A Survey of Race and National Origin and Access to Small Business Loan and Rental Modifications

Key Takeaways:

- The CARES Act isn’t enough to save small businesses during the COVID-19 pandemic.

- Small business owners need other options, like modifications of outstanding loans and credit card debt.

- An NCRC survey found that Black and Latino small business owners had less access to those options than White ones.

- Financial institutions need to complete file reviews of their modification requests and approvals to ensure that no fair lending violations have taken place.

Key Findings:

- White small business owners had significantly more access to business credit cards and business lines of credit than Black and Latino small business owners.

- Latino small business owners were significantly less likely than White small business owners and Black small business owners to contact a lender about a business credit product modification.

- Black small business owners were less likely to receive loan modifications.

- White small business owners who contacted commercial financial institutions received modification approvals at a significantly higher rate than Black and Latino small business owners who contacted commercial financial institutions.

- White and Latino small business owners had significantly more access to credit from family and friends than Black small business owners.

Executive Summary

The second round of Paycheck Protection Program (PPP) loans under the CARES Act ended in August 2020. A third round started in January 2021. During this time, businesses continued to experience severe revenue loss because of the COVID-19 pandemic, resulting in their inability to pay their existing credit obligations or commercial rental leases. NCRC wanted to know whether small business owners have explored other options, such as lease and loan modifications to save their businesses, and if so, whether they were able to access these options. To gain insight into this question, NCRC conducted a multi-MSA survey of small business owners across the country who had either obtained a credit product with an outstanding balance before March 1, 2020, and/or had a commercial rental lease. The survey was conducted from October 23, 2020, to December 29, 2020. Using a chi-square statistical analysis of responses from 938 White, Black and Latino small business owners, we found significant differences in their financial health. We also found significant differences in the rates at which they contacted lenders about modifications and if their modifications were approved.

The survey highlighted concerns that access to business loan modifications during the pandemic has not been equal. To help remedy this, NCRC recommends:

- Small business lenders should regularly conduct fair lending file reviews and incorporate testing and training programs to ensure compliance with fair lending laws

- Increase funding to educate small business owners

- Implement Section 1071 of the Dodd-Frank Act that requires financial institutions to report data on small business loans

Introduction

Advocates, politicians and small business owners have raised important concerns about the pandemic’s negative impact on small businesses’ ability to remain open and keep their employees on their payroll. State and local government restrictions to limit the pandemic’s spread have negatively impacted small business owners’ ability to conduct business as usual. In April 2020, Congress passed the Coronavirus Aid Relief and Economic Security Act (CARES Act), which contained two initiatives aimed at small business survival. The first initiative was the Paycheck Protection Program (PPP), which received a great deal of media attention and provided loans that could become grants if used for payroll and other expenses. Section 1112 of the CARES Act required the Small Business Administration (SBA) to make principal and interest payments for 7(a) loans for six months. This short-term help expired at the end of September and only aided a small portion of small business owners.

Small business owners take out loans to expand their businesses with the optimism that they will pay back this credit. There exists a gap in our understanding of the types of credit products entrepreneurs use. The pandemic has made it challenging to repay their small business loans. Still, there is little empirical data on businesses’ finances and how they have been faring during the pandemic. We know that the CARES Act programs are insufficient to save a substantial portion of the small businesses that currently exist. In 2019, before the pandemic, 17% of small business owners said that they would have to close if they experienced a two-month revenue loss. Unfortunately, many small businesses have been without pre-pandemic revenue levels for ten months now.

A loan modification can help to ensure that a business will survive past the pandemic. A loan modification allows the borrower and lender to renegotiate the loan after its origination, usually to prevent delinquency or default. A loan modification is different from a commercial workout. A modification can result in changes to the terms of a loan. There can be a decrease in the interest rate, deferment from payment for some time, or an increase in the loan’s repayment length.

In addition to loans, small businesses often take on commercial leases. These leases are common with businesses with a larger footprint and are another type of financial obligation that often requires renegotiation. Government restrictions of stay at home orders and staged re-entry combined with the public safety concern of patronizing businesses in person have profoundly impacted the amount of possible revenue, making it harder for these small businesses to pay the rent. A business owner’s ability to work with the lessor to receive a modification is just as important as a business owner working with a financial institution to receive a loan modification.

Methodology

NCRC wanted to understand if modifications for business credit products and commercial rental space are being offered in the marketplace and whether there were differences in White, Black and Hispanic small business owners’ ability to access them. Specifically, we wanted to know:

- What type of credit did small business owners have before the pandemic?

- What race and/or national origin were the small business owners that received a modification?

- Which financial products were modifications provided for?

- How often did financial institutions offer a modification after being contacted by the borrower?

