With the publication of Richard Rothstein’s 2017 book, The Color of Law: A Forgotten History of How Our Government Segregated America, the issue of racial and economic “redlining” has come to the forefront. The shocking thing about the revelations in Rothstein’s book is the degree to which policies and practices of segregation were accepted and formalized in the era prior to the Civil Rights Act and The Fair Housing Act of 1968. Before those protections were enacted, racial and ethnic discrimination were part of the decision-making process of institutions and government agencies, like the Federal Housing Administration,

on which communities received credit, which is essential for owning a home or opening a business.

These policies influenced the economic viability of neighborhoods today. Partly this is because redlining occurred during a critical moment in the creation of the middle class and reconfiguration of where wealth was concentrated. After World War II, from the late 1940s through the 1960s, almost exclusively white families moved from central cities to the suburbs. This reorganization, or suburbanization of families, was made possible by construction of new highway systems and the large-scale construction of tract-home developments, while the purchase of these new homes was largely financed through mortgage loans backed by government programs like VA and FHA.

- How 1930s discrimination shaped inequality in today’s cities

- NCRC Report: The persistent structure of segregation and economic inequality

- Interactive: View and download maps for 114 metropolitan areas

- View Full Report (PDF)

- Download full report (PDF)

This reorganization of America’s cities also reinforced patterns like segregated neighborhoods as low income and minority families were left behind in central cities. The most direct visual evidence of a past history of redlining comes from the Residential Security Maps produced during the late 1930s by the Home Owners Loan Corporation, or HOLC. The HOLC was a Federal agency which helped families in mortgage default by purchasing and setting new terms of repayment. These Residential Security Maps were a project by HOLC to assess the credit risk of neighborhoods where mortgages were held.

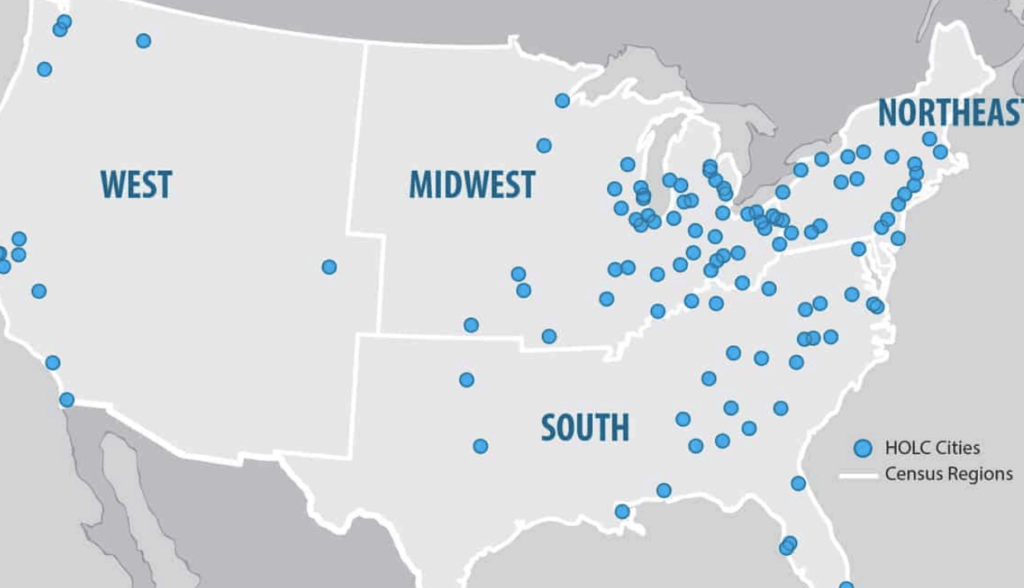

The HOLC dispatched examiners to about 114 cities, to interview bank officers, appraisers, and city officials about neighborhood quality in their cities. So the HOLC maps document how local banks and appraisers viewed the risk of making loans in different neighborhoods of their communities. The examiners then classified neighborhoods in one of four categories: Best, Desirable, Definitely Declining, and Hazardous. Each neighborhood had a standardized assessment sheet that evaluated housing construction quality, trends in home values, amenities like parks or disadvantages like factories and limited transportation access, but also the economic status or class of residents and their racial, ethnic and national make-up. The areas graded “Hazardous” were shaded in red on the HOLC maps. Disproportionately areas that were graded “Hazardous” neighborhoods had high percentages of minorities, who at that time were seen as anyone who was not of white, Northern European background. Credit was either very expensive or unavailable in the “Hazardous” red areas, making it difficult to purchase or improve houses there.

To get a better idea of how “redlining” has impacted neighborhoods, NCRC studied

how the HOLC neighborhood classifications corresponded with the recent economic status and racial/ethnic makeup of neighborhoods. We found nationally that 74% of areas that were classified by HOLC as “Hazardous” almost 80 years ago are low-to-moderate income today and almost 64% are minority-majority communities. The economic pattern was especially entrenched in cities of the Midwest and South, where over 80% of the “Hazardous” neighborhoods were low-to-moderate income. The racial patterns were most entrenched in the South and West, with their large African American and Hispanic communities, where about 70% of the “Hazardous” neighborhoods were minority-majority. We then looked at the levels of segregation of African Americans and Hispanics relative to whites, and the economic inequality today in neighborhoods with the “Hazardous” grade.

Today, we found lower incomes, more minorities, and signs of gentrification in neighborhoods marked by HOLC as “hazardous.” We found segregation was significantly higher in cities which had experienced less change in neighborhood status. In other words, cities where higher percentages of “Hazardous” graded neighborhoods had remained low- to moderate-income or majority-minority. We found that cities with greater gentrification had more neighborhoods that transitioned from HOLC “Hazardous” to middle- and upper-income status, and also had greater interaction between African American and white residents. However, lastly and most alarmingly, these cities also had greater levels of economic inequality.

As our study indicates, gentrification is changing America’s structure of urban disinvestment and segregation. However, we need to be certain that economic opportunity neighborhood transition extends to all Americans, regardless of race, ethnicity, gender or national origin. This requires public policies that account for the past as we grapple with the history of long-term disinvestment in “redlined” neighborhoods.