In September 2018, the Federal Deposit Insurance Corporation (FDIC) released the results of a survey

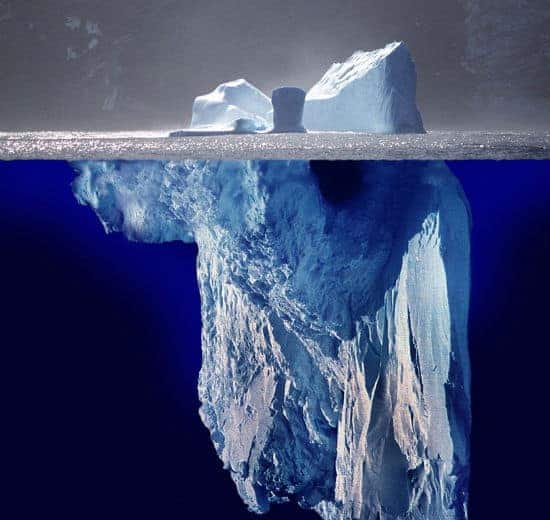

of 1,200 banks on small business lending in America. It found that small business lending is threatened by the decline of smaller banks and the reduction of bank branches in many communities. But just as revealing was what the survey didn’t find. More information that would be essential for policy and regulatory decisions remains concealed, invisible to the public, much like an iceberg that typically has most of its mass concealed below the surface of the ocean.

More data could reveal answers to pressing questions about the performance of individual banks in neighborhoods, like:

- How many loans are banks making to minority business owners?

- How well are banks meeting the credit needs of women-owned businesses?

- What business types and industries are banks lending to?

- Do particular banks favor certain types of neighborhoods?

- How strong is the relationship between where branches are located and a bank’s business lending in that neighborhood?

The data is incomplete in another significant way. The FDIC estimates that 29% of small bank business lending activity is not collected under the Community Reinvestment Act (CRA). This means policy decisions and regulatory actions are made using incomplete information.

What the FDIC survey reveals are the similarities and differences varying sized banks face when making small business loans. Smaller banks have several advantages over their larger counterparts. They know their local markets better and tend to have more personal connections to local business owners. This facilitates more “relationship” lending, where loan terms can be flexible enough to better meet the needs of small business owners.

Conversely, larger banks offer more competitive rates on their products. They also are more likely to offer products that use government guarantees, like Small Business Administration insured loans.

There are also many ways small and large banks face similar challenges. Small business lending is highly relational, depending on person-to-person contacts, and banks that do not have branches or a business-oriented staff in the community do not make as many loans. Small business lending requires more staff attention and is less likely to be as automated as mortgage lending.

The survey offered a few key insights into the new data:

“Given the current consolidation trend in U.S. banking, it is essential to understand the practices that banks use to meet the needs of small businesses, and how these practices differ between banks of different sizes. In particular, the continued decline in the number of small banks and of bank branches (for banks of all sizes) may have significant negative effects on U.S. small businesses.”

“The findings of the survey show that the best available proxy for small business … lending substantially understates the amount of lending extended by banks to small businesses, especially by small banks.”

“…the data collected by the [survey] confirm that small banks are indeed more likely to rely on relationship lending practices, while large banks are more likely to use transactional methods.”

The survey reinforced the need for greater clarity on small business lending in America. Small business lending has not increased relative to the amount of deposits banks are taking in since the end of the Great Recession and the start of the recovery. But the unseen 29% of all lending prevents us from truly knowing the extent of the threat this represents to our country.

In 2010, the Dodd-Frank Wall Street Reform Act required under Section 1071 that banks report all small business lending. This rule has yet to be implemented by the CFPB, although it might soon be placed back on the rulemaking schedule. NCRC supports the implementation of this section of the law, so we can see the full extent of lending to small businesses.

On May 14, 2019 the California Reinvestment Coalition, a member of the National Community Reinvestment Coalition, filed suit in Federal court to force the CFPB to implement Section 1071 and to start collecting data on small business lending.

Small businesses are critical to the U.S. economy, with over 99% of businesses with employees being considered a small business. About half of all workers in the U.S. are employed by a small business. Yet small businesses report that the lingering effects of the Great Recession, more industry consolidation and the closure of bank branches threaten the flow of credit they rely on to operate and expand. These threats to job growth are issues too dangerous to ignore. Expansion of existing businesses accounts for 60% of new jobs.

Jason Richardson is Director of Research and Evaluation and Josh Silver is Senior Advisor at NCRC.

Photo by the Uwe Kils and Wiska Bodo.