To answer these questions, NCRC created an in-depth survey that was administered to U.S. residents with small businesses that employed 500 people or less and who had obtained a credit product with an outstanding balance before March 1, 2020, and/or had a commercial rental space.

This survey provided a large-scale first-person insight into what business owners have been experiencing and if they have reached out to financial institutions for help. This survey offered a snapshot of the small business lending marketplace and if it is equally serving all borrowers as required under fair lending laws.

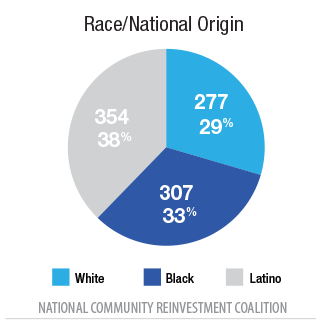

We used online survey software and recruited business owners using panel services and Chamber of Commerce groups through social media campaigns. Our sample included 938 total responses with 307 responses from Black small business owners, 277 responses from White small business owners and 354 responses from Latino small business owners. The survey instrument was available in both English and Spanish.

We used online survey software and recruited business owners using panel services and Chamber of Commerce groups through social media campaigns. Our sample included 938 total responses with 307 responses from Black small business owners, 277 responses from White small business owners and 354 responses from Latino small business owners. The survey instrument was available in both English and Spanish.

We were interested in investigating nine Metropolitan Statistical Areas (MSA) distributed across the country: Washington, D.C.; Los Angeles, California; Atlanta, Georgia; New York City, New York; Chicago, Illinois; Houston, Texas; Miami, Florida; Detroit, Michigan; and Seattle, Washington. This geographic distribution of MSAs allows for a deeper understanding of the national small business lending marketplace.

Survey Demographics

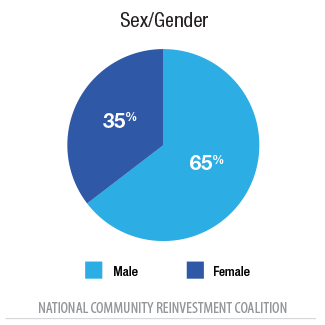

The average age of the respondent was 38 years. Thirty-five percent of respondents were women, and 65% were men.

The average age of the respondent was 38 years. Thirty-five percent of respondents were women, and 65% were men.

The type of businesses included in the sample spanned all of the NAICS codes. Industries most represented in the sample include retail trade (17.4%), construction (9.6%) and information technology (9.5%). The ownership structure of the businesses sampled was mostly sole proprietorships (42.6%) followed by limited liability corporations (19.4%), partnerships (16.3%) and joint proprietorships (13.3%). We did not differentiate between employer firms and non-employer firms.

