make a relatively small portion of its loans in a rural area but still have a dominant position as one of the largest lenders in that area. That area then becomes a candidate for full scope status given the importance of the bank.

Stakeholders have had animated discussions about AA coverage of retail lending. In an era where banks are increasingly lending via non-branch means such as the internet, some stakeholders have asserted that AAs based on branches is outdated. This analysis has suggested that for the top 50 banks, this concern may not be immediately pressing. The vast majority of retail lending – both home and small business – was covered by the AAs for all banks in the sample. The caveat was that the percentage of loans in AAs does not include affiliates per CRA regulatory procedures. Some of the affiliates could be large loan volume mortgage companies. However, these results were consistent with other studies that suggest that AAs capture about 70% of bank home lending.9

This analysis was not to suggest that assessment area reform was not a priority. NCRC has advocated for several years that AAs must be retained for geographical areas where branches are located and be added for geographical areas where banks are making considerable numbers of loans beyond their branch networks. The agencies should adopt AA reforms sooner rather than later in order to anticipate changes in lending channels rather than playing catch up with the market years later.

Affiliates on CRA exams

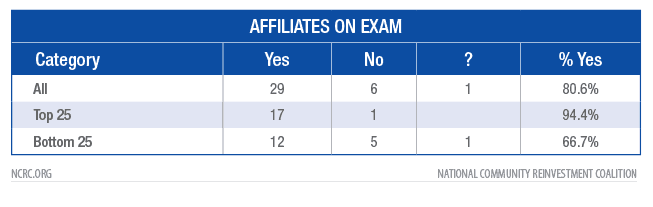

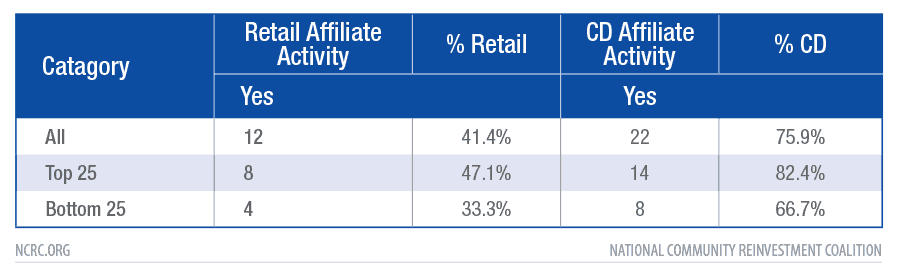

The vast majority (80%) of the banks in this study with affiliates opted to have them included on their CRA exams. The largest banks were more likely to include affiliates, with the top 25 banks including 94% as opposed to two-thirds of the bottom 25 banks.

In terms of activity types, affiliates conducting community development financing were more likely to be on CRA exams than those engaged in retail lending. For all banks in the sample that included affiliates on their exams, 41% included retail lending affiliates while 76% included affiliates engaged in community development financing. The splits were similar for the top and bottom 25 banks.

COMMUNITY DEVELOPMENT FINANCING

This section of the report developed various measures of community development lending and investment. The main purpose was to determine whether current assessment area procedures facilitate or constrain community development financing. An Interagency Question and Answer (Q&A) document contains the most detail about treatment of community development financing outside of assessment areas. The Q&A document states that retail banks can seek favorable consideration of community development financing outside of their AAs provided they have met needs for community development inside their AAs.10

The CRA regulation defines community development as affordable housing, economic development with a focus on small business, community facilities or revitalization and stabilization of LMI tracts, distressed middle-income rural tracts and communities recovering from natural disasters. Community development financing can take the form of either a loan or an investment. An example of a community development loan is a construction loan for affordable housing for LMI households. Other examples include investments in Low Income Housing Tax Credit (LIHTC) developments or Small Business Investment Corporations (SBICs).

Banks will seek favorable consideration for community development financing outside of their AAs in response to opportunities and/or market conditions. Banks have stated that vigorous competition has driven up the price of investments in LIHTCs in some large city AAs, while needs for affordable housing are plentiful in small metropolitan areas or rural counties outside of their AAs. Banks have also stated that CRA examiners are inconsistent in their application of AA procedures. Some have asserted that examiners are inconsistent in determining when banks have met needs in their AAs and when they received favorable consideration for community development financing outside of their AAs.

This report was unable to definitely determine whether AA procedures prevent needed community development financing. However, by observing data from 50 CRA exams, this report could offer educated guesses about the status of community development financing inside and outside of AAs and some policy recommendations.