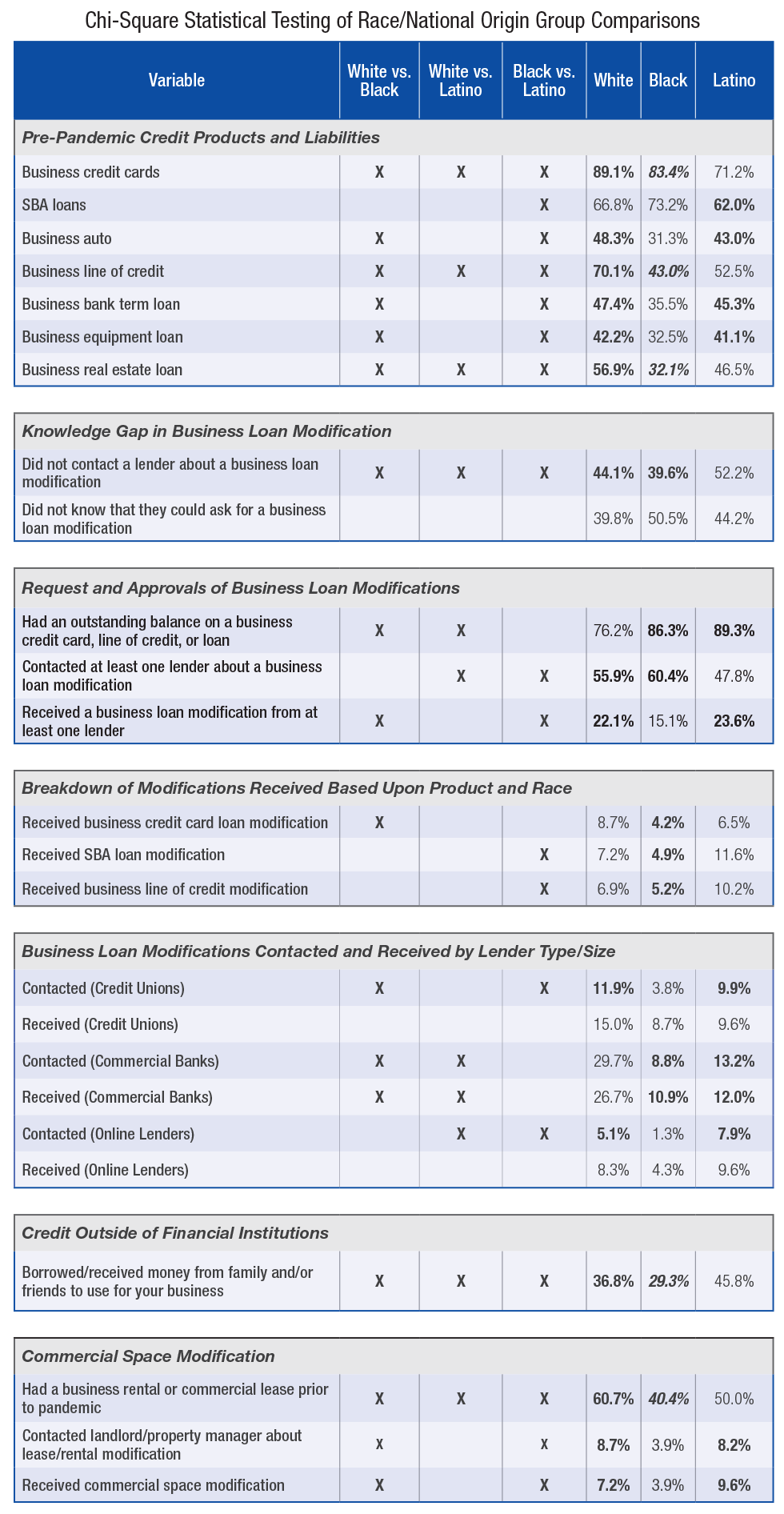

We performed statistical analysis to determine whether there were any statistically significant differences in behaviors and experiences between White, Black and Latino small business owners across the survey responses. The chi-square test for independence is a particularly robust way for social scientists to evaluate whether there are substantial differences in outcomes between groups. The simple “yes or no” categorization of the small business owners’ financial portfolio enabled the survey results to achieve a level of high validity.

Analysis

The data revealed that:

- White small business owners had significantly more access to business credit cards and business lines of credit than Black and Latino small business owners.

- Latino small business owners were significantly less likely than both White and Black small business owners to contact a lender about a business credit product modification.

- Black small business owners were less likely to receive loan modifications.

- White small business owners who contacted commercial financial institutions received modification approvals at a significantly higher rate than Black and Latino small business owners who contacted commercial financial institutions.

- White and Latino small business owners had significantly more access to credit from family and friends than Black small business owners.

Loan Product Modification:

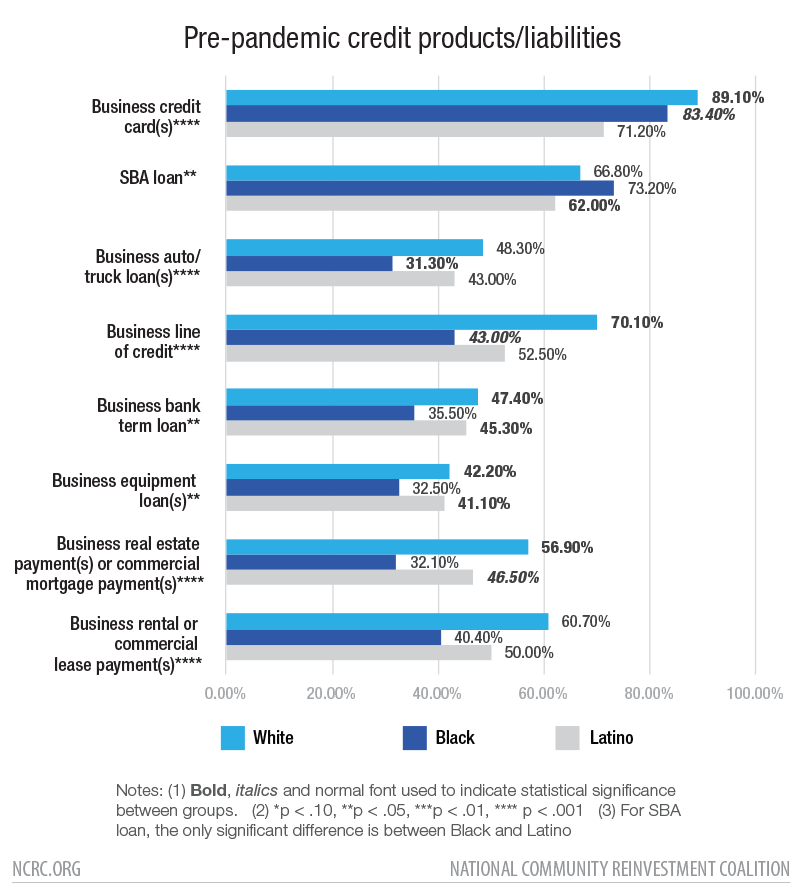

Pre-Pandemic: Type of Credit/Liabilities Based Upon Race

Pre-pandemic, within each type of business credit product, White small business owners utilized credit products more often than Black and Latino small business owners except for SBA loans. Business credit cards were the most utilized small business credit product by all small business owners. White small business owners had a higher rate of access to business lines of credit, which offer the most flexibility and lower interest rates than business credit cards. White business owners were more likely to have business real estate, signaling their business longevity and stability. Black business owners were more likely to have an SBA loan compared to White and Latino business owners.

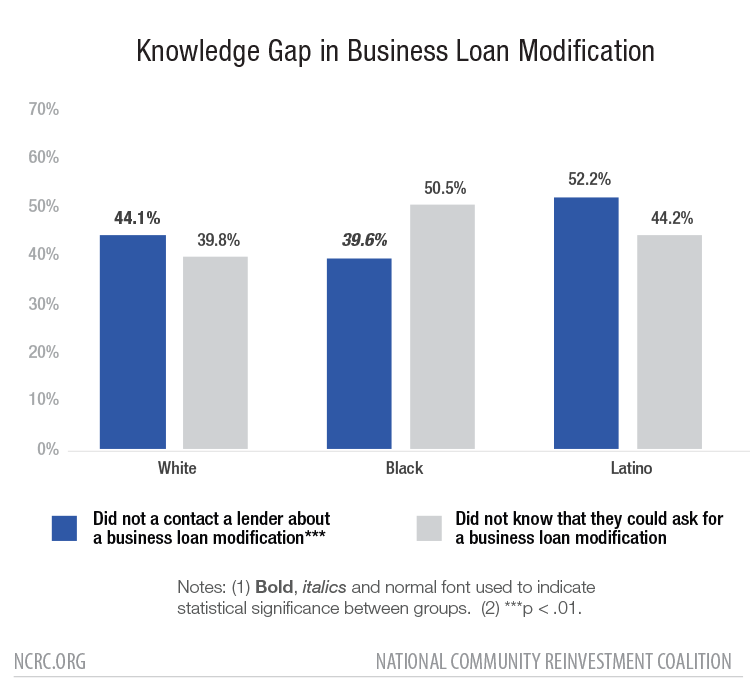

Knowledge Gap on Business Loan Modifications:

Not all small business owners were aware they could receive a modification on a small business credit product. Latino small business owners were significantly less likely than both White and Black small business owners to contact a lender about a business credit product modification. However, when this specific group of respondents were then asked if they knew that they could contact a lender regarding a modification, we saw a trend[1] that more Black small business owners did not know that this option was available to them. This trend highlights a knowledge gap that exists for all small business owners but is more prevalent among Black small business owners.

Request and Approvals of Business Loan Modifications:

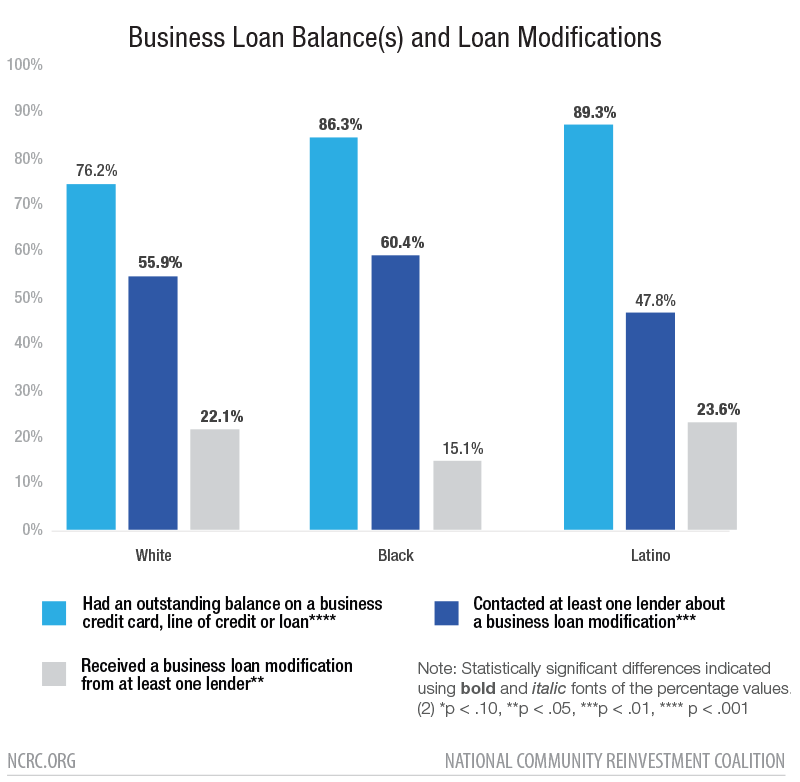

There are significant differences in bank contact about a loan modification and approval of a loan modification between White, Black and Latino small business owners.