Community development lending

The median community development lending amount for the banks in this study was $1.76 billion dollars. CRA exams did not always report aggregate dollars for community development lending. This report found that 28 exams out of the 50 reported aggregate figures (for the other exams, it would be necessary to tally community development lending dollars for several assessment areas in order to derive a total figure. This report did not attempt to do this).

The median dollar amount outside AAs for 12 CRA exams that reported this information was about $158 million. The median percentage of community development lending outside of AAs was 7.4%. Twelve exams constituted 24% of this report’s sample. However, a higher number of banks sought favorable CRA consideration for community development lending outside of AAs. This report found seven additional banks, all overseen by the OCC, sought CRA credit for outside of AA community development financing. These banks were not included in the study’s calculations because the exams did not present aggregate community development lending outside of the AAs.

The report found some banks with very high percentages of community development loans outside of AAs. These included one bank with 27% of its community development lending outside of its AAs and two banks at 15% each.

If regulators were consistently implementing the Q&A guidance on outside AA community development lending, banks with higher than median levels of community development lending would also have higher than median levels of lending outside of AAs. One of the quantitative measures of the lending test is the dollar amount of community development lending. Therefore, a bank should have a relatively high level of community development lending in its AAs before it ventured outside of its AAs to engage in community development lending.

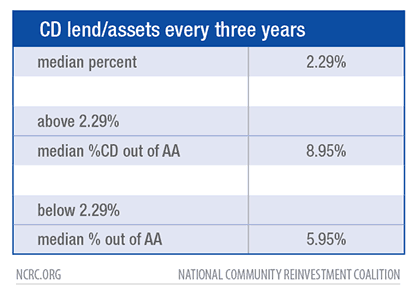

This report found that for this sample of banks, the Interagency Q&A was implemented appropriately in the case of community development lending. Banks in the sample had a median level of community development lending over three years of 2.29% of their assets. Banks above this median level of community development lending also had a higher median percent of community development lending outside of their AAs of 8.95%. Banks with below median percent of community development lending per assets also had a lower median percent of lending outside of their AAs of 5.95%.

Overall, the median percent of community development lending outside of their AAs was relatively low, suggesting that it would not unduly boost CRA ratings for the banks (it might make a difference between High Satisfactory and Outstanding, but it is unlikely to boost a failing rating to a passing rating or make the difference between Satisfactory and Outstanding).

Community development investments

CRA exams include consideration of current and prior community development investments (also referred to as qualified investments in the CRA regulations). Current investments refer to investments occurring in the period covered by the current CRA exam. Prior period investments refer to investments that occurred during the period covered by the bank’s previous CRA exam. CRA examination procedures provide favorable consideration for prior investments since these investments remain on the bank’s balance sheet and remain a commitment of the bank’s capital. CRA exams separately document and analyze current and prior investments.

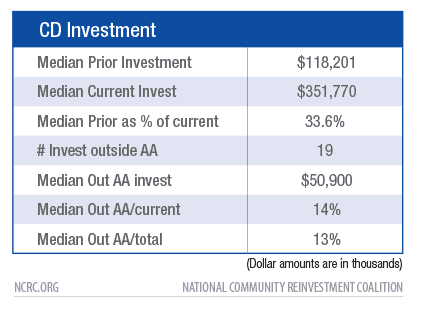

The median prior investment for the 29 banks with aggregate data on investments was $118 million, and the median current investment was $351 million. The dollar amount of prior investments represented about 33.6% of current investment dollar amounts.

Nineteen banks had aggregate data on investments outside of AAs. More banks pursued outside AA investment opportunities as discussed above. With that said, 38% of the large banks in this report sought out and reported on outside AA investments. The median dollar amount of outside AA investments was almost $51 million. The median investment outside of AAs was 14% of current investments and 13% of total investments (prior plus current). Banks with a high percentage of investments outside of AAs included one bank at 71%, one bank at 31%, one bank at 30% and one at 29%.

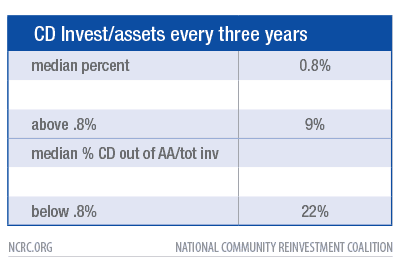

This report provided initial data suggesting that outside AA investments could be contributing to CRA ratings inflation. The median investment (prior and current) over three years was just under 1% (.8 %) of assets. Banks with below this median investment percentage were making more investments outside of their AAs at 22%. In contrast, banks above the median investment percentage were making a lower percentage of their investments (9%) outside of their AAs.

It seems inconsistent with the interagency Q&A that banks with relatively low ratios of investments to assets were the banks making a higher percentage of investments outside of AAs. CRA exams use both the dollar amount of investments and ratio of investments to assets to evaluate whether banks are meeting needs in their AAs. When a bank is below median performance, presumably the bank needs to work harder to increase investments in its AA. However, in this sample of the largest banks, the below median performers were not enhancing relatively good performance in their AAs, but might have been using outside AA investments to boost their mediocre performance on the quantitative criteria. This possibility of outside AA consideration contributing to grade inflation is consistent with the disproportionate percentage of banks receiving Outstanding ratings as described above.

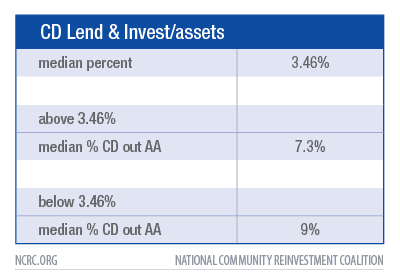

When considering community development lending and investments together, the pattern is repeated. The lower than median performers used outside AA community development financing to boost their performance. The median ratio of community development financing (loans and investments) to assets was 3.46%. The banks below this median ratio of financing to assets had a median of 9% of their community development financing outside of AAs. In contrast, the banks above the median ratio of financing to assets had a median of 7.3% of their community development financing outside of AAs. Smaller differences for community development lending reduced the sharper differences among above and below median performing banks in investments outside of AAs. However, the possible gaming on the investment test still overcame the absence of manipulation in the community development lending part of the lending test.

.

CASE STUDIES OF CRA EXAMS: Community development financing outside AAs

Case studies of CRA exams will provide additional indications of whether the patterns of community development financing outside AAs are appropriate per the guidance in the Interagency Q&A or whether the patterns could indicate gaming behavior. While a bank may have motivations to game the system, it is unclear why an examiner would count questionable community development financing for which the bank is seeking favorable consideration. Perhaps, examiners may feel pressure from their regulatory agencies to pass banks.

Community development investments: West coast bank

A west coast bank’s CRA exam seemed to include abuses associated with outside AA investment activity. In fact, it appeared that if the examiner did not consider the outside AA investment activity, the bank would have failed its CRA exam.

The bank is a FDIC-supervised institution that had assets of $24.7 billion at the time of its CRA exam.11 The bank grew significantly in size after its acquisition of another bank. The west coast bank serves 30 AAs in the five states of Oregon, Washington, California, Idaho and Nevada. On the 2016 exam, it received a High Satisfactory on the Lending Test, a Low Satisfactory on its Investment Test and a Needs to Improve on the Service Test. The major reason why the bank failed its Service Test was that it closed 77 branches in the wake of its recent acquisition.

The bank was on the precipice of failing its CRA exam and would have done so had it also failed its Investment Test. It eked out Low Satisfactory on its Investment Test due to its high level of outside AA investments. Of the $247.6 million in current and prior investments, the bank made $176 million or 71% outside of its AAs in a broader regional area encompassing its AAs. The bulk of its outside AA investments ($144 million of $176 million) consisted of Mortgage Backed Securities (MBS). MBS are purchases of loans that other banks make to LMI borrowers. Most CRA exams, including this one, do not consider MBS to be particularly innovative or complex. Thus, the examiner allowed the bank to bulk up on a type of investment outside of its AAs that was not considered innovative. It was clear that without MBS and outside AA investments, the bank would have failed its Investment Test since outside AA investments were more than 70% of total investments.

The other downside of this allowance for outside AA investments was that the examiner left the bank off the hook for responding to a variety of community needs. The CRA exam includes a table of the breakdown of investments by type, which revealed that the bank committed $222 million to affordable housing, $19 million to community development services including financial education, $5.4 million for activities that revitalized and stabilized neighborhoods and just $129,000 for economic development. If the examiner had not allowed the bank to bulk up on MBS, the bank would have been compelled to satisfy a diversity of needs across its 30 AAs and would have likely increased its attention to economic development and revitalizing and stabilizing neighborhoods.

Community development lending: Southern bank

At the time of its CRA exam conducted by a Federal Reserve Bank, the southern bank had $21.6 billion in assets, 198 branches and operated in 35 AAs across seven southern states. The bank had a Satisfactory rating overall with High Satisfactory on its Lending, Investment and Service Tests.

The bank’s dollar amount of community development lending was $602 million and $164 million of it was outside of its AAs. It had a high percentage (27%) of its community development lending outside of its AAs.

Unlike the west coast bank, however, the southern bank was not gaming its Lending Test by seeking to conduct a disproportionate amount of its community development lending outside of its AA. Overall its ratio of community development lending divided by assets was 2.28%, which was about the median percentage for the banks in this study. Therefore, the southern bank was not trying to boost a low ratio by engaging in outside AA community development lending. Furthermore, unlike the west coast bank, its outside AA financing was not dominated by one activity like MBS financing. It offered $11 million in affordable housing financing and $136 million in Small Business Administration (SBA) construction loans outside of its AAs. Overall, inside and outside AA community development activity was mixed with healthy amounts of financing for affordable housing, community services, economic development and revitalization activities. In contrast, the west coast bank’s financing was skewed towards housing as it was permitted to load up on MBS investments.

REFORM PROPOSALS FOR OUTSIDE AA COMMUNITY DEVELOPMENT FINANCING

As stated above, the CRA reform discussion has prominently featured the issue of favorable consideration of community development financing outside AAs. Over the years, banks have complained about examiners inconsistently applying the Q&A guidance regarding outside AA community development financing. The data presented in this paper raises questions about how difficult it is to garner favorable consideration for outside AA community development financing. For community development lending, the study found data for 24% of the banks. For community development investments, we found data for 38% of the banks. In addition, seven banks overseen by the OCC sought and received outside AA favorable consideration but the CRA exams did not present aggregate data on dollar totals for community development financing overall or financing outside AAs. However, adding these seven banks to the numbers receiving favorable consideration for outside AA investments suggested that about half of the banks in the sample received favorable consideration for investments made outside AAs.

With half of the largest banks in the country receiving consideration for outside AA community development financing, is it as difficult to receive favorable consideration as the CRA reform discussion makes it out to be? Furthermore, this report has uncovered evidence that the procedures for qualifying outside AA community development was abused in some cases. Favorable consideration for outside AA financing must be reserved for banks that are meeting needs in their AAs. This report has found evidence that some very large banks with below median levels of community development financing were receiving favorable consideration for outside AA financing. It is debatable whether these banks have first met needs in their AAs. Moreover, the case study above described a bank with mediocre and failing ratings on component tests receiving favorable consideration for a very large percentage of community development financing in just one activity that the examiner did not consider innovative or complex.

The upshot of the findings in this report was that reforms encouraging even more outside AA consideration of community development financing must be carefully targeted and transparent in order to reach truly underserved communities and avoid grade inflating abuses.

Three proposals have gained prominence during the CRA reform discussion so far: allowing banks with Satisfactory ratings to receive automatic consideration for outside AA community development financing; establishing a limit on outside AA financing but automatically granting favorable consideration up to that limit; and having separate AAs for retail lending and community development financing.

Each of these proposals are discussed in turn:

Banks with at least Satisfactory ratings: A number of bank trade associations in their comments on the OCC’s Advance Notice of Proposed Rulemaking (ANPR) promoted automatic consideration for outside AA community development financing for banks with Satisfactory ratings on their previous CRA.12 The proposal has some intuitive appeal. If a bank received at least Satisfactory ratings either overall or on all of its component tests, it must be meeting the needs in its AAs, according to some observers.

The shortcoming of this proposal, however, is that CRA performance may have changed since the previous exam either overall, on the component tests or in various AAs. Therefore, a bank that is not performing in a Satisfactory manner in community development in its AAs could be allowed to pursue community development financing outside of its AAs. In contrast, we have described a procedure below that uses more current data than the previous CRA exam for determining whether a bank is eligible to venture outside of its AAs and engage in community development financing.

A cap of outside AA community development financing: A cap such as a percentage of total community development financing that could be outside of AAs is appealing in that it appears to be straightforward. However, a cap is arbitrary. In some cases, too high of a cap would allow banks to skirt needs in their AAs. In other cases, too low of a cap would prevent banks that have met needs in AAs to engage in community development financing in other underserved areas.

This report documented a wide range of community development financing outside of AAs as discussed above. Whereas the median percentage of community development financing outside an AA was 7% of total community development lending and 13% of total investments, some banks were at 30% or higher for both types of financing. Should the cap be at median levels or higher? Any decision would appear to be arbitrary and could prevent a bank from meeting community needs in underserved areas.

Separate AAs for retail lending and community development lending: In a speech at the NCRC Just Economy conference this past March, Federal Reserve Governor Lael Brainard addressed the concept of separate AAs for retail and community development lending and investing.13 She discussed retaining the existing AA delineation procedures for retail lending, which generally consist of designating counties or metropolitan areas as AAs where banks have branches. She then hinted that banks of a certain “scale” could have AAs for community development activities that would include states in which banks have branches. She states:

Community development activities, in order to achieve an appropriate scale, often operate in larger areas that may not neatly overlap with a bank’s assessment area. A more expansive and ex ante clearer community development assessment area definition would afford CRA consideration for any such activity in a state where the bank has an assessment area. This approach would help eliminate uncertainty and could encourage more capital for affordable housing, community facilities and economic development activities in underserved areas. Moreover, a broader assessment area for community development activities could help address the concentration of investment dollars in metropolitan areas where several banks may have branches, while other smaller metropolitan and rural areas remain chronically underserved.

My recent visit to the Pine Ridge Reservation in South Dakota brought home the importance of addressing the problem of credit hotspots and deserts that result from the CRA’s current assessment area definition. I met with the Thunder Valley Community Development Corporation and viewed their impressive 34-acre mixed-use project to create a new commercial center for the reservation. When completed, it will include single-family and multifamily housing units, a boarding house for visitors, a community center and a retail shopping area in a community where residents currently must drive an hour to reach a grocery store. In examining a list of all the project funders, it was noticeable that there were active financing commitments from many foundations, but no banks. Although this is likely to be a very impactful investment, there is only one bank currently whose assessment area may extend to Pine Ridge. In contrast, under the proposed community development assessment area approach, more of the banks with branches in Aberdeen, South Dakota, for instance, might be inclined to make such a community development loan with confidence it would get CRA consideration.

The governor discussed how statewide AAs could reduce the presence of hotspots with concentrations of community development financing as well as deserts such as rural areas with a paucity of community development financing. Another issue has been whether several AAs such as 50 or 100 may result in banks finding easier activities to finance such as purchasing MBS rather than responding to pressing or unique needs in each AA. Community development financing is a complex undertaking which can require on-site presence or an infrastructure of sophisticated nonprofit organizations or local government agencies. Not all AAs will have this readily available infrastructure; as a result, banks may resort to easier activities.

The reference to scale in the governor’s speech indicates sensitivity to the issue of scrambling to find community development opportunities across several AAs. Determining a threshold such as the number of AAs may require more research. For example, does the quality of community development financing decline after a certain number of AAs is reached. Critical analysis of CRA exams would be necessary to make this determination. As stated above, the median number of AAs of the top 50 banks in this study was 27.5, the top ten was 122 and the bottom 25 was 14. If a threshold was to be chosen, this study directs the agencies to look more critically at CRA exams with about 30 to 100 AAs to see if there was a fall-off in quality of community development financing above a certain size.

The example in the governor’s speech about the Pine Ridge Reservation was puzzling considering that existing AA procedures allow community development financing in a state or regional area after meeting needs in AAs. The question raised was if current procedures are not being implemented reasonably, what changes could be made to make the implementation more reasonable and predictable.

While on the surface, the concept of distinct AAs for community development financing and retail lending has appeal, the separate AAs may create new problems for local areas in terms of ensuring that banks meet their needs. The CRA statute requires separate evaluations for metropolitan and rural parts of a state where a bank has branches.14 If regulators evaluate retail lending on a metropolitan and rural county basis and community development is statewide, how will the exams ensure that community development is sufficiently meeting needs in metropolitan areas and rural counties that are being examined for retail lending and services. Will the exams do a good job of examining retail activities in the current metropolitan and rural areas but not such a good job of examining the provision of community development lending in these areas. If an examiner is competent, one would suspect that they would do a good job examining community development in all parts of a state, including metropolitan and rural areas where banks have branches. However, examiner quality is inconsistent.

In addition, would an examiner be able to conduct a holistic evaluation within an assessment area such as a metropolitan area or rural county if the examiner now has to conduct a retail and community development test with different AAs? For example, would an examiner look at retail and community development activity within a rural county and consider whether both retail and community development lending complement each other in a way to successfully revitalize the rural county?

Of the three proposals for consideration of activities outside of AAs (banks with Satisfactory ratings can venture outside of AAs, a cap on outside AA activity or separate AAs for community development and retail lending), the separate AAs concept most directly addresses the current problems associated with CRA exam implementation. Currently, CRA examiners are not consistent about under what circumstances they count outside AA community development activity. Some critical needs, such as those on Native American reservations, are overlooked. A statewide AA for community development financing would, therefore, appear to be a sensible solution in response to the ambiguity of when community development activity outside of AAs count. If this reform were to be accompanied by annual data on community development financing, stakeholders could readily check to see whether urban and rural parts of a state are receiving levels of community development financing in relation to their needs.

Of the three common proposals for reform, NCRC would favor the separate AA concept. However, there would be new complexities introduced, such as how CRA exams would synchronize their evaluations of retail lending and community development financing. NCRC has produced two proposals immediately below that we believe will avoid new complications.

NCRC PROPOSAL #1: Add underserved areas and collect CD data

In comments in response to the OCC’s Advanced Notice of Proposed Rulemaking, NCRC suggested that the agencies retain current procedures for qualifying community development financing outside AAs but further facilitate outside AA financing by implementing annual data collection and increasing the number of eligible areas, called underserved areas, that would qualify for community development outside AAs.

The NCRC proposal would work in the following manner:

The agencies would implement annual collection of community development data. This would consist of data on lending and investing that would correspond to the categories in the CRA regulation. As stated above, the CRA regulation defines community development financing as financing for affordable housing for LMI people, economic development geared towards supporting the creation and growth of small businesses, community facilities and activities that revitalize and stabilize neighborhoods. This data would be collected on a census tract and county level. Precedents for this data collection include OCC databases on public welfare investments that are produced every quarter and can be downloaded.16

Using community development data, an examiner can determine one year after the previous CRA exam whether a bank is meeting needs in its assessment areas. First, the examiner can determine whether for all assessment areas combined together, a bank is above or below median levels of community development financing in a manner similar to the above analysis. Then, the examiner can determine how current levels of community development financing in specific assessment areas compare to past levels on an annualized basis to see if a bank is on track to meeting needs. If the bank passes these tests, the examiner can pre-qualify the bank as eligible to pursue community development outside of its AAs. If a bank does not pass muster on these measures, it can spend the next year on improving its performance in its AAs and then pursue community development outside of its AAs. It can then ask for another agency review the second year after its previous exam.

This procedure using community development data is more objective and certain than the current procedure, which appears to vary based on the subjective judgments of different CRA examiners. Also, it provides an opportunity for a bank not passing muster in the first year after its previous exam to improve during the second year and become eligible for outside AA community development activities.

In addition to retaining the allowance for outside AA financing in statewide and regional areas, NCRC suggests that the agencies designate underserved areas that could be counties anywhere in the country that are underserved in terms of community development lending and investing. The agencies could develop measures to identify underserved counties such as the dollar amount of community development lending and investing on a per capita basis. Counties in the lowest quartile or quintile of community development financing per capita then could be candidates for designation as underserved.

The agencies could also use demographic and economic criteria for designating underserved areas much as they do now for identifying underserved and distressed rural middle-income census tracts. A combination of lending, demographic and economic criteria could be used to designate underserved counties. The counties receiving underserved designation could be updated annually as is the case now with rural underserved and distressed tracts.

The designation of underserved counties would eliminate the possibility of cherry-picking counties that are easier places for community development financing outside of AAs. Hopefully, underserved county designation would alleviate the issue of hotspots and deserts by directing community development financing to places most in need. Also, since the designation of counties would be conducted annually, counties may come off the list if they received substantial amounts of community development financing and others may be added that have pressing needs. The annual designation may further smooth out and more evenly distribute community development financing.

As a further inducement for community development financing in underserved counties, the pre-qualification procedures could be less stringent for a bank being allowed to engage in community development in an underserved county. For example, a bank may need to be at or above median levels of community development financing to be eligible to engage in community development in a statewide or regional area, but could be below the median if it wanted to offer community development financing in underserved counties. Perhaps a tolerance could be established such as no less than 20% below median for engaging in community development in underserved counties.

NCRC PROPOSAL #2: Expand AAs to include areas without branches but that still receive substantial lending or services

In our previous report on AAs and in our ANPR comment letter, we also outline a proposal to retain AAs in geographical areas where banks have branches and add AAs in areas outside of bank branches that receive a considerable number of retail loans. We describe how some existing CRA exams add AAs beyond bank branches, but these AAs now serve as a form of extra credit in that good performance on retail lending can enhance a bank’s rating. Instead of being used to boost a bank’s rating, these additional AAs must involve an obligation for a bank to serve credit needs and must, therefore, contribute significant weight to a bank’s rating.

Even though this NCRC proposal to expand AAs focuses on developments in the retail lending market (that is lending beyond bank branches), it should also help regarding bank complaints about constraints associated with engaging in community development financing beyond AAs. The NCRC proposal will provide banks with more AAs with which to find community development financing opportunities.

We have heard from some banks that they are concerned that expanding AAs beyond bank branch networks might be difficult for community development because the banks would not have a physical presence or branch-based staff in the new AAs. However, these banks have not explained sufficiently why the lack of branches and staff in the new AAs would be any different than a lack of staff in statewide or regional areas where banks are currently allowed to engage in community development. Moreover, CRA examiners will consider performance context including under-developed infrastructure when considering community development financing any new AAs. Banks could be encouraged to develop infrastructure in certain cases by investing in and/or providing technical assistance to nonprofit organizations and/or local agencies serving the AAs.

RECOMMENDATIONS

This study has focused on community development financing outside AAs. It concluded that the incidence of community development financing outside AAs appears to be higher than one would guess based on the grousing and complaining about examiner inconsistency regarding favorable consideration outside AAs. The study also documented possible abuses associated with the favorable consideration of outside AAs investing, including allowing some banks to engage in this activity when they had not met needs in their AAs and when allowance of community development outside AAs appeared to result in grade inflation.

Given these findings, NCRC recommends a more incremental reform instead of a wider-ranging reform such as separate AAs for retail and community development activities. Here is a summary of a series of recommendations:

More timely CRA exams: A key element of public accountability for meeting the needs of communities is timely CRA exams. Banks will perform more consistently and robustly if they know they will be examined frequently. This report found that about three-fourths of the banks in the sample were examined in a three-year period, which is customary. During the research period for this study (first quarter 2019), the most recent OCC exams for six banks had been conducted during 2011 and 2012. Lags of this long will fail to motivate banks to maintain consistent CRA performance.

Combat grade inflation on the investment test: In the sample of the 50 largest banks, 60% scored Outstanding on the investment test, which is a much higher percentage than those that scored Outstanding overall or on the lending test. Some of this inflation might be due to an overly generous allowance for community development financing outside of AAs. The report found that banks making below median levels of community development financing as a percentage of assets made a higher percentage of investments outside their AAs (this was not the case for community development lending). Banks with below median levels of community development investment or lending should not be allowed to engage in financing outside of AAs.

Better data presentation on CRA exams: On several OCC exams, the narrative indicated that banks received favorable consideration for community development lending and investment outside AAs but the exam did not provide aggregate data on community development activity overall or outside AAs. The reader of an exam would have to comb through hundreds of pages of evaluations for states and AAs in order to tabulate these figures. In contrast to OCC exams, the exams of the FDIC and Federal Reserve Board usually but not always presented aggregate community development figures.

Reform of AAs for retail lending and affiliates: This report did not dwell on AAs for retail lending and affiliates since a previous report examined these issues. The report finds that the great majority of home and small business lending occurred in AAs. The limitation to this finding, however, is that it does not consider affiliate activity since the CRA regulation does not allow consideration of affiliate retail lending when calculating the percentage of lending in AAs. NCRC recommends changing this procedure because affiliate lending must be automatically considered on all criteria of CRA exams to see if all parts of the bank are meeting credit needs. We find that CRA exams consider retail lending by affiliates less frequently than community development lending.

Community development data and underserved areas: This report reviews proposals for considering community development outside AAs. These proposals include automatic consideration of community development outside AAs when a bank had a previous rating of Satisfactory, a cap on the amount or percentage of community development outside AAs and separate AAs for community development and retail activities. NCRC believes that these proposals have shortcomings that could allow community development outside of AAs when banks have not met needs inside AAs. Instead, NCRC recommends that outside of AA activities be guided by additional data on community development financing and the designation of underserved counties. Additional data would allow examiners to judge on a real-time basis whether banks are meeting needs in AAs and would also help designate counties with pressing needs outside of banks’ AAs for community development financing.

CONCLUSION

This study emphasized the importance of establishing baseline information before answering critical questions about CRA reform. Objective data collection, analysis and mapping of community development projects is the proper method for assessing progress and obstacles to serving community needs and reaching traditionally underserved communities. Anecdotes about obstacles posed by assessment area procedures cannot guide rulemaking that concerns important matters such as community development financing.

The issue of community development lending and investing outside AAs has been raised loudly by stakeholders over several years. In response, the regulatory agencies spent considerable resources and time revising legalistic language in their Interagency Q&A document in an effort to help banks, community organizations and other stakeholders further understand the circumstances under which banks will receive favorable consideration for engaging in community development financing outside of their AAs. This seems to be the opposite approach to what was needed. The agencies should have first conducted their own baseline research using their resources (which collectively would overwhelm the resources of one senior analyst at NCRC that conducted this study) to conduct data analysis similar to that in this report. The agencies could then conduct follow-up stakeholder interviews to review findings of the data analysis and to dig deeper into the real impediments to community development financing.

If the agencies had taken the approach recommended by NCRC, they would have found more substantive and effective solutions to impediments to community development financing. In fact, they may have found that if anything, the current procedures may be too lax and leading to abuses and gaming, particularly on the investment test on CRA exams. They may have then instituted additional data reporting requirements on community development lending and investing to gather more information on inside and outside AA financing and on hotspots and deserts. This research may have then informed either regulatory reforms or changes to examination guidelines and procedures that would have facilitated outside AA community development financing in a manner that did not shortchange AAs and that targeted communities in need.

The question going forward is whether the agencies will engage in careful research and data analysis when developing CRA regulatory reform proposals. This would be the most effective way for preserving and improving the success of CRA in combating redlining and promoting reinvestment in LMI neighborhoods.

1 Josh Silver, Increasing community development financing data a necessary component for CRA reform, March 25, 2019, https://ncrc.org/increasing-community-development-financing-data-a-necessary-component-for-cra-reform/ NCRC used data from the FFIEC webpage to calculate dollar value of community development lending and small business data in low- and moderate-income census tracts. For the FFIEC data, see https://www.ffiec.gov/craadweb/national.aspx

2 NCRC, The Community Reinvestment Act and Geography, May 2017, https://ncrc.org/the-community-reinvestment-act-and-geography/

3 NCRC Comment on the OCC ANPR, https://ncrc.org/ncrc-comments-regarding-advance-notice-of-proposed-rulemaking-docket-id-occ-2018-0008-reforming-the-community-reinvestment-act-regulatory-framework/#The_OCC_must_align_with_the_Federal_Reserve_Board_and_FDIC_so_that_CRA_rating_examinations_and_remedial_standards_are_consistent

4 The ratings for all banks and large banks during 2017 can be obtained fromhttps://www.ffiec.gov/craratings/default.aspx

5 The asset sizes adjust annually. For 2017, large banks were at least $1.226 billion in assets. See Joint Press Release, Agencies release annual CRA asset-size threshold adjustments for small and intermediate small institutions, December 29, 2016, https://www.federalreserve.gov/newsevents/pressreleases/bcreg20161229a.htm

6 See NCRC, CRA and Geography, op cit., pp. 14-17.

7 OCC Bulletin, Description: Supervisory Policy and Processes for Community Reinvestment Act Performance Evaluations, 2018-17, https://www.occ.gov/news-issuances/bulletins/2018/bulletin-2018-17.html

9 Urban Institute, Community Reinvestment Act: Lending Data Highlights, November 2018, p. 8, https://www.urban.org/research/publication/community-reinvestment-act-lending-data-highlights/view/full_report

10 Community Reinvestment Act; Interagency Questions and Answers Regarding Community Reinvestment, see Q&A related to §_.12(h)—6:, p. 48529, Federal Register / Vol. 81, No. 142 / Monday, July 25, 2016.

11 FDIC 2016 CRA exam, https://www5.fdic.gov/CRAPES/2016/17266_161229.PDF

12 For example, see the letter of the American Bankers Association, p. 20. Access the comment letters on the ANPR via https://www.regulations.gov/docket?D=OCC-2018-0008

13 Federal Reserve Governor Lael Brainard, The Community Reinvestment Act: How Can We Preserve What Works and Make it Better? At the 2019 Just Economy Conference, National Community Reinvestment Coalition, Washington, D.C., March 12, 2019, https://www.federalreserve.gov/newsevents/speech/brainard20190312a.htm

14 See 12 U.S. Code § 2906. Written evaluations of the CRA statute, https://www.law.cornell.edu/uscode/text/12/2906

15 Definition of community development in the CRA regulations, see the Definitions section, §25.12, https://www.ffiec.gov/cra/regulation.htm

16 To access the databases, see https://www.occ.gov/topics/community-affairs/resource-directories/public-welfare-investments/national-bank-public-welfare-investment-authority.html

Josh Silver is Senior Advisor at NCRC