Pre-pandemic business credit rates

Black small business owners (86.3%, Chi-square = 9.95, p= .002) and Latino small business owners (89.3%, Chi-square = 19.35, p = .0001) were significantly more likely to have outstanding balances on business credit products[2] (86.30%) at the onset of pandemic compared to White small business owners (76.2%). There was no significant difference in pre-pandemic outstanding business loan balances (Chi-square = 1.34, p = .247) when comparing the Black and Latino small business owner groups to each other.

Rate of contact with a lender about a modification

While the raw data showed that Black small business owners requested a modification at a higher rate than White and Latino small business owners, the statistical testing analyses revealed that there was no significant difference between the rate of contact about modifications between White (55.0%) and Black small business owners (60.4%, Chi-square = .959, p= .327). However, the rate of contact about business loan modification was significantly lower for Latino small business owners (47.8%) compared to White small business owners (Chi-square = 3.354, p= .067) and when compared to Black small business owners (Chi-square = 9.188, p = .002).

Rate of modification approval

Despite the similar contact rate between White small business owners and Black small business owners, the desired outcome of receiving a loan modification was significantly lower for Black small business owners. While the likelihood of getting a loan modification was low across all groups, White business owners had significantly higher success rates (22.1%) compared to Black business owners (15.1%, Chi-square = 4.588, p= .032). Despite contacting lenders about business loan modifications less often than White and Black small business owners, Latino (23.6%) small business owners were also significantly more likely to receive a business loan modification than Black small business owners (Chi-square = 7.369, p= .007). There was no significant difference in the success rate of loan modification requests between White and Latino businesses (Chi-square = .201, p= .654)

Breakdown of Modifications Received Based Upon Product and Race

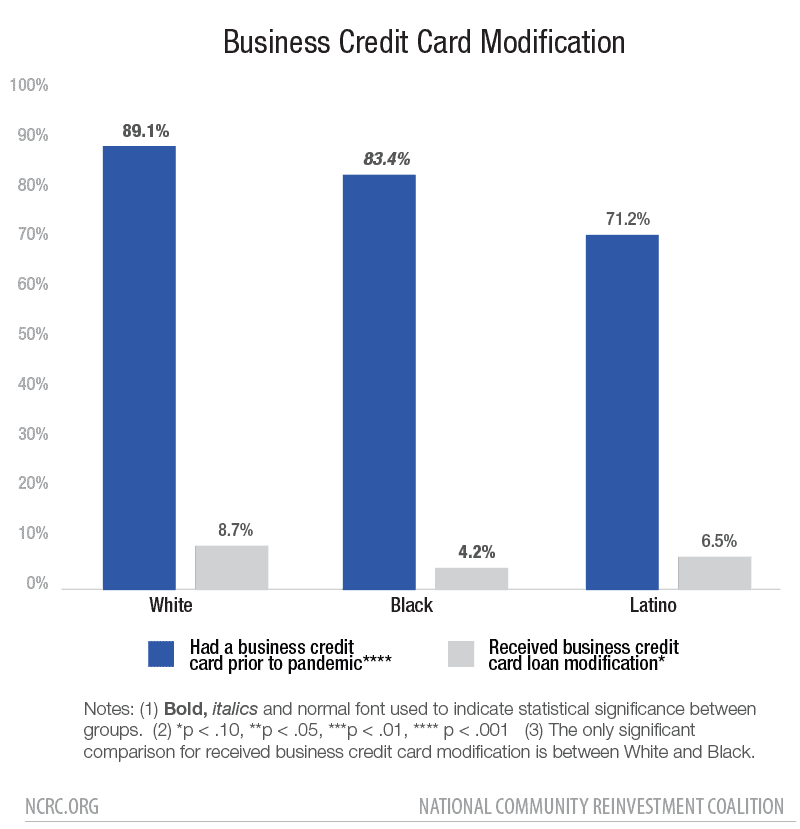

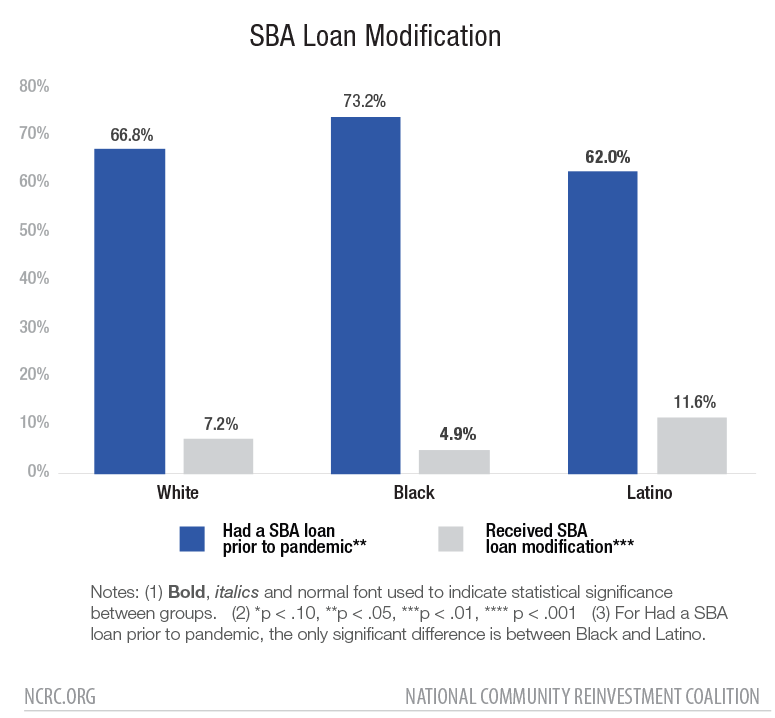

The small business owners surveyed were most likely to have a business credit card, SBA loans and/or a business line of credit based upon pre-pandemic credit products. Thus a modification on one of these products is potentially beneficial.

Business Credit Card Modifications Received

Before the pandemic, White small business owners had significantly more business credit cards than both Black and Latino small business owners, but interestingly, Black small business owners had significantly more credit cards than Latino small business owners. White small business owners received approvals for business credit card modifications at significantly higher rates than Black small business owners. There was no statistical significance when comparing White and Latino small business owners and Black and Latino small business owners for approvals of modifications.

SBA Loan Modifications Received

Before the pandemic, Black small business owners had significantly more SBA loan credit than both White and Latino small business owners. There was no statistical significance between the White and Latino businesses for pre-pandemic SBA credit. Latino small business owners received a modification on an SBA loan at a significantly higher rate than Black small business owners. There is no statistical difference between Black and White small business owners or between Latino and White small business owners.

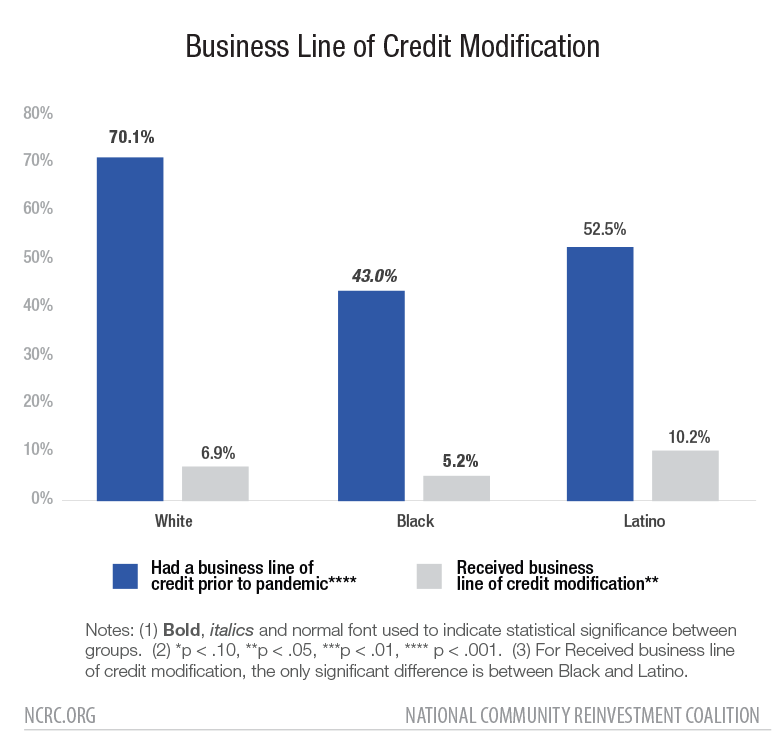

Line of Credit Modifications Received

Prior to the pandemic, White small business owners had significantly more business lines of credit than Black and Latino small business owners. However, Latino small business owners significantly more often received a modification on a line of credit when compared to Black small business owners. There was no statistical significant difference in the rate of modifications received between White and Black small business owners and White and Latino small business owners.

Who are Financial Institutions Serving?

Knowing if different types of financial institutions are serving all borrowers equally is a fair lending issue. When investigating the difference between the different types of financial institutions: credit unions, commercial banks including community, regional and national banks, online lenders and CDFIs, we found that there were significant differences among White, Black and Latino small business owners in the amount of contact initiated by the small business owner and the success rate of receiving loan modification. Black and Latino small business owners contacted significantly less credit unions (Chi-square = 6.948, p = .031), commercial banks (Chi-square = 23.394, p = 23.394) and online lenders (Chi-square = 7.904, p = .019) than White business owners. There was no significant difference in the frequency of contact to CDFIs (Chi-square = .728, p = .393) for loan modification. Specifically, we found that Black business owners were less likely to contact credit unions (3.8%) compared to Whites (11.9%; Chi-square = 6.697, p = .01) and Latinos (9.9%; Chi-square = 4.718, p = .03). There was no significant difference in contacts to credit unions between Whites and Latinos.

When seeking modification with an online lender, Latino business owners (7.9%; Chi-square = 8.105, p = .004) and White business owners (5.1%; Chi-square = 3.573, p = .059) contacted online lenders significantly more than Black owners (1.3%).

There was no significant difference in the success rate of receiving a loan modification from a credit union (Chi-square = 1.373, p = .503), an online lender (Chi-square = 1.153, p = .562) or a CDFI (Chi-square = .181, p = .913).

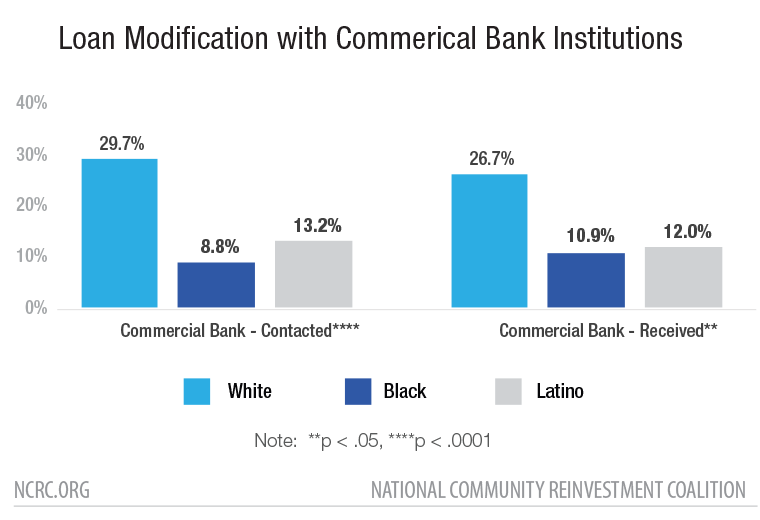

Business Loan Modifications Contacted and Approved by Commercial Bank Institutions

When seeking modification with commercial banks, White business owners contacted commercial banks (29.7%) significantly more than both Black owners (8.8%; Chi-square = 20.453, p = .0001) and Latino owners (13.2%; Chi-square = 10.974, p = .001). There was no difference in the contacting of commercial banks between Black and Latino owners (Chi-square = 1.612, p = .204). Importantly, we also found a significant difference in the success rate of receiving a loan modification from commercial banks (Chi-square = 6.785, p = .034). Specifically, we found that both Black owners (10.9%, Chi-square = 4.090, p = .043) and Latino owners (12.0%, Chi-square = 5.003 , p = .025) received loan modification significantly less of the time with commercial banks than compared to White business owners (26.7%).

Credit Outside of Financial Institutions

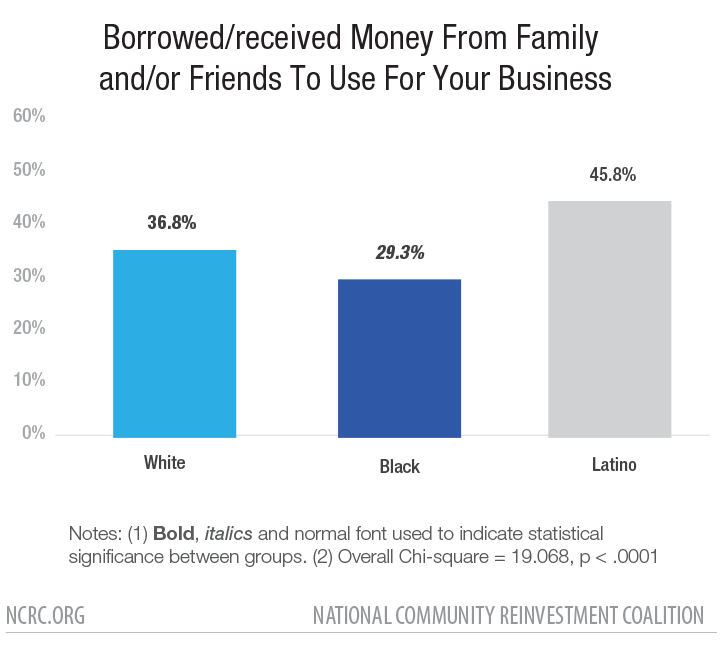

The ability to access assistance outside of financial institutions impacts a business’s ability to survive the pandemic. Latino small business owners are significantly able to access alternate funding compared to White and Black business owners despite their having an average of one-fifth the wealth of White families. However, White small business owners are significantly more able to access alternate funding from family and friends than Black small business owners. This difference highlights the racial wealth divide and how structural racism can prevent Black business owners from staying afloat when they cannot access credit products from financial institutions. This inability to find alternative assistance from either family, friends or government may have played a large role in the loss of at least 450,000 Black businesses since the pandemic began.

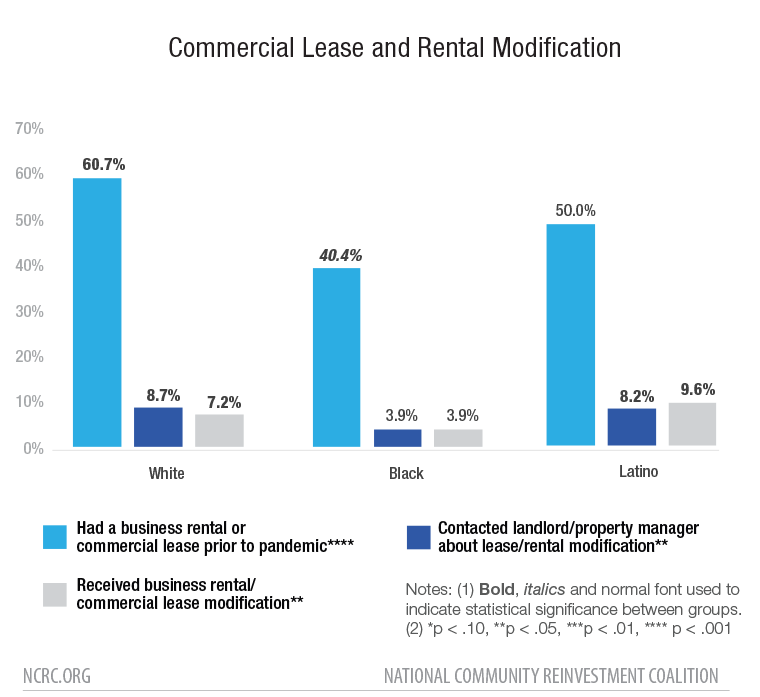

Commercial Space Modification

Pre-pandemic, White small business owners had significantly higher rates of business rentals and commercial leases than Black and Latino small business owners. Black business owners had statistically fewer instances of having commercial leases pre-pandemic than both White and Latino business owners. Black business owners contacted and received modification on these agreements at a significantly lower rate than White and Latino business owners.

Recommendations

The survey highlighted concerns that White, Black and Latino small business owners have not had equal access to business loan modifications during the pandemic. For this reason, we recommend that:

- Financial institutions need to complete file reviews of their modification requests and approvals to ensure that no fair lending violations have taken place. Financial institutions should conduct a file review to examine both disparate treatment and disparate impact. Financial institutions should also incorporate testing and training programs to ensure compliance with fair lending laws.

- Financial institutions should initiate contact with consumers when crises such as pandemics occur. They should not wait for consumers to initiate contact as not all consumers know what options are available.

- Small business owners need to be better educated. Funding needs to be allocated at federal, state and county levels for increased education and outreach. If we provide better education and support for business owners, they will be better prepared to survive an economic disaster. Education will also help business owners when negotiating commercial lease agreements. Though the PPP loan effort failures were at the administrative level, the understanding that small business owners could request loan modifications was low across all racial groups.

- Financial institutions need to recognize the role structural racism plays in minority entrepreneurs accessing credit. They need to understand the role that wealth accumulation plays in one’s ability to weather a disaster when commercial credit sources are closed to them. As financial institutions fulfill their CRA requirements by meeting the needs of the specific communities they serve, they need to develop small business products that will serve these communities better.

- The Consumer Financial Protection Bureau should finalize a small business loan data transparency rule under Section 1071 of Dodd-Frank in 2021 to improve market transparency and facilitate fair lending review and enforcement.

Conclusion

As small businesses continue to struggle due to COVID-19, loan modifications can mean the difference between survival and failure. The survey provided valuable insight into the marketplace for business owners who had credits before the pandemic and how they have attempted to weather this storm financially. It revealed troubling trends suggesting that financial institutions are still failing to serve all customers equally as required under fair lending laws. Without equal knowledge, access and approval of loan modifications, minority-owned small businesses will continue to be vulnerable to the state of the economy.

Appendix:

[1] This trend is not statistically significant, but it potentially could be with an increased sample size.

[2] Business credit product in this graph is a compilation score consisting of business credit cards, business lines of credit, business terms loans, SBA loans, business equipment loans, and business auto loans.

Photo: ©Leigh Trail – stock.adobe